- What is cash flow management?

- Why is cash flow management important?

- What’s the difference between cash flow management and cash management?

- What are the types of cash flows?

- Common causes of cash flow problems

- Examples of cash flow management

- What are the components of cash flow management?

- 6 tips to improve your business’s cash flow

- Simplify cash flow management with Ramp

Properly managing cash flow is essential for your business's financial health. Positive cash flow means more cash coming in from sales and investments than going out in bills and business expenses.

Cash flow management isn’t always easy, though. In this article, we cover what cash flow management is, why it matters, and the three main types of cash flow. Plus, learn practical strategies to improve your cash management process.

What is cash flow management?

Cash flow management is the practice of planning, tracking, and controlling the money moving in and out of your business. It's crucial for ensuring you have enough cash on hand to cover expenses, pay employees, and keep business operations running smoothly. It’s also about looking ahead and making smart decisions to support future growth.

Cash flow management is just one part of your business's overall financial management, which also covers budgeting, tax planning, investments, and long-term strategy. While financial management looks at the big picture, cash flow management focuses on your immediate ability to meet obligations.

Why is cash flow management important?

The main objective of managing cash flow is to make sure your business has enough liquidity to meet its short-term financial obligations and operational needs.

Positive cash flow means you have more money coming in than going out, allowing you to cover expenses, pay employees, and maintain day-to-day stability. On the other hand, poor cash flow management can leave you unable to pay bills on time, miss out on growth opportunities, or even risk insolvency during downturns.

By managing cash flows effectively, your business can better plan for the future, seize investment opportunities, and create a cushion for potential financial setbacks while fostering sustainable growth and long-term financial stability.

What’s the difference between cash flow management and cash management?

Cash flow management focuses on analyzing and optimizing your business’s cash flows to ensure smooth operations and meet short-term obligations. It’s all about the timing and amount of money flowing in and out. For example, making sure payments from customers come in on time so you can cover rent, payroll expenses, and other costs when they’re due.

Cash management, on the other hand, is about how your company handles and invests its available cash to maintain liquidity and earn returns. This often includes managing bank accounts, deciding how much to keep in reserves, and investing excess cash in short-term accounts such as money market funds (MMFs) or certificates of deposit (CDs).

Cash flow management might involve adjusting your invoicing practices so you’re paid faster to avoid a cash shortage. Meanwhile, cash management could mean deciding to invest excess funds in a short-term bond until they’re needed.

What are the types of cash flows?

Tracking all three types of cash flow is essential for comprehensive cash flow management. Together, they give you a full picture of where your money is coming from, how it’s being used, and whether your business is on a sustainable path.

The three types of cash flows include:

1. Cash flows from operations (CFO)

Cash flow from operations (CFO) refers to the income generated through regular business activities, such as manufacturing and selling products. This metric is essential for determining your ability to cover operating expenses. In order to keep your business running, you must have a higher amount of incoming cash flow from operations than outgoing.

2. Cash flows from financing (CFF)

Cash flow from financing (CFF) refers to the net flows of cash used to finance your company and its working capital. These cash flow activities can include securing loans, selling stocks, and distributing dividends. CFF gives investors a glimpse into your company's cash reserves and the health of your financial structure.

3. Cash flows from investing (CFI)

Investing cash flow (CFI) shows the amount of cash that’s been generated or spent on investment-related activities in a specific period, such as purchasing equipment or selling assets. While negative CFI can indicate growth investments, it’s important to monitor so you don’t overextend and compromise liquidity.

Common causes of cash flow problems

Cash flow problems can significantly impact your business's ability to operate and grow, and having a good grasp of the main causes of these problems is key to successful financial management. Here are the primary factors that can lead to cash flow challenges:

Inadequate sales or revenue

One of the primary causes of cash flow problems is simply not making enough sales or generating enough revenue. Without a steady and sufficient income, a business will struggle to cover operating expenses like rent, salaries, and other overhead costs.

Seasonal fluctuations in sales can exacerbate this issue, leading to periods where cash outflows exceed inflows.

Poor management of accounts payable and accounts receivable

Poor management of accounts payable and receivable is a significant contributor to cash flow problems. Inefficient receivable practices delay cash inflows by allowing customers to extend payments, while poor payable strategies can either strain supplier relationships or drain cash too quickly.

This imbalance hampers your business's ability to cover operational expenses and invest in growth opportunities, leading to potential cash flow issues.

Excessive inventory

Holding too much inventory ties up cash that could otherwise be used for other operational needs or opportunities. Excessive stock can lead to additional costs for storage, insurance, and potential obsolescence. Your business should balance inventory levels carefully with demand forecasts to avoid unnecessary cash flow constraints.

Overinvestment in fixed assets

Investing heavily in fixed assets such as property and equipment can also lead to cash flow problems, particularly for growing businesses. While these investments are often necessary for expansion, they require significant upfront cash outlays that may not generate immediate returns. This can strain cash reserves, especially if you haven’t planned for these expenses.

Inadequate cash flow planning

Insufficient cash flow planning and forecasting are major contributors to financial challenges. Without clear cash flow projections, it's challenging to make informed decisions about spending, investment, and growth. This can lead to a mismatch between incoming revenues and outgoing expenses, resulting in cash flow shortages.

High debt levels

Relying too heavily on debt to finance operations or growth can lead to cash flow problems, especially if your business faces challenges in generating enough profit to cover debt repayments. High interest and principal repayments can quickly deplete cash reserves, leaving your business’s financial health vulnerable.

Examples of cash flow management

Here are two real-world scenarios that show how businesses handle both challenges and opportunities with their cash flow:

Example 1: Facing a short cash cycle

Say you own a small marketing agency, and many of your clients are on net 60 or net 90 payment terms. You’re left rushing to cover payroll and office rent while waiting for payments to come in.

To stay afloat, you tighten your invoicing process by sending invoices as soon as work is delivered, offering early payment discounts, and following up consistently. You also negotiate longer payment terms with your vendors to spread out expenses.

In this example, staying proactive with receivables and payables helps keep your cash flowing and business running smoothly.

Example 2: Managing surplus cash

Now, picture your software startup just had a record-breaking quarter, leaving you with more cash than expected. You put a portion of this cash into a high-yield savings account and reinvest the rest into your business by upgrading your systems and developing new product offerings.

This example illustrates that, when you have a healthy cash flow, smart cash flow management helps you build on your success and get more value from your money.

What are the components of cash flow management?

Properly managing cash flow supports your business’s long-term viability and success. Here are the key components of effective cash flow management and how each one helps keep your finances on track:

- Cash flow forecasting: Develop a cash flow forecast to anticipate inflows and outflows over a specific period so you can plan ahead and avoid surprises

- Monitoring accounts receivable and payable: Stay on top of customer payments and vendor obligations to keep money moving in and out at the right pace

- Managing working capital: Balance your current assets and liabilities by controlling inventory, expenses, and short-term obligations to maintain liquidity

- Using automation tools: Leverage accounting and expense automation software to streamline invoicing, payments, and tracking, saving time and reducing errors

- Regular review and analysis: Continually review cash flow statements and compare actuals against forecasts to ensure ongoing positive cash flow

6 tips to improve your business’s cash flow

Small, strategic changes can make a big difference. Here are six practical tips to help improve your cash flow:

1. Monitor your spending consistently

Maintaining a positive cash flow starts with knowing exactly where your money is going. Project your business’s capital requirements and regularly analyze the cash coming in and going out.

It also helps to have the right financial management software to track these metrics. Automated accounting software can give you instant visibility into your inflows and outflows, helping you improve decision-making and spot problems early.

2. Speed up invoicing and receivables

The faster you get paid, the healthier your cash flow will be. Send invoices immediately after work is delivered, make payment terms clear, and offer small discounts for early payments. Where possible, ask for deposits or upfront payments instead of waiting 30 to 60 days.

Automation tools can also help streamline the process with templates, reminders, and multiple payment options to make it easy for customers to pay quickly.

3. Negotiate better payment terms with vendors

Don’t be afraid to work with your vendors to extend your payment terms. Spreading out vendor payments or negotiating longer terms gives you more breathing room and helps smooth out cash outflows. Just make sure to maintain strong relationships with vendors by communicating openly and staying dependable with timely payments.

4. Reduce unnecessary expenses

Even with strong sales, high operating costs can drain your cash flow. Evaluate each department’s spending based on ROI and identify non-essential costs you can cut. Look for opportunities to renegotiate rent, reduce discretionary travel, outsource selectively, or eliminate low-value expenses.

Expense tracking software can also help you pinpoint cash flow inefficiencies and redirect funds toward areas that drive business growth.

5. Leverage cash flow forecasting

Cash flow forecasting helps you predict your future cash position and avoid surprises. By projecting your expected inflows and outflows over the coming weeks or months, you can plan ahead for slow periods, prepare for large expenses, and make more confident decisions about everything from investments to hiring.

Regularly checking your actual results against your forecast also helps you stay flexible and adjust your plans as needed.

6. Implement accounts payable automation

Automated accounts payable software can help you improve your payment timing and reduce manual errors. For example, you can schedule payments to align with your cash inflows, improving your liquidity without risking late fees. Many AP tools also integrate with forecasting software to give you better visibility into your future cash needs.

Simplify cash flow management with Ramp

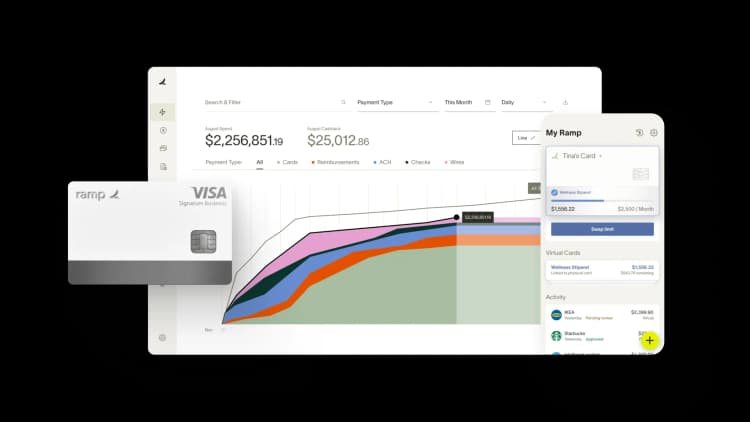

Managing cash flow is a lot easier when your accounts payable process works with you, not against you. Ramp Bill Pay automates your AP workflow from start to finish so you can optimize payment timing and free up cash without the manual hassle.

Our AP software makes it simple to process invoices quickly, set up smart approval flows, and pay vendors using their preferred method (ACH, check, card, or wire), all in a single platform

You’ll get full visibility into your cash outflows so you can stay ahead of due dates and keep your business’s cash flow steady, saving you time and reducing errors.

Ready to learn more? Try an interactive demo.

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark