- What is a travel expense report?

- Types of business travel expenses

- Why are travel expense reports important?

- How to make a travel expense report

- Essential components of a travel expense report

- Travel reimbursement process

- Travel expense report templates and tools

- Best practices for tracking and automating T&E reports

- How Ramp eliminates manual travel expense reporting

- Travel expense reporting that pays dividends

Travel expense report

A travel expense report (T&E report) is an itemized list of expenses incurred during a business trip. These documents help your company track business travel spending and organize expenses for compliance and tax purposes.

Business travel is rising again, and with it comes more pressure to track costs accurately. A travel expense report gives you a clear record of what employees spent on a trip and why, helping you stay on budget and avoid reimbursement delays.

When these reports are inconsistent or incomplete, finance teams deal with missing receipts, policy confusion, and slow approvals. A clear, well-documented report keeps spending transparent and travel workflows running smoothly.

What is a travel expense report?

A travel expense report is an itemized record of all costs incurred during a business trip, including receipts, trip details, and totals used for reimbursement and compliance.

Travel and expense reports include costs like airfare, lodging, rental cars, meals, and other incidental expenses. Each entry typically includes the purchase date, amount, category, vendor name, payment method, and an attached receipt or proof of purchase.

While a regular expense report can cover any business-related purchase, a travel expense report applies specifically to business trips and captures details like itineraries, mileage logs, per diem calculations, and lodging receipts.

Several groups rely on these reports to keep travel spending accurate and compliant, including:

- Employees who submit their expenses

- Managers who review and approve costs

- Finance teams who verify receipts, enforce policy, and process reimbursements

Types of business travel expenses

Business trips generate a wide range of costs, and knowing which expenses qualify for reimbursement helps employees stay within policy and keeps reports consistent.

Transportation costs

Transportation is often the largest travel expense. Common reimbursable items include:

- Airfare and booking fees for flights

- Ground transportation such as taxis, rideshares, shuttles, and rental cars

- Parking and tolls during travel days or at hotels and event venues

- Personal vehicle mileage reimbursed at your approved rate

Non-reimbursable expenses may include luxury upgrades, premium seating without approval, or personal side trips.

Accommodation expenses

Lodging varies widely depending on destination and trip length. This category typically includes:

- Hotel stays and taxes

- Extended-stay lodging

- Approved Airbnb or alternative lodging

Non-reimbursable examples include room service upgrades outside policy, in-room entertainment charges, or lodging added for personal travel.

Meals and entertainment

This category covers food and business-related client entertainment, typically within your policy’s per diem or receipt requirements:

- Per diem allowances or actual meal expenses

- Client entertainment tied to business activities

- Alcohol when permitted by policy

- Tipping according to local guidelines

Non-reimbursable items may include excessive alcohol spending, personal meals unrelated to the trip, or entertainment not tied to business.

Other reimbursable expenses

Additional eligible expenses may include:

- Internet and phone charges

- Conference, training, or event fees

- Baggage fees

- Currency exchange fees

Examples that are typically not reimbursable include passport fees, souvenirs, or purchases that have a mixed personal-business purpose.

Why are travel expense reports important?

A complete travel expense report is easier to assemble when employees stay organized before, during, and after their trip.

Before trips

Clear expectations upfront make reporting much easier. Make sure employees understand your travel and expense policy, including what’s reimbursable, what requires preapproval, and any spending limits. Equip them with the right tools, such as corporate cards or receipt-capture apps, so they can track expenses from the start.

During trips

Staying organized while traveling helps keep reports accurate. Employees should save receipts as soon as they make a purchase and upload digital copies through your expense system. Real-time logging prevents missing details and makes documentation easier, especially for foreign currency transactions where conversion methods must match company policy.

After trips

A consistent submission process keeps reimbursements timely. Employees should organize receipts, categorize expenses, and document the business purpose of each item before submitting their report. Common issues—like missing receipts, duplicates, incorrect categories, or unclear business purposes—slow down reviews, so clear instructions help reduce back-and-forth.

How to make a travel expense report

A complete travel expense report is easier to assemble when employees stay organized before, during, and after their trip.

Before trips

Clear expectations upfront make reporting much easier. Make sure employees understand your travel policy, including what’s reimbursable, what requires preapproval, and any spending limits. Equip them with the right tools—such as corporate cards or receipt-capture apps—so they can track expenses from the start.

During trips

Staying organized while traveling helps keep reports accurate. Employees should save receipts as soon as they make a purchase and upload digital copies through your expense system. Real-time logging prevents missing details and makes documentation easier, especially for foreign currency transactions where conversion methods must match company policy.

After trips

A consistent submission process keeps reimbursements timely. Employees should organize receipts, categorize expenses, and document the business purpose of each item before submitting their report. Common issues, like missing receipts, duplicates, incorrect categories, or unclear business purposes, slow down reviews, so clear instructions help reduce back-and-forth.

Essential components of a travel expense report

On a typical T&E report, employees provide the following:

- Employee information: Name, title, department, and contact information

- Trip details: Destination, travel dates, and the business purpose of the trip

- Expense categories: Transportation, lodging, meals, entertainment, and other business-related expenses

- Itemized expenses: Specific items purchased within each category and the amounts spent

- Required fields for each expense: Transaction date, purchase cost, description of the expense, vendor name, payment method (per diem, credit card, etc.), and an attached itemized receipt or invoice

- Grand total and reimbursement calculation: Total cost of all trip expenses and the amount eligible for reimbursement based on company policy

- Approval section: Manager or department lead approval, including signature (digital or physical) and date

- Policy notes: Explanations or justifications for any out-of-policy expenses

Travel reimbursement process

A clear reimbursement workflow helps employees submit complete reports and ensures finance teams can process payments on time.

Submission timeline

Most companies require employees to submit travel expense reports within 7–14 days of returning. Sticking to a firm deadline keeps reimbursements timely and prevents month-end close delays. Late submissions can cause accounting discrepancies or result in denied expenses.

Approval workflow

After submission, a manager or department lead reviews the report to confirm the trip’s purpose and ensure the expenses are reasonable. Finance teams then verify receipts, check policy compliance, and adjust reimbursements as needed. Reports are commonly rejected when receipts are missing, categories are incorrect, or the business purpose isn’t clearly documented.

Payment methods

Most reimbursements are issued by direct deposit to keep payments efficient and trackable. If your company uses corporate cards, many expenses can be paid directly by the business. Expense advances are another option for travelers who can’t cover upfront costs, with final reimbursement adjusted once the report is submitted and approved.

Travel expense report templates and tools

You can manage travel expenses using simple templates or automated software, depending on your team’s needs and travel volume.

Manual templates

Templates help standardize reporting when you’re not ready to invest in software. Excel files allow formulas for totals, Google Sheets provides easy sharing, and PDFs work well when you need a fixed, printable format. These options give employees a consistent structure for logging trip details, itemizing expenses, and attaching receipts.

Expense management software

As travel volume grows, dedicated software can automate and streamline your entire workflow. Look for tools with automatic receipt capture and categorization, mobile support, and integrations with your accounting software. Automation reduces manual work, speeds up approvals, and gives your team real-time visibility into spending.

Simplify your expense management with Ramp

Best practices for tracking and automating T&E reports

Simple process improvements can make travel expense reporting faster, more accurate, and far less manual.

Simplify your expense reporting process

Clear, straightforward steps help employees submit reports that comply with your travel policy. A simplified process reduces errors, shortens review time, and prevents finance teams from chasing down missing information.

Encourage consistent booking practices

When employees book travel through the same approved channels, your spending data stays centralized and easier to reconcile. Consistent booking also reduces the risk of missing receipts or charges spread across multiple consumer travel platforms.

Digitize your policies and guidelines

A digital travel policy gives employees quick access to reimbursement rules, spending limits, and documentation requirements. Even without software, a standardized template with built-in guidance helps ensure complete and consistent reporting.

Invest in the right tools

When you’re ready to automate, choose expense management software that integrates with your existing systems, supports your travel policies, and automatically scans receipts. Automation reduces manual entry and helps keep reports accurate.

Take advantage of corporate cards

Corporate cards eliminate the need for employees to front expenses and provide real-time transaction data. This improves visibility, reduces the chance of manual errors, and eliminates many of the delays associated with reimbursement.

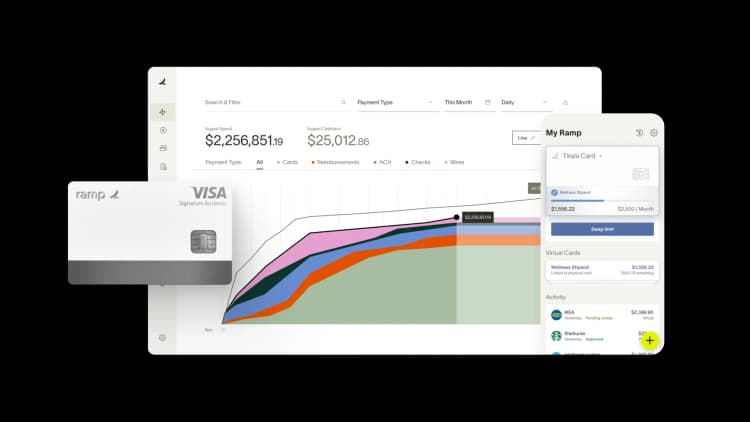

How Ramp eliminates manual travel expense reporting

Travel expense reporting is a notorious time drain for finance teams. You deal with employees submitting crumpled receipts weeks after their trips, manually matching hotel bills to credit card statements, and chasing down missing documentation for flights booked on personal cards.

The back-and-forth alone can stretch the reimbursement process to 30 days or more, frustrating employees and creating unnecessary administrative burden.

Automated expense capture and categorization

Ramp's expense management software transforms this chaotic process into an automated workflow that practically runs itself. When employees book travel through Ramp, every transaction automatically flows into pre-categorized expense reports with merchant details, amounts, and dates already populated. There's no manual data entry or guesswork.

Effortless receipt collection and audit-ready documentation

The platform's receipt capture technology makes documentation effortless. Employees use their phones to snap a photo of their receipts, send it via text or mobile app, and optical character recognition (OCR) instantly extracts vendor names, amounts, and expense categories.

These digital receipts automatically attach to the corresponding transactions, creating a complete audit trail without any filing or paperwork. For travel expenses like hotels that often generate multiple receipts, Ramp intelligently groups related charges, preventing duplicate submissions and confusion.

Built-in policy enforcement and faster reimbursements

Real-time policy enforcement ensures compliance before expenses are even submitted. You can set specific rules for travel spending, like maximum per diem rates for meals or preferred hotel chains, and Ramp automatically flags any out-of-policy expenses for review.

This proactive approach eliminates the need to retroactively deny reimbursements or have awkward conversations about excessive spending. The overall result is a travel expense process that takes minutes instead of hours.

Travel expense reporting that pays dividends

Ramp’s expense management software streamlines the expense reporting process from start to finish, eliminating busywork so your finance team can close the books faster and reimburse employees sooner.

Whether you’re looking for customizable travel policies, integrated corporate cards, powerful automation workflows, or all of the above, Ramp has you covered.

Learn more with a free interactive demo.

FAQs

Employees get reimbursed faster when they submit their reports promptly and include complete documentation for every expense. Using company-preferred vendors and booking tools also reduces the back-and-forth, since transactions flow into your system more cleanly.

Keeping organized records and communicating with approvers when questions arise helps eliminate delays, especially during month-end close. For even more help, expense management software can automate receipt capture and categorization, cutting down approval time.

A business travel expense is any cost you incur while traveling away from your tax home for work purposes. This includes airfare, lodging, meals, transportation, and other necessary costs directly related to conducting business.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°