What are the International Financial Reporting Standards?

- What are International Financial Reporting Standards (IFRS)?

- Why IFRS matters

- The evolution and history of IFRS

- Global adoption: Who uses IFRS?

- Key principles and requirements of IFRS

- What's the difference between IFRS and GAAP?

- Practical steps for IFRS compliance and implementation

- Why adopting IFRS is a strategic advantage for businesses

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

As businesses expand across borders, having a common set of accounting standards makes financial reporting more transparent and consistent. Without them, comparing financial results between countries would be difficult, creating confusion for investors, regulators, and companies themselves.

International Financial Reporting Standards (IFRS) provide that shared framework. These globally recognized rules guide how companies prepare financial statements, promoting transparency and building investor confidence.

What are International Financial Reporting Standards (IFRS)?

The International Financial Reporting Standards are a globally recognized set of accounting principles issued by the IFRS Foundation and the International Accounting Standards Board (IASB) to promote consistency and comparability of financial statements across international borders.

The IFRS ensures your business reports financial data accurately and transparently, making it easier for investors, regulators, and stakeholders to evaluate performance.

If your company expands beyond its home country, IFRS is a critical tool for compliance and investor confidence. As more economies adopt IFRS, businesses that align with these standards position themselves for smoother financial operations and better access to global investment opportunities.

IFRS replaced the earlier International Accounting Standards (IAS), issued before 2001. While many IAS standards are still in use today, they have gradually become part of the IFRS framework, making IFRS the modern global accounting standard.

Why IFRS matters

IFRS plays a central role in global finance. A shared framework for financial reporting helps your company attract investment and operate confidently across borders:

- Promotes transparency: IFRS requires clear, detailed disclosures so stakeholders understand how to prepare financial statements

- Enables comparability: Standardized rules allow investors and regulators to evaluate companies across different industries and countries on a level playing field

- Builds investor trust: Accurate, consistent reporting reduces uncertainty and strengthens confidence in financial performance

- Supports multinational growth: If your company expands abroad, it can streamline compliance and reduce reporting complexity by using a globally recognized framework

- Improves access to capital: Global investors are more willing to fund your business because following IFRS makes financial statements easier to interpret and compare

The evolution and history of IFRS

Financial reporting used to be fragmented. Different countries followed their own accounting rules, making cross-border business complex and inefficient. To solve this, the IASB introduced IFRS in 2001, creating a single framework for financial reporting.

The 2008 financial crisis accelerated the adoption of IFRS. Regulators saw the need for a unified approach to financial reporting to prevent discrepancies and improve economic stability. Since then, IFRS has evolved to address modern financial complexities, including fair value measurement, lease accounting, and revenue recognition.

Global adoption: Who uses IFRS?

Today, more than 140 countries require or permit IFRS, including major economies such as the European Union, Canada, and Australia. The need for transparency, consistency, and investor confidence in a globalized market drives its widespread adoption.

While countries like China and India have developed IFRS-converged standards, the United States continues to use Generally Accepted Accounting Principles (GAAP). This divide highlights both the progress toward global alignment and the remaining challenges.

If you run a multinational business, adopting IFRS means greater access to international capital markets, simplified regulatory compliance, and increased investor trust. This has made it the standard of choice for international finance.

Key principles and requirements of IFRS

IFRS is built on a set of core principles that form the foundation of financial statements and help ensure that financial information is reliable and comparable across different jurisdictions.

Revenue recognition (IFRS 15)

IFRS 15 governs how and when your company recognizes revenue. It uses a five-step model to ensure consistency across industries:

- Identify the contract with the customer

- Identify performance obligations

- Determine the transaction price

- Allocate the transaction price to performance obligations

- Recognize revenue when obligations are satisfied

This standard prevents your business from recording revenue too early or inconsistently, improving comparability for investors.

IFRS recognition rules also require you to record transactions in the period when economic activity occurs, not when cash changes hands. For example, if your company delivers a service in December but receives payment in January, IFRS requires you to record the revenue in December. This prevents a manipulation of earnings by accelerating or delaying payments.

Lease accounting (IFRS 16)

IFRS 16 requires you to report nearly all leases on the balance sheet as a liability and a “right-of-use” asset. This change eliminated the practice of keeping operating leases off the books, giving investors and regulators a clearer picture of your company’s financial obligations.

Measurement principles

IFRS uses different methods to value assets and liabilities:

- Fair value measurement: Many businesses report assets and liabilities at fair value, which is their current market price, instead of historical cost. This ensures financial statements reflect a company’s true economic position.

- Historical cost: Common for tangible items like equipment and inventory

- Present value techniques: Used for items such as pensions or long-term contracts, adjusting future cash flows to today’s value

These measurement principles prevent companies from inflating asset values or hiding liabilities, ensuring accurate and comparable financial reporting.

Disclosure requirements

Beyond recognition and measurement, IFRS mandates detailed disclosures so stakeholders understand how financial statements are prepared. Your company must disclose its accounting policies, assumptions, and risks.

For example, if your company estimates bad debt expenses, it must disclose the methodology used. Transparent disclosure prevents your company from concealing financial risks and allows investors to make informed decisions.

IFRS for SMBs

The IASB developed a simplified version of IFRS tailored to small and medium-sized businesses (SMBs). It reduces disclosure and recognition requirements while maintaining the core principles of transparency and comparability, making compliance more manageable for growing businesses.

What's the difference between IFRS and GAAP?

While IFRS is the global standard, GAAP remains the dominant framework in the U.S. Both systems aim to ensure accuracy, consistency, and transparency, but they follow different philosophies in how financial information is recorded and presented.

IFRS (International Financial Reporting Standards) | GAAP (Generally Accepted Accounting Principles) | |

|---|---|---|

Adoption | Used in 140+ countries, including the EU, Canada, and Australia | Primarily used in the U.S. |

Approach | Principles-based, allowing more professional judgment | Rules-based, with strict guidelines for financial reporting |

Revenue recognition | Focuses on control of goods/services transferred to the customer | Follows detailed industry-specific rules for revenue recognition |

Inventory valuation | Prohibits the last-in, first-out (LIFO) method | Allows both LIFO and FIFO methods |

Asset valuation | Uses fair value accounting for certain assets | Primarily uses historical cost accounting |

Lease accounting | Requires you to report nearly all leases on the balance sheet | Classifies leases as operating or financing leases |

Expense recognition | More flexibility in expense reporting | Strict rules on when expenses must be recorded |

Financial statement structure | Less prescriptive in format, but requires key financial disclosures | Standardized financial statement format with specific line items |

Regulatory body | Governed by the International Accounting Standards Board (IASB) | Overseen by the Financial Accounting Standards Board (FASB) |

Revenue recognition differences

Under IFRS, you recognize revenue when control of goods or services passes to the customer, providing a principles-based approach that works across industries. GAAP uses detailed, industry-specific rules, which can result in a more rigid application.

Lease accounting variations

IFRS 16 requires you to report nearly all leases on the balance sheet, increasing transparency around obligations. GAAP, however, continues to classify leases as either operating or financing, meaning some leases can remain off the balance sheet.

Inventory methods

IFRS prohibits the use of the last-in, first-out (LIFO) method, as it may distort profitability during times of inflation. GAAP allows both LIFO and first-in, first-out (FIFO), giving U.S. companies more flexibility in inventory valuation.

Other notable differences

IFRS and GAAP diverge in several other ways. IFRS generally uses a single-step impairment model, while GAAP applies a two-step process. IFRS allows capitalization of certain development costs, whereas GAAP typically requires you to expense them.

Presentation also differs. IFRS offers flexibility in financial statement format, while GAAP prescribes specific line items.

Practical steps for IFRS compliance and implementation

Transitioning from local GAAP to IFRS can be a complex process, but breaking it down into steps makes it more manageable. Here’s what your business needs to know:

1. Transition from Local GAAP to IFRS

The first step is to perform a gap analysis between your current GAAP-based financial reporting and IFRS requirements. This helps identify areas that need adjustment, such as revenue recognition, asset valuation, or disclosure practices.

Your company should then update accounting policies, adjust internal controls, and train staff to apply IFRS consistently. In many cases, upgrading or reconfiguring financial systems is also necessary to ensure you can report data in line with IFRS.

Finance teams, executives, and auditors each play a role in this process. Accounting teams handle transaction recording, asset valuation, and disclosures, while CFOs and controllers oversee IFRS application at a strategic level.

2. Prepare IFRS-compliant financial statements

Once the transition is underway, prepare the four standardized financial statements required by IFRS:

- Balance sheet

- Income statement

- Cash flow statement

- Statement of changes in equity

Each must provide a true and fair view of your company’s financial position and be comparable across reporting periods. You must also include additional notes, explaining significant accounting policies and estimates.

3. Apply IFRS recognition and measurement principles

Revenue and expense recognition must align with IFRS principles, meaning your company should record revenue when transferring control of goods or services to the customer, not when you receive cash. You must report expenses in the same period as the related revenue.

Similarly, you often need to value assets and liabilities at fair market value, with regular reassessments to keep financial statements accurate.

4. Ensure proper disclosures

IFRS requires detailed disclosures of accounting policies, assumptions, and risks. Your company must explain how it recognizes revenue, measures assets, and calculates liabilities. If it uses estimates, such as depreciation rates or impairment tests, you must disclose the methodology.

Why adopting IFRS is a strategic advantage for businesses

Adopting IFRS means your business can compete in international financial markets, attract global investors, and simplify compliance with financial regulations. Standardized disclosures also strengthen investor confidence, making it easier for your company to raise capital.

Transitioning to IFRS also brings operational advantages by improving financial accuracy, risk management, and decision-making. Clearer reporting gives executives better insights, while consistent rules reduce uncertainty in business planning.

Recent updates, such as IFRS 16 on leases and new sustainability disclosure standards from the ISSB, show how IFRS continues to evolve to address emerging risks and transparency needs. Staying current with these changes helps organizations maintain compliance and build long-term investor trust.

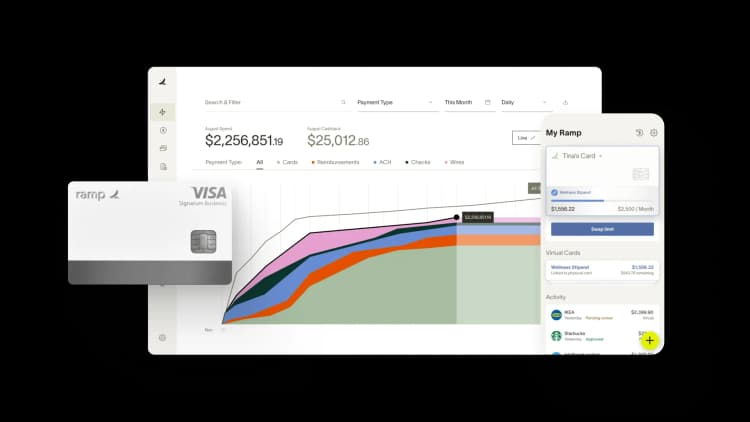

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

The four key principles of IFRS are clarity, relevance, reliability, and comparability. In practice, that means company financial statements must be easy to understand, provide useful information for decision-making, present accurate and unbiased data, and allow stakeholders to compare results across companies and time periods.

IFRS 16 requires businesses to report nearly all leases on the balance sheet as liabilities and right-of-use assets. This replaces the old system where businesses could keep operating leases off the balance sheet, which wasn’t as financially transparent.

Private companies, small businesses, and organizations in countries that follow their own accounting rules—such as the U.S., which uses GAAP—aren’t required to use IFRS. Unless a regulator or investor specifically asks for it, these businesses can stick with local standards instead.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits