How to implement segregation of duties in accounts payable

- What is segregation of duties in accounts payable?

- Why is segregation of duties in AP important?

- Examples of segregation of duties in accounts payable

- How to implement segregation of duties in accounts payable

- Advantages of SoD in AP

- Disadvantages of SoD in AP

- Industry-specific considerations for segregation of duties

- Tools for managing segregation of duties

- Get strong AP controls with Ramp Bill Pay

- Why choose Ramp Bill Pay?

Segregation of duties (SoD) protects your organization from financial fraud while maintaining compliance and operational accuracy. Many finance teams struggle with identifying which roles need separation, finding the right balance between efficiency and internal controls, and meeting regulatory demands.

The good news is that implementing effective controls doesn't have to disrupt your workflow or create unnecessary bottlenecks when done thoughtfully. Here, we cover what segregation of duties in accounts payable (AP) is and why it’s important. We also present examples and walk through the implementation steps to protect your business.

What is segregation of duties in accounts payable?

Segregation of duties in accounts payable is an internal control principle that divides financial responsibilities among multiple employees to minimize fraud risk, prevent errors, and promote accountability.

Segregation of duties serves as your first line of defense against AP fraud and errors while helping you meet compliance requirements across different regulatory frameworks. By dividing financial responsibilities among team members, this practice creates natural checkpoints that protect your business and maintain the integrity of your financial data.

Key principles of segregation of duties

The foundation of segregation of duties rests on a simple yet powerful concept: No single person should control all aspects of any financial transaction. The main goals are:

- Fraud prevention: Dividing tasks among multiple people makes it significantly harder for individuals to commit fraud, since that would require collusion

- Error reduction: Multiple sets of eyes on financial processes catch mistakes before they become costly problems

- Accountability: Clear role divisions create audit trails that make it easy to track who handled each step of a transaction

These principles work together to create a control environment with financial accuracy and integrity built into your daily operations.

Common accounts payable roles

Most accounts payable departments involve several distinct functions that you should distribute among team members:

- Invoice entry: Recording vendor invoices and coding them to the appropriate accounts

- Approval: Reviewing and authorizing invoices for payment based on established limits

- Payment processing: Executing approved payments through check, ACH, or wire transfers

- Reconciliation: Matching payments to invoices and bank statements to verify accuracy

The key separation happens between authorization and execution. The person who approves payments should never be the same person who processes them. This prevents anyone from approving fraudulent invoices and then paying themselves or accomplices.

Similarly, the person entering invoices shouldn't also handle approvals, as this could lead to fictitious invoices being created and approved by the same person.

Segregation of duties vs. division of duties

While these terms sound similar and are often used interchangeably, they represent different approaches to organizing work. Division of duties simply means breaking up tasks among multiple people for efficiency, much like an assembly line.

Segregation of duties, however, specifically focuses on separating tasks that could create conflicts of interest or opportunities for fraud when the same person performs them. The goal isn't just efficiency, it's control and risk mitigation.

Why is segregation of duties in AP important?

Without segregation of duties, your business is exposed to risks such as fraud, errors, and audit failures. The primary goal of SoD in AP is to create a system of checks and balances that strengthens financial integrity and mitigates those risks. SoD in AP is important for:

Fraud prevention

One of the most significant reasons SoD is essential in AP is to prevent fraud. According to the Association of Certified Fraud Examiners (ACFE) 2024 Report to the Nations, occupational fraud costs businesses an estimated $5 trillion globally, with asset misappropriation and financial statement schemes accounting for a large portion of financial fraud.

If your business lacks segregation of duties in accounts payable, you're far more susceptible to these risks.

Error reduction and accountability

Errors in AP, such as duplicate payments, incorrect amounts, or payments sent to the wrong vendors, can lead to financial losses and strained vendor relationships. When you segregate responsibilities:

- One person enters invoices, ensuring accuracy

- Another person approves them, verifying legitimacy

- A third person reconciles payments, catching any inconsistencies

This layered approach creates accountability, prevents errors from compounding, and makes sure you identify and correct issues before they affect financial reporting.

Compliance and audit readiness

Regulatory bodies and auditors expect your business to have internal controls that prevent financial mismanagement. SoD is a critical component of compliance for:

- Sarbanes-Oxley Act (SOX): Requires internal controls for financial reporting

- General Data Protection Regulation (GDPR): Mandates secure processing of financial data

- Payment Card Industry Data Security Standard (PCI DSS): Enforces strict control over payment processes

- Health Insurance Portability and Accountability Act (HIPAA): Requires segregation of duties to protect patient health information and ensure secure handling of healthcare financial transactions

Failing to implement SoD can lead to audit failures, fines, or reputational damage. By establishing robust segregation of duties early, you can proactively demonstrate your commitment to regulatory compliance and build trust with stakeholders, auditors, and customers.

Strengthening internal controls

Weak accounts payable controls can open the door to both internal fraud and external cyber threats. If one individual has complete control over vendor payments, they can manipulate records and might be vulnerable to social engineering exploitation.

Separation of duties in accounting means no single person has unrestricted access to financial transactions, making unauthorized changes or fraudulent activity much more difficult to execute and easier to detect.

To balance control with efficiency:

- Cross-train key personnel: Train multiple people on each process step to maintain separation while avoiding bottlenecks when someone is out of the office. This gives you backup coverage without compromising your control framework.

- Use approval hierarchies with delegation: Set up clear spending limits where front-line staff approve smaller invoices, while larger amounts require manager sign-off. This keeps routine payments moving quickly while maintaining oversight on significant expenses.

- Implement smart automation rules: Configure your accounts payable software to auto-approve invoices that match purchase orders and fall within preset parameters. This frees up your team to focus manual review on exceptions and higher-risk transactions.

The key is finding that sweet spot where you're not slowing down operations with excessive approvals, but you're still catching errors and preventing fraud. Good segregation of duties should help your team work more confidently and efficiently, not act as a roadblock that makes everything take twice as long.

Examples of segregation of duties in accounts payable

Segregation of responsibilities transforms abstract compliance requirements into practical daily operations. Here's how AP teams across different organization sizes can implement these critical controls:

Small business implementation

ABC Manufacturing employs 45 people and processes about 200 invoices monthly. Their AP segregation works like this:

- Sarah in accounting receives invoices and enters them into the system, coding them to the right expense categories

- Department managers approve invoices up to $5,000 through the system, while the CFO handles anything above that threshold

- Their controller reviews approved invoices and initiates ACH payments twice weekly

This simple three-person process prevents fraud while maintaining efficiency. Sarah can't approve her own entries, managers can't process payments for invoices they approve, and the controller provides final oversight before money leaves the company. The system automatically tracks who performed each step, creating a clear audit trail.

Enterprise-level segregation

ACME Corp. processes 15,000 invoices monthly across multiple countries and currencies. Their segregation matrix involves six distinct roles:

- Invoice processors handle data entry

- Procurement specialists perform invoice matching

- Department managers provide business approval

- Finance analysts perform accounting review

- Treasury staff execute payments

- Controllers perform monthly reconciliations

The system enforces additional controls based on invoice amounts and types. Routine office supplies under $1,000 require only departmental approval, while capital expenditures over $50,000 need multiple sign-offs from finance, legal, and executive teams.

Payment timing follows a structured calendar, with different staff members handling domestic versus international transfers, creating multiple checkpoints before disbursing any funds.

What happens when SoD isn't in place?

Let's say there's a growing software company where the trusted office manager handles everything from vendor onboarding to payment processing. Without proper segregation, this person could easily create fictitious vendors, submit fake invoices for IT services and office supplies, and transfer substantial amounts to personal accounts over time.

Such a scheme might involve manipulating invoices, forged approval signatures, and careful payment timing to avoid detection. The fraud could continue for years until a routine audit questions payments to a vendor with a suspicious address.

Beyond the immediate financial loss, the company would face insurance claim disputes, damaged banking relationships, and months of forensic accounting work to restore accurate records and rebuild internal controls.

How to implement segregation of duties in accounts payable

Implementing SoD requires a structured approach to properly assign roles without creating inefficiencies. Here’s a detailed breakdown of the key steps:

Step 1: Identify critical AP processes and risks

Before implementing SoD, you need to assess which processes carry the highest risk of fraud or error. Some of these key AP processes include:

- Invoice receipt and data entry

- Invoice approval

- Payment processing

- Vendor management and verification

- Payment reconciliation

- Financial reporting and audits

Each of these areas must have clear ownership, ensuring that no single person handles multiple stages of payment processing.

Step 2: Assign distinct roles and responsibilities

Once you identify key risk areas, divide responsibilities across multiple employees. Create job descriptions and process maps, and then assign roles by creating an accounts payable segregation of duties matrix.

This structure creates built-in accountability at each stage. When you distribute critical functions among different employees, no single person has complete control over the entire accounts payable process, significantly reducing the risk of errors and fraudulent activities.

Step 3: Enforce system-based controls

Manual segregation alone isn't enough. You can also use automation and system-based controls to enforce SoD. AP software and ERP systems offer role-based access controls, so that:

- Employees only have access to the functions required for their role

- Invoice approval requires multi-level authorization

- Payments over a set threshold require dual approval from senior executives

Step 4: Implement dual authorization for payments

Dual approval means that no single person can process payments without oversight. Best practices include:

- Threshold-based approval: Large payments require C-suite or finance leader approval

- Vendor verification checks: Before you approve payments, verify vendor details to prevent fraudulent payments to fake vendors

- Payment review log: All payments should have a digital audit trail capturing who approved and executed transactions

This multi-layered approach creates a safety net that catches errors and prevents fraud before payments leave your business.

Step 5: Train employees on fraud prevention and SoD policies

AP teams must understand why SoD matters and how fraud occurs. Training should cover:

- Common fraud schemes, such as fake vendors and invoice tampering

- How to spot red flags such as duplicate invoices and sudden vendor changes

- How to report suspicious activity

Continuous education helps employees remain vigilant. Well-trained staff become part of the business's defense, capable of identifying and preventing fraudulent activities before they can cause financial damage.

Step 6: Conduct regular audits and reconciliation

Even with SoD in place, regular accounts payable audits and reconciliations are necessary. This step involves:

- Monthly bank reconciliations to match payments against invoices

- Vendor audits to verify legitimacy

- Expense and invoice reviews to detect anomalies

- Surprise audits to catch potential fraudulent activity

Using AI-driven anomaly detection can further enhance the effectiveness of financial oversight. These systematic reviews create an additional layer of verification that ensures segregation of duties policies work as intended.

Tip: Use AP automation to reinforce segregation of duties

Even the best SoD policies can fall short if your systems rely heavily on manual processes. Implementing AP automation software allows you to enforce role-based permissions, route approvals based on invoice thresholds, and maintain detailed audit trails automatically.

Not sure where to start? Check out our accounts payable automation software comparison to find a solution that fits your team's needs.

Advantages of SoD in AP

Segregation of duties in accounts payable creates a foundation of control that benefits organizations of all sizes. Here are three key advantages that make SoD implementation worthwhile.

Enhanced fraud prevention and financial protection

Spreading key AP functions across multiple employees creates barriers against fraudulent activity. One person can't create fake vendors, approve payments, and process checks without detection.

This multi-person approach stops common fraud schemes before they start:

- Vendor fraud becomes nearly impossible when different people handle vendor setup and payment approval

- Ghost employee schemes fail when payroll entry and approval require separate authorization

- The review process detects duplicate payment scams

Improved accuracy and reduced errors

Multiple sets of eyes on AP transactions catch mistakes before they become costly problems. When different employees handle data entry, approval, and payment processing, errors are apparent during natural handoffs.

Common accuracy improvements include:

- Flagging duplicate invoices during the approval stage

- Correcting math errors on invoices before payment

- Verifying incorrect vendor information during the review process

- Resolving payment timing issues before checks go out

This collaborative approach means your AP team catches problems early, reducing vendor disputes and maintaining positive relationships with suppliers.

Better regulatory compliance and audit readiness

Proper segregation of duties creates the documentation trail that auditors and regulators expect to see. When your AP process has built-in checks and balances, you're always prepared for compliance reviews.

Key compliance benefits include:

- Clear audit trails showing who handled each transaction step

- Documented approval processes that meet regulatory standards

- Reduced risk of penalties from oversight agencies

- Easier preparation for internal and external audits

Your business stays ahead of compliance requirements while building credibility with stakeholders, lenders, and regulatory bodies who value strong internal controls.

Disadvantages of SoD in AP

While segregation of duties in accounts payable strengthens fraud prevention and compliance, it also presents a few challenges that you need to navigate.

Slower processes and operational inefficiencies

When multiple employees must sign off on transactions, the AP approval process can slow down. This is especially challenging for businesses handling high transaction volumes or urgent payments. To reduce delays:

- Implement AP automation tools that route approvals instantly

- Use threshold-based approvals, such as auto-approvals for small payments and additional review for large payments

- Streamline workflows to reduce unnecessary steps

With the right technology and clear approval limits, you can maintain control without sacrificing speed.

Increased staffing and training costs

Smaller companies may lack enough employees to separate duties effectively. Hiring additional staff or restructuring responsibilities adds costs.

To reduce costs:

- Use role-based access controls in software instead of manual segregation

- Leverage AP outsourcing for independent oversight

- Train employees to follow internal controls without expanding the workforce

Using technology and external resources can help smaller businesses achieve effective segregation without breaking the budget.

Risk of collusion among employees

While SoD prevents individual fraud, collusion between employees remains a risk. Two or more employees may work together to bypass controls.

How to prevent collusion:

- Conduct surprise audits to identify unusual transaction patterns

- Use AI-powered fraud detection tools to flag anomalies

- Rotate roles periodically to prevent long-term fraud schemes

Regular monitoring and unpredictable oversight measures make collusion much more difficult to execute and sustain.

Industry-specific considerations for segregation of duties

SoD is essential across industries, but implementation varies depending on regulatory requirements, transaction volume, and AP fraud risks. Here's a breakdown of how different industries approach segregation of duties in accounts payable:

SoD needs across industries

Industry | Key SoD focus | Common risks | SoD best practices |

|---|---|---|---|

Financial services & banking | High regulatory oversight (AML, SOX) | Insider fraud, unauthorized transactions | Multiple approval layers, strict role-based access |

Healthcare & pharmaceuticals | Strict compliance (HIPAA, FDA) | Fraudulent medical claims, overbilling | Vendor verification, claim auditing, system-based approvals |

Retail & e-commerce | High transaction volume | Duplicate payments, return fraud | Automated reconciliation, vendor approval processes |

Manufacturing & supply chain | Vendor relationships, procurement fraud | Fake suppliers, over-invoicing | 3-way matching (invoice, purchase order, goods received note), vendor risk assessment |

Government & public sector | Public fund transparency | Grant misallocation, procurement fraud | External audits, documented spending approvals |

Technology & SaaS | Subscription-based expenses | Fake vendor invoices, expense fraud | Subscription tracking, AP automation |

Tools for managing segregation of duties

Software solutions designed for financial operations now include built-in controls that make it much easier to establish appropriate separation between different AP functions. These platforms automatically enforce authorization hierarchies, track who performs each action, and create clear documentation trails that support compliance requirements.

When evaluating software solutions, look for these key features that support strong segregation of duties in accounts payable:

- Role-based access controls: Limit users to only the functions they need for their specific responsibilities

- Multi-level approval workflows: Route transactions through appropriate authorization chains based on dollar amounts or vendor types

- Comprehensive audit trails: Capture detailed records of who performed each action and when

- Pre-built SoD matrix templates: Help you define and implement appropriate duty separations for your business

- Real-time monitoring and alerts: Flag potential control violations or unusual activity

- Integration capabilities: Connect with your existing ERP or accounting software while maintaining control boundaries

- Customizable reporting features: Generate compliance documentation and management oversight reports

These solutions don't replace good internal controls; they amplify them. By automating the enforcement of duty separation rules and creating permanent records of all activities, technology helps you maintain strong financial controls without overwhelming your team with manual oversight tasks.

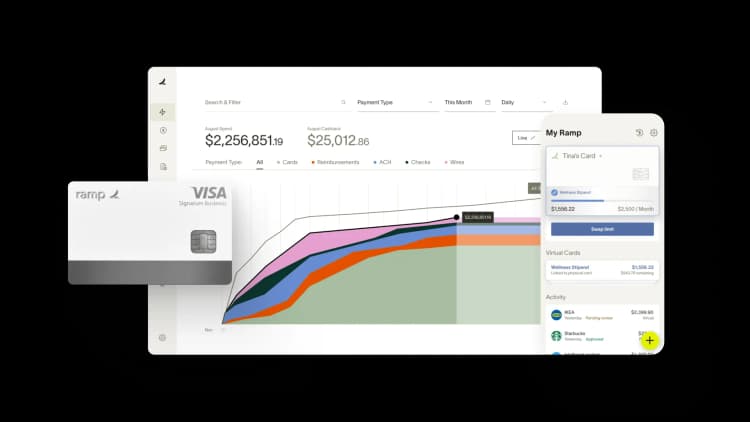

Get strong AP controls with Ramp Bill Pay

Ramp Bill Pay is autonomous accounts payable software that runs AP without manual intervention. Four AI agents handle invoice coding, flag fraud, create approval documentation, and execute card payments—your team doesn't need to touch it. OCR hits 99% accuracy on line-item data, helping businesses push through invoices 2.4x faster than legacy AP software1.

Use Ramp Bill Pay on its own, or link it with Ramp corporate cards, expense tracking, and procurement systems for complete spend oversight. Up to 95% of businesses see improved payables visibility after adopting Ramp2.

Top features for strong AP controls

- Fraud prevention agent: Flags suspicious activity before payments go out, including unexpected banking detail changes, suspicious vendor email domains, and unverified accounts

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons—then recommends approval or rejection

- Custom approval workflows: Configure multi-tier authorization paths that route invoices based on organizational roles and structure

- Roles and permissions: Implement granular access controls that ensure appropriate segregation of financial responsibilities

- Automated PO matching: Reconciles invoices with purchase orders through dual and triple verification methods, preventing billing discrepancies before funds are released

- Real-time invoice tracking: Follow each invoice's progress from submission through final payment

- Vendor Portal: Offer vendors a secure channel to update banking details, monitor payment timing, and communicate with your AP staff

- Real-time ERP sync: Maintain bidirectional synchronization of vendor information with leading accounting platforms including NetSuite, QuickBooks, Xero, Sage Intacct, and others—ensuring your books stay audit-ready

- GL coding: Route transactions to appropriate ledger accounts using intelligent coding recommendations

- Reconciliation: Complete your monthly close in less time through automatic transaction matching

Why choose Ramp Bill Pay?

Ramp Bill Pay delivers complete AP functionality as a standalone solution. However, if you want a single platform that unifies payables, card spending, expense reports, and purchasing, Ramp offers that option too.

Standalone or integrated, Ramp Bill Pay provides touchless AP with a level of precision and speed that older platforms simply can't match. Ramp also consistently earns recognition as one of the easiest AP platforms to use on G2, with 2,100+ verified customer reviews and an average rating of 4.8 stars. Finance leaders turn to Ramp to eliminate tedious manual processes, catch mistakes before they impact the business, and shorten their close cycles.

You can choose Ramp's free plan for essential AP features, and Ramp Plus for more advanced capabilities for $15 per user per month.

AP should be simple. With Ramp Bill Pay, it is. Try Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits