- 7 signs it's time to switch your business credit card

- How to choose the right corporate card for your business

- What to do with your old business credit card after switching

- Switch to a corporate card built for all businesses

- Ready to switch?

Your business credit card should match how you actually spend money. When it doesn't, you're leaving rewards on the table, paying unnecessary fees, or missing features that could make your job easier.

Most businesses switch cards when spending patterns shift, growth accelerates, or their current provider can no longer keep up. But there are plenty of other reasons your current card might no longer be the right fit—from outdated rewards structures to major changes at your card issuer. A card that worked for a $200,000 startup won't serve a $2 million company with a distributed team.

7 signs it's time to switch your business credit card

1. Your spending has outgrown your card

If you're spending $50,000 per month but your card caps rewards at a lower amount, you're missing out on thousands in cash back or points. Similarly, if your card's credit limit hasn't kept pace with your growth, you may find yourself making multiple payments per month just to free up available credit—a hassle that signals you've outgrown your current card.

2. Your rewards no longer match how you spend

Businesses evolve, and spending patterns shift. Maybe you used to spend heavily on travel but now work with a distributed remote team. Or perhaps your biggest expenses have moved from one category to another entirely. If your card's rewards structure was designed around how you used to spend—not how you spend today—you may be leaving money on the table. The right card should deliver consistent value across your actual spending, not just the categories you used to prioritize.

3. Your card issuer has been acquired or is undergoing major changes

The fintech and banking landscape is constantly shifting. When your card issuer gets acquired by a larger bank, merges with another company, or undergoes significant leadership changes, the product you signed up for may not be the product you end up with.

Take Capital One’s recent acquisition of Brex in January 2026. This kind of major change rightfully has customers wondering about changes in rewards structures, customer support models, fee schedules, and platform integrations. The Brex card was built for startups and growth-stage companies—will they now shift their focus to enterprise customers? The nimble fintech experience customers chose could gradually take on the feel of a traditional bank, with slower innovation and less responsive support.

Even if an acquirer promises continuity, transitions rarely go perfectly. You might experience disruptions to integrations with your accounting software, changes to how employee cards are managed, or shifts in the underwriting criteria that affect your credit limit. If your card issuer announces a major acquisition or ownership change, it's worth evaluating your options before the transition—not after.

4. You need better spend management tools

If you can't set spending limits per employee card, see transactions in real time, or integrate with your accounting software, you're managing expenses blind. Modern corporate cards offer granular controls, automated receipt capture, and real-time visibility that older cards simply don't provide. As your team grows, these features shift from nice-to-have to essential.

5. You're paying for benefits you don't use

A $595 annual fee for airport lounge access doesn't make sense if you fly twice a year. Evaluate whether you're actually using the perks that justify your card's annual fee. If not, a lower-fee card with benefits aligned to your actual needs will serve you better.

6. Your business structure has changed

If you started as a sole proprietorship and have since incorporated as an LLC or S-corp, your old card may no longer fit. Different business structures have different financial needs, and some cards offer better protections, reporting, or credit-building benefits for established entities.

7. Your card's terms have changed

Beyond ownership changes, card issuers occasionally modify rewards structures, increase fees, or adjust terms on their own. If your card's value proposition has eroded since you signed up, it may be time to explore alternatives. Pay attention to any notices about changes to your card agreement.

How to choose the right corporate card for your business

When evaluating a new corporate card, look beyond introductory offers to find a card that provides long-term value.

Rewards that match your spending

Does the card reward your largest spending categories, or does it offer a flat rate on all purchases? The best corporate card for your business is one that maximizes returns on the categories where you actually spend—whether that's software subscriptions, advertising, travel, or office supplies.

Fee structure and card type

Understand whether you're looking at a charge card or a credit card. Charge cards require you to pay your balance in full each billing cycle, which enforces spending discipline and eliminates interest charges. Credit cards allow you to carry a balance, but interest adds up quickly if you don't pay in full.

Beyond card type, evaluate annual fees against the value you'll actually receive. Many modern corporate cards have eliminated annual fees entirely while still offering competitive rewards and features.

Employee card controls

Check for spend controls, virtual card capabilities, and the ability to issue cards to employees without personal credit checks. The right card should make it easy to scale as your team grows while maintaining oversight of every dollar spent.

Software integrations

Ensure the card provider syncs with your accounting software, ERP, and other financial tools. Seamless integrations reduce manual work and help you close your books faster.

Customer support and stability

Consider the issuer's track record for customer support, platform reliability, and long-term stability. A card is only as good as the company behind it.

What to do with your old business credit card after switching

A little prep work upfront can save you from missed payments, lost rewards, or confused employees. Once you've decided to switch, take these steps to ensure your transition is smooth:

- Inventory your recurring payments: List all subscriptions, vendor autopays, and recurring charges tied to your old card. You'll need to update each one with your new card details to avoid service interruptions or late fees.

- Redeem your rewards: Use or transfer any accumulated points or cash back before closing the account—unredeemed rewards are often forfeited.

- Communicate with your team: Give authorized users advance notice of the switch-over date, collect and destroy old employee cards, and make sure everyone is set up on the new system before you cut off the old one.

- Download your statements: Save all past statements for tax and accounting records. Once the account is closed, you may lose access.

- Confirm a $0 balance: Ensure the account is fully paid off before you officially close it.

- Decide whether to close or keep the account: If there's no annual fee, keeping the old card open can help preserve your credit history. If there is a fee, ask the issuer about downgrading to a no-fee version.

- Update your accounting: Inform your accountant or finance team so they can update your chart of accounts and bookkeeping software.

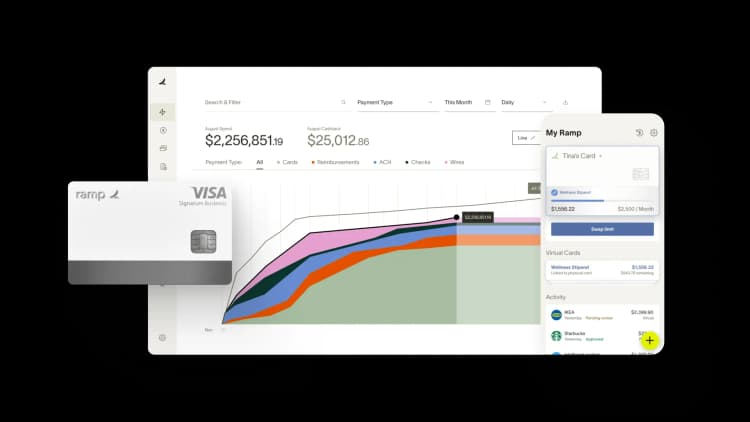

Switch to a corporate card built for all businesses

Switching corporate cards is a strategic move when your current card no longer fits how your business operates. Whether you've outgrown your current provider, need better controls for a growing team, or want to get ahead of changes at your card issuer, the right card can make a real difference.

The good news? Switching doesn't have to be painful. Most finance software takes months to implement—Ramp takes days.

Here’s how one company switched off their old corporate card to Ramp and saved 20 hours a month, improved their expense compliance by 58%, and closed the month-end 3 days faster.

How Piñata halved its finance team's workload after switching from Brex to Ramp

When Piñata, the nation's premier reward and credit-building program for renters, outgrew its previous corporate card, the finance team was losing hours every week manually matching receipts to expenses. Nearly 40% of transactions had missing receipts, and the limitations were delaying their monthly close.

"We needed a corporate card that kept our pace, saving us the two things every 0-to-1 startup needs: more time and money," says Piñata CEO Lily Liu.

With Ramp, Piñata's finance team no longer had to manually chase down receipts—Ramp automatically pulls receipts from employees' Gmail inboxes and has built-in integrations with merchants like Amazon Business, Uber, and Lyft that attach receipts without any employee action required.

The team also started using Ramp's card auto-lock feature, which nudges employees to submit receipts from previous expenses by locking their cards if they don't send them in by a certain date.

With Ramp, Piñata improved its receipt compliance to 95%, the finance team cut their weekly expense work from 10 hours to five, and shaved three days off its monthly close.

"Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy," Liu says.

Ready to switch?

With Ramp, you can apply in five minutes, connect your ERP and HRIS in minutes, and issue unlimited virtual and physical cards to your team with pre-set controls right out of the gate. A dedicated onboarding specialist guides you through setup, and live training gets your team up to speed.

It's why 98% of businesses that switch to Ramp stay on Ramp.

With cash back, no annual fees, and built-in controls that give you visibility into every dollar spent, Ramp is the corporate card built for growing businesses.

See how much Ramp can save you. Switch to Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits