- Using a template to create proforma invoices

- How to fill in a proforma invoice step-by-step

- Is a proforma invoice legal?

- Take the stress out of invoice management with Ramp

Proforma invoices are preliminary bills sent to buyers before goods are shipped or services are provided. Think of them as a snapshot of what’s to come—a way to set clear expectations for both parties without it being a final or legally binding document.

In this guide, we’ll guide you through using a free, customizable proforma invoice template to save time and ensure accuracy. Plus, we’ll show you how to fill it out step-by-step so you can create professional, organized invoices effortlessly.

Using a template to create proforma invoices

Our free proforma invoice template makes invoicing straightforward. Designed to be user-friendly, it helps you draft invoices quickly and professionally, saving you time and ensuring accuracy. Whether you're new to invoicing or looking to streamline your process, our free template below has you covered.

Get our free Proforma Invoice Template

Here’s an example of a proforma invoice using our template:

How to fill in a proforma invoice step-by-step

Filling out a proforma invoice is simple with our user-friendly template. Follow these steps to create a professional and organized invoice:

Step 1: Open the template

After downloading, open the template in Microsoft Word or your preferred editing tool. Familiarize yourself with the layout and pre-formatted sections designed to streamline the process.

Step 2: Enter your business details

At the top of the template, input your business name, address, contact information, and logo (if applicable).

Step 3: Add your client’s information

In the designated section, provide the client’s details, including their name, address, and contact information.

Step 4: Assign a unique invoice number and issue date

Every invoice needs a unique number for easy tracking and record-keeping. Add the invoice's issue date as well, so both you and your client can refer to it easily when needed.

Step 5: Fill in the details of goods or services

Use the provided table to list the items or services you’re invoicing for. Include a clear description, quantity, unit price, and total cost for each line item. For services, specify the work completed and its cost. For goods, describe the product details accurately.

Step 6: Clearly state payment terms

Specify payment terms at the bottom of the invoice, including due dates and accepted payment methods. If applicable, note any early payment discounts or late payment penalties to ensure clarity and encourage timely payments.

Step 7: Add delivery information (if applicable)

If delivery details are relevant, include estimated delivery dates and shipping methods. This helps set client expectations and adds transparency to the transaction.

Step 8: Double-check for accuracy

Review all details carefully—totals, contact information, and payment terms—to ensure everything is correct before sending the invoice.

Step 9: Send your invoice

Once finalized, share the invoice with your client via email or your preferred method. Save a copy for your records to track the invoice status and follow up as needed.

Is a proforma invoice legal?

No, a proforma invoice is not legally binding. It’s a preliminary document used to outline costs and terms but doesn’t serve as a legal commitment from either party. Think of it as a quote in invoice form, ensuring both sides are on the same page before moving forward. In contrast, a commercial invoice, is generally legally binding.

Take the stress out of invoice management with Ramp

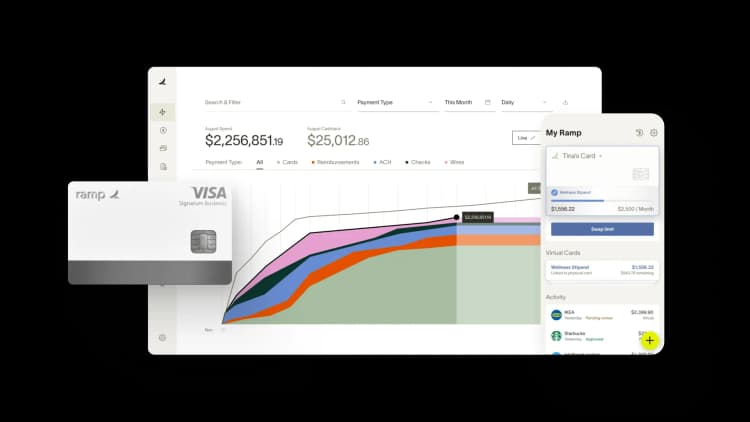

Ramp Bill Pay is an autonomous AP platform that eliminates manual invoice work through four AI agents—handling everything from transaction coding and fraud detection to approval summaries and automatic card payments to vendors. The platform captures invoice data at 99% OCR accuracy and processes bills 2.4x faster than legacy AP software1.

Need a dedicated invoice automation tool? Ramp works as a standalone solution. Want everything connected? Pair it with Ramp's corporate cards, expense management, and procurement for unified spend visibility. Either way, companies using Ramp see up to 95% improvement in financial visibility2.

Ramp's touchless automation tackles the bottlenecks that slow AP teams down:

- Four AI agents: Automate invoice coding, flag fraud before payment, create approval summaries with vendor and pricing context, and process card-eligible payments directly through vendor portals

- Intelligent invoice capture: Extracts every line item at 99% OCR accuracy—no manual data entry required

- Automated PO matching: Compares invoices against purchase orders with 2-way and 3-way matching to catch discrepancies before payment

- Custom approval workflows: Set up multi-level approval chains with routing rules that match your org structure

- Real-time invoice tracking: See exactly where every invoice stands from receipt to payment

- Flexible payment methods: Pay vendors via ACH, card, check, or wire transfer

- International payments: Send wires to vendors in 185+ countries

- Batch payments: Pay multiple vendors in a single batch to streamline payment cycles

- Recurring bills: Automate regular vendor payments with templates

- Real-time ERP sync: Sync bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for always-current records

- AI-assisted GL coding: Automatically map transactions to the right accounts based on historical patterns

- Reconciliation: Close books faster with automatic transaction matching

Why finance teams choose Ramp

Ramp is redefining what touchless invoice processing looks like—accurate, fast, and built for how modern finance teams actually work. Run it as your standalone AP solution or connect it across your full spend stack for end-to-end control.

Over 2,100 verified reviewers on G2 rate Ramp 4.8 out of 5 stars, ranking it the easiest AP software to use. Teams switch to Ramp to cut manual work, prevent costly errors, and close books faster.

Stop chasing invoices. Start automating them. Learn more about Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits