- What is cost accounting?

- Types of cost accounting

- Key cost elements in cost accounting

- How cost accounting helps with decision-making

- Cost accounting methods and their impact

- The challenges in implementing cost accounting

- Track and control costs in real time with Ramp

Key takeaways

- Cost accounting helps businesses track the cost of production, improve pricing, and make informed business decisions to maximize profitability.

- Choosing the right costing method and cost accounting system ensures accurate cost control, better budgeting, and improved financial performance.

- Understanding fixed costs, variable costs, direct costs, and overhead costs is essential for managing operating costs and setting profitable prices.

- Cost accounting aligns with financial management, supporting strategic planning and ensuring businesses maintain healthy cash flow.

Cost accounting helps businesses track expenses, set accurate pricing, and make informed financial decisions. It focuses on analyzing costs related to production, operations, and resource allocation, allowing businesses to improve their efficiency and maximize their profitability.

Unlike financial accounting, which prepares reports for external stakeholders, cost accounting is used internally for decision-making, budgeting, and cost control. It helps businesses monitor their fixed costs, variable costs, and overhead costs, giving management a clear picture of where money is being spent and where expenses can be reduced.

Different costing methods provide insights into product and service profitability. Companies use standard costing, activity-based costing, and marginal costing to evaluate expenses and improve their financial performance. Tracking costs accurately ensures better forecasting, helps businesses stay competitive, and supports long-term growth.

Businesses also follow GAAP (Generally Accepted Accounting Principles) when designing a cost accounting system to ensure compliance with reporting standards. Many companies implement lean accounting to eliminate inefficiencies, reduce waste, and improve cost tracking.

Understanding cost accounting is important for all businesses that are looking to manage their expenses, optimize their production, and improve their profitability.

What is cost accounting?

Cost accounting is a system that tracks, analyzes, and controls the cost of production, helping businesses optimize their cost structure, improve pricing, and make informed financial decisions by measuring direct costs, indirect costs, and operating costs.

This system breaks costs into two main categories: direct costs and indirect costs. Direct costs include direct materials and labor costs, which are directly tied to producing goods or services. Indirect costs, such as overhead costs and depreciation, cover expenses that support operations but are not linked to a specific product. Understanding these costs helps businesses control operating costs and determine the unit cost of goods or services.

One of the biggest benefits of cost accounting is cost control. By monitoring expenses and analyzing cost trends, businesses can identify inefficiencies and adjust spending to improve profitability. It also supports financial management by helping companies allocate resources effectively and prepare budgets.

Unlike financial accounting, which focuses on external reporting, cost accounting is used internally for decision-making. While financial accounting produces reports like the income statement and balance sheet for stakeholders, cost accounting helps managers assess real-time cost data and adjust operations accordingly.

Types of cost accounting

Different costing methods help businesses track expenses, improve pricing, and manage cost control more effectively. The right approach depends on the industry, production process, and financial goals.

- Standard costing - Standard costing compares estimated costs with actual costs to identify variances in spending. Businesses set predetermined costs for direct materials, labor, and overhead costs, then analyze differences to adjust operations. This method helps companies maintain efficiency and improve financial performance by keeping expenses in check.

- Activity-based costing - Activity-based costing (ABC) assigns overhead costs based on actual activities rather than total production volume. Instead of spreading costs evenly, ABC identifies which processes drive expenses, leading to more precise pricing and better decision-making. This method is particularly useful for companies with complex operations where traditional costing methods may not accurately reflect costs.

- Process costing - Process costing is designed for mass production industries, where goods go through multiple stages before completion. It calculates the total cost per unit cost, ensuring expenses are properly allocated across high-volume production. This approach is widely used in manufacturing, food processing, and chemical production.

- Marginal costing - Marginal costing focuses on cost-volume-profit analysis by examining how variable costs impact profitability. It helps businesses determine the minimum selling price needed to cover costs and reach a break-even point. This method is often used for short-term pricing decisions and evaluating the impact of production changes on overall financial performance.

- Lean accounting - Lean accounting streamlines bookkeeping by reducing waste and improving efficiency. It eliminates unnecessary inefficiencies in cost tracking, making financial reporting more straightforward. Businesses adopting lean accounting focus on value-driven processes, continuous improvement, and simplifying financial data to enhance decision-making.

Key cost elements in cost accounting

Understanding cost components is essential for tracking expenses and optimizing profitability. Fixed costs and variable costs, direct costs and indirect costs, and total cost calculations all play a role in financial planning and pricing strategies.

Fixed costs stay the same regardless of the level of production. Expenses like rent, salaries, and depreciation remain constant whether a business produces one unit or thousands. These costs provide stability but can reduce flexibility in times of financial uncertainty.

Variable costs, on the other hand, change based on production output. Raw materials, hourly wages, and utilities fluctuate with demand, making these costs more difficult to predict. As production increases, variable costs rise, but they also decrease when demand slows.

Direct costs are tied to a specific product or service. Expenses like raw materials and wages for production workers are directly associated with creating a product. These costs are easy to track and are essential in setting accurate pricing and profitability goals.

Indirect costs are expenses that support operations but are not linked to a specific product. Overhead costs, administrative salaries, and receivable write-offs fall into this category. Businesses allocate these costs across different departments or products to ensure accurate reporting.

Total cost is the sum of all business expenses, including operating costs, cost of goods sold (COGS), and production process costs. By calculating the total cost, businesses can determine their break-even point and adjust spending to maximize efficiency.

How cost accounting helps with decision-making

Accurate pricing depends on knowing the true cost of a product. Cost accounting calculates the unit cost, factoring in direct costs, indirect costs, and overhead costs to ensure businesses set prices that cover expenses and generate profit. Adjusting pricing based on cost trends helps businesses stay competitive and improve margins.

A break-even analysis determines how many units a company must sell to cover total expenses. By comparing sales revenue to the cost of a product, businesses can calculate profitability and make adjustments if costs rise or demand shifts. This analysis is crucial for new businesses and those looking to expand without taking on unnecessary risk.

Budgeting and cost control are easier with a clear breakdown of expenses. Cost accounting helps businesses forecast costs, monitor spending, and identify areas where operating costs can be reduced. Whether through process improvements, supplier negotiations, or waste reduction, controlling costs leads to higher efficiency and better financial stability.

Allocating costs properly ensures that expenses are assigned to the right cost objects, such as a product line, healthcare service, or manufacturing process. By tracking how resources are used, businesses can refine production strategies and allocate budgets where they provide the most value.

Cost accounting methods and their impact

A cost accounting system helps track business expenses in real-time, improve budgeting, and make informed financial decisions. Choosing the right costing method ensures accurate cost allocation, supports pricing strategies, and improves overall financial performance.

Different cost accounting methods suit different business models. Standard cost accounting compares projected costs to actual costs, helping businesses identify variances and adjust their spending. Activity-based costing assigns costs based on specific activities, making it useful for companies with complex operations where traditional cost allocation methods may be inaccurate. Marginal costing focuses on cost-volume-profit analysis, helping businesses evaluate the impact of variable costs on profitability and determine the break-even point.

Proper cost tracking directly affects a company’s financial statements. By understanding the relationship between costs and revenue, businesses can identify inefficiencies, reduce waste, and increase profitability.

The challenges in implementing cost accounting

Accurately allocating costs is one of the biggest challenges businesses face when implementing a cost accounting system. Fixed costs, like rent and salaries, remain constant, while variable costs, such as raw materials and utilities, change with production. Properly distributing these expenses across products or services requires careful planning to avoid miscalculations that could distort profitability.

Bookkeeping and data accuracy are also very important. Cost accounting must align with financial accounting records to ensure consistency in reporting. Errors in data entry, incorrect allocation of overhead costs, or misclassified expenses can lead to misleading financial insights. Businesses need reliable systems to track costs and prevent discrepancies.

Industry-specific challenges also affect cost accounting methods. In healthcare, tracking patient services and resource usage requires a different approach than manufacturing, where process costing is common. Retail businesses must monitor inventory costs and adjust for seasonal fluctuations. Choosing the right costing methods for a specific industry ensures accurate financial analysis and better decision-making.

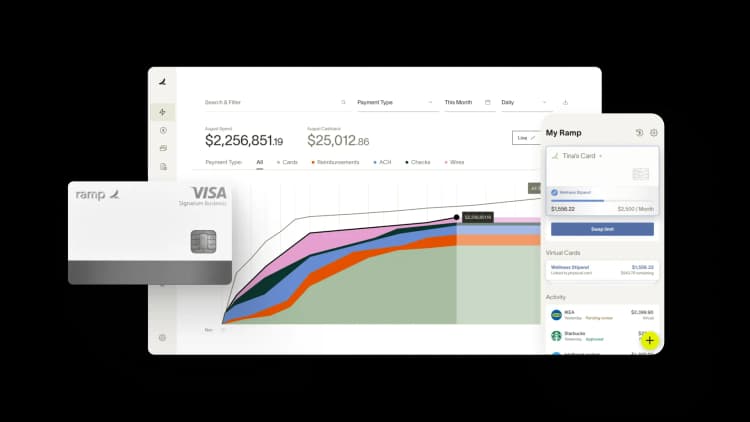

Track and control costs in real time with Ramp

Tracking business costs accurately is nearly impossible when expenses live across multiple cards, systems, and spreadsheets. You need real-time visibility into what's being spent, who's spending it, and whether it aligns with your budget—before costs spiral out of control.

Ramp gives you complete control over business spending with tools that enforce budgets, automate approvals, and surface insights the moment transactions post. You'll know exactly where money goes, catch overspending before it happens, and make faster decisions with data that's always current.

Here's how Ramp helps you track and control costs:

- Set granular spending limits: Create budgets by department, vendor, project, or employee and enforce them automatically at the point of purchase so teams stay within approved amounts

- Automate approval workflows: Route purchase requests through custom approval chains based on amount, merchant, or category so every dollar is reviewed before it's spent

- Track spend in real time: See all transactions as they happen with automatic categorization and receipt matching so you always know your current burn rate

- Flag policy violations instantly: Ramp identifies out-of-policy spend the moment it posts and alerts you to take action before expenses hit your books

- Analyze spending patterns: Use built-in reporting to spot trends, identify cost-saving opportunities, and understand where budget adjustments will have the biggest impact

Ramp's accounting automation software connects spend management with your accounting system so cost tracking feeds directly into financial reporting without manual reconciliation.

Try a demo to see how businesses gain complete visibility and control over their spending with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits