Year to date (YTD): Definition, formula, and examples

- What does year to date mean?

- Calendar year vs. fiscal year YTD

- Common YTD applications in business

- How to calculate year-to-date

- YTD in payroll and employee compensation

- YTD for investment returns

- YTD vs. other time period metrics

- Benefits and best practices for using YTD

- Automate YTD reporting with real-time syncing

Year to date (YTD) is the total from the first day of the year through today. It’s a simple way to measure progress in real time, whether you’re tracking business performance, payroll totals, or investment returns.

What does year to date mean?

Year to date (YTD) means the total of something from the first day of the year through the current date. It’s a time-based measure often used in financial management and investing. Most North American companies define year to date using the calendar year, which starts January 1.

Some companies instead base year to date on their fiscal year, which may differ from the calendar year. Businesses often set non-standard fiscal years to match seasonality, customer demand, or reporting needs.

Calendar year vs. fiscal year YTD

Year to date (YTD) can be calculated using either the calendar year or your company’s fiscal year, depending on reporting standards:

- Calendar year YTD: January 1 through today. This is the default for most individuals and businesses because it aligns with the standard calendar.

- Fiscal year YTD: From the start of a company’s fiscal year through today. Many organizations choose a non-calendar fiscal year to better match seasonality, customer demand, or internal reporting needs.

Examples of different fiscal years

| Organization | Fiscal year cycle | Why this timing works |

|---|---|---|

| Apple | Ends late September | Closes books after back-to-school shopping peak |

| Schools & universities | Jul 1 – Jun 30 | Matches academic calendars and tuition payments |

| Retailers | Ends late January | Captures full holiday sales season before closing |

Common YTD applications in business

Businesses use year to date (YTD) figures to check progress against budgets and prior periods without waiting for year-end reports. YTD helps leaders see how revenue, business expenses, and overall results are pacing against annual goals.

YTD revenue and sales

Tracking YTD sales shows whether revenue is on pace to hit yearly targets. For example, if your company earns $50,000 in January, $60,000 in February, and $70,000 in March, the YTD revenue through March is $180,000. Comparing this total with your annual budget helps you forecast results and adjust strategy mid-year.

YTD expenses and budgeting

YTD expense data helps keep spending aligned with budgets. Suppose your software costs already total $80,000 out of a $120,000 budget halfway through the year—you’ll know to adjust before overspending. Tracking expenses this way highlights trends and informs course corrections.

YTD financial reporting

Accountants rely on YTD figures to prepare financial statements and estimate tax liabilities. Reports often include YTD revenue, expenses, and net income, allowing comparisons with the same period in prior years. For example, YTD net income of $450,000 through June compared with $400,000 the year before shows year-over-year improvement.

How to calculate year-to-date

YTD measurement is more sensitive to early changes than later ones, so it’s best used alongside other metrics like year-end, quarter-on-quarter (QoQ), or custom date ranges.

The basic YTD formula is:

YTD = (Current value – Beginning value) / Beginning value * 100

This formula applies whether you’re calculating profits, investment returns, or portfolio performance.

Step-by-step calculation process

- Identify the start date: Decide whether you’re measuring from the beginning of the calendar year or your company’s fiscal year

- Determine the end date: Select the cutoff date (usually today, though you can choose another date)

- Apply the formula: Use the values that match what you’re measuring, such as revenues, expenses, stock prices, or portfolio values

Always exclude the current day when calculating YTD, since results for that day aren’t yet complete.

YTD calculation examples

Business profits

A profit & loss (P&L) statement shows revenue, expenses, and profit for any period. Suppose your fiscal year starts on January 1. As of April 2, income totals $670,539 and expenses $340,708.

YTD profit = 670,539 – 340,708 = $320,831

Investment return

To calculate a stock’s YTD return, subtract its price on the fiscal year’s start date from its most recent closing price. Divide that difference by the start price, then multiply by 100.

YTD return = (Current price – Beginning price) / Beginning price * 100

Portfolio return

Imagine a portfolio that began the year at $100,000, with $70,000 in stocks and $30,000 in bonds. By June 30, the stocks are worth $77,000 and the bonds $32,000, for a total of $109,000.

YTD return = (109,000 – 100,000) / 100,000 * 100 = 9%

YTD in payroll and employee compensation

Payroll is one of the most common places you and your employees will see year to date (YTD) figures. Pay stubs and payroll reports show cumulative earnings and deductions from the start of the year through the current pay period.

Understanding YTD on pay stubs

Most pay stubs display YTD totals alongside current pay. These figures help both you and your employees track earnings and withholdings throughout the year:

- YTD gross earnings: Total income earned since the start of the calendar or fiscal year, before any deductions

- YTD deductions: Cumulative taxes, benefit premiums, and retirement contributions withheld from paychecks

- YTD net pay: The amount actually taken home after deductions

For employees, YTD figures support tax planning and provide accurate income details for loan or credit applications. For employers, they aid in budgeting, ensure compliance with payroll tax rules, and simplify preparation of year-end forms like the W-2.

Example: YTD payroll calculation

Suppose an employee earns $1,500 every two weeks. By the end of May (10 pay periods), their YTD gross earnings equal $15,000. If $3,000 has been withheld for taxes and $1,000 for benefits, their YTD net pay comes to $11,000.

YTD for investment returns

YTD returns show the gains or losses on an investment from the start of the year through today. They provide a quick snapshot of your financial performance relative to your goals and the broader market.

Calculating YTD investment returns

The standard formula for YTD investment returns is:

YTD return = (Current price – Beginning price) / Beginning price * 100

Suppose you bought a stock at $50 on January 1 and it’s now trading at $60.

YTD return = (60 – 50) / 50 * 100 = 20%

If the stock also paid $2 in dividends during this period, you’d add that to your gain before dividing by the beginning price:

YTD return = (60 – 50 + 2) / 50 * 100 = 24%

Including dividends, interest, and other distributions gives a more accurate picture of total return.

Comparing YTD performance

To add context, compare YTD returns against benchmarks like the S&P 500 or Dow Jones Industrial Average. This shows whether your portfolio, or your company’s investments, are underperforming or outperforming the market.

YTD analysis can also guide financial decisions such as rebalancing, shifting into safer assets, or increasing exposure to growth opportunities. In seasonal industries like retail or travel, YTD performance helps distinguish normal fluctuations from meaningful changes in fundamentals.

YTD vs. other time period metrics

YTD results are most useful when compared with other time-based metrics. Businesses often look at month-to-date (MTD), quarter-to-date (QTD), and year-over-year (YoY) to add context.

YTD vs. month-to-date (MTD)

MTD measures progress from the start of the month through today. It’s useful for tracking short-term activity like campaigns or productivity.

For example, if you launch a marketing campaign at the start of June, MTD highlights its early performance without being diluted by prior months. Seasonal businesses can also use MTD to isolate peak months, such as April or May, for clearer trend analysis.

YTD vs. quarter-to-date (QTD)

QTD covers performance from the start of the current quarter through today. Public companies use QTD figures to prepare quarterly earnings reports, while private companies often use them as internal checkpoints.

QTD is a subset of YTD. For instance, in May, YTD covers January–May, while QTD only covers April–May. Together, they provide both a detailed quarterly snapshot and a broader year-to-date view.

YTD vs. year-over-year (YoY)

YoY compares performance in the same period across different years, such as January–September this year vs. last year. Unlike YTD, which is partial-year, YoY accounts for seasonality and provides a longer-term view of growth or decline.

Benefits and best practices for using YTD

Using year to date (YTD) figures helps you track performance in real time and make better business decisions. Done correctly, YTD reporting highlights strengths, flags issues early, and provides a solid basis for planning:

- Real-time tracking: Monitor performance as it unfolds without waiting for year-end statements

- Early trend detection: Spot growth opportunities or problems before they escalate

- Smarter decisions: Use cumulative data to guide hiring, budgeting, and investment choices

- Accurate records: Reconcile accounts often and keep entries up to date to ensure YTD figures are reliable

- Error prevention: Avoid mistakes like starting with the wrong balances or missing transactions, which can distort results

Common mistakes to avoid

- Forgetting to exclude the current day’s incomplete results

- Using prior-year carryovers or wrong opening balances

- Overlooking transactions that leave gaps in the data

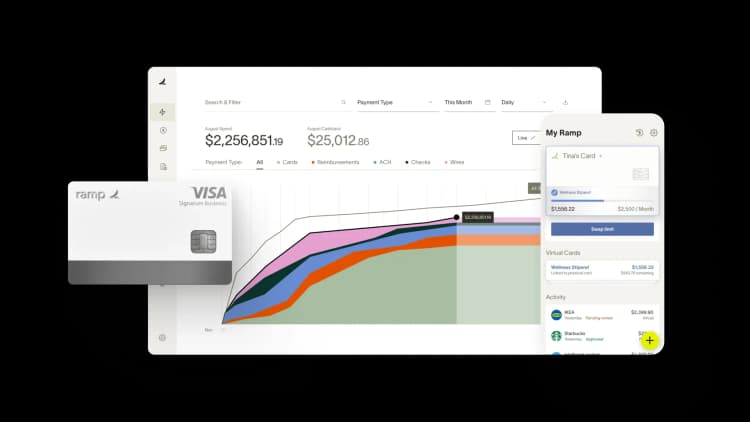

Automate YTD reporting with real-time syncing

Year-to-date financial reporting often requires hours of manual data gathering, reconciliation, and validation across multiple systems. You're pulling transaction data from credit cards, ERPs, and spreadsheets, then spending valuable time ensuring everything matches before you can even begin analysis.

Ramp's accounting automation software eliminates this manual work by automating the entire reporting pipeline from transaction to insight. Every expense is coded in real time using AI that learns your accounting patterns, so transactions land in the right accounts and categories as they happen.

Here's how Ramp streamlines YTD reporting:

- Real-time transaction coding: Ramp's AI codes transactions across all required fields as they post, applying your feedback to improve accuracy over time and ensuring consistent categorization

- Automated ERP sync: Ramp identifies in-policy transactions and syncs them to your accounting system automatically, so your books stay current without manual data entry

- Instant reporting visibility: Access YTD reports on demand with real-time data that reflects your current financial position, not last week's or last month's snapshot

- Automated reconciliation: Ramp's reconciliation workspace surfaces variances and missing entries automatically, so you can validate YTD figures with confidence

With Ramp's AI-powered accounting automation, you get accurate YTD reports whenever you need them, backed by data that's already coded, synced, and reconciled.

Try an interactive demo to see how Ramp improves financial visibility.

FAQs

Most pay stubs display YTD earnings, but you can also calculate it manually. Add up all payments you’ve received since the start of the year through your most recent paycheck. For example, if you earn $1,500 every two weeks and it’s now the end of May (10 pay periods), your YTD gross earnings equal $15,000.

YTD net pay is the total an employee has taken home after taxes and deductions from the start of the year through the current pay period. It helps employees track actual earnings for budgeting and tax planning, and provides accurate income details for loan or credit applications.

To compare, look at the same YTD period across both years—for instance, January–September this year vs. last year. Then calculate the percentage change between the two totals. This shows whether performance is improving and highlights trends, seasonality, and areas where adjustments may be needed.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits