Business loan vs. line of credit: Which one makes the most sense for your business?

- What’s the difference between a business loan and a line of credit?

- What is a business loan?

- How to get a business loan

- What is a business line of credit?

- How to get a line of credit

- Business loan vs line of credit: which should my business use?

- Why spend management is critical to managing your debt

- How Ramp helps you make smarter financing decisions

- Optimize spend and control your finances with Ramp

Businesses can’t run without cash flow, or working capital, and there’s nothing more frustrating than needing money and not knowing where to get it. Each business is unique and there are a lot of options when it comes to securing funds. Two of these are business loans and lines of credit.

In this article, we’ll explain what each of these are and why they could be a good fit for your business. We’ll also go over some alternatives to both and how to increase your funding and build business credit without borrowing.

What’s the difference between a business loan and a line of credit?

A business loan is a sum of cash given to qualifying businesses that must be repaid over a given time period at a predetermined interest rate. A line of credit gives businesses access to a certain amount of money that they can draw on, repaying (with interest) based on the amount they withdrew.

The primary difference between the two is flexibility. With business loans you’re given the entire amount upfront and must repay in full, plus interest, while lines of credit enable you to withdraw the amount that you need over time and repay only that amount (plus interest).

We dive into both in more detail below.

What is a business loan?

A business loan is a type of loan that is used to finance a wide variety of business needs, such as buying inventory, expanding operations, or covering short-term expenses. The loan can come from a variety of sources, including traditional banks, credit unions, or online lenders. There are also several private lenders and companies that offer business loans.

How to get a business loan

It's important to carefully consider whether a business loan is the right option for your specific situation. You should evaluate your financial management strategies first to see if you have any other options. But if you're ready to apply for a business loan, here are the steps you need to take:

- Shop for a lender: There are a variety of lenders who offer business loans, including traditional banks, credit unions, online lenders, and private companies.

- Compare interest rates: It's important to compare the interest rates from different lenders to get the best deal.

- Research the terms and conditions: Not all lenders offer the same terms and conditions, so compare them carefully.

- Read the fine print: Make sure you understand all the details of the loan before you sign up. This includes the interest rate, repayment schedule, and any fees that may apply.

- Prepare your business plan: To increase your chances of approval, you'll need a solid business plan and good credit history.

- Complete the application form: This can usually be done online. The lender will require your personal and business information, as well as your credit history.

- Wait for approval: After submitting your application, you'll need to wait for approval. This process can take anywhere from a few days to a few weeks.

- Sign the loan agreement: This is a legally binding contract and it's important to read it carefully before signing. You’ll receive your funds after this is done.

Terms and rates

The terms of a business loan will vary depending on the lender, but typically they range from one to five years. One of the key advantages of a business loan is that it can help businesses access capital quickly and easily. This can be especially useful for companies that are just starting out or those that have been hit with unexpected expenses.

Interest rates vary by the lender. SBA loans, for example, have low rates relative to many traditional bank loans (see our SBA loan calculator to find the best payment terms for your business).

Interest rates can also be affected by the personal credit score of the primary borrower. Lenders look at the creditworthiness of the company, but someone needs to be the primary on the loan agreement. With smaller companies, that’s typically the business owner. Larger corporations may assign a corporate officer to be the point person

What is a business line of credit?

A business line of credit (LOC), or credit line, is a type of loan that gives businesses quick access to cash. The terms of a line of credit are like those of business credit cards. The business can borrow up to a certain limit and must pay back the money within a certain period. Unlike a loan, a line of credit is reusable. Once the money is paid back, you can borrow again, up to your credit limit. The limit is set by the lender after they evaluate credit score, payment history, and business revenue.

LOCs are typically used by businesses when they need to make a large purchase and don't have the cash on hand to cover the cost, such as buying new equipment or inventory. They can also be used for expenses during tough times, like when sales are down, or the business is facing a cash crunch. The flexibility of a line of credit may be better than a loan in these situations.

There are two main types of LOCs: secured and unsecured. A secured LOC is backed by collateral, such as the business's inventory or equipment. With inventory financing, if the business fails to make payments on the loan, the lender can seize and sell the collateral to cover the debt. An unsecured LOC doesn't require any collateral and is typically more expensive than a secured LOC

How to get a line of credit

To qualify for a business line of credit, the primary applicant will need to have a good credit score and history, and the business must be profitable. The most common way to get a business line of credit is to go through a traditional bank, but there are several online lenders that offer LOCs. Shop around and compare rates before you decide on one.

Be prepared to put up some collateral. Most banks will want to see some proof that you're able to repay the loan, and they'll usually ask for collateral in the form of assets like property or equipment. If you can meet all these requirements, you should be able to get a business line of credit easily. Read the terms and conditions carefully, so you know what you're agreeing to.

Terms and rates

The terms and conditions of the LOC outline the allotted time to pay back any funds you take, what the monthly payments will be, and other fees that might apply. The interest rates for business lines of credit are typically variable rates that go up and down based on the prime rate. Both vary based on the lender, so do your research.

A variable rate of interest adds another dimension to this funding option that’s not present with a traditional business loan. Taking money from your LOC creates a variable expense, which can be challenging for financial planning and analysis. Traditional loans have fixed rates of interest, which is easier for accounting purposes.

Business loan vs line of credit: which should my business use?

The choice between these two funding options is usually situational. When you have a specific purchase in mind that requires a fixed amount of money, a business loan will probably work just fine. For project-based spending, like building a new wing or expanding a sales team, the line of credit gives you more flexibility. It’s a question of fixed versus variable amounts needed.

Of course, business isn’t always that simple. If it were, you could just use a corporate card to cover all expenses and not need to seek out extra funding. That’s only possible with some major changes, which we’ll go through below. Under normal circumstances, you may need fixed and variable funding to run your business. A loan combined with an LOC is a way to do that.

An example of this is a sales team expansion to boost sales for a new product. The materials cost of the product could be funded with a business loan because that’s a fixed expense. The sales team expansion is a variable expense because of turnover and training costs, so a line of credit is a better option to fund that. One is not better than the other. You need both.

Why spend management is critical to managing your debt

Getting a business loan or line of credit is just the first step. Much of the challenge comes after that. To be successful with your loan or LOC, you need sound spend management processes in place. That could include issuing your employees prepaid cards for business expenses or eliminating cost-intensive processes like expense reimbursement and free spending.

This is a challenge for many small business owners. Securing finance without a plan on how to spend it could put your company in a difficult position. Loans and lines of credit need to be paid back. Debt is something you want to take off your books as soon as possible. Managing cash outflows and expenses is one way to do that. Not borrowing in the first place is another.

How Ramp helps you make smarter financing decisions

Choosing between a business loan and line of credit can feel overwhelming when you're juggling cash flow forecasts, expense projections, and growth plans. You need clear visibility into your financial position to determine whether you need a lump sum for a specific investment or flexible access to funds for ongoing operational needs.

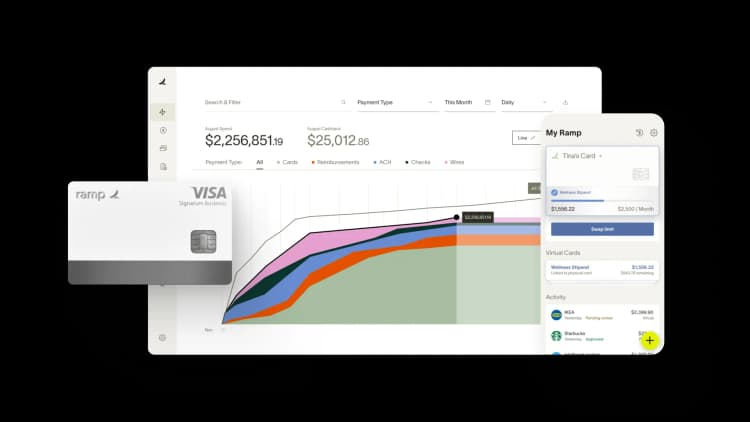

Ramp's expense management platform gives you the real-time financial insights you need to make this critical decision. With automated expense tracking and categorization, you can see exactly where your money goes each month, helping you identify whether your financing needs are predictable (pointing toward a term loan) or variable (suggesting a line of credit). The platform automatically captures and categorizes every transaction across your business, eliminating the guesswork from your cash flow analysis.

Your financing decision also depends on understanding your true borrowing capacity and how additional debt will impact your business. Ramp's real-time reporting dashboards show you key metrics like burn rate, runway, and expense trends at a glance. This visibility helps you calculate how much you can comfortably borrow and whether fixed monthly payments or variable drawdowns better align with your revenue patterns.

Perhaps most importantly, Ramp's spend controls and approval workflows ensure that once you secure financing, you're using those funds effectively. You can set spending limits, require approvals for large purchases, and track exactly how borrowed funds are being deployed across your organization. This level of control and transparency not only helps you maximize the value of your financing but also positions you as a responsible borrower for future funding needs. With Ramp, you're not just choosing between financing options—you're building the financial infrastructure to use either option successfully.

Optimize spend and control your finances with Ramp

Many business owners wonder if they need external financing at all. Before taking on debt, consider this: better spend management often eliminates the need for loans or credit lines entirely.

Ramp's charge cards give you powerful spending tools without the debt burden of traditional credit products. Unlike credit cards that encourage carrying balances, our charge cards require full monthly payment—keeping you disciplined and debt-free.

Here's what makes the difference: when you optimize your existing revenue through smarter spending, you might discover you're already profitable. The cash you need could be hiding in uncontrolled expenses, duplicate subscriptions, or inefficient processes. Ramp helps you find and fix these leaks before you borrow a single dollar.

FAQs

A small business loan is a loan for a set amount of money that is paid back in equal monthly installments with a fixed rate of interest. A line of credit (LOC) is a limit amount which can be borrowed in increments, with a variable interest rate based on the current prime rate when the money is taken. Repayment times are outlined in the terms and conditions of the LOC.

Most lenders prefer a credit score of 600 or higher to qualify a business owner for a business line of credit, but there are online lenders that offer LOCs to applicants with credit scores as low as 500. The lower the credit score, the higher the interest rate.

Interest rates on LOCs are variable, so they are based on the lender’s prime rate. In 2021, LOC interest was as low as 2% for a secured LOC, but rates have risen since then. Business owners with higher credit scores are more likely to get lower rates.

A term loan is a loan that must be repaid over a certain time period and at a specific agreed-upon interest rate. The interest rate is determined by the loan amount, the length of the repayment period (with short-term loans carrying lower interest rates), and the business credit score of the applicant.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group