- What is a business line of credit?

- How does a business line of credit work?

- Types of business lines of credit

- How to qualify for a startup business line of credit

- Best business lines of credit for startups

- Pros and cons of a business line of credit for startups

- Is a business line of credit right for your startup?

- How to get a business line of credit

- How Ramp helps startups bridge cash flow gaps

- Access more flexible funding with Ramp

Cash flow is one of the biggest challenges new businesses face. From covering payroll and restocking inventory to investing in growth, many startups need extra capital to keep operations running smoothly.

For startup founders, a business line of credit offers a flexible, accessible way to manage those ups and downs. Unlike a traditional term loan, a business line of credit gives you ongoing access to funds: you borrow what you need when you need it, and you only pay interest on what you use.

Here’s how this flexible funding option can help startups stay resilient as they grow.

What is a business line of credit?

A business line of credit is a flexible funding option that gives your startup access to a set amount of capital you can draw from as needed. You only pay interest on what you use, and once you repay what you borrow, your available credit is restored. That makes it a revolving source of funds rather than a one-time loan.

Unlike a term loan, which provides a lump sum repaid over a fixed schedule, a business line of credit lets you borrow, repay, and borrow again as your cash flow fluctuates. Most lenders divide this into two phases: a draw period, when you can access funds, and a repayment period, when you pay down any remaining balance.

For example, if your startup secures a $20,000 line of credit and draws $8,000 to cover inventory, you’ll only pay interest on that $8,000. Once you repay it, your full $20,000 limit becomes available again.

How does a business line of credit work?

When you apply for a business line of credit, your lender approves you for a specific credit limit based on factors like revenue, time in business, and credit score. Once approved, you can draw funds as needed, up to that limit, to cover operating costs or short-term projects.

During the draw period, you can withdraw money at any time and pay interest only on the portion you use. Interest is typically calculated daily and billed monthly on the outstanding balance. As you make repayments, your available credit replenishes automatically, so you can reuse the funds without reapplying.

For example, if your startup secures a $10,000 line of credit and uses $5,000 for new equipment, you’ll pay interest on that $5,000 until it’s repaid. Once you pay it back, your full $10,000 becomes available again. Most lines of credit don’t charge prepayment penalties, so you can reduce interest costs by paying early.

Types of business lines of credit

Business lines of credit come in two main forms—secured and unsecured—and are available through both traditional banks and online lenders.

Secured vs. unsecured lines of credit

- Secured line of credit: Backed by collateral such as equipment, real estate, or other business assets; if you default, the lender can claim the collateral to recover losses. Secured lines usually offer higher credit limits and lower interest rates.

- Unsecured line of credit: Doesn’t require collateral; lenders rely on your credit history and business performance to determine eligibility. These are easier for newer startups to access but often come with higher interest rates and tighter repayment terms.

Traditional banks vs. online lenders

Both traditional banks and online lenders offer business lines of credit, but their processes and requirements differ.

| Feature | Traditional banks | Online lenders |

|---|---|---|

| Typical credit limits | Up to $250,000 or more | Up to $250,000 (often less for new startups) |

| Approval time | 1–2 weeks | 24–48 hours |

| Interest rates | 8%–12% APR typical | 15%–50% APR typical |

| Collateral required | Often required for higher limits | Rarely required |

| Best for | Established businesses with steady revenue | Startups needing fast, flexible funding |

Traditional banks tend to offer lower rates but require stronger credit and longer time in business. Online lenders trade higher rates for speed and accessibility, making them a common choice for early-stage startups that need quick funding.

How to qualify for a startup business line of credit

Qualifying typically comes down to your credit profile, time in business, revenue, and basic documentation. Lenders use these to gauge risk and set your limit and rate.

Credit score requirements

Most lenders look for a good personal credit score (around 670 or higher), though some online providers accept lower scores for smaller limits or higher rates. If you don’t yet have a business credit score, focus on responsible use and on-time payments to build history.

Time in business and revenue

Traditional banks usually want at least one to two years in business and consistent revenue. Newer startups can still qualify with online lenders, but limits may be smaller and rates higher. Typical revenue minimums range from monthly thresholds to roughly $100,000 in annual revenue for more established options.

Documentation needed

Have essential paperwork ready to speed up underwriting.

- Tax returns: Recent business and, if requested, personal tax returns

- Bank statements: Recent business bank statements showing cash flow

- Financial statements: Up-to-date financial statements prepared from your accounting system

- Formation documents: Articles of incorporation or other proof of business formation

- Collateral information (if applicable): Details on assets for secured lines

Many lenders also require a personal guarantee: this is a promise to repay if the business cannot. Using a line responsibly can help build business credit, but missed payments can harm your personal credit when a guarantee is in place.

Best business lines of credit for startups

The right business line of credit for your startup depends on your credit score, revenue, and how quickly you need funding. Here are several top options to consider.

Bluevine Business Line of Credit

Bluevine is best for startups that need flexible, fast access to capital.

- Credit limit range: Up to $250,000

- Interest rates: Starting at 7.8%

- Minimum credit score: 625

Pros

- Potential for a low interest rate for qualifying borrowers

- Lower credit score requirement

- High maximum credit limit

- No annual or draw fees

Cons

- May require a personal guarantee

- Maximum interest rate not publicly available

- Monthly revenue requirements apply

Bluevine offers revolving lines of credit with interest rates starting at 7.8%. There are no account maintenance fees, making it a popular choice for startups looking to keep costs low. You can qualify with a credit score of 625 or higher, one year in business, and at least $10,000 in monthly revenue.

OnDeck Business Line of Credit

OnDeck is best for startups with fair credit that want quick funding access.

- Credit limit range: $6,000–$200,000

- Average interest rate: 56.6% APR

- Minimum credit score: 625

Pros

- Lower credit score requirement

- No annual or draw fees

- No prepayment penalty

Cons

- High average interest rate

- Lower maximum credit limit relative to cost

OnDeck is known for flexible qualification criteria and fast funding. Startups can be approved with a 625 credit score, one year in business, and $100,000 in annual revenue. Funding can arrive within one business day after approval.

Bank of America Unsecured Business Line of Credit

Bank of America is best for established startups with strong credit histories.

- Credit limit range: Starting at $10,000

- Interest rates: Starting at 8.75% APR

- Minimum credit score: 700

Pros

- Competitive starting interest rate

- No origination or cash advance fees

- Interest discounts available for Preferred Rewards members

Cons

- Higher personal credit score requirement

- Line of credit typically limited to one year, subject to renewal

- Maximum interest rate not publicly available

Bank of America’s unsecured lines of credit start at $10,000, with rates as low as 8.75% APR. You’ll likely need a personal credit score above 700, at least two years in business, and $100,000 in annual revenue. Secured lines with collateral start at $1,000 and carry a $150 annual fee (waived the first year).

PNC Bank Unsecured Small Business Line of Credit

PNC is best for startups that value relationship banking and potential rate discounts.

- Credit limit range: $10,000–$100,000

- Interest rates: Variable, based on the Prime Rate

- Minimum credit score: Not disclosed

Pros

- No collateral required

- 1.0% rate discount for qualifying borrowers

- Overdraft protection available

Cons

- $175 annual fee

- Personal guarantee required

- Interest rates not publicly disclosed

PNC offers unsecured business lines of credit for startups that prefer traditional banking. You generally need two years in business, but some options may be available sooner. Qualifying borrowers can access rate discounts or higher limits if they provide additional assets as collateral.

Wells Fargo BusinessLine line of credit

Wells Fargo is best for startups seeking low fees and flexible access to working capital.

- Credit limit range: $10,000–$150,000

- Interest rates: Prime Rate + 1.75%

- Minimum credit score: 680

Pros

- Low on fees

- No collateral required

- Access through checks, ATMs, or online transfers

Cons

- Personal guarantee required

- Each owner with 25% or more ownership must sign

Wells Fargo offers an unsecured line of credit available after six months in business. It’s a good fit for startups that value low fees and convenient access. Funds can be used for payroll, inventory, or short-term working capital needs.

American Express Business Line of Credit (Installment Loan)

American Express is best for startups that want transparent terms and same-day funding.

- Credit limit range: $2,000–$250,000

- Interest rates: 3%–27% monthly fee

- Minimum credit score: 660

Pros

- High maximum limit

- No annual, origination, or draw fees

- Same-day funding after approval

Cons

- Requires personal guarantee

- Monthly fee can vary by term length

American Express offers up to $250,000 in funding with fixed monthly fees instead of variable interest. Startups need at least one year in business and $3,000 in monthly revenue. The straightforward fee structure makes it easier to forecast costs.

Fundible Business Line of Credit

Fundible is best for startups with lower credit scores or limited operating history.

- Credit limit range: $1,000–$250,000

- Interest rates: Starting at 1.00% monthly fee

- Minimum credit score: 500

Pros

- Low minimum credit score

- Only six months in business required

- No prepayment penalties

Cons

- Requires at least $8,000 in monthly revenue

- Limited public information on fees

Fundible is designed for startups still building credit. You can qualify after six months in business with a 500 credit score. Each draw combines new and existing balances into a new repayment term, offering flexibility for ongoing working capital needs.

Current interest rates for business lines of credit

Here’s a snapshot of what leading lenders are charging.

| Provider | Interest rates |

|---|---|

| Bluevine Business Line of Credit | Starting at 7.8% |

| OnDeck Business Line of Credit | Average 56.6% APR |

| Bank of America Unsecured Business Line of Credit | Starting at 8.75% APR |

| PNC Bank Unsecured Small Business Line of Credit | Variable (Prime Rate) |

| Wells Fargo BusinessLine line of credit | Prime Rate + 1.75% |

| American Express Business Line of Credit | 3%–27% monthly fee |

| Fundible Business Line of Credit | Starting at 1.00% monthly fee |

Pros and cons of a business line of credit for startups

A business line of credit can be a powerful financial tool for startups, but it’s important to weigh its benefits and drawbacks before applying.

Pros

- Flexible funding for unpredictable cash flow: Access funds whenever you need them to handle seasonal slowdowns, cover payroll during lean months, or restock inventory ahead of busy periods

- On-demand capital reuse: As you repay what you borrow, your available credit replenishes, so you can draw funds again without reapplying. Revolving access helps smooth out uneven cash flow.

- Builds business credit: Using a line of credit responsibly—keeping utilization low and making on-time payments—can help your startup establish a strong business credit history

- Lower cost than other short-term financing options: Lines of credit often have lower rates than business credit cards or merchant cash advances. You’ll pay interest only on the amount you draw, making them a cost-effective way to cover short-term expenses.

Cons

- Potentially higher costs than term loans: Lines of credit may carry higher rates than traditional term loans, plus possible annual, draw, or maintenance fees. Review fee disclosures carefully before committing.

- Credit and collateral requirements: Most lenders require good personal or business credit to qualify, and larger credit lines may need collateral

- Not ideal for large, one-time purchases: For major investments such as equipment or real estate, a business term loan usually offers better rates and fixed repayment terms

Is a business line of credit right for your startup?

A business line of credit for new businesses can be a smart, flexible way to manage expenses, but it’s not the right fit for every situation. Before applying, it’s important to understand when this type of funding makes sense for your startup and when another option might be a better choice.

When a business line of credit makes sense

The purpose of a business line of credit is to provide access to short-term working capital. This is a good choice in certain scenarios, including:

- You want to fund short-term projects: For example, if you have marketing or contract costs that will generate revenue in a few months, you can draw the funds you need to pay down projects as you go

- You want to bridge cash flow gaps: You can use a business line of credit to pay your business’s bills now and pay it back when payments come in

- You need savings for periodic expenses: If your business has infrequent, recurring expenses you need cash for, you can have a credit line ready without draining funds or waiting on approval

When a business line of credit doesn't make sense

Although a business line of credit may seem like the perfect option if you need funding, it can hinder your startup’s growth if used unwisely. In some cases, a business line of credit just doesn’t make sense, including:

- You need to make a one-time purchase: If you’re making a large, one-time purchase, you’ll likely be better served with a business term loan that offers lower interest rates and fees with fixed monthly payments

- You don’t have great credit and can’t access reasonable rates: If you can’t secure a line of credit with reasonable interest rates and terms, consider options such as crowdfunding, revenue-based financing, or business grants

How to get a business line of credit

If you’re ready to apply for a business line of credit, here are the key steps to help you prepare and move through the process smoothly:

1. Review your qualifications

Take note of your credit scores. Most lenders require a personal credit score of at least 670 if your business is new. You should also know your startup’s annual revenue, time in business, and whether you have any collateral to offer.

2. Gather your documents

Make sure you have the following documentation in order to speed up the review process:

- Tax returns: The lender may want to look at your business and personal tax returns for the past 3 years as part of the qualifying process

- Bank statements: Your lender will likely want to take a look at your business bank account to ensure you can afford the loan

- Articles of incorporation: The lender will use your articles of incorporation to verify the age and legitimacy of your business

- Collateral documents: You may need to provide documents related to real estate or other collateral you plan to use

3. Compare lenders

Compare business lines of credit lenders based on approval requirements, borrowing limits, interest rates, and lender reviews. If you need cash fast, consider funding speed as well. Newer businesses may want to consider online lenders or fintech providers for more flexible terms.

4. Fill out and submit your application

Once you've found a lender that fits your needs and you're confident you meet the requirements, complete the application and upload the necessary documents. From there, approval timelines can vary. Some lenders respond within hours, while others may take a few business days.

How Ramp helps startups bridge cash flow gaps

Managing cash flow gaps can feel like walking a tightrope for startups. You're waiting on customer payments while vendors demand immediate payment, and traditional funding options often come with lengthy approval processes or rigid terms that don't match your business's dynamic needs.

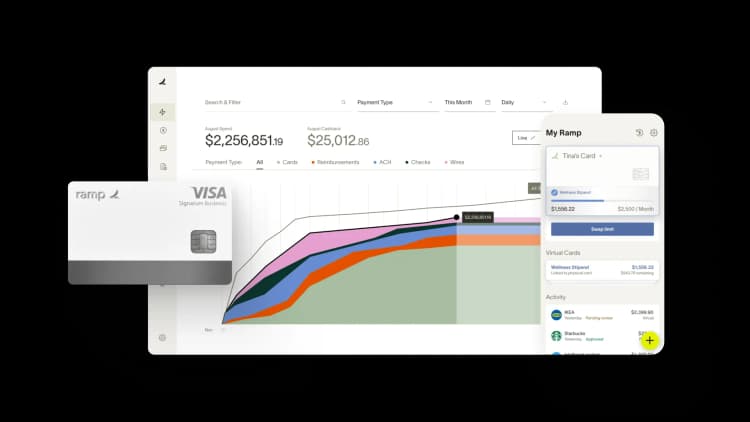

Ramp's corporate cards offer startups immediate access to working capital without the typical funding hurdles. Unlike traditional business credit cards that require personal guarantees or extensive credit histories, Ramp provides higher credit limits based on your business fundamentals and cash position. This means you can cover essential expenses—from inventory purchases to marketing campaigns—while preserving your cash reserves for strategic initiatives.

The platform's expense management capabilities give you unprecedented visibility into where every dollar goes. Real-time transaction tracking and automated receipt matching mean you always know your burn rate and can spot cash flow issues before they become critical. When you need to extend your runway, Ramp's built-in controls let you set precise spending limits by category, vendor, or team member, ensuring that increased access to capital doesn't lead to runaway spending.

Ramp's accounts payable software transforms how startups handle vendor relationships during cash-sensitive periods. Instead of choosing between preserving cash and maintaining good supplier relationships, you can schedule payments strategically, taking advantage of early payment discounts when flush with cash or extending payment terms when you need breathing room.

The platform automatically syncs with your accounting software, giving you accurate cash flow forecasts that help you make informed decisions about when to tap into credit versus when to deploy existing capital. This combination of flexible funding access and intelligent cash management tools means you spend less time worrying about making payroll and more time building your business.

Access more flexible funding with Ramp

Looking for a smarter way to fund your startup? The Ramp Business Credit Card delivers the benefits of a line of credit without the drawbacks.

Get approved in less than 2 days with no annual fees and no interest charges when you pay your balance in full each month. Plus, you'll unlock more than $350,000 in exclusive partner rewards from vendors like AWS, Notion, and OpenAI.

Try an interactive demo and join 50,000+ businesses that trust Ramp to power their growth.

FAQs

Business loans and lines of credit may seem similar, but there are significant differences between the two. A business term loan is a lump sum repaid over a fixed period, while a line of credit lets you draw and repay funds as needed. Lines of credit offer more flexibility, but term loans often come with lower overall costs.

While it's possible to get a business line of credit without revenue, you’ll likely receive much higher interest rates, a lower credit line maximum, and poorer repayment terms. If your startup hasn’t made money yet, instead consider options such as a small business credit card, a microloan, or business grants.

You’ll generally need a “good” credit score (670 or higher on the FICO scale) to qualify for a business line of credit, though there are lenders that offer options for fair or poor credit. Lenders may also look for at least 1 year in business and an annual revenue of at least $100,000.

For startups and newer businesses, most lenders offer lines of credit ranging from $10,000 to $100,000, though some online lenders may go higher depending on your qualifications. Factors such as your time in business, annual revenue, and personal or business credit score will influence how much you can borrow and at what rate.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°