When to get a business credit card: Signs you’re ready to apply

- When to apply for a business credit card

- Benefits of using a business credit card

- Situations where a business credit card adds operational value

- What to consider before applying for a business credit card

- Get more from your business credit card with Ramp

A business credit card is a financial tool designed to help companies pay for everyday expenses while keeping personal and business spending separate. It gives you a credit line to cover operating costs, manage cash flow, and track transactions tied directly to your business.

If you're spending more on your business, starting to hire employees, or planning for the future, the right card can help you stay organized, build business credit, and access the working capital you need to grow.

When to apply for a business credit card

The founder, finance lead, or whoever manages your cash flow usually decides when to get a business credit card. It’s a financial decision, but it also impacts operations, compliance, and how your team spends money. Here are some clear signs that it’s the right time to apply:

- You want to separate personal and business expenses: Forming an LLC, partnership, or corporation is the first step toward separating business finances from personal ones. Most business credit card issuers require a legal structure and a federal Employer Identification Number (EIN). This makes it easier to apply without relying on your personal credit and sets your business up to build credit under its own name.

- Your business has consistent operational costs: A business credit card can streamline regular payments for tools, services, or inventory. You avoid using personal credit cards or bank transfers and create a clear record of recurring expenses. A business card makes managing those payments easier.

- You need to build or strengthen business credit: If you plan to raise funding, negotiate supplier terms, or apply for larger financing, your business credit profile matters. A small business credit card establishes a record of responsible spending and timely payments. Lenders use this history to assess risk.

- Your personal credit score is strong enough: Most issuers review your personal credit when you apply, especially if your business is new. A solid personal credit score improves your approval odds and may qualify you for better credit cards and terms.

- You’re planning large purchases or preparing for growth: A business credit card offers short-term flexibility and helps you manage cash flow while expanding your business, whether you’re investing in equipment or scaling operations.

Benefits of using a business credit card

A business credit card becomes especially useful once your company starts growing. If you’re managing recurring expenses, onboarding new team members, or setting up systems to scale, a business card helps you structure your finances.

Improves expense tracking and organization

A business credit card makes it easier to see where your money is going. Every transaction is tied to the business, so you can view spending patterns, track vendor payments, and flag unusual activity without digging through personal statements.

Many business credit cards offer downloadable statements and transaction summaries. When paired with accounting software or an enterprise resource planning (ERP) system, you can automate expense categorization and eliminate manual entry. This reduces errors and helps you stay audit-ready.

If your team uses multiple cards, assigning individual cards with custom credit limits to employees or departments gives you a clearer view of who's spending, how much, and why. This structure supports better oversight, minimizes receipt chasing, and helps enforce internal policies across your organization.

Access to rewards

Many business credit cards offer valuable perks that go beyond simple spending. You can earn credit card points or cashback on common business spending categories. If you or your team frequently hit the road, travel rewards such as airline miles, hotel stays, or airport lounge access can help offset business travel costs and boost employee satisfaction.

Some cards include introductory offers such as welcome bonuses and 0% intro APR periods on purchases, balance transfers, or both, offering extra flexibility when managing short-term expenses. While variable APRs can apply if you carry a balance, responsible use lets you maximize rewards while avoiding interest charges.

Helps establish business credit history

Lenders, vendors, and leasing companies check your business credit profile before extending terms. If you rely on your personal credit for business purchases, your company has no way to build financial credibility. A business credit card solves this by creating a credit history under your company’s name.

Consistent use and on-time payments strengthen your credit profile with business credit bureaus such as Dun & Bradstreet (D&B), Experian, and Equifax. This matters when applying for larger lines of credit, qualifying for better interest rates, or negotiating net payment terms with suppliers.

A strong business credit profile is also key in scaling responsibly, especially if you plan to raise capital or invest in infrastructure.

Offers short-term financing and spending flexibility

Business expenses don’t always line up with cash inflows. Some business credit cards help you manage these timing gaps by giving you a short period to pay for purchases without interest.

Business credit cards give you a short grace period, typically around 20–30 days, during which you can pay off your balance without accruing interest. This gives you time to cover expenses and align payments with incoming cash flow, as long as you pay in full by the due date.

With a business credit card, you don’t need to dip into savings or scramble for short-term business loans. You can manage operational costs more predictably while preserving liquidity.

Separates business and personal finances

Mixing personal and business spending creates confusion. Tracking expenses, claiming deductions, and keeping accurate records becomes harder. This makes bookkeeping more time-consuming and increases the risk of errors while filing business taxes.

Using a business credit card helps you keep your finances clean. You can track business-related purchases in one place and avoid sorting through personal transactions later. This makes it easier to prepare financial reports, stay organized, and file taxes with confidence.

Separating your personal and business finances also provides legal protection if you've formed an LLC or corporation. Charging personal expenses to a business account blurs legal lines and puts your personal assets at risk in a lawsuit or audit. By using a dedicated business card, you reinforce your company’s legal structure and adhere to best practices from the start.

Higher credit limits than personal cards

Business credit cards often come with higher credit limits than personal cards, especially if your company has a steady revenue stream. This gives you more flexibility to cover big expenses, invest in growth, or manage seasonal spending without maxing out your personal credit.

Discover Ramp's corporate card for modern finance

Situations where a business credit card adds operational value

Operational value is the return you get from running your business more efficiently. This includes fewer delays, tighter controls, and smoother workflows. A business credit card supports this by helping you manage expenses in real time, reduce manual work, and improve how your team spends.

Managing recurring payments and subscriptions

If you're paying for software, cloud storage, or other tools on a monthly basis, a business credit card can help you stay on top of those costs. Subscriptions renew without notice, and without a system in place, you risk paying for tools you no longer use.

You can assign recurring payments to a business credit card and track them in one place. It lets you see exactly what’s being charged, when it’s billed, and how much it costs. This helps you catch duplicate tools, spot price increases, and cancel subscriptions that no longer serve you.

You can also use a unique virtual credit card for each subscription. This lets you set limits, restrict usage, and automatically block unauthorized charges. If you cancel a tool, you can deactivate the card without affecting other payments. This gives you tighter control without adding extra steps to your workflow.

Streamlining employee expense management

If you manage a growing team, tracking employee expenses can quickly get out of hand. When team members use personal cards and submit receipts later, you spend more time managing reimbursements than reviewing spending.

A business credit card helps you take control of the process. You can issue employee cards with clear limits tied to their roles, departments, or projects. This lets your team spend within policy without needing constant oversight and approvals. It also eliminates the burden of requiring employees to cover expenses up front and wait for reimbursements.

With card-level controls, you decide where and how to use the business credit card. Modern corporate cards like Ramp allow you to block certain merchants, set spending categories, and require receipts before expenses get approved.

Preparing for seasonal or cyclical spending patterns

If your business sees spending spikes during certain times of the year, you need a way to manage those costs without putting pressure on your cash flow. A business credit card gives you the flexibility to cover those expenses while keeping your budget on track.

You might spend more during the holidays, trade shows, product launches, or peak service periods. These costs often come before you see the related revenue. With a business credit card, you can pay for inventory, marketing, or short-term hires and then pay off the balance once revenue comes in. The 30-day float built into most cards gives you the time to do that.

You can also assign virtual cards to seasonal campaigns or vendors. This helps you track results, stay within budget, and review performance after the season ends. If you're preparing for a busy period, a business credit card can give you the structure and flexibility to manage it with less friction.

What to consider before applying for a business credit card

The business credit card application process usually takes just a few minutes when you apply online. Some credit card issuers may require additional documentation, such as your EIN, business license, incorporation papers, or a manual review, depending on your business structure and credit profile.

But before you apply, it's worth slowing down to make sure the card fits your business needs. Once you're approved, the card will impact how you manage cash flow, control spending, and track expenses:

- Understand your business credit profile: See if your business has an established credit file. Some issuers look at business credit; others rely on your personal credit, especially if your company is new. If you have not built credit under your business name, look for a card that underwrites based on your cash flow and connected bank accounts.

- Evaluate the terms: Understand how much the card will cost if you carry a balance or miss a payment. Review the APR, any late fees, and repayment terms. Many business cards offer a 30-day repayment window, but the details matter. If you plan to carry a balance on your card, make sure you understand the financial impact.

- Choose a card that fits your business operations: If you manage expenses across departments or projects, look for a card that lets you create custom limits and restrict usage by category or vendor. If your finance team spends time on manual reconciliation, choose a card with automation and direct ERP integration. These features save time.

- Know whether the card affects your personal credit: Some business cards require a personal guarantee and check your personal credit score. Others won’t impact your personal credit and don’t require a founder guarantee. If protecting your personal credit is a priority, choose a card that keeps liability within the business.

- Check whether the rewards align with your spending: Not all rewards programs offer real value. If your expenses are broad and unpredictable, a flat-rate cashback card is often more practical than a tiered rewards system.

- Confirm integration with your financial systems: If you use accounting tools or an ERP, make sure the card integrates directly. Without integration, you'll spend more time on credit card reconciliation and chasing receipts. With integration, your expenses post in real time, your records stay clean, and your finance team gets more time back.

Get more from your business credit card with Ramp

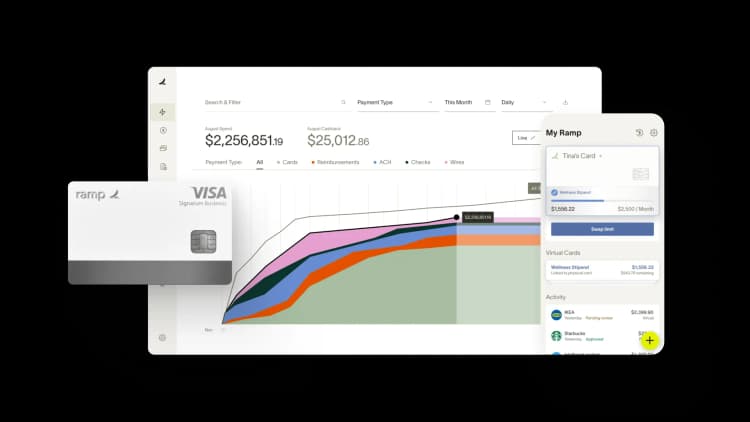

With the Ramp Business Credit Card, you can do more than just cover expenses—you can control them. Ramp lets you issue unlimited physical and virtual cards, set custom limits by vendor or category, and automatically flag out-of-policy spend. You’ll save time with real-time insights, automated expense reporting, and integrations that eliminate manual follow-ups.

Unlike many other business credit cards, Ramp doesn’t require a credit check, and there's no personal guarantee. Credit limits are based on your company’s financial profile, giving you room to grow without compromise. Plus, with cashback on purchases and access to over $350,000 in exclusive partner offers, you can save an average of 5% across all business spending.

Ready to get started? Try an interactive demo to see what Ramp can do for your company.

FAQs

No, you don’t need an LLC to get a business credit card. Sole proprietors and freelancers can apply using their Social Security number, though a formal business structure and an EIN can make it easier to qualify and separate personal and business finances.

You don't necessarily need to prove revenue to apply for a business credit card. Some issuers evaluate your application based on estimated revenue or cash flow projections, especially if your business is new.

The best time to apply for a business credit card is when your company has steady operating expenses, a legal structure, and a personal credit score in good standing. Applying early can help you build business credit before you need larger financing.

Use your legal business name if you’ve registered an LLC, corporation, or partnership. If you’re a sole proprietor or freelancer, you can typically apply under your own name and Social Security number, with the option to include a “doing business as” (DBA) name if you have one.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°