- What is an itemized receipt?

- Itemized receipts vs. regular receipts

- Why are itemized receipts important?

- When are itemized receipts required?

- Common itemized expense categories

- Best practices for managing itemized receipts

- How Ramp transforms receipt management from manual burden to automated compliance

Key takeaways

- An itemized receipt is a detailed proof of purchase that lists each individual item or service from a transaction, including its specific cost.

- Unlike a standard receipt, an itemized receipt provides the necessary detail to verify purchases against company policy and accurately categorize your spending.

- Itemized receipts are crucial for tax compliance and audit readiness, serving as the required evidence to support your business expense deductions.

- You should always require itemized receipts for key expense categories like employee reimbursements, travel and meals, and client-billed expenses.

- You can eliminate the manual burden of chasing down receipts by using expense management software like Ramp to automatically capture, match, and store them for you.

An itemized receipt is a detailed document that lists each product or service purchased in a transaction. Understanding itemized receipts and automating the process of collecting and tracking them simplifies recordkeeping and ensures you have the thorough and accurate documentation your business needs.

Here, we explain what itemized receipts are, why they’re important for proper recordkeeping and tax compliance, and offer practical tips for managing and organizing business receipts.

What is an itemized receipt?

An itemized receipt lists each line item of the goods or services purchased in a transaction. Unlike a standard receipt, which only lists the total amount paid, an itemized receipt provides a detailed breakdown of each item or service, including vendor information, product names, quantities, price, and totals.

By capturing all these details, an itemized bill paints a complete picture of a transaction. It eliminates any ambiguity about what you purchased and the method for calculating the total cost. This helps ensure transparency in employee reimbursements and compliance with tax requirements for claiming deductions.

What does an itemized receipt look like?

Itemized receipts typically follow a similar format and layout:

- Header: At the top, you'll find the vendor’s name and contact information, including address, phone number, and sometimes email, as well as the receipt number and date and time of purchase

- Itemized list: Next, generally, is the list of purchases or services, which includes descriptions, quantities, unit prices, and the subtotals for each item

- Payment information and totals: Below the itemized list is the sum of all subtotals, any applicable taxes, fees, or discounts, and the final total of the transaction

- Other: Lastly, the receipt may also include information about returns, purchase order numbers, or customer details

Required details on an itemized receipt

Itemized receipts list more details than standard receipts and include information such as:

- Vendor information: The seller’s name, address, and contact information

- Date of service: The time and date of purchase

- Transaction number: A unique invoice or receipt number for the transaction

- Item details: Description, quantity, and unit price of each item you purchased

- Subtotal: The sum of all items purchased before adding in other charges

- Taxes and fees: Any applicable taxes or fees, like sales tax or resort fees

- Grand total: The total amount you paid

- Payment method: Details about how you made the payment (cash, credit card, etc.)

Itemized receipts vs. regular receipts

The biggest difference between an itemized receipt and a regular receipt is the level of detail each provides. Standard receipts typically only report the total amount spent, without providing line-by-line details about the specific items purchased. Itemized receipts break out each item in a transaction, along with detailed information such as cost, quantity, and taxes.

Say an employee submits an expense report for a meal they had on a business trip. A standard receipt would only show the total cost. You don’t know what they purchased, how much gratuity they left, or what taxes they paid. If your T&E policy doesn’t reimburse employees for the purchase of alcohol, for example, you wouldn’t be able to tell whether they were trying to expense a bottle of wine.

An itemized receipt would show you all the details you need to properly categorize employee expenses and verify that they’re within policy. This makes it much easier to track expenses, justify their business purpose for reimbursement, understand what is and isn’t tax-deductible, and prepare documentation in case you’re ever audited.

Why are itemized receipts important?

Itemized receipts play a crucial role in many financial processes, helping you streamline your books. These are key reasons why:

- Compliance: Many business expenses are tax-deductible, but only if you have proper documentation. Itemized receipts provide critical evidence to support deduction claims by proving expenses were genuinely business-related and are required for specific categories, such as meals and entertainment, to comply with tax rules.

- Transparency: Itemized receipts help you track and categorize business expenses more accurately. When you can see a detailed receipt rather than just a total, you can allocate costs to specific expense categories such as meals, business travel, or office supplies. This allows for transparent and accurate spend analysis.

- Audit readiness: Whether it's an internal review or an external audit, itemized receipts are key for validating transactions. Auditors will scrutinize high-value expenses and use itemized receipts to confirm that charges are legitimate and properly recorded in financial statements. Incomplete or missing proof of purchase can result in failed audits.

Also, when employees make work-related purchases, they must submit receipts to receive reimbursement for these expenses. Itemized receipts make the process easier for everyone involved. Accounting can quickly verify that purchases comply with company expense policies.

And when a receipt explicitly lists every item your employee purchased, it reduces the risk of fraud. No one can pull a fast one on you by trying to submit expenses for personal items or anything outside of your expense policies.

Tax compliance and auditing

Itemized receipts are crucial for tax deductions for three key reasons:

- They serve as proof of payment for the deductible expense

- They verify the details of the expense

- They support the accuracy of your deductions during an audit

And in the face of a tax audit, well-organized and itemized receipts minimize discrepancies and become the most crucial piece of evidence in meeting the burden of proof for the legitimacy of your deductions.

It’s always in your best interest to keep accurate, thorough, and detailed records of your expenses for tax purposes. However, auditors will likely request itemized receipts for business travel expenses, such as transportation, meals, and entertainment; office supplies and equipment; and charitable contributions.

When are itemized receipts required?

Although itemized receipts are recommended for most business purchases, there are certain situations where they’re an absolute must for compliance, reporting, and auditing. Your company expense policy should require itemized receipts for:

- Travel reimbursement

- Transactions you plan to submit as tax deductions

- Reimbursable expenses billed to clients

- Spending on company credit cards

Employee reimbursements

Documentation requirements for employee reimbursement are at the discretion of every company, but you should detail them in a company expense policy to avoid confusion. Itemized receipts are usually a must to ensure compliance with company policies.

The IRS has its own definition of business expenses. They must be ordinary and necessary to the business to qualify. However, the IRS always recommends keeping accurate and detailed records, such as itemized receipts, for tax purposes.

Tax deductions

Typically, you would not submit itemized receipts when submitting your tax returns. However, it’s important to keep copies for documentation and in the event of an audit.

The IRS is particularly strict when it comes to deducting expenses for travel, meals, entertainment, gifts, and vehicle use, as detailed in Publication 463. You should always keep itemized receipts for those categories, but consult their guidelines for complete details.

External auditing

If the IRS audits you, auditors will specifically request itemized receipts for the following scenarios:

- Employee expense reimbursements

- Tax deductions

- Travel and entertainment expenses

- Client-billed expenses

- High-cost or high-value purchases

- Fraud detection

- Compliance checks

Common itemized expense categories

In addition to the above, list the most common expense categories in your policy. For tax purposes, these are a few common expense categories where you will want an itemized receipt:

- Meals and entertainment spending: Include the date, time, location, number of guests, all food and drink items, and business purpose

- Air travel: Receipts should include travel date and time, airfare, booking fees, taxes, and any additional charges for baggage or upgrades

- Hotel stays: Lodging receipts are mandatory and should include dates of stay, room costs, taxes, fees, and business purpose

- Rental cars: Rental agreements generally include the rental period, daily rates, fuel surcharges, insurance, upgrades, and taxes

- Office supplies, equipment, or inventory purchases: Include details of the purchases to prevent over-ordering or duplication of inventory

- Software subscriptions: Receipts for software include a description of the tool, the dates of service, subscription costs, and any applicable taxes and fees

Best practices for managing itemized receipts

Here are four key tips for managing and organizing your business receipts:

- Establish a filing system: Whether your receipts are physical or digital, you need an organized filing system to store them. For physical receipts, use binders or labeled folders. For digital, find the cloud storage method that works best for you. Examples include Google Drive, Dropbox, and expense management tools.

- Be consistent: Name and categorize your labels and file names consistently. Organize your receipts chronologically. The key is to make sure you can find the receipts you need when you need them.

- Stick to a routine: Every time you make a purchase, follow the same steps to make sure you’re collecting and storing your receipts consistently. Scan them immediately or store them in the proper files so nothing goes missing. They’ll pile up if you let them.

- Schedule time to review: Set a weekly or monthly cadence to review and organize receipts so you stay up to date. For digital files, back them up regularly for safety.

Automating receipt tracking

Managing itemized receipts no longer requires a manual process. With modern expense management software like Ramp, you can streamline the entire workflow by automating receipt processing. Here’s how:

- Use a receipt scanning app: Receipt scanning apps enable employees to snap photos of itemized receipts immediately after making a purchase. The system then optically scans and digitizes them, populating key fields such as date, amount, and vendor to centralize receipt storage, simplifying bookkeeping and audit preparation.

- Embrace digital receipts: Encourage employees to opt for electronic receipts (e-receipts) whenever possible. Employees can forward these directly to your expense system for electronic processing. Digital receipts eliminate the need for manual scanning and filing of paper receipts.

- Automatically match receipts to expenses: Leading tools can automatically link receipts to the corresponding expense transactions imported from corporate cards or bank feeds. Ramp utilizes AI to match itemized receipts with expenses, which eliminates the need for manual expense reconciliation.

- Automate expense reporting and approval: Employees simply review and submit their itemized expense list through a mobile app. You can configure rules-based approval workflows that alert managers when team members submit expenses, and you can easily review reports on any device before approving them for reimbursement.

- Sync expense data to accounting: Integrating your expense management solution with your accounting software enables you to sync itemized receipt data to the general ledger automatically. This reduces manual data entry and ensures that expenses are captured accurately in company financials.

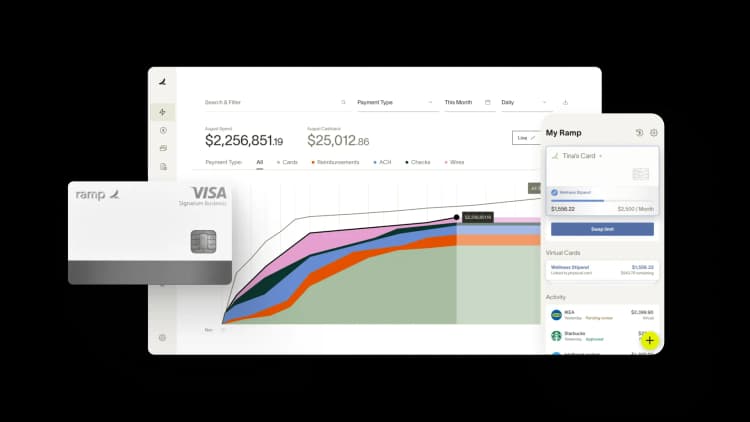

How Ramp transforms receipt management from manual burden to automated compliance

Managing itemized receipts for every business expense is a tedious task. You're constantly chasing employees for missing receipts, manually matching transactions to documentation, and scrambling during audit season to prove compliance. Meanwhile, your finance team wastes hours on data entry instead of strategic work that actually moves the business forward.

Ramp's expense management software eliminates these headaches through intelligent automation that captures, processes, and stores receipt data without manual intervention. When employees make purchases with Ramp corporate cards, the platform automatically prompts them to upload receipts via text or mobile app. Ramp's OCR technology instantly extracts vendor names, amounts, dates, and line-item details, creating searchable digital records that satisfy IRS requirements for itemized documentation.

The real magic happens in how Ramp enforces compliance without creating friction. The system automatically flags transactions missing receipts and sends smart reminders to employees based on your company's expense policy. You can set custom rules requiring receipts for purchases over specific thresholds or for certain merchant categories. For recurring subscriptions or regular vendors, Ramp can even auto-attach receipts from previous transactions, reducing repetitive work.

Beyond receipt capture and storage, Ramp's automated categorization ensures every expense lands in the right general ledger account for accurate financial reporting. The platform learns from your categorization patterns and applies machine learning to improve accuracy over time. This automation doesn't just save time—it reduces compliance risk and gives your finance team time back to focus on analysis and strategy rather than administrative tasks.

Start saving time and money with Ramp

By automating receipt collection and categorization, Ramp eliminates the need for manual expense reports, reducing the administrative burden on employees and finance teams. Ramp's automated expense management doesn't just handle the paperwork—it fundamentally changes how your team spends and tracks money.

Teams that choose Ramp save an average of 5% a year across all spending. Try an interactive demo to see why.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits