Accrual vs. deferral in accounting: Differences, examples, and how to record

- What's the difference between accruals and deferrals?

- What are accruals in accounting?

- How to record accrued expenses

- What are deferrals in accounting?

- How to record deferred expenses

- Why are accruals and deferrals important?

- Automate accruals so every expense lands in the right period

Accruals and deferrals are key concepts in accrual accounting, which recognizes revenues and expenses when they happen rather than when cash is exchanged. They help ensure your business’s financial statements accurately reflect a business's financial health during a specific period.

For example, if you provide a service in December but aren’t paid until January, you’d still record it in December as accrued revenue. On the other hand, if you receive payment in advance for a service you’ll deliver later, you’d record that payment as deferred revenue until the service is complete.

We break down accruals vs. deferrals, how to record each type, and why they matter for accurate reporting, investor confidence, and smarter financial planning.

What's the difference between accruals and deferrals?

Understanding the differences between an accrual vs. deferral in accounting is essential for accurate financial reporting. Here are some of the key distinctions:

Criteria | Accrual | Deferral |

|---|---|---|

Timing | Recorded when earned or incurred | Recorded when receiving or paying cash, but recognition comes later |

Financial impact | Increases accounts receivable or accounts payable | Creates deferred revenues or prepaid expenses |

Examples | Accrued revenue: Services provided but not yet billed Accrued expense: Salaries owed but not yet paid | Deferred revenue: Subscription payment received in advance Deferred expense: Prepaid rent for the next 6 months |

Journal entry | Requires an adjusting entry to recognize revenue or expenses before cash movement | Requires an adjusting entry to recognize revenue or expenses later, as the service is performed or products are used |

What are accruals in accounting?

With an accrual, you record a transaction on your financial statement as a debit or credit before actually making or receiving the payment. By recognizing revenue earned or expenses incurred ahead of the transaction, you gain a more precise, forward-looking perspective on your finances.

This helps you make better operational adjustments and supports compliance with the matching principle, which requires that expenses be recorded in the same period as the revenue they help generate.

In accounting, you typically divide accruals into two main categories: revenue and expenses.

Accrued revenue

Accrued revenue refers to income your business earns by selling a product or service for which you haven’t received payment yet. For example, if you’ve completed a service or issued a loan and expect an interest payment to arrive later, you can record the expected amount as accrued revenue for the current accounting period.

Accrued expenses

Accrued expenses are payments or liabilities you record before processing the transactions. For example, if your business receives a utility bill in January for electricity used in December, you’d record that cost as an accrued expense in December.

Likewise, you’ll often categorize employee salaries and wages as current liabilities and document them as accrued expenses on your balance sheet.

How to record accrued expenses

The way you record accrued expenses depends on your company’s unique accounting process. However, all publicly traded businesses must follow the Generally Accepted Accounting Principles (GAAP) established by the Financial Accounting Standards Board (FASB), which require the use of accrual basis accounting.

In accrual accounting, you document accruals through journal entries at the end of each accounting period. Accrued expenses appear on the liabilities side of the balance sheet rather than under revenue or assets. Once you pay the expense, you remove the liability. This helps you clearly view all current assets and liabilities, avoiding inflated profits or understated debt.

Here’s how it works:

- Identify expenses incurred but not yet paid: These are expenses that belong to the current period, even if you haven’t received or paid the bill yet. They often include recurring costs such as wages, utilities, or interest.

- Record the expense and corresponding liability: Use a journal entry to capture the cost on your income statement and reflect the unpaid amount as a liability on your balance sheet

- Update your books once payment is made: When you pay the expense, reduce the liability and reflect the cash outflow accordingly to keep your records accurate

Creating journal entries for accrued expenses

Suppose your company receives a utility bill for $1,000 in January for electricity you used in December. Since you used the service in December, you record the cost as an accrued expense for that period even though you haven’t made the payment yet.

Here’s how to reflect this in your journal entry:

Account | Debit | Credit |

|---|---|---|

Utility expense | $1,000 | |

Accrued liabilities | $1,000 |

Once you pay the bill, update the entry to remove the liability and reflect the cash outflow:

Account | Debit | Credit |

|---|---|---|

Accrued liabilities | $1,000 | |

Cash | $1,000 |

What are deferrals in accounting?

A deferral or advance payment occurs when you pay for a product or service in the current accounting period but record it after delivery. Deferral accounting improves bookkeeping accuracy and helps you lower current liabilities on your balance sheet. As with accruals, you divide deferrals into revenue and expenses.

Deferred revenue

Deferred revenue refers to payments you receive for products or services but don’t record until after you deliver them.

If a customer pays $60 in December for a 6-month subscription at $10 per month, you record the initial $10 on the income statement for the first month. You’ll defer the remaining $50 to a later accounting period, typically at year-end or whichever period aligns with the subscription’s expiration date.

Deferred expenses

Deferred expenses are payments to a third party for products or services recorded upon delivery. One example is a prepaid insurance policy. If you prepay $1,200 for a 12-month policy at $100 monthly, you only recognize $100 as an expense for the current accounting period and defer the remaining $1,100.

This approach to adjusting entries enables you to lower future liabilities by paying for services beforehand. It also enhances the accuracy of monitoring business expenses according to the specific times when vendors provided services or delivered products.

How to record deferred expenses

As with accruals, you record deferrals using journal entries. But instead of listing incomplete transactions as expenses, deferrals treat completed transactions as assets. It converts them to expenses later in the fiscal year, usually after the delivery of all products and services.

- Identify prepaid expenses: Look for payments your business has made in advance for services you’ll use over time, such as rent, insurance, software subscriptions, or retainers

- Record the full payment as a prepaid asset: At the time of payment, record the entire amount under a prepaid expense account on your balance sheet. This reflects that the business hasn’t yet received the full benefit of the service.

- Allocate the expense across the relevant periods: Each month, or applicable period, recognize the portion of the prepaid expense that applies, and reduce the prepaid balance accordingly

Repeat this process until the prepaid balance is fully expensed.

Creating journal entries for deferred expenses

Extending the deferral example above, say you prepay $1,200 for a 12-month policy at $100 monthly. At the time of payment, you should record the full amount as a prepaid asset:

Account | Debit | Credit |

|---|---|---|

Prepaid insurance | $1,200 | |

Cash | $1,200 |

At the close of each month, you’d report $100 as an insurance expense and decrease the prepaid insurance account by the same amount:

Account | Debit | Credit |

|---|---|---|

Insurance expense | $100 | |

Prepaid insurance | $100 |

Why are accruals and deferrals important?

Strong financial reporting and expense management are crucial for all businesses, but they’re especially vital for small businesses and startups. Incorporating accruals and deferrals into your accounting process goes a long way toward improving your financial planning and analysis (FP&A) process.

Here's how properly recognizing accruals and deferrals can benefit your business:

Improves accuracy

While many small businesses may initially prefer simple cash accounting, which records revenues and expenses immediately when receiving or spending funds, this method doesn’t provide the full picture of each transaction.

By using accrual and deferral accounting, you can more clearly see when your business actually earns revenue and incurs expenses. This helps ensure your financial statements reflect the true state of your operations during each period.

Enables strategic adjustments

Once you understand how and when money flows in and out of your business—based on revenue earned or expenses incurred in correlation with the delivery of products and services—it’s much easier to assess your overall performance. From there, you can adjust your strategy for continued growth.

Attracts investors

Technically, accrual basis accounting is required only for publicly traded corporations under GAAP. However, as a small business or startup, you may struggle to attract investors without offering the insights accrual and deferral accounting methods provide.

Cash accounting might show an uptick in sales and a decline in liabilities. However, it doesn’t give you an in-depth view of how your organization generates and manages its revenue and expenses. It also fails to tell you whether these processes are sustainable.

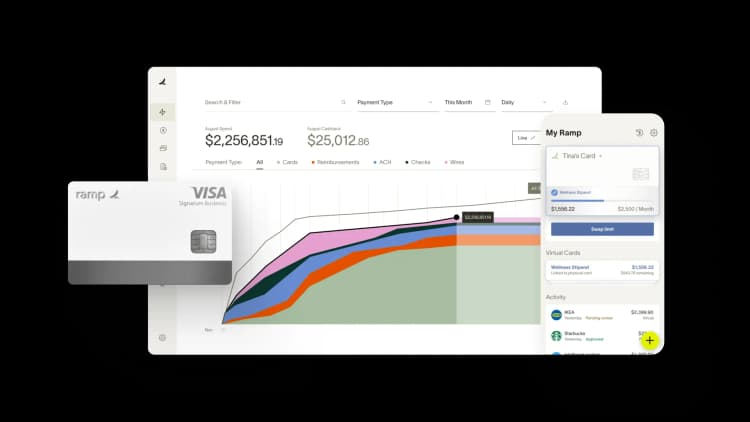

Automate accruals so every expense lands in the right period

Recording accruals and deferrals manually is time-consuming and error-prone. One missed reversal or miscoded transaction can throw off your financials and create headaches during close.

Ramp's accounting automation software eliminates this manual work by handling accruals automatically. When a transaction posts without a receipt or approval, Ramp creates an accrual entry in your ERP and reverses it once the missing context arrives. You don't need to track these entries manually or worry about forgetting to reverse them; Ramp handles the full lifecycle so expenses always hit the right period.

Here's how Ramp automates period-end accounting:

- Auto-post accruals: Ramp creates accrual entries when receipts are missing and reverses them automatically once documentation arrives

- Amortize prepayments: Spread prepaid expenses across multiple periods with automated amortization schedules that apply to recurring transactions

- Maintain audit trails: Every accrual, deferral, and reversal includes full documentation so your books are always audit-ready

Try a demo to see how Ramp automates accruals and deferrals for compliant, accurate reporting.

FAQs

Accruals and deferrals affect taxes by influencing when you recognize income and expenses, impacting taxable income. Businesses must follow IRS rules to report these correctly.

The 4 main types of accruals are accrued revenues, accrued expenses, deferred revenues, and deferred expenses. These help your business match income and costs to the periods they’re earned or incurred, rather than when cash changes hands.

Salaries payable are an accrual. They represent wages your company owes employees for work already performed, so you record them as an accrued expense.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits