- At a glance: Expensify alternatives compared

- 1. Ramp: The best overall Expensify alternative

- 2. Navan (formerly TripActions)

- 3. Paylocity

- 4. Sage Expense Management

- 5. Emburse Professional (formerly Emburse Certify)

- 6. Coupa

- Choose the top-rated Expensify competitor

Expensify is a longtime player in the finance space, offering spend management, receipt tracking, employee reimbursements, and a business credit card. Its accessibility has made it one of the biggest names in expense management software for small and midsize businesses.

Expensify is highly rated and widely used. It has more than 5,000 user reviews and an overall score of 4.5 out of 5 stars on the software review website G2. But despite its popularity, Expensify isn't without its critics.

In this article, we compare Expensify against other highly rated expense management software on the market, including:

- Ramp

- Navan (formerly TripActions)

- Paylocity

- Fyle (now part of Sage)

- Emburse Professional (formerly Emburse Certify)

- Coupa

To determine our favorites, we took a deep dive into their features, combining our own research into each tool with real user reviews and ratings from G2. Read on to find out which Expensify competitor is the best fit for your business.

At a glance: Expensify alternatives compared

| Platform | G2 rating | Market segment | Key features | Minimum cost |

|---|---|---|---|---|

| Ramp | 4.8 | Startups, small businesses, mid-market | Expense management, corporate cards, travel booking | $0; unlimited free tier |

| Navan | 4.7 | Mid-market | Travel booking, expense management | $0; free tier with seat and usage limits |

| Fyle | 4.6 | Mid-market | Expense management | $11.99 per user per month, billed annually |

| Paylocity | 4.5 | Mid-market | Procurement, expense management | N/A; all pricing is quote based |

| Emburse Professional | 4.5 | Mid-market, enterprise | Expense management | $3,000 per year |

| Coupa | 4.2 | Mid-market, enterprise | Procurement, expense management, invoice automation, payments | N/A; all pricing is quote based |

1. Ramp: The best overall Expensify alternative

Ramp is an all-in-one finance operations platform that helps eliminate the biggest expense management headaches, including employee reimbursements, spend monitoring, receipt tracking, and financial reporting. On top of that, Ramp also offers full-featured travel booking and management, accounts payable (AP) automation, and procurement software.

Ramp eliminates manual data entry and gives you real-time visibility into all your corporate spending. Ramp’s corporate charge cards automatically enforce your expense policy and offer additional controls at the funds, individual, department, or vendor level.

All this comes packaged in a modern, easy-to-use interface, making setup and training a breeze. Plus, you can take Ramp on the go with our handy mobile app for iOS and Android.

Ramp has earned a rating of 4.8 out of 5 stars on G2 based on more than 2,000 user reviews. We might be a little biased, but for all those reasons, Ramp is our clear pick as the best Expensify alternative.

Key features

- Single platform that unifies AP, corporate travel booking, and expense management, consolidating all your finance data and workflows

- One-step bill import and 99% accurate AI matching for every invoice line item

- Free bill pay, with the ability to schedule payments via physical or virtual corporate cards, ACH, checks, and international wire transfers

- Automatic bill routing for approvals, plus easy approvals in Slack and email

- Auto-coding of bills as liabilities, plus accounting integrations with ERP and HRIS

- Easy syncing with popular accounting software like QuickBooks and NetSuite

- Responsive and helpful customer support

Why customers choose Ramp vs. Expensify

- Error-free spend management: No more hoping team members remember to save and submit expense receipts—and no more calls to hotels, airlines, stores, or restaurants to find receipts when they forget. Ramp gives everyone convenient text and email receipt submission, and we automate coding for frustration-free finance oversight.

- Purchase well, save on procurement: Ramp allows you to tailor spending with customizable limits and auto-enforced expense policies. Plus, Ramp’s procurement software lets you benchmark quotes against thousands of real, anonymized transactions to negotiate confidently and secure the lowest price.

- Significant time savings: Our research estimates Ramp can save users more than 20,000 hours a year vs. legacy solutions like Expensify. Ramp's finance automation features integrate with the accounting tools you already have in your tech stack, eliminating the need for manual coding of bills and vendor payments.

By the numbers: More than 1,900 businesses have chosen Ramp over Expensify for its AI-powered receipt capture, automated expense tracking, and real-time reporting.1

"I was spending 4 hours a month on Expensify. Now I’m in and out of Ramp in 5 minutes."

– Sam Meek, Founder and CEO, Sandboxx

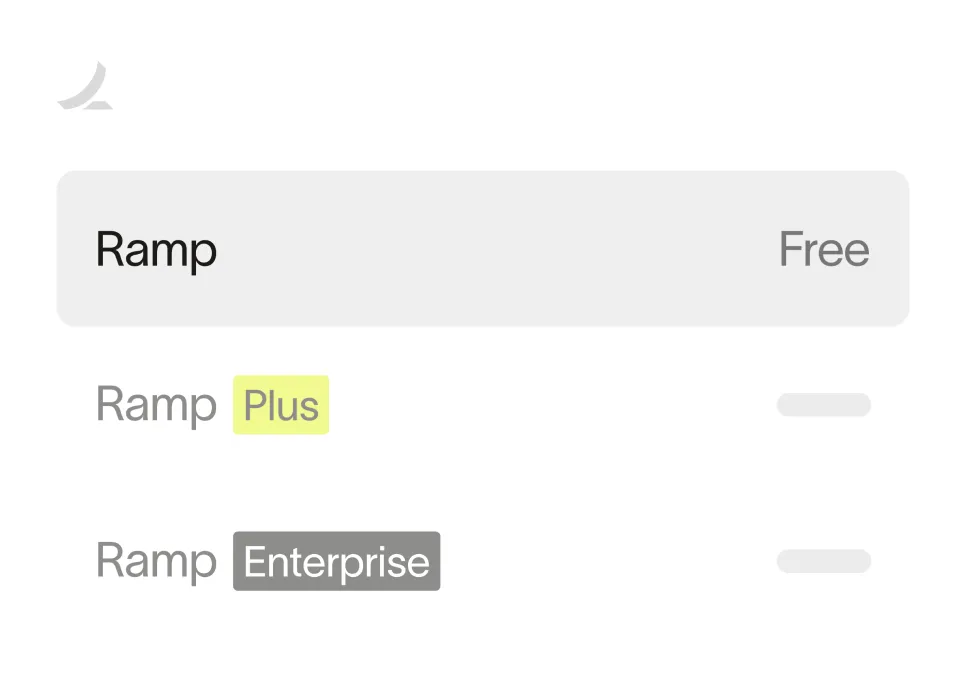

Pricing

You can use most of Ramp’s expense management features for free. That means you can issue unlimited physical and virtual corporate cards, manage and track business spending, and automate expense reporting and reimbursements without paying a cent.

If you need additional control, custom workflows, and advanced ERP integrations, you can get Ramp Plus for just $15 per user per month. Ramp also offers enterprise pricing—just reach out for a quote.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

2. Navan (formerly TripActions)

Navan, formerly known as TripActions, is a travel booking and expense management solution that allows employees to book, view, and manage trips and expenses. Navan is rated 4.7 out of 5 on G2, and it’s a popular choice for mid-market companies:

Key features

- Customizable spend controls to stop out-of-policy spending

- Automated expense reconciliation at the point of sale

- Link your existing business credit cards to the Navan platform so you can keep your existing banking relationships and rewards programs

- Reimbursements for out-of-pocket spend across 45 countries and 25 currencies

Why customers choose Navan vs. Expensify

G2 reviewers like Navan's user interface and automation better than Expensify, giving it high marks for ease of use. Users particularly liked how scans of receipts auto-populate the relevant fields, removing the need for finance teams to update them manually.

Pricing

Navan offers a free tier for up to 5 users. You’ll need to get in touch with Navan’s sales team for enterprise pricing.

3. Paylocity

Paylocity is a procure-to-pay platform that now incorporates Airbase’s former spend management capabilities. It offers guided procurement, accounts payable automation, and expense management in a single, unified interface. According to G2, Paylocity holds an average rating of 4.5 out of 5 based on thousands of verified reviews, performing competitively with Expensify across core categories.

Key features

- Automated procurement with customizable approvals and vendor onboarding

- Invoice processing and bill payments in a unified interface

- Real-time expense reporting with all spending activities captured as they occur

- Receipt management with digital scanning and OCR capabilities

Why customers choose Paylocity vs. Expensify

Reviewers highlight Paylocity’s automation capabilities, centralized spend visibility, and built-in controls for procurement and expense workflows. Several users also note that Paylocity’s integrated system reduces the need for manual expense submissions and separate reporting processes often required in Expensify.

Pricing

Paylocity does not publish standardized pricing for its spend and expense management modules. Businesses can contact the Paylocity sales team for a custom quote tailored to company size and needs.

4. Sage Expense Management

Sage Expense Management, fomerly Fyle, is on a mission to help accountants reduce the time they spend on business expense management. Founded in 2016, Fyle is a popular choice for mid-sized companies that want to build spend management controls around their existing business credit cards. Fyle holds a 4.6 rating on G2, beating Expensify in six of seven rating categories and tying in the “Meets Requirements” category:

Key features

- Track all card spending with direct data feeds

- Automatically extracts, codes, and categorizes paper and e-receipt data

- Submit expense reports and receipts via text message

- Track receipts directly from Gmail and Outlook with Fyle's plug-in

Why customers choose Fyle vs. Expensify

One Fyle user on G2 commented that they’ve never had issues uploading files, which they had previously run into when using Expensify.

Pricing

Fyle’s Growth plan starts at $11.99 per user per month, billed annually. The Business plan is a step up at $14.99 per user per month and requires a minimum of 10 monthly users. Fyle also offers custom quotes for enterprises with more than 250 users.

5. Emburse Professional (formerly Emburse Certify)

Emburse Professional, previously known as Emburse Certify, provides spend management, travel booking, accounts payable, and other solutions for companies with more complex expense management needs. Emburse has an overall rating of 4.5 out of 5 and tops Expensify in four out of seven of G2’s ratings categories:

Key features

- Real-time spend management, with automated expense categories and policy enforcement

- Travel booking that suggests the most economical options by default

- Mobile applications to capture and report expenses on the go

- Automatic matching of credit card payments with expenses

Why customers choose Emburse vs. Expensify

One G2 reviewer found Emburse easier to use than Expensify, and on the whole, many reviewers say Emburse’s receipt management and expense tracking features exceed their expectations.

Pricing

Emburse doesn’t publish any pricing info on their site. However, their pricing page on G2 notes that plans start at $3,000 a year, making this one of the pricier Expensify alternatives.

6. Coupa

Coupa is a spend management platform built for mid-market and enterprise organizations. It brings procurement, expense management, invoicing, and payments into one system. On G2, Coupa has an overall rating of 4.2 out of 5.

Key features

- Procurement and expense management in one platform

- Automated invoice processing and approval workflows

- Spend analytics for compliance and reporting

Why customers choose Coupa vs. Expensify

According to G2 reviews, customers often turn to Coupa when they need a system that supports more complex workflows beyond expense tracking. Reviewers mention procurement and invoice automation as areas where Coupa provides broader coverage compared to Expensify.

Pricing

Coupa does not publish pricing on its website. Pricing is quote-based and varies depending on company size and requirements.

Choose the top-rated Expensify competitor

When it comes to your finances, it pays to pick the best solution. While many tools can help your team in one or two areas, Ramp’s modern finance operations platform covers them all: expense management, travel booking, integrated corporate cards, AP automation, procurement, and more.

That’s what makes Ramp the clear market leader. Try an interactive demo and see why.

Sources

1 Ramp internal customer usage data, 2025.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°