35 essential business expense categories for businesses of all sizes

- What is a business expense?

- How do you categorize business expenses?

- 35 business expense categories to know

- Best practices for categorizing and tracking expenses

- How Ramp automates expense categorization and tracking

- Set expense categorization on autopilot

Key takeaways

- Business expenses are the ordinary and necessary costs you incur to run your company, which you can often deduct from your revenue to lower your taxable income.

- You should organize expenses into broad categories that reflect your business structure, such as by department, and use custom fields to capture specific transaction details.

- Common expense categories for most businesses include salaries and wages, rent, marketing, software, professional services, and employee benefits.

- To effectively track spending, you need to review your accounts regularly, assign a category to every single transaction, and ensure your categories meet your business's specific needs.

- You can save time and reduce errors by using an expense management platform like Ramp to automatically categorize transactions, match receipts, and sync with your accounting software or ERP.

Whether big or small, every company incurs expenses in the course of doing business. Common examples of business expenses include the cost of goods and services, everyday operating expenses like payroll and rent, and countless others.

Organizing all your expenses into business expense categories ensures you know exactly how your business spends money. This helps plan budgets, control costs, and claim all your eligible business tax deductions on your income tax returns.

In this article, we explain what qualifies as a deductible business expense, break down how to categorize business expenses, and list 35 common expense categories for businesses of any size. Plus, we’ll share some helpful best practices to stay organized by automating expense categorization.

What is a business expense?

Business expenses are the ordinary and necessary costs required to run your business. Anything you spend money on in the name of doing business can be categorized as a business expense.

Because business expenses are tax-deductible, it’s important to understand exactly how the IRS defines "ordinary" and "necessary" in the context of business expenses:

- Ordinary: Common expenses for businesses in your industry

- Necessary: Expenses needed to operate your business, even if they aren’t indispensable

Business expenses are sometimes called deductions because you subtract them from your revenue to determine your taxable income. As such, you record them on your business income statement.

What are the three types of expenses?

The three main types of expenses are direct costs, indirect costs, and depreciation expenses. And these can be further grouped into various expense categories, including payroll, employee benefits, general and administrative (G&A) expenses, marketing and advertising, research and development, and payments for professional services.

How do you categorize business expenses?

Small business owners often struggle with expense categorization, but there’s no need to overcomplicate the process. The key is to categorize business expenses in a way that reflects your business structure—that is, by department and spend management needs.

For example, you can classify expenses by type, like "G&A" and "Research and Development," and then sort them by department, like "Marketing" and "Engineering."

Keep your expense categories general and limit the number of general ledger (GL) accounts you have. Use custom fields to capture the who, what, where, and why of each transaction so you can easily sort or reclassify them as needed.

Say for internal purposes, you may only need to know that an employee made a meal purchase. But if you want to deduct the expense as a business meal come tax time, you’ll need to know if the employee ate alone, with a team, or with a client, and what was discussed.

35 business expense categories to know

If you’re not sure where to start with creating business expense categories, we’ve done some of the legwork for you. Below are 35 common business expense categories for businesses of all sizes. Of course, you need to tailor these to your own company’s structure and business operations:

1. Employee benefits

Your company's payments toward employee benefits like health insurance, retirement plans, life insurance, and home office expenses.

2. General and administrative (G&A) expenses

This category includes office supplies like computers, pens, and paper; cleaning services for your office space; and other miscellaneous office expenses. Website hosting and domain payments may fall into this category as well.

3. Rent and leases

Any rent or lease payments you make toward renting office space, equipment, a warehouse, or vehicles.

4. Marketing and advertising

Anything that covers the cost of directly promoting or marketing your business.

5. Employee training

This category covers skills training for employees, provided the training is for job-related skills.

6. Research and development (R&D)

Costs related to developing and improving your products, including expenses for software directly necessary for developing and testing your product.

7. Legal and professional services

This category includes payments to agencies or contractors—for example, the money you spend on PR agencies, headhunters, freelance designers, CPA services, tax preparation, and legal fees.

8. Utilities

Utilities such as electricity, water, gas, and sewage for commercial space. If you work from a home office, you can deduct a portion of utilities relative to how much of your home you use for business purposes.

9. Salaries and wages

This category includes all payments to employees, including salaries, wages, bonuses, and commissions.

10. Insurance

Business insurance premiums, including general liability, malpractice, and commercial real estate or property insurance, typically have their own dedicated expense category.

11. Travel expenses

Lodging, airfare, travel insurance, and other costs related to business travel go in this category. These expenses are typically fully deductible, but note that you can only deduct 50% of the cost of meals, even while traveling.

12. Depreciation

Expenses related to the depreciation of business assets, such as equipment, vehicles, and buildings.

13. Maintenance and repairs

Any costs you incur to maintain and repair necessary business equipment, vehicles, and facilities.

14. Taxes and licenses

Business property taxes, permits, and licenses required to operate legally. Examples include construction permits or licenses to practice law or medicine in your state.

15. Continuing education

Educational expenses for seminars, workshops, and conferences that promote ongoing education. Educational materials like books fall into this category as well.

16. Software

Business software is usually a tax-deductible business expense category. This includes subscription costs or the outright cost to own the software, including accounting or project management tools.

17. Interest

Interest payments on business loans, business credit cards, lines of credit, debt, or mortgages.

18. Dues and subscriptions

Paid subscriptions for industry magazines or academic journals related to your business, as well as dues or membership fees for trade associations.

19. Shipping and postage

Postage or freight costs you incur to ship your products, including stamps or postage for sending business-related mail. However, envelopes and packing materials would generally go in the G&A category.

20. Charitable contributions

You can deduct donations you make to charitable organizations, provided they meet the most current IRS requirements.

21. Business use of vehicles

Fuel, maintenance, insurance, and other car expenses are all business expenses, provided you use the vehicle exclusively for business purposes. You can also deduct the IRS standard mileage rate.

22. Employee meals and entertainment

This is a common business expense category, but note that you can only deduct up to 50% of the cost of business meals and entertainment expenses.

23. Collection fees

This category covers any costs related to hiring a third party to collect on a bad debt expense.

24. Printing

This category can include ink cartridges, physical printers, or payments for printing services—for example, for direct-mail marketing campaigns.

25. Startup costs

You may be able to deduct a limited portion of the costs associated with starting a small business. These costs might include market research, employee training, business development, and other related expenses.

26. Moving expenses

If you move more than 50 miles from your previous location for work-related purposes, you can deduct 100% of your moving costs.

27. Security

Expenses related to security systems and personnel for your business.

28. Equipment maintenance contracts

Active contracts for the maintenance of business equipment.

29. Inventory

This category includes the cost of goods sold (COGS), including raw materials, finished products, and inventory management expenses.

30. Employee transportation benefits

If you provide transportation benefits to employees, you can deduct this expense category come tax time.

31. Pension contributions

Any contributions to employee pension plans go in their own business expense category.

32. Employee assistance programs

Programs to support employees’ well-being in the workplace or their personal lives.

33. Gifts

Business-related gifts to clients, employees, or vendors are considered business expenses so long as the purpose of the gift is to promote business relations.

34. Bank fees

Expenses related to banking, including monthly service fees for your business bank account.

35. Telecommunications

The cost of business phone and internet services.

Best practices for categorizing and tracking expenses

Now that you know what the categories are, how do you apply this to your business? Here are four best practices for effectively getting organized so you can categorize and track your expenses properly.

- Understand the categories that meet your business needs: Which of the 35 above apply to the specifics of your work, and which, perhaps needs to be added or amended?

- Review your accounts often: You need to review your account statements, expense reports, and invoices on some regular cadence. That way you’ll know both whether your categories are effective and how you’re tracking against your budget goals.

- Let automated tools do the heavy lifting: Expense management software helps automate expense mapping and categorization. Software that integrates with modern business expense cards adds another layer of control by providing customizable rules for every business expense.

- Be sure to assign categories to every transaction: Your new system only works if you implement it. When tracking your business expenses, make sure every single transaction is assigned a category so you have a handle on what’s what.

How Ramp automates expense categorization and tracking

Manually categorizing business expenses is tedious and error-prone. You're dealing with hundreds of transactions across multiple cards, trying to match receipts to charges, and hoping your team coded everything correctly. Meanwhile, month-end close drags on as you chase down missing documentation and fix miscategorized expenses.

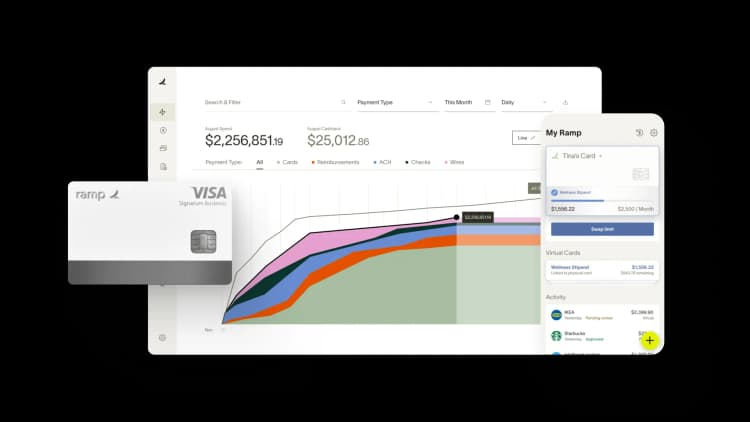

Ramp eliminates these headaches through intelligent automation. Our modern expense management software automatically categorizes expenses using merchant data and machine learning, drastically reducing manual work. When employees make purchases, Ramp instantly matches transactions to the correct expense categories based on vendor information and spending patterns. You can customize these categories to match your chart of accounts, ensuring seamless integration with your accounting system.

Real-time expense tracking gives you complete visibility into spending as it happens. Instead of waiting for monthly statements, you see every transaction the moment it occurs. Ramp's customizable reporting dashboards display spending by category, department, and employee, making it easy to spot trends and anomalies. For example, if marketing spend suddenly spikes, you'll know immediately rather than discovering it weeks later during reconciliation.

The platform's receipt matching technology further streamlines expense management. Employees simply snap photos of receipts through the mobile app, and Ramp automatically attaches them to the corresponding transactions. OCR technology extracts key details like vendor name, amount, and date, eliminating manual data entry. The system even sends automated reminders for missing receipts, ensuring you maintain complete documentation for audits and tax compliance.

This combination of automated categorization, real-time visibility, and intelligent receipt management transforms expense tracking from a time-consuming chore into an efficient, accurate process that gives you better control over your company's spending.

Set expense categorization on autopilot

Ramp automates the entire business expense tracking, reporting, and categorization process, reducing errors and saving you time and money. With Ramp’s powerful finance automation and AI behind your business expense categorization, tax season is just another day at the office.

Try an interactive demo and see for yourself why Ramp customers save an average of 5% a year across all spending.

FAQs

There is some room for flexibility in your expense categories, so long as they are staying within the bounds described above and as guided by the IRS. If you’re unsure, consult with financial advisors who understand your business, leverage an automated tool to take some of the guesswork out, and, above all, keep accurate and current documentation for every transaction so you always have the support behind your choices.

Business expenses you can’t write off on your taxes are known as non-deductible expenses. These are any expenses that do not meet the IRS criteria of ordinary and necessary. Examples include personal expenses, commuting costs, gifts, and others. Be sure to understand the difference before submitting your tax return.

Yes, you can take the standard deduction and also deduct business expenses.

Yes, but generally only 50% of meal costs are deductible, and entertainment expenses are not unless directly related to business and documented.

Capital expenses are long-term investments like equipment or buildings. Operating expenses are recurring costs like rent, salaries, and utilities.

The IRS generally recommends keeping receipts and records for at least 3 years.

Yes, as long as the expenses are ordinary, necessary, and properly documented.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group