Accounting reconciliation software: Best tools and how to choose

- What is account reconciliation software?

- Types of reconciliation software

- Benefits of automated reconciliation

- ROI and cost savings

- Manual vs. automated process timeline

- Key features to look for

- Best account reconciliation software options

- How to choose the right accounting reconciliation software

- Streamline reconciliation with AI that codes, matches, and flags discrepancies in real time

Month-end close often brings the same stress every time: endless spreadsheets, manual data entry, and the worry that one misplaced decimal could throw everything off. Finance teams know this cycle too well: losing valuable hours to repetitive work that demands perfect accuracy.

Account reconciliation software changes that by automating how financial records are compared and verified. These tools handle the heavy lifting of matching transactions, flagging discrepancies, and maintaining audit trails. As automation reshapes finance operations, reconciliation platforms free accountants to focus on analysis and strategy instead of manual data entry.

What is account reconciliation software?

Account reconciliation compares two sets of financial records to confirm they match and identify any discrepancies. Businesses use it to verify that their internal books align with external statements from banks, credit card processors, vendors, and other sources—ensuring accurate, reliable data.

Finance teams once performed this work entirely by hand, spending days comparing statements and manually entering data into spreadsheets. That left plenty of room for keystroke errors, missed transactions, and delayed month-end closes. Modern software now automates these repetitive tasks by using matching rules to compare transactions across multiple data sources and flag exceptions that need human review.

Account reconciliation software supports many types of reconciliations across your financial operations, from balance sheet accounts to intercompany transactions. Bank reconciliation software focuses on matching internal records with bank statements. While that’s a common use case, broader platforms also reconcile credit cards, merchant accounts, payroll, fixed assets, and more.

Key components of reconciliation software

These platforms share core features that make automated financial matching and verification possible:

- Transaction matching capabilities: The software compares line items across data sources using rules you define, automatically pairing transactions that align by amount, date, reference number, or other criteria

- Data import and integration features: Direct connections to banks, accounting systems, enterprise resource planning (ERP) systems, and payment processors pull financial data automatically, eliminating manual downloads that slow reconciliation

- Exception management tools: When the system can’t match transactions automatically, it routes them to your team with context about why they failed to match so reviewers can resolve discrepancies quickly

- Reporting and audit trail functionality: Complete records of who reconciled what and when create transparency for internal controls and audits, while dashboards show reconciliation status across all accounts

Together, these components reduce manual work while maintaining the accuracy and documentation your finance team depends on.

Types of reconciliation software

Reconciliation platforms vary in scope and specialization. Some focus on specific financial processes, while others handle multiple reconciliation types across your organization.

Bank reconciliation software

Bank reconciliation software connects directly to your financial institutions to pull transaction data and match it against your accounting records. The platform identifies cleared checks, deposits, electronic payments, and bank fees, then flags any items that appear in one system but not the other.

These tools help maintain an accurate daily cash position, which is critical for managing payroll timing, vendor payments, and cash flow forecasts. Many solutions handle multiple accounts across different institutions, giving treasury teams a consolidated view of available funds.

They also manage common bank reconciliation challenges such as outstanding checks that haven’t cleared, deposits in transit, and bank errors that require correction with your financial institution.

General ledger reconciliation tools

General ledger reconciliation extends beyond bank accounts to verify accuracy across all balance sheet accounts. These platforms compare your GL balances against subledgers, third-party statements, and supporting documentation to catch discrepancies before they affect financial reporting.

Intercompany reconciliation features help organizations with multiple entities confirm that transactions recorded in one company’s books match corresponding entries in another. This is especially important for consolidated financial statements where intercompany eliminations must be complete and accurate.

The software also matches subledgers for accounts receivable, accounts payable, inventory, and fixed assets. This process identifies timing differences, posting errors, and missing transactions that could distort your financial position.

Specialized reconciliation solutions

Credit card reconciliation software manages the complexity of matching employee expense reports and corporate card transactions against bank feeds and statements. These tools identify duplicate charges and unauthorized transactions while simplifying approval workflows for finance teams.

Investment account reconciliation verifies positions, transactions, and valuations across brokerage accounts and investment portfolios. It reconciles trades, dividends, interest, and market value changes against custodian statements—valuable for businesses managing treasury investments or pension funds.

Merchant services reconciliation supports companies processing payments through multiple channels. These platforms match sales transactions, refunds, chargebacks, and processing fees against merchant account deposits to identify discrepancies in payment processing.

Benefits of automated reconciliation

Automated reconciliation delivers measurable improvements across every part of the financial close process, from time savings to accuracy, compliance, and scalability.

Time savings

Finance teams typically cut reconciliation time by 70%–80%, turning a process that once took days into one that completes in hours. Businesses reconciling hundreds of accounts each month can reclaim 40–60 hours of staff time, freeing teams to focus on higher-value work.

Error reduction and accuracy improvements

Manual reconciliation carries a 4% error rate due to data entry mistakes, transposed numbers, and overlooked discrepancies. Automated matching eliminates these errors and flags exceptions for review, improving overall accuracy to above 99%.

Compliance and audit readiness

Complete audit trails document every reconciliation action, showing who reviewed which accounts and when approvals occurred. This satisfies internal control requirements, audit requests, and regulatory standards such as Sarbanes-Oxley (SOX). Without proper records, businesses risk fines such as a 20% accuracy-related penalty for underreported income or up to 75% for willful fraud.

Real-time visibility and reporting

Dashboards display reconciliation status across all accounts, helping finance leaders identify bottlenecks before they delay month-end close. Management gains real-time visibility into cash positions, outstanding items, and exception trends instead of waiting for manual reports.

Scalability for growing businesses

As transaction volumes increase, automation handles higher workloads without adding headcount. Teams can reconcile thousands of daily transactions across dozens of accounts with the same small group that once struggled through monthly closes.

These benefits compound over time as your finance team redirects saved hours toward analysis, forecasting, and other projects that create business value.

ROI and cost savings

The return on investment for reconciliation software often appears within 6–12 months, driven by both direct cost savings and efficiency gains. Hard savings come from reduced labor costs when automation eliminates overtime or delays the need for additional hires as transaction volumes grow.

Example ROI calculation

Consider a mid-size company spending 160 hours a month on manual reconciliation across four accounting staff members earning $35 per hour. That’s $5,600 per month, or $67,200 per year. Reducing that time by 75% through automation saves roughly $50,000 annually in direct labor costs alone.

Soft savings deliver additional value that’s harder to quantify but just as impactful. Faster month-end closes mean management gets financial statements sooner, while fewer errors reduce time spent investigating and correcting mistakes. Lower audit fees often follow when records are organized and findings are minimized.

Strong ROI typically comes not just from cutting time, but from enabling finance teams to focus on analysis and forecasting instead of manual verification.

Manual vs. automated process timeline

A typical bank reconciliation highlights just how much time automation can save. Here’s how the two approaches compare:

| Step | Manual reconciliation | Automated reconciliation |

|---|---|---|

| Data collection | Download bank statement PDF and export GL data to Excel | Software automatically imports bank feed and pulls GL data through direct integration |

| Transaction entry | Manually enter transactions and format columns for comparison | Transactions sync automatically from bank and ERP connections |

| Matching process | Sort and compare transactions line by line | System applies matching rules and auto-pairs ~95% of transactions |

| Exception handling | Investigate unmatched items, track down missing receipts or approvals | Review 10–20 flagged exceptions with full context provided |

| Reporting and approval | Prepare reconciliation report and route for manager approval | Approve with one click; platform generates audit-ready report automatically |

| Total time per account | 4–6 hours | 30–45 minutes |

Automation reduces reconciliation time by roughly 85% per account. For a company reconciling 20 accounts each month, that’s more than 100 hours of staff time recovered monthly.

Key features to look for

Choosing reconciliation software means evaluating how well it automates, integrates, and secures your financial data. The right platform should reduce manual work without disrupting your existing systems.

Automation capabilities

A platform’s value depends on how much manual work it eliminates:

- Auto-matching rules and tolerance settings: Configure the software to automatically pair transactions by amount, date, reference number, or acceptable variance. Define penny-difference tolerances or percentage thresholds to determine when the system auto-approves matches versus flags them for review.

- Machine learning and AI features: Advanced platforms learn from your reconciliation patterns, suggesting new matching rules based on how your team resolves exceptions. Over time, the system identifies anomalies and predicts which transactions need attention.

- Workflow automation: Route unmatched items to specific team members based on account type or amount. Set up approval hierarchies, escalation rules, and notifications that keep reconciliations moving without manual oversight.

These automation features define how much time your team truly saves versus simply digitizing manual work.

Integration and compatibility

Your reconciliation software should connect seamlessly with the systems you already use:

- ERP system connections: Direct integrations with NetSuite, SAP, Oracle, Microsoft Dynamics, and other ERPs pull general ledger data automatically, including balances and supporting documentation

- Bank feed integrations: Connections through networks like Yodlee, Plaid, or direct bank APIs bring in transaction data daily or in real time. Multi-bank support helps if you manage accounts across different institutions.

- API availability: Open APIs let you connect proprietary systems, payment processors, or other specialized software. Clear documentation and developer support make these integrations easier to maintain.

Without reliable integrations, your team can slip back into manual data entry that undermines automation gains.

Security and compliance features

Because financial data is sensitive, security and compliance must be built into the software itself:

- Data encryption standards: Look for AES 256-bit encryption for stored data and TLS 1.2 or higher for data in transit to protect against unauthorized access

- User access controls: Role-based permissions limit who can view, reconcile, or approve specific accounts. Segregation of duties ensures no single user can reconcile and approve the same account.

- Audit trail maintenance: Logs that capture every action with timestamps and user IDs create an immutable record of activity for audits and regulatory reviews

- Regulatory compliance support: Platforms built for SOX compliance, GAAP, or other industry standards include built-in controls and templates. Certifications like SOC 2 and ISO 27001 show the vendor’s own security commitment.

Strong security and compliance features protect your organization from both external threats and internal control weaknesses.

Best account reconciliation software options

The right reconciliation software depends on your business size, industry, and financial complexity. A small business with straightforward transactions may need a simple tool that automates bank reconciliations.

In contrast, an enterprise handling large volumes of transactions and multi-currency accounts requires advanced automation, AI-powered error detection, and integration with ERP systems. Here are some options that cover all the bases.

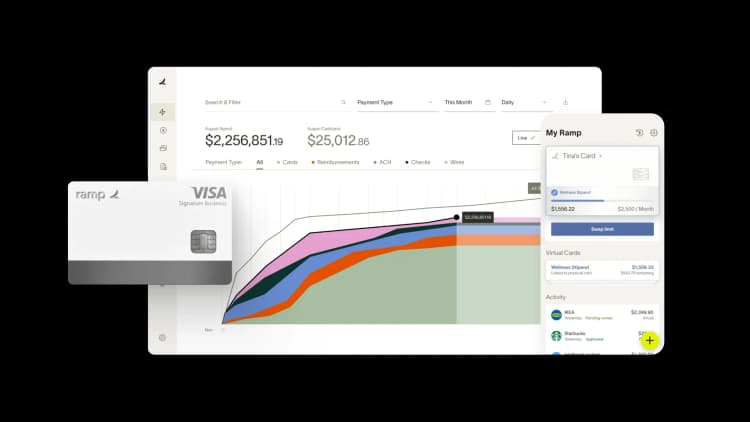

1. Ramp: Best for automated spend management and reconciliation

Ramp combines spend management with automated reconciliation capabilities to streamline your entire financial workflow. While traditional reconciliation software focuses on matching transactions after they occur, Ramp prevents reconciliation issues from happening in the first place by automating expense categorization, receipt collection, and policy enforcement.

Pricing

- Free: $0 per month, per user

- Plus: $15 per month, per user

- Enterprise: Custom

Benefits

- Automates receipt collection and expense categorization in real time

- Integrates directly with major accounting platforms for automatic syncing

- Provides AI-powered transaction categorization to reduce manual entry

- Enforces spending policies automatically to prevent reconciliation issues

- Offers real-time visibility into all company spending

Drawbacks

- Only available to formally established businesses

- Requires switching corporate cards to maximize automation benefits

Best for

Ramp is ideal for growing businesses that want to automate their entire financial stack, from spend management to reconciliation. It works particularly well for companies looking to eliminate manual receipt tracking, reduce accounting errors, and automate their month-end close process.

2. BlackLine: Best for high-volume transactions

BlackLine is a cloud-based reconciliation tool that pulls data from ERP systems, spreadsheets, and financial applications, eliminating the need for manual transaction matching.

It also includes customizable approval workflows, ensuring the account reconciliation process is reviewed and approved by the right people. This strengthens internal controls and reduces the risk of errors or fraud.

Pricing

- Unpublished; must contact sales

Benefits

- Automates financial close, reducing manual processes

- Supports multi-currency transactions for global businesses

- Strengthens compliance with audit-ready records

- Improves internal controls with approval workflows

- Keeps financials closely organized with checklists and automated tracking

Drawbacks

- Requires time and resources for setup

- Pricing is not available up front and requires a sales inquiry

- Lacks built-in variance calculations and data normalization features

Best for

BlackLine is best suited for large enterprises, multinational corporations, and businesses with high transaction volumes. Companies in regulated industries such as banking, healthcare, and publicly traded firms rely on BlackLine for audit readiness and compliance.

3. ReconArt: Best for cloud-based reconciliation

ReconArt is web-based reconciliation software that helps businesses automate financial processes. It supports bank, credit card, balance sheet, and intercompany reconciliations, ensuring accuracy and efficiency.

You can choose between cloud-based or on-premise hosting, giving you control over where your financial data is stored. The software integrates with ERPs and internal financial systems, eliminating the need for manual data entry.

Pricing

- Unpublished; must contact sales

Key benefits

- Automates reconciliations for bank account balances, credit cards, and balance sheets

- Integrates with ERP systems, syncing data in real-time

- Reduces manual effort and improves reconciliation accuracy

- Offers both cloud-based and on-premise hosting for flexibility

- Handles complex financial tasks, including variance analysis and journal entry matching

Drawbacks

- Pricing is not available up front and requires a sales inquiry

- Best suited for mid-sized to large businesses needing advanced automation

Best for

ReconArt is ideal for businesses with high transaction volumes that need full automation. It’s widely used by mid-to-large enterprises, financial institutions, and companies requiring ERP integration.

4. Xero: Best for simple, automated accounting

Xero is an online accounting platform built for small businesses that need an easy way to streamline cash flow and reconcile accounts. It gives you real-time financial tracking so you can monitor transactions as they happen. You can also manage invoicing, track inventory, and reconcile accounts from anywhere with an internet connection.

Xero's bank reconciliation feature simplifies transaction matching. It pulls in bank feeds automatically, suggests matches for transactions, and flags discrepancies. The platform also allows unlimited users on all plans, making it a cost-effective choice for small teams.

Pricing

- Early: $25 per month

- Growing: $55 per month

- Established: $90 per month

Benefits

- Provides real-time cash flow tracking for better financial management

- Automates bank reconciliation, reducing manual effort

- Supports invoicing, inventory tracking, and bill payments in one system

- Allows unlimited users, making it ideal for small teams

- Offers detailed financial reports with transaction linking

Drawbacks

- Costs can increase for larger businesses with complex needs

- Lacks some advanced reconciliation features required by bigger companies

Best for

Xero is ideal for small businesses, freelancers, and startups that need a simple and easy-to-use accounting tool. It works best for companies looking for automated bank reconciliation, invoicing, and real-time cash flow tracking without the complexity of enterprise software.

5. FloQast: Best for real-time collaboration

FloQast is a cloud-based accounting automation platform that is built for mid-sized to large businesses that need real-time tracking, task management, and collaborative workflows. FloQast automates reconciliations, reducing manual work and shortening the month-end close process.

The platform's AI-powered AutoRec automates account reconciliations, helping you spot discrepancies and maintain accuracy. It integrates with ERPs, Microsoft Suite, and Slack, making collaboration easy.

Pricing

- Unpublished; must contact sales

Benefits

- Uses AI-driven AutoRec to automate reconciliations

- Reduces financial close process time by 30%

- Enhances teamwork with multi-user workflows and version control

- Offers real-time tracking of reconciliation tasks and variances

- Provides pre-built templates to simplify onboarding

Drawbacks

- Pricing is not publicly available; you need to request a quote

- Limited to reconciliation and financial close; lacks broader financial planning and analysis (FP&A) tools

- Some users find Flux Reporting and multi-currency conversion difficult to use

Best for

FloQast is ideal for fast-growing businesses, accounting teams, and enterprises with complex reconciliations. Companies needing AI-driven automation, real-time tracking, and strong collaboration tools rely on FloQast.

6. Vena: Best for automating reconciliations and financial close in Excel

Vena is a corporate performance management (CPM) platform that helps you manage financial planning, budgeting, forecasting, and reconciliation. It integrates data from multiple data sources, so you don't have to copy and paste entries manually.

Vena's biggest advantage is its Excel-native interface, which makes it easy to use without extensive training. It connects directly to ERP and general or sub-ledger systems, allowing you to pull in data from accounts payable, accounts receivable, and fixed assets.

Pricing

- Unpublished; must contact sales

Benefits

- Uses a familiar Excel interface, reducing the need for extensive training

- Integrates with ERP and GL systems to consolidate financial data

- Provides configurable templates for bank reconciliations, prepaid expenses, and fixed assets

- Automates workflow approvals and audit trails for compliance

- Speeds up financial close and reconciliation cycles with real-time updates

Drawbacks

- It may require API setup if your ERP or GL system does not have a direct connector

- Some users find the interface less accessible, with small fonts and limited color contrast

- Additional training is needed to fully utilize the reconciliation features

Best for

Vena is a great choice for mid-sized to large businesses that rely on Excel but need automation to improve accuracy and efficiency.

7. Adra by Trintech: Best for multi-way transaction matching

Adra by Trintech is a cloud-based reconciliation tool that simplifies transaction matching, balance sheet reconciliation, and task management. Its multi-way transaction matching links data across multiple sources, eliminating errors from manual reconciliation.

The platform provides real-time dashboards, helping you track financial close progress. It also centralizes reconciliation tasks, improving visibility and compliance.

Pricing

- Unpublished; must contact sales

Benefits

- Automates multi-way transaction matching, reducing manual effort

- Provides real-time dashboards for better financial tracking

- Centralizes task management, making financial close easier

- Improves compliance with built-in controls

- Group accounts to reduce the number of reconciliations needed

Drawbacks

- Limited customization for complex reconciliation needs

- Pricing is not publicly listed and requires a consultation

- Some users face challenges with currency conversion for FX payments

Best for

Adra is best for small to mid-sized businesses that need a simple, automated reconciliation tool. It works well for finance teams that want to centralize their workflows and gain better financial visibility.

8. Bank Rec: Best for customizable transaction matching

Bank Rec by Treasury Software is a straightforward reconciliation tool that automates bank account reconciliation. It automatically reduces manual work by matching transactions, making the process faster and more accurate. If a transaction does not match, Bank Rec rolls it forward until a match is found.

With customizable matching rules, you can set specific criteria for how transactions should be reconciled, ensuring the system adapts to your business needs. It also supports high-speed transaction matching, helping you resolve issues quickly.

Pricing

- Standard: $199.95–$299.95 per month

- Corporate: $299.95–$399.95 per month

- Advanced: $399.95–$499.95 per month

Benefits

- Automates bank reconciliation, saving time and effort

- Provides customizable matching rules for flexibility

- Rolls forward unmatched records until a match is found

- Uses high-speed transaction matching for efficiency

- Identifies, tracks, and resolves discrepancies in real-time

Drawbacks

- Limited to five users per plan; must purchase additional seats for more users

- Focuses mainly on bank reconciliation, with fewer broader accounting processes

Best for

Bank Rec is a great fit for small to mid-sized businesses that need an affordable, automated bank reconciliation solution. It’s best for teams that want an easy setup and flexible transaction matching.

Integrate your accounting reconciliation software with Ramp

Some of these reconciliation tools integrate with Ramp to automate the entire expense management process. If you already use tools such as QuickBooks or NetSuite, you can connect them with Ramp to automatically categorize transactions and match receipts before they reach your accounting software. This may be the best solution if you’re looking to reduce manual work in your monthly close process.

How to choose the right accounting reconciliation software

Start by documenting your current reconciliation process in detail. Map how long each account takes to reconcile, which team members handle specific reconciliations, where bottlenecks occur, and what types of exceptions consume the most time. Establishing this baseline helps you identify improvement opportunities and measure results after implementation.

Next, identify the main challenges driving your search for software. You may struggle to meet close deadlines, lack visibility into reconciliation status, face compliance concerns about documentation, or need additional capacity without hiring more staff. Different platforms excel at different challenges, so clarity about your priorities helps you choose the right fit.

Develop evaluation criteria that reflect your business goals and assign weights to each factor based on importance. Score vendors on automation, integration, user experience, reporting, pricing, and support quality. A weighted scoring system keeps the process objective and prevents bias toward familiar tools.

Implementation considerations

Timeline expectations vary widely based on system complexity and company readiness. Simple bank reconciliation tools can go live within four to six weeks, while enterprise platforms handling multiple entities may take three to six months. Allow time for data migration, integration setup, testing, and user acceptance before setting a go-live date.

Training needs also depend on the software’s complexity and your team’s experience. Plan an initial training phase covering core functionality, followed by role-specific sessions for power users who configure rules and manage exceptions. Build in time for hands-on practice before reconciling live accounts.

Change management is equally important. Involve key team members in vendor selection and implementation planning so they feel ownership over the transition. Communicate benefits clearly, address concerns openly, and celebrate early wins to encourage adoption across the finance team.

Vendor evaluation checklist

Questions to ask vendors

- What reconciliation types does the platform support beyond basic bank reconciliation

- How does pricing scale with additional users, accounts, or transaction volumes

- What level of customer support is included, and what are the response times

- How often does the vendor release updates, and how are new features prioritized

Demo best practices

- Provide your company’s real reconciliation data for demos so vendors can show how their tools handle your specific scenarios

- Ask vendors to demonstrate exception-handling workflows and variance reporting

- Include multiple team members in demos to gather feedback from different user roles

- Request sandbox access to explore the interface independently after the demo

Reference checking tips

- Contact customers with a similar company size, industry, and reconciliation complexity

- Ask how accurate their implementation timeline was and what challenges they encountered

- Find out how responsive customer support has been to technical issues

- Learn about any limitations or frustrations discovered after going live

Thorough evaluation reduces the risk of selecting a platform that performs well in demos but fails to meet day-to-day operational needs.

Streamline reconciliation with AI that codes, matches, and flags discrepancies in real time

Manual reconciliation is time-consuming and error-prone, leaving finance teams vulnerable to missed transactions, duplicate entries, and potential fraud. When you're matching thousands of transactions by hand each month, it's easy for discrepancies to slip through—and by the time you catch them, the damage may already be done.

Ramp’s accounting automation software streamlines reconciliation by keeping Ramp and your ERP aligned and making it easy to spot breaks on demand. You can run a reconciliation report at any time to compare what’s in Ramp against what’s in your ERP, automatically surface amount differences or missing and duplicate entries, and see the exact transactions that make up each variance, so you can resolve issues as they appear instead of waiting for month-end.

Here's how Ramp prevents reconciliation errors and fraud:

- Reduce reconciliation cleanup: Ramp’s AI coding keeps transactions consistently coded across GL accounts, departments, and locations, so there’s less messy reclassification work when it’s time to reconcile and review variances

- On-demand reconciliation reports: Run reconciliation reports at any time to compare Ramp against your ERP, automatically surface amount differences, missing items, and duplicates, and see the exact transactions behind each variance

- Flag discrepancies in real time: Ramp surfaces mismatches, duplicate-like transactions, and unusual spending patterns so you can investigate and resolve issues before they roll up into your financial statements

- Enforce policy controls upfront: Ramp blocks out-of-policy spend at the point of purchase and requires receipts and memos before transactions sync, preventing unauthorized or unsupported charges from ever reaching your books

- Maintain complete audit trails: Every transaction includes full documentation, approval history, and coding rationale, giving you clear visibility into who spent what, when, why, and how it was reviewed

Try a demo to see how Ramp helps finance teams reconcile faster with fewer errors and stronger fraud prevention.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits