Electronic payments: What they are and how they work

- What is an electronic payment?

- How electronic payments work

- Types of electronic payment methods

- Benefits and risks of e-payments for businesses

- Security and compliance in electronic payments

- The future of electronic payments

- How automation enhances e-payments

- Vendor e-payments are easier on Ramp

Money continues to move toward digital formats, and advancements in technology and e-commerce have made electronic payments the new standard. According to the Federal Reserve Bank of Atlanta, two-thirds of financial transactions were made by card in 2023, with 32% by credit card and 30% by debit.

Electronic payments aren’t just for online transactions. Consumers made only one-quarter of in-person payments in cash, which shows how quickly digital options have become the norm. For businesses, offering electronic payment methods improves the customer experience and simplifies day-to-day operations.

What is an electronic payment?

An electronic payment, also called an e-payment or electronic funds transfer (EFT), is a digital transaction where money moves between accounts without using physical cash or paper checks.

Common examples include credit cards, debit cards, digital wallets such as Apple Pay and Google Pay, online bank transfers, ACH payments, and even cryptocurrencies like Bitcoin. E-payments let customers pay for goods or services through secure digital platforms, offering convenience and flexibility for your business and its customers.

How electronic payments work

Every electronic payment involves a few key parties:

- Payer: The individual or business sending the funds

- Payee: The recipient of the payment

- Payment processor: The intermediary that securely transmits payment details and verifies the transaction

- Financial institutions: The banks or credit unions that hold and transfer the funds

In a typical transaction, the payer authorizes a charge using a payment method such as a card or digital wallet. The payment processor sends this information to the relevant banks for approval and settlement. Making transactions rely on payment rails which allow money to move between financial institutions securely.

Once the transaction is approved, the funds move electronically from the payer’s account to the payee’s account, often within seconds. Electronic payments eliminate the need for physical cash by using secure digital channels such as credit cards, digital wallets, and peer-to-peer apps.

Electronic payments vs. traditional payment methods

Electronic payments differ from cash and checks in several important ways:

- Speed: E-payments are processed instantly or within minutes, while checks can take days to clear

- Cost: Digital payments may include processing fees, but they reduce manual labor and administrative costs compared to handling paper checks or cash deposits

- Convenience: Your customers can pay anytime and anywhere using their preferred digital method, without needing in-person exchanges

- Security: Digital payments use encryption, authentication, and fraud monitoring tools to protect sensitive data, whereas cash and checks are more vulnerable to loss or theft

- Recordkeeping: Electronic systems automatically generate transaction records, making it easier to reconcile accounts and maintain accurate financial records

Types of electronic payment methods

Here’s a look at the different types of electronic payment methods, how they work, and their pros, cons, and average costs per transaction.

1. ACH payments

Automated Clearing House (ACH) payments transfer funds directly between bank accounts through a centralized electronic network. These payments are processed in batches by financial institutions and settle within 1–3 business days.

- How ACH payments work: The payer authorizes a transaction through their bank or payment platform, and the payment processor submits it to the ACH network for settlement

- Common uses: Direct deposit, bill pay, B2B vendor payments, and recurring expenses

- Processing time and cost: Typically 1–3 business days; $0.26–0.50 per payment

- Key considerations: ACH payments are cost-effective for recurring transfers but slower than card payments. Insufficient funds or account errors can delay settlement

ACH payments are cost-effective for recurring transfers and typically settle in 1-3 business days. Understanding the differences between ACH and credit cards can help businesses choose the right method for each transaction type.

If you're looking to accept ACH payments as a business, you'll need to set up a merchant account and choose a payment processor that supports ACH transfers.

2. Credit cards

Credit cards are the most common form of electronic payment, used for both online and in-store purchases. They’re fast, secure, and widely accepted.

- How credit card processing works: When a customer pays, the transaction request passes through a payment processor and card network like Visa or Mastercard to the issuing bank for authorization

- Common uses: Retail purchases, e-commerce, subscriptions, and travel-related expenses

- Processing time and cost: Typically 1–2 business days; 1.5–3.5% of the total transaction

- Key considerations: Credit cards are convenient and secure, but fees can add up for merchants. Chargebacks may occur if customers dispute transactions

3. Debit cards

Debit cards draw funds directly from the payer’s bank account at the time of purchase.

- How debit card processing works: Transactions can be authenticated via PIN, which routes through bank networks, or signature, which routes through credit networks

- Common uses: Everyday retail purchases, bill payments, and ATM withdrawals

- Processing time and cost: Instant or same-day; approximately 0.73% of the transaction amount

- Key considerations: Debit cards carry lower fees but offer limited fraud protection. Spending limits may apply based on the account or bank

4. Virtual cards

Virtual cards are digital versions of credit or debit cards. You can generate virtual cards with unique card numbers, expiration dates, and spending limits for a specific transaction.

- How virtual cards work: Your business can issue unique virtual card numbers with preset limits and expiration dates for controlled spending

- Common uses: One-time online purchases, vendor payments, and secure B2B payments

- Processing time and cost: Same processing time and fees as the associated physical card

- Key considerations: Virtual cards enhance security by masking real card details, but they may not be accepted by all merchants

5. Purchase cards (P-cards)

P-cards are corporate charge cards employees use for business-related purchases, making procurement and expense management more efficient.

- How P-cards work: P-cards function like credit cards but connect to a centralized company account with spending limits and category restrictions

- Common uses: Office supplies, travel expenses, and vendor payments

- Processing time and cost: Varies by issuer; generally lower than standard credit card rates

- Key considerations: P-cards simplify purchasing and tracking, but they require internal controls to prevent misuse

6. Digital wallets and mobile payments

A digital wallet stores payment information and allows users to complete transactions online or with their smartphones. Examples include Apple Pay, Google Pay, Samsung Pay, Venmo, and Cash App.

- How digital wallets work: Most use near-field communication (NFC) for tap-to-pay transactions, while others rely on QR codes

- Common uses: Mobile checkouts, in-store tap payments, and peer-to-peer transfers

- Processing time and cost: Instant or within minutes; typically free or around 1% for instant transfers

- Key considerations: Digital wallets offer convenience and security but require compatible hardware and aren’t accepted everywhere

7. Cryptocurrencies

Cryptocurrency payments such as Bitcoin, Litecoin, or Ethereum are less common but offer an alternative digital transfer method.

- How crypto payments work: Payments move directly between digital wallets, and transactions are verified on a decentralized ledger

- Common uses: Online purchases, international transfers, and payments from tech-forward consumers

- Processing time and cost: Minutes to hours depending on network congestion; typically $0.50–2.50 per transaction

- Key considerations: Crypto can reduce transaction fees and offer privacy, but it’s volatile and not widely accepted

8. Online payment gateways

Online payment gateways like PayPal, Stripe, and Square facilitate secure online transactions and often support multiple payment types.

- How online payment gateways work: When a customer checks out, the gateway encrypts and sends payment details to the processor for authorization and settlement

- Common uses: E-commerce transactions, SaaS subscriptions, and service-based payments

- Processing time and cost: Instant authorization; typically 2.9% of the transaction amount plus $0.30

- Key considerations: Gateways are essential for online sales but can incur fees and chargebacks

9. Wire transfers

Wire transfers send money electronically between banks, typically for high-value or time-sensitive payments.

- How wire transfers work: The payer’s bank initiates the transfer through systems such as Fedwire or SWIFT

- Common uses: Large domestic payments, international transactions, and real estate or vendor settlements

- Processing time and cost: Domestic transfers typically process within hours; international transfers take 1–5 business days. Fees range from $0–40 per domestic transfer

- Key considerations: Wire transfers are fast and reliable for large amounts but can be costly and irreversible

E-payment methods compared

| Payment method | Pros | Cons | Average cost per transaction |

|---|---|---|---|

| ACH payments | Cost-effective, ideal for recurring payments | Slower processing, potential returns | $0.26–0.50 per payment |

| Credit cards | Widely accepted, rewards, fraud protection | High fees, chargebacks | 1.5–3.5% of the total transaction |

| Debit cards | Lower fees, immediate transfers | Less fraud protection, insufficient funds | 0.73% of the transaction value |

| Virtual cards | Enhanced security, fraud prevention | Limited use, not always accepted | Same as the associated physical card |

| Purchase cards (P-cards) | Streamlines procurement, better tracking | Higher fees, risk of misuse | Generally lower than credit cards |

| Digital wallets and mobile payments | Contactless, secure, fast | Not accepted everywhere | Typically free; around 1% for instant transfers |

| Cryptocurrencies | Lower fees, secure, tech-savvy appeal | Volatile, not widely accepted, complex | $0.50–2.50 per transaction |

| Online payment gateways | Simple integration, secure transactions | Transaction fees, chargebacks | 2.9% of the transaction amount plus $0.30 |

| Wire transfers | Fast, reliable for large amounts | High fees, irreversible | $0–40 for domestic transfers |

Benefits and risks of e-payments for businesses

Electronic payment systems offer several advantages over cash and paper checks, but it’s important to consider the risks as well.

Benefits of electronic payments

- Speed and convenience: Electronic payments can be virtually instantaneous, which helps maintain healthy cash flow and reduces delays tied to mailing or depositing paper checks

- Reduced administrative costs: Digital payments minimize manual data entry, check handling, and deposit tracking, lowering administrative overhead and freeing up time for higher-value work

- Better recordkeeping: Electronic payments automatically generate transaction records, which simplifies accounting, improves accuracy, and reduces the risk of human error

- Global reach and 24/7 availability: Accepting multiple forms of electronic payments lets customers pay at any time, from anywhere

- Security: Encryption, tokenization, and fraud-detection tools make electronic payments more secure than handling cash or checks

- Potentially higher revenue: Offering convenient digital payment options can boost sales, as customers may be more likely to complete purchases using their preferred methods

Electronic payment risks

- Cybersecurity threats: While generally secure, e-payment platforms aren’t immune to cyberattacks. If you accept digital payment options, you may need additional safeguards to protect sensitive payment data.

- Transaction fees: Payment processors often charge fees for each transaction, which can add up and impact margins for smaller businesses

- Technical issues: System outages, software bugs, or connectivity problems can disrupt payments and cause delays or lost sales if backup payment processing options aren’t available

- Chargebacks: Some payment methods, especially credit cards, may lead to disputes or chargebacks, resulting in lost revenue and additional administrative work

Security and compliance in electronic payments

Security and compliance are essential to any electronic payment system. Safeguarding customer data and meeting regulatory standards protects both your business and the people you serve.

Common security measures

Modern payment systems rely on multiple layers of protection to keep transactions safe:

- Encryption and tokenization: Sensitive card or account data is encrypted and replaced with unique tokens to prevent exposure during transfers

- Two-factor authentication (2FA): Customers verify their identity with an extra step, such as a code or biometric check

- Fraud detection systems: AI-driven tools monitor transactions in real time and flag suspicious activity before losses occur

Regulatory compliance

Payment processors and businesses must meet strict compliance standards to maintain trust and avoid penalties:

- Payment Card Industry Data Security Standard (PCI DSS): Requires secure handling, transmission, and storage of payment card information

- Know Your Customer (KYC): Financial institutions verify customer identities to reduce fraud and financial crimes

- Anti-Money Laundering (AML): Regulations designed to detect and prevent illegal financial activity across global transactions

These practices help ensure electronic payments remain safe, compliant, and reliable for your business and your customers.

The future of electronic payments

The next wave of electronic payments is driven by innovation and speed. Technologies like blockchain and AI in payment processing are making transactions faster and more transparent, while real-time payment networks are reducing settlement times from days to seconds.

Biometric authentication such as facial or fingerprint recognition is enhancing security and streamlining customer experiences. Cross-border payment innovations are also removing friction for global businesses by enabling faster transfers in multiple currencies.

As these technologies mature, financial operations, automation, and payment processing will continue to converge.

How automation enhances e-payments

Streamlining e-payments with B2B payment automation tools and accounts payable (AP) software can transform how your business handles transactions. These tools automate recurring payments, flag errors, and provide real-time visibility into cash flow.

By integrating payment workflows with AP software, your business can centralize processes, reduce manual effort, and ensure timely, accurate transactions. This not only saves time but also strengthens financial oversight so you can operate more efficiently.

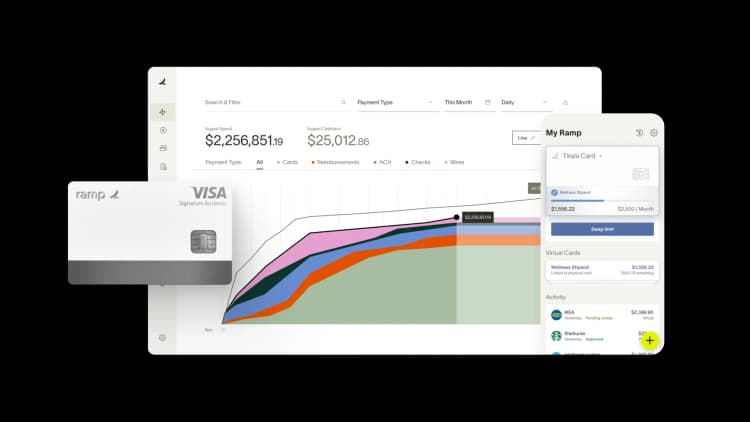

Vendor e-payments are easier on Ramp

Ramp’s accounts payable automation software helps your business streamline vendor payments by offering multiple ways to pay from a single platform. Make payments via card, check, same-day ACH, or international wire; whatever your vendors prefer.

Ramp also integrates with accounting systems like QuickBooks and NetSuite to ensure seamless data flow and more accurate recordkeeping. With features that identify duplicate invoices and match invoices to purchase orders (POs), you can minimize the risk of fraud and payment errors.

Interested in trying Ramp for yourself? Check out a free interactive demo.

FAQs

Most electronic payments are processed instantly or within a few minutes. Some methods, such as ACH transfers, can take 1–3 business days for funds to appear in your bank account.

Electronic payments are any digital transfers of money that don’t involve cash or paper checks, including card payments, bank transfers, and ACH payments. Online payments are a subset of electronic payments that occur exclusively over the internet.

Electronic payments are generally secure. Payment platforms and financial institutions may use encryption, tokenization, and other fraud-prevention tools to protect sensitive data, but strong cybersecurity practices are still essential to prevent unauthorized access or data breaches.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°