- What is unused enterprise software and why does it matter?

- How much money companies waste on unused software

- Common types of unused enterprise software

- Root causes of enterprise software waste

- Steps to identify unused software in your organization

- Software license management strategies

- Best practices for preventing software waste

- Software waste reduction case studies

- How to prevent unused software charges with Ramp virtual cards

- Calculate your savings and take control

Unused enterprise software is a quiet but expensive problem. Companies pay for licenses that no one uses, tools that overlap with existing systems, and subscriptions that keep renewing long after their value has faded, draining budgets and increasing risk.

As organizations grow, software sprawl makes it harder to see what’s actually being used, who owns each tool, and whether spend aligns with real business needs. Without clear visibility and governance, unused software becomes a recurring source of waste rather than a one-time cleanup issue.

What is unused enterprise software and why does it matter?

Unused enterprise software refers to paid software that delivers little or no value relative to its cost. This includes licenses that are never activated, tools that are only lightly used, and applications that overlap with others already in your stack.

The issue goes beyond a few forgotten subscriptions. As companies add new tools to support growth, teams, and initiatives, software sprawl makes it harder to track what’s actually being used and why. Without centralized visibility, unused software accumulates quietly and becomes embedded in renewal cycles.

The problem matters because unused software creates real costs and risks. Every idle license represents wasted spend, but it also expands your security surface area, increases audit and compliance exposure, and adds operational complexity for IT, finance, and procurement teams.

How much money companies waste on unused software

The statistics surrounding software waste paint a disturbing picture of organizational inefficiency. Research shows that 50% of all software licenses go unused, costing companies $45 million per month in completely wasted software spend. To put this in perspective, that's more than the GDP of some small countries, evaporating into thin air simply because organizations can't keep track of what they're paying for.

The problem extends far beyond occasional oversights. Globally, 37% of all installed software is never used, translating to $259 in wasted spending per desktop in the United States alone. Over a four-year period, this amounts to a staggering $30 billion in lost value across the country.

When we focus specifically on Software-as-a-Service applications, the waste becomes even more pronounced. 53% of SaaS applications go underutilized or unused, with organizations squandering approximately $21 million each year on SaaS licenses that provide no benefit. Meanwhile, only 34% of subscriptions are actively used, meaning roughly two-thirds of subscription spending may be delivering zero value to organizations.

The problem varies by industry, with some sectors showing particularly alarming waste rates. Education leads the pack with 47% software waste, followed closely by energy and technology companies. For enterprises specifically, more than 10% of entire IT budgets disappear into unused software, with this figure climbing even higher in larger organizations where oversight becomes increasingly challenging.

The true cost of software waste

Software waste isn’t just a one-time budgeting mistake. It’s a structural issue that compounds as organizations grow and decentralize purchasing.

Direct costs show up as wasted license fees, support contracts, and minimum commitments you pay regardless of usage. Indirect costs are harder to quantify but just as impactful, including increased security risk from dormant accounts, higher compliance exposure from unmanaged licenses, and additional overhead from managing an unnecessarily complex vendor portfolio.

There’s also opportunity cost. Money tied up in unused software can’t be redirected toward tools employees actually use, security controls you need, or strategic initiatives that move the business forward.

Common types of unused enterprise software

Unused enterprise software typically falls into a few predictable categories:

Completely unused licenses

Licenses purchased for planned hires, pilots, or rollouts that never happened often sit unassigned or untouched in admin consoles. Canceling or reclaiming these licenses can deliver immediate savings with little operational impact.

Underutilized software

In these cases, users log in occasionally but only use a fraction of the features or capacity they’re paying for. This often happens when teams buy premium tiers that exceed their actual needs or when adoption stalls after implementation.

Redundant applications

Redundancy arises when different teams purchase tools that solve the same problem. Multiple project management tools, analytics platforms, or survey tools add cost and complexity without adding value.

Legacy systems

Legacy systems may linger because they feel risky to retire, even when they deliver little current value. Over time, ongoing support fees, maintenance, and license renewals turn these systems into a persistent source of waste.

Root causes of enterprise software waste

Unused software rarely accumulates because of a single bad decision. It’s usually the result of growth, decentralization, and fast purchasing colliding with slow governance. When no one owns the software portfolio end to end, unused licenses, overlapping tools, and forgotten renewals go unnoticed.

Organizational factors

Most waste starts with organizational gaps rather than technology failures, including:

- Decentralized purchasing, where departments buy tools independently with different pricing models, contract terms, and renewal dates

- Limited visibility beyond the initial purchase, even when orchestrated procurement is involved

- Poor communication between teams, which leads to duplicated tools solving the same problems

- Employee turnover that leaves subscriptions without clear owners after people leave

Without shared standards or accountability, these issues compound over time and make it difficult to identify what should be consolidated, canceled, or renewed.

Technical and process issues

Even with strong intentions, technical and process gaps make waste hard to detect and correct, such as:

- Inadequate software asset management, which prevents teams from reconciling what they’ve purchased with what’s actually deployed and used

- Complex licensing models that bundle users, features, modules, and usage tiers in ways that are easy to overbuy

- Failed or incomplete implementations that never achieve full adoption

- Lack of reliable usage monitoring, which forces teams to renew subscriptions out of caution rather than evidence

Together, these issues turn temporary inefficiencies into long-term software waste that quietly persists across renewal cycles.

Steps to identify unused software in your organization

You don’t need a perfect inventory to start finding waste. The goal is to create enough visibility to make better renewal decisions in the next 30–90 days, then mature the process over time.

Step 1: Conduct a software audit

A practical software audit follows three phases: discover, measure, and decide. Most organizations can complete an initial pass in 4–6 weeks, then shift to lighter monthly or quarterly reviews.

Start with discovery by inventorying what you have, where it lives, and who pays for it. Pull data from finance systems, identity providers and single sign-on directories, endpoint management tools, and SaaS admin consoles.

Key metrics to track include:

- Login frequency, such as last login and active days in the last 30, 60, and 90 days

- Feature usage, especially for premium tiers and add-on modules

- License utilization, comparing purchased seats with assigned and active seats

Build a comprehensive inventory you can maintain. A common starting point is your top 20 vendors by spend, then expand over time. Record application name, owner, business purpose, departments, contract terms, renewal date, total cost, user counts, and utilization metrics.

Step 2: Analyze usage patterns

Define what “unused” and “underused” mean in practice. Unused typically indicates little to no activity over a defined window, while underused means the license is active but delivers far less value than its cost.

As a starting point, many teams use:

- 30 days with no activity as an early warning

- 60 days as a review threshold

- 90 days as a strong candidate for reclamation or cancellation

Benchmarks should vary by category. A design or analytics tool may be used heavily by a small group, while a companywide collaboration tool should not have most users inactive. Pressure-test thresholds with stakeholders, then run a department-by-department analysis to identify adoption gaps, tier mismatches, and duplicate toolsets.

Map redundant functionality across tools. Project management, surveys, knowledge bases, and observability platforms are frequent sources of overlap.

Step 3: Engage stakeholders

Usage data shows what is happening; stakeholders explain why. Pair admin-console data with short employee surveys to understand which tools people rely on, which they avoid, and where overlap exists.

Work with department heads to establish standards and ownership. The objective is not to remove tools arbitrarily, but to reduce sprawl, protect security, and fund tools that drive outcomes.

Bring finance and IT procurement in early to align on renewal timing and contract levers. Their involvement helps translate usage signals into concrete savings and renewal decisions.

Software license management strategies

Once you have visibility into what’s being used, you can move from diagnosis to action. The most effective approach separates quick wins in the next renewal cycle from longer-term process and governance improvements.

Immediate actions

These steps typically deliver the fastest savings with minimal disruption:

- Canceling or not renewing unused licenses that show no meaningful activity over a defined review period

- Consolidating redundant tools by selecting a standard for each core category

- Reassigning licenses from inactive users before purchasing additional seats

Taking action before renewal windows close is critical. Once contracts auto-renew, leverage shifts back to the vendor.

Long-term optimization strategies

Preventing waste requires ongoing systems and discipline, not one-time cleanups. Implementing software asset management practices helps connect what you’ve purchased, what’s assigned, and what’s actively used.

Many organizations support this with software asset management and SaaS management tools that centralize entitlements, usage data, and renewal tracking. Common platforms in this space include ServiceNow Software Asset Management (SAM Pro), Flexera, and Snow Optimizer.

Strong approval workflows also matter. New purchases should follow a single intake path with a defined owner, a documented business case, and a check against existing tools to prevent duplication.

Clear usage policies make expectations explicit:

- Define inactivity windows

- Require utilization reviews before renewal

- Set rules for premium tiers and add-ons

- Establish exception and escalation paths

Finally, schedule regular reviews tied to renewal dates. Quarterly reviews for top vendors by spend are often enough to maintain control without creating unnecessary overhead.

Negotiation and vendor management

Usage data changes the tone of vendor negotiations. Instead of relying on anecdotes, teams can negotiate based on real adoption and demand.

Renegotiate vendor contracts using utilization data to right-size tiers, reclaim unused seats, and push for flexibility such as true-down clauses, rollover credits, or shorter terms.

Where it fits your usage patterns, usage-based pricing can reduce overbuying. Vendor consolidation can also improve leverage and simplify management, as long as it doesn’t degrade the user experience or adoption of core tools.

Best practices for preventing software waste

Preventing waste is less about one-time cleanup and more about building habits and governance that make visibility and accountability the default. When teams know who owns each tool and how usage is evaluated, surprise renewals become far less common.

Establish software governance

Clear governance sets expectations for how software is purchased, used, and reviewed. A lightweight review board with representation from IT, security, finance, and procurement can set standards, review exceptions, and prioritize consolidation where it matters most.

Effective governance practices include:

- Defining ownership for every application

- Standardizing procurement and renewal workflows

- Requiring utilization reviews ahead of renewals

- Documenting exceptions and escalation paths

These practices help prevent shadow purchasing and ensure accountability doesn’t disappear as teams grow.

Implement technology solutions

Technology helps make governance scalable. Automated monitoring tools can surface usage data, identify inactive seats, and alert teams before renewals so optimization happens while there is still leverage.

Many organizations pair monitoring with software asset management platforms to reconcile entitlements, deployments, and usage in one place. Over time, these systems reduce reliance on manual audits and improve confidence in renewal decisions.

AI can support this process by highlighting unusual usage patterns or forecasting demand, but it should inform decisions rather than replace human review. Usage data still needs context from owners and stakeholders to avoid false positives.

Drive cultural and process changes

Software waste often persists because employees don’t see the cost of the tools they use. Training teams on software spend and explaining the reasons behind consolidation helps reduce workarounds and rebuild trust.

Accountability also matters. Every major application should have an owner who can explain what success looks like, how adoption is measured, and what happens if usage falls short.

Regular software portfolio reviews reinforce these habits. Over time, reviews shift from reactive cost cutting to proactive portfolio management, making it easier to invest in tools that genuinely support the business.

Shadow IT

Shadow IT refers to employees or teams acquiring software outside official procurement channels. It creates additional subscriptions that aren’t visible in any central system. Without governance, this action becomes a blind spot that drives software waste, compliance risk, and redundancy.

Create accountability for software return on investment (ROI). Every major app needs an owner who can explain what success looks like, what adoption should be, and what happens if it doesn’t get there. Run regular software portfolio reviews. Over time, this becomes less about “cutting” and more about “keeping the stack healthy,” so you can invest in the tools that actually move the business.

Software waste reduction case studies

Several companies have reduced unused enterprise software by improving visibility, governance, and accountability across their software portfolios. These examples show how different approaches translated into measurable savings and operational improvements.

Case study 1: SaaS visibility

Investec built deeper SaaS and license visibility, driving reductions of roughly 15% in Adobe spend and 12% in Microsoft spend ahead of upcoming renewals. By integrating usage analytics into procurement and finance systems, the company improved forecast accuracy and negotiated more precise contract terms that matched actual usage. This effort also improved security posture by ensuring offboarding processes consistently deprovisioned idle accounts.

Case study 2: Misallocated licenses

After identifying misassigned SAP licenses, EDEKA DIGITAL reduced SAP licensing costs by €6.2 million by right-sizing user types and eliminating redundant entitlements. The team introduced automated usage tracking that flags low-activity seats before renewal windows, driving sustained savings.

Case study 3: Governance

Adobe reclaimed more than 20,000 idle licenses and decommissioned overlapping tools across multiple categories, freeing up approximately $60 million in savings and cost avoidance. The company also instituted quarterly usage reviews and tighter procurement controls to prevent future duplication.

Tactics these case studies have in common include:

- Establishing a single source of truth for software inventory and usage

- Reclaiming inactive seats and reassigning them before buying more

- Consolidating redundant tools into a defined set of standards

- Tying software governance directly to procurement workflows

- Using automation to support analysis, renewal timing, and negotiations

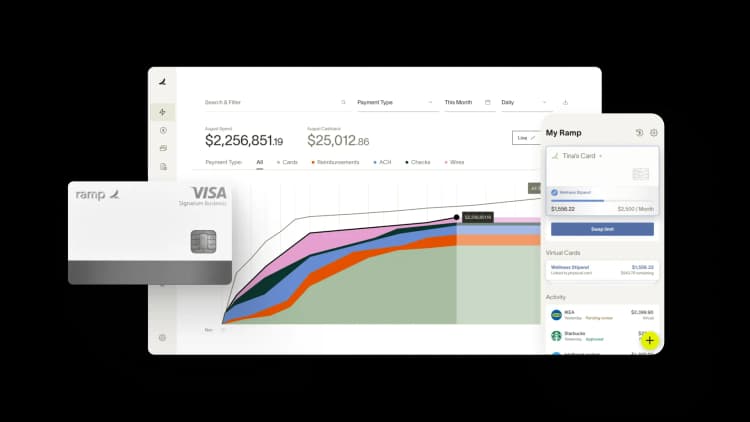

How to prevent unused software charges with Ramp virtual cards

Virtual cards offer several practical approaches to eliminate software overspend and prevent forgotten subscriptions that traditional corporate cards simply can't match.

Configure virtual cards for maximum control

Some businesses prefer the one-to-one mapping approach where every software tool gets its own unique virtual card—individual cards for Zoom, Notion, Salesforce, and every other subscription. Others create cards for specific budgets or teams, like a Marketing team advertising card or a Design team software card. This approach works well for departments that need flexibility while maintaining budget boundaries.

When issuing virtual cards, configure spending limits that align with your vendor's expected billing and your budget constraints. Ramp offers different types of limits for different subscription scenarios: recurring monthly limits work perfectly for standard SaaS subscriptions, one-time limits are ideal for annual plans or project-based tools, and total spend caps are essential when testing new tools with uncertain costs.

For example, if your Canva Pro plan costs $120 annually, set a $120 annual limit on that card. This prevents price creep, unauthorized upgrades to premium tiers, and surprise charges from vendors who increase pricing without clear notification.

Use expiration dates to prevent forgotten renewals

Virtual card expiration dates provide automated protection against forgotten renewals—one of the biggest sources of software waste. Configure cards to expire automatically based on your specific use case.

For free trials, set 30-day expiration for tools you're testing. For short-term campaigns, align expiration with campaign end dates. For temporary licenses, match card life to project timelines.

This feature is particularly powerful for trial management. Instead of relying on calendar reminders or manual tracking, the card simply stops working when the trial should end, forcing an active decision to continue or discontinue the service.

Assign clear ownership for accountability

Every virtual card should have an individual owner—someone responsible for monitoring charges, evaluating usage, and making renewal decisions. This person becomes accountable for that specific software investment.

Owner responsibilities include reviewing monthly charges, assessing whether the tool is delivering expected value, and taking action when usage drops or needs change. If your Head of Growth owns the Mixpanel card, they'll receive alerts about renewals and be prompted to evaluate whether the analytics tool is still justified.

Let Ramp's monitoring catch what you miss

Ramp automatically analyzes virtual card transactions to identify waste patterns and anomalies. The system flags several critical issues: duplicate subscriptions when multiple team members are paying for the same or similar tools, price increases when vendors raise prices without clear notification, and inactive billing for tools that haven't been used but continue charging.

These insights arrive via Slack or email notifications, enabling immediate investigation and action. Instead of discovering duplicate Slack subscriptions during quarterly reviews, you'll know within days of the second subscription being activated.

Use the dashboard for strategic decisions

Ramp's centralized SaaS dashboard provides a comprehensive view of all software subscriptions managed through virtual cards. This single interface shows active subscriptions, card owners, monthly spending trends, and usage patterns across your entire organization.

The department filtering feature is particularly valuable for identifying consolidation opportunities. Filter by marketing to see three different social media scheduling tools, or review engineering subscriptions to spot overlapping development platforms. This visibility enables strategic decisions about vendor consolidation and enterprise package negotiations.

Review and optimize regularly

Establish quarterly review cycles for all software subscriptions using the data from your virtual card dashboard. These reviews should evaluate current usage levels, value delivery against cost, and opportunities for cost optimization through negotiations or plan changes.

Involve relevant stakeholders in these reviews—IT for technical assessment, finance for cost analysis, and department heads for strategic value evaluation. Use concrete usage metrics rather than assumptions about software value to guide these discussions.

Calculate your savings and take control

The return on investment for implementing virtual card-based subscription management is typically immediate and substantial. For a company spending $100,000 annually on software subscriptions, implementing better control mechanisms could easily capture $15,000-20,000 in annual savings by eliminating forgotten renewals, duplicate tools, and unused licenses. Even conservative estimates show savings that far exceed the cost of implementing virtual card solutions.

The administrative time savings add another layer of value, as finance teams can redirect hours previously spent tracking down mysterious charges toward more strategic activities. Security and compliance benefits provide additional value, as better oversight reduces risk exposure and simplifies audit processes.

Beyond immediate cost savings, virtual card implementation enables improved budget accuracy and forecasting, as organizations gain real-time visibility into their software spending patterns. This enhanced data supports better vendor negotiations and more informed strategic decisions about technology investments.

The hidden cost of unused software represents one of the most significant yet overlooked drains on organizational resources. With billions of dollars wasted annually on subscriptions that provide no value, the status quo is simply unsustainable in today's competitive business environment.

Virtual cards offer a simple yet powerful solution to this pervasive problem, providing the visibility and control necessary to eliminate waste while enabling strategic technology investments. The implementation is straightforward, the benefits are immediate, and the long-term impact extends far beyond cost savings.

In an era of tight budgets and increased scrutiny on technology spending, unused software represents a luxury that no business can afford. The question isn't whether your organization is wasting money on unused software—the statistics make clear that waste is virtually inevitable with traditional payment methods. The question is how much you're willing to continue losing before taking action.

The financial tools and strategies exist to solve this problem today. The only question remaining is whether you'll continue feeding the silent drain or take control of your software spending once and for all.

FAQs

Virtual cards can be programmed with expiration dates that automatically stop payments when trials or subscriptions should end. Instead of relying on calendar reminders, the card simply stops working, forcing an active decision to continue or cancel the service. You can also set spending limits that prevent unexpected charges or price increases without approval.

When you deactivate a virtual card, all future charges are automatically declined. The vendor will typically notify the cardholder (via the email on file) that payment failed, at which point you can decide whether to reactivate the subscription with a new card or let the service lapse. This gives you complete control over which subscriptions continue.

Virtual card dashboards provide a centralized view of all active subscriptions, making it easy to spot when multiple team members are paying for similar tools. You can filter by department or software category to identify consolidation opportunities, then negotiate enterprise packages or eliminate redundant subscriptions to reduce costs.

Yes, virtual cards are more secure than traditional corporate cards for software subscriptions. Each virtual card has unique details that can be instantly deactivated if compromised. They also provide better oversight since each subscription has its own payment method, making unauthorized charges easier to detect and stop immediately.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits