Expense reports are the worst. We all know this - and many are still forced to submit them. Finance teams often leverage the fact that employees hate filing expense reports in order to prevent reimbursements. After all, if filing and reporting expenses was fun, every employee would be doing it, right?

This article outlines why this way of thinking may do more harm than good for your company. It also provides an alternative to expense reports: issuing a corporate card for employees with the right permissions. Let's dive in...

Why you should eliminate expense reports

1. Wastes time of highly paid employees

It takes on average 20 minutes to file an expense report form. Add onto that time for management to approve and the finance team to approve after that - it's a significant time sink on an annual basis. It's also expensive from a payroll perspective given the manager is likely senior. All that time for just a cup of coffee or team lunch is hardly worth it.

Tip: You are not paying your employees to be accountants. You are paying them to add value to your bottom line.

2. Demoralizes employees

Employees hate filling expenses. You have to go through your personal expenses, figure out what should be expensed, find receipts, upload all these transactions and documents by hand into a clunky system, select from ineligible drop down menus, and hope that you will get paid back. Most employees would rather file their taxes.

Tip: Don't use poor employee experience as a way to cut costs. Keep employees happy with the tools they use to increase engagement and retention.

3. Harms company culture and growth

Employees spend in order to add value to a company. By adding unnecessary steps to personal reimbursements, companies are preventing employees from adding value. Almost 1 in 4 employees have postponed or canceled a meeting in order to avoid personal expense pay out. This means avoiding taking the team out to lunch to build rapport. Or going to a conference to network and learn. There's a reason you've set aside budgets - unlock their value.

Tip: Define your business expense policy and financial culture to empower spend, not prevent it at all costs. Make your employees feel like owners.

The Finance team should be an enabler, not an obstacle to overcome.

4. Wastes money

On top of the time cost of filing expenses, companies incur the cost of the expense management solution itself. Solutions like Expensify or Abacus can cost $5-10 per user per month. This means that for a company of 200 people, the cost can run up to $24,000/year.

Tip: Look at your existing accounting or payroll solutions. Oftentimes they have lightweight expense reimbursement solutions available for free.

5. Causes anxiety by borrowing from employees

When you ask an employee to spend on their own card and file an expense report, you are essentially treating that employee like a bank loan. Employees that travel often for a business trip accrue significant expenses which can amount to a significant portion (25%+) of their paycheck. It will take many weeks for the employee to file expenses, and several additional days process the expense and get the cash back. Even worse - 1 in 10employees don't even file expenses because of the effort it takes. That's a direct tax on employees who don't have the time.

Tip: Don't add to your employee's finance anxiety - it leads to missing work and a decrease in productivity.

6. Is full of inaccuracies

19% of expense reports are filed with a mistake. That makes sense considering you are asking employees with no formal expense management training to pick from a drop down of accounting categories for each transaction. Given all of this is done manually in software that is poorly designed and rolled out, errors are bound to happen.

That's more work for the finance teams to correct it, which leads to more time spent, which leads to more money wasted. And if the errors are not caught, inaccurate data is submitted to your accounting software. Poor data leads to poor decisions and possible corrections down the line which could be harmful to your business.

Tip: The more automated rules, the less likely human errors ruin your plans.

7. Doesn't actually prevent expense fraud

Self reported expense reports are more likely to be fraudulent than if the employee was spending on a card you control. The most common causes of expense report fraud- such as expensing something that was returned, or falsifying the tip charged on a transaction- cannot be caught without verifying the underlying transaction. Unfortunately, with expense reports you only have access to what is reported.

Tip: Implement a system that highlights out of ordinary expenses and a process to sample expenses rather than review line by line.

8. Incentivizes maximizing spend

Employees love points. And when you ask employees to put in on their card - they think of one thing: how much can I get away with? It makes sense considering that credit card points systems are designed to incentivize spending. That might be fine for consultants who charge clients, but this is your company dime. Your company should be earning those points. And they can add up quickly. Expense reports lead to more spending out of pocket, and less cash back for you.

Tip: Keep business spending on business owned cards. Employees should not enrich themselves on behalf of company spending.

9. Delays closing your books

People will always wait until to the last possible second to file expenses. You've sent out the 3rd reminder to submit expenses and completed your month end close process only to have your VP of Sales submit a large expense report. Awkward. Yet again, you have to pick between being the nice person and the process person. Late expense reports. Delays in closing your books. Reminders and nagging. More nagging. That's not what you signed up for.

Tip: You didn't get a degree in being an expense report police. Let expense management software do that for you and focus on growing yourself and the company.

10. Prevents visibility into company spend

Finance teams need real time visibility into company spending in order to make decisions around budget allocation and cash management. That becomes impossible when you sales team blows their quarter budget on a full week offsite to Vegas which you found out a few weeks after the fact in the form of a hefty expense report.

Tip: Just because accounting is done monthly doesn't mean the finance team should settle for monthly data.

Don't just take my word for it. Ask your employees and managers. Look at how many expense reports are filed and how long it takes your organization. And ask yourself: is this worth it? Or is there a better way to do things?

There is a better way

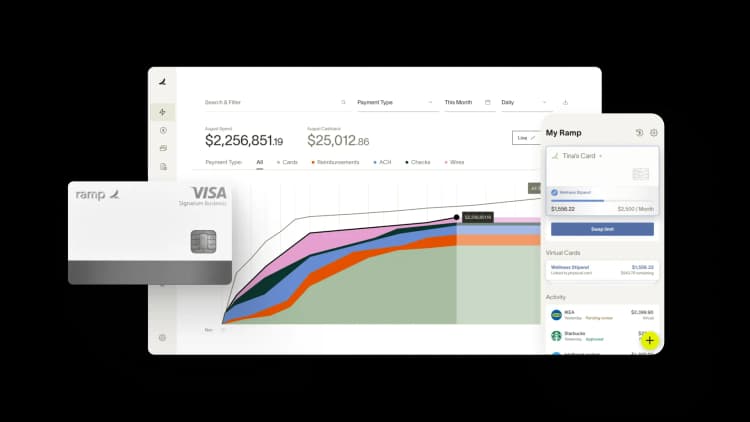

High growth companies are shifting to a better way of doing things - issuing employees cards in real time for their spending needs. By leveraging real time virtual and physical card platforms, finance teams maintain the same control and remove all of the pain. Employees are simply invited with specific spending privileges or request one-off spend and get issued the right card for the job. Financial management teams have full visibility into company spend. Best part: more cash back for the company and one less SaaS solution.

Here are 10 reasons why our customers have switched over to Ramp and killed their expense management solutions:

- Time saved for employees. Simply swipe, text, and done. Automated receipt matching. Even foreign receipts.

- Refreshing user experience. No more clunky drop downs. No more submitting. Transactions are synced in real time. Users love it.

- More control than expenses. Granular controls at the card level (e.g. one time, daily, monthly and yearly allowances)and user level. Review requests and approve additional spend in real time.

- Real time transactional data with enriched merchant sanitization (AMZ → Amazon Web Services)

- Advanced reporting to slice and dice your data in any dimension

- Automated insights into ways to cut spend even further, like sudden increases in recurring contracts, or opportunities to downgrade a solution.

- Encoded expense policy that asks for receipts and justifications based on the rules you have set, and does the nagging for you.

- Close your books fast with integrations into your favorite accounting system (QuickBooks, Xero, NetSuite, Sage, etc.) and advanced accounting rules for automated coding.

- 100% free for unlimited number of users.

So what are you waiting for? Come join our community of innovative companies that are killing their expense reports and switching to Ramp.

Check out our guide on designing better expense policies for stronger spend control.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits