What is a corporate credit card program? Benefits and how to implement

- What is a corporate credit card program?

- Benefits of implementing a corporate card program

- How to set up a corporate credit card program

- Corporate card policy best practices

- Managing and optimizing your program

- Who offers corporate credit cards?

- Common challenges and solutions

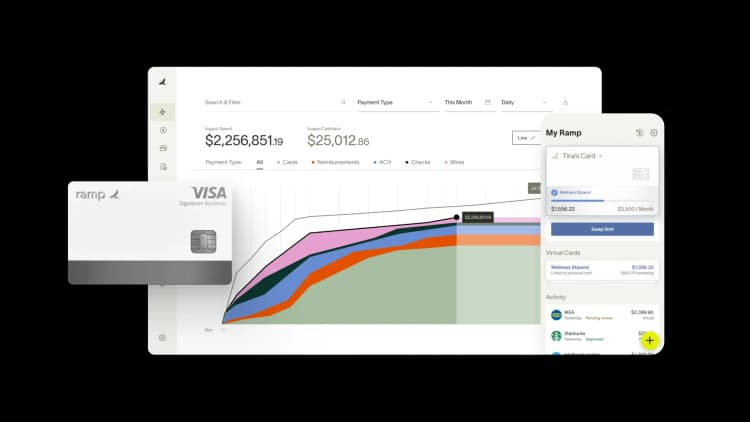

- Consider Ramp’s modern corporate card

A corporate credit card program issues company-owned cards to employees so your business can control spending centrally and handle all charges under one account. These programs help growing companies gain real-time visibility into expenses, improve cash flow through extended payment terms, and set guardrails that keep budgets on track. With the right setup, they make it easier for teams to spend responsibly while reducing manual work for finance.

What is a corporate credit card program?

A corporate credit card program provides employees with company-issued cards connected to a centralized account owned and managed by the business. The company sets spending policies, controls card access, and assumes responsibility for all charges made across the program.

These programs differ from business credit cards and purchasing cards in meaningful ways. Business credit cards typically support small companies or individual owners who assume personal liability, while purchasing cards are built for procurement and vendor payments with more restricted merchant categories.

Corporate cards are used across many functions within an organization. Sales teams rely on them for client meetings and travel, executives use them for business development, and operations teams use them for software, supplies, and vendor payments. Meanwhile, spending flows into a centralized billing system.

Corporate credit cards vs. business credit cards

Corporate credit cards and business credit cards differ most clearly in liability and eligibility requirements. Corporate cards place financial responsibility on the company, while business credit cards typically require a personal guarantee from the business owner.

Here’s a quick comparison:

| Feature | Corporate credit cards | Business credit cards |

|---|---|---|

| Primary user | Incorporated businesses (corporations, LLCs, etc.) | Freelancers, sole proprietors, and small business owners |

| Liability | The company | The business owner or individual |

| Repayment structures | Full monthly payment; no balance carryover (no APR) | Balances may be carried month to month with interest |

| Eligibility criteria | Company financials and revenue history; no personal guarantee required | Personal credit score, income, and a personal guarantee |

| Use cases | Managing employee expenses, travel, vendor payments, and centralized tracking | Daily business purchases, building business credit, separating personal and business spend |

| Rewards programs | Often focused on travel benefits, volume discounts, and rebate programs | Points, cashback, miles, and category-based bonuses |

| Best for | Larger companies with multiple employees needing expense cards | Small businesses and solo operators |

Liability is the key dividing line between these two card types. Corporate cards (including the Ramp card) shift responsibility to the organization, protecting employees from personal debt. Business credit cards require a personal guarantee, making them easier for early-stage companies to obtain but tying repayment obligations to the individual applicant.

Approval processes also differ. Corporate card programs review the company’s financials, bank activity, and revenue, while business credit cards rely on personal credit history. Rewards and benefits vary as well: corporate cards emphasize controls, reporting, and software integrations; business cards focus more on perks designed for individual owners.

Other types of corporate cards

In addition to standard corporate credit cards, companies can choose from several specialized card types depending on their spending patterns and expense workflows.

- Corporate travel cards: Corporate travel cards are designed to manage travel-related expenses such as flights, hotels, and ground transportation

- Corporate expense management cards: Corporate expense management cards help teams control and consolidate a wide range of business expenses

- Corporate prepaid cards: Prepaid cards are loaded with a set amount of money and aren’t linked to a bank account or credit line

- Corporate virtual cards: Virtual cards provide single-use or merchant-specific card numbers for secure online purchases without issuing a physical card

The right type of card will depend on your company’s expense patterns, existing controls, and reporting needs.

Benefits of implementing a corporate card program

Corporate card programs give finance teams real-time visibility into company spending by pulling transactions into a centralized dashboard with merchant details, amounts, and cardholder information. This transparency helps you spot unusual purchases quickly, understand spending patterns, and make more informed budget decisions across departments.

Expense reporting also becomes faster and more accurate when employees use corporate cards. Transactions flow directly into expense management systems, reducing manual entry and the amount of time teams spend collecting receipts or correcting errors.

Extended payment terms can improve working capital by giving your company 30 to 60 days before payment is due. This added flexibility is especially useful for businesses with seasonal cash flow needs or teams managing large project expenses.

Cost savings and efficiency gains

Corporate credit card programs save companies time and money by reducing the manual work involved in processing expenses. With automated data capture and centralized controls, finance teams can shift away from administrative tasks and focus on analysis that drives more value.

- Administrative overhead reduction: Finance teams process expenses in minutes instead of hours, freeing staff for higher-value work

- Reimbursement delay elimination: Employees use corporate cards instead of personal funds, removing the need to wait for reimbursement

- Automated categorization: Transactions sort into accounting categories automatically, improving accuracy and reducing manual entry

These savings add up quickly. Ramp research shows that 86% of companies say corporate cards have saved them money because they can rely on fewer expense management tools.

Enhanced spending controls

Corporate card programs let your finance team set clear guardrails around employee spending while giving cardholders the flexibility they need to do their jobs.

- Real-time spending visibility: View transactions as they occur through dashboards or mobile apps, making it easier to catch issues early

- Customizable spending limits: Set daily, weekly, or monthly limits by employee or role, with higher thresholds for executives or travel-heavy positions

- Merchant category restrictions: Block certain types of purchases, such as cash advances or personal shopping, while allowing approved business expenses

These built-in controls enforce your policies automatically and reduce the need for constant oversight from managers or finance teams.

How to set up a corporate credit card program

Setting up a corporate credit card program starts with choosing a provider that fits your business needs, then developing clear policies and training employees on how to use their cards. These steps help you maximize benefits, maintain control, and prevent misuse as the program scales.

Step 1: Choose the right corporate card provider

Begin by evaluating providers based on the features that matter most to your company. Look at costs such as annual fees and foreign transaction charges, the quality of reporting dashboards, and the strength of customer support. Rewards structures also differ, so select one that aligns with your spending patterns.

Ask about credit limits, fraud protection practices, card-issuance timelines, and references from companies similar to yours. Strong integrations with platforms like QuickBooks, NetSuite, or Xero can also reduce manual entry and improve financial visibility.

How to maximize your credit limit

If you’re an e-commerce business, consider providers like Ramp that can underwrite your credit limit using sales data from platforms such as Stripe, Shopify, and Amazon. This may help you qualify even without extensive revenue history.

Step 2: Establish your corporate card policy

Your corporate card policy defines how employees should use their cards and sets clear expectations. Essential components include who is eligible for a card, the consequences for policy violations, and guidelines for submitting receipts and documentation.

Set spending limits that reflect employee roles and responsibilities, such as different thresholds for junior staff, managers, and executives. Outline which expenses are allowed and which are prohibited, including restrictions on personal purchases, cash advances, and gift cards. Provide rules for handling accidental personal charges and clarify any pre-approval thresholds for larger expenses.

Step 3: Train employees and roll out

Training ensures employees understand how to use their cards responsibly from day one. Consider phasing the rollout by department or role, and provide reference guides with examples of common expenses and FAQs.

Offer live training sessions on policy details, receipt capture, and expense submission, and supplement them with short videos and written instructions. Follow-up sessions after 30 and 90 days can surface issues early and help refine your program based on real-world feedback.

Discover Ramp's corporate card for modern finance

Corporate card policy best practices

A well-crafted policy balances employee autonomy with financial oversight, creating guidelines that protect your company while enabling productive work.

Setting clear usage guidelines

Clear usage guidelines help employees understand what they can charge and how to stay within policy. Most companies permit expenses related to business travel, client entertainment, office supplies, and software subscriptions. These categories provide structure without limiting employees who regularly spend as part of their roles.

- Business travel: Airfare, hotels, ground transportation, parking, and meals for work trips

- Client entertainment: Restaurant meals, event tickets, and hospitality with a documented business purpose

- Office supplies: Equipment, furniture, software subscriptions, and materials needed for daily operations

- Professional development: Conference registrations, training courses, industry memberships, and educational materials

Documentation requirements help finance teams verify expenses efficiently. For example, you may require receipts for purchases over $25 and ask employees to submit them within 5 business days using digital photos or emailed confirmations. Personal purchases should be prohibited, and your policy should outline how to report accidental charges and reimburse the company quickly to keep the program consistent and fair.

Implementing approval workflows

Approval workflows help control spending by ensuring larger or unusual purchases receive the right level of review. For example, you might require manager approval for expenses above a certain threshold or for categories outside normal business use. These workflows can be handled through email or built directly into your expense management software.

Regular manager reviews strengthen oversight and help teams stay within budget. Monthly check-ins can surface issues early, while quarterly reviews with finance give the company a broader understanding of spending patterns. For one-off or atypical purchases, a clear exception process allows employees to request approval with an explanation of the business need.

Compliance and monitoring

Consistent monitoring keeps your corporate card program compliant and helps deter misuse. Many companies review a sample of monthly transactions to confirm receipts, merchant categories, and descriptions are accurate, while annual audits reveal broader trends or policy gaps that need attention.

Your policy should clearly outline consequences for violations, from warnings and retraining to temporary suspension or, in serious cases, termination. Because business needs evolve, review your card policy annually and communicate updates through email and brief refresher training so cardholders stay aligned with current expectations.

Managing and optimizing your program

Once your corporate card program is in place, ongoing management helps you maintain oversight and identify areas for improvement. Regular reviews of spending patterns, employee usage, and policy alignment keep the program efficient as your business evolves.

Expense management integration

Connecting cards to expense management software eliminates manual data entry and speeds up expense submission. Direct integrations push transactions into systems like Ramp, Concur, or Divvy within minutes of purchase, allowing employees to attach receipts and submit expenses quickly. A Forrester study commissioned by Ramp found that automating expense reporting saved employees a total of 2,280 hours per year. Automation can also categorize transactions, flag potential policy violations, and route approval requests to the right manager.

Real-time reporting gives finance teams a clear view of spending by department, employee, or category. Alerts help managers monitor limits or unusual activity, and dashboards make it easier to compare current spend against budgets. Together, these tools help your company stay on top of expenses without relying on manual review.

Technological features

Modern corporate card platforms offer features that make it easier to manage spending and support employees in the field. Mobile apps allow users to view transactions, freeze or unfreeze cards, adjust limits, and approve requests from anywhere. Receipt capture tools ensure documentation stays connected to each transaction.

Virtual cards provide an additional layer of control for online purchases. Companies can generate single-use or merchant-specific card numbers to reduce fraud risk and better manage recurring subscriptions. These features also simplify vendor management and give finance teams more control over high-volume online purchases.

Tracking program performance

Monitoring performance metrics helps you understand whether your program is delivering the expected value. Common metrics include expense processing time, policy compliance rates, employee adoption, and program cost per transaction. Tracking these numbers highlights where processes are working and where adjustments may be needed.

Spending analysis can uncover opportunities to negotiate better rates, adjust limits, or update policy language. Regular quarterly reviews with stakeholders help keep your program aligned with business goals, while annual evaluations give you a chance to reassess providers, renegotiate terms, or expand card access as your company grows.

Who offers corporate credit cards?

There are two primary sources for corporate credit cards: traditional banks and software-based financial providers. Each type serves different business needs, with banks emphasizing credit history and software providers focusing on accessibility and modern controls.

Traditional banks

Traditional banks typically design their corporate card offerings for larger companies with strong credit histories and higher annual revenue. These cards often come with more stringent eligibility requirements because banks take on greater risk by offering higher credit limits. They may also charge annual fees and foreign transaction fees for international spending.

Examples of bank-backed corporate cards include:

- American Express Corporate Card

- Chase Ink Business Preferred Card

- Citi Commercial Card

- Capital One Spark Cash Plus

These cards don’t always offer the same depth of spend controls or software integrations that modern finance teams expect, which can limit real-time visibility.

Software providers

Software-oriented providers offer corporate cards with more flexible eligibility criteria, making them accessible for startups and small to medium-sized businesses. Many use real-time financial data and connected bank accounts to make underwriting decisions, enabling faster approval and easier onboarding.

Examples of software-backed corporate cards include:

- Ramp corporate card

- Brex card

These providers prioritize usability, offering real-time spend tracking, integrations with accounting platforms, automated expense management, and tools for managing recurring subscriptions. Their tech-forward approach simplifies application, improves visibility, and supports more hands-on spend management than most traditional bank programs.

Common challenges and solutions

Corporate card programs can face challenges during rollout and ongoing use, but addressing them early helps ensure long-term adoption and compliance.

Employee adoption issues

Employees may resist new processes because they’re worried about oversight or simply unfamiliar with corporate card systems. Clear communication about the benefits, such as eliminating out-of-pocket expenses and reducing paperwork,helps ease those concerns. Sharing feedback from early adopters and providing quick reference guides can build confidence and encourage better habits.

Privacy worries also surface when employees fear their spending will be monitored too closely. Explaining what data is collected, why it matters, and how it protects employees from liability helps reduce hesitation. Incentives like recognition for high compliance or consistent receipt submission can also motivate proper card usage across teams.

Fraud prevention and security

Fraud risks include stolen cards, compromised card numbers, duplicate vendor billing, and intentional misuse. Preventive measures such as spending limits, merchant category blocks, real-time alerts, and virtual card numbers for online transactions reduce exposure and help finance teams identify suspicious activity quickly.

A clear response plan ensures issues are handled efficiently. Employees should know how to report lost cards immediately, and finance teams should investigate questionable transactions within 24 hours. Tracking metrics such as fraud incident rates, time to detect charges, and recovery rates helps you evaluate the effectiveness of your controls and identify areas that may need stronger safeguards.

Consider Ramp’s modern corporate card

Legacy corporate cards often lack modern spend controls and require rigid qualification criteria, while business credit cards typically rely on personal guarantees. Ramp offers a more flexible alternative with built-in spend management features that give your company real-time visibility and control.

Ramp combines a corporate card with software for managing approvals, vendor payments, recurring subscriptions, and spending limits across teams. Companies can streamline their financial operations without sacrificing control or adding extra tools.

To qualify for a Ramp Card, you’ll need:

- A registered LLC or corporation in the United States

- An EIN number

- $25,000 or more in a U.S. business bank account, or eligibility through sales-based underwriting

- Personal contact details as the business owner

Apply for the Ramp Card to simplify your spend management and earn cashback on every purchase.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits