Accounts payable turnover ratio: Formula, examples, and tips

- At-a-glance: Accounts payable turnover ratio basics

- What is the accounts payable turnover ratio?

- How to calculate your accounts payable turnover ratio

- How can you manage your AP turnover ratio?

- Using KPIs to analyze your AP turnover ratio

- How Ramp Bill Pay automates your entire AP process

- What makes Ramp Bill Pay different

The accounts payable (AP) turnover ratio is a valuable metric for understanding how efficiently your business pays its suppliers and manages cash flow. Your business’s AP turnover ratio gives you insights into your payment practices and helps you identify areas for improvement.

In this guide, we’ll break down what the AP turnover ratio is, how to calculate it, and what it tells you about your financial condition.

At-a-glance: Accounts payable turnover ratio basics

Criteria | Details |

|---|---|

What it measures | The speed or rate at which your company pays off its suppliers and vendors during a given accounting period. |

How to interpret it | A higher ratio often reflects operational efficiency and timely payments, which can strengthen vendor relationships and creditworthiness. A lower ratio might signal cash flow strategies, extended payment terms, or potential late payment issues. |

Why it matters | Helps assess short-term liquidity, operational efficiency, and supplier relationships while evaluating financial health. |

What is the accounts payable turnover ratio?

Your accounts payable (AP) turnover ratio measures how frequently your business pays off its accounts payable balance within a given period. A higher AP turnover ratio means you pay off your balance more quickly, while a lower ratio indicates that you're holding onto cash longer by making payments more slowly.

The AP turnover ratio is essentially a financial metric that provides a snapshot of short-term liquidity and payment practices, offering insight into cash flow and status of your vendor relationships.

What does the AP turnover ratio mean?

A high ratio signals prompt payments, often due to short payment terms, taking advantage of discounts, or improving creditworthiness.

A low ratio is more nuanced. It can reflect strategic cash flow management—like holding onto cash longer to invest in other areas—or extended payment terms, such as negotiating net 60 to net 90. However, a ratio that’s too low might also suggest late payments or cash flow issues, raising potential concerns.

What is a good AP turnover ratio?

There’s no universal benchmark for an ideal AP turnover ratio, as it varies by industry and business needs. Generally, a higher ratio indicates frequent payments, which can signal strong creditworthiness and reassure suppliers when extending credit.

However, a turnover ratio that’s too high might suggest over-purchasing or running low on inventory. It’s essential to compare your ratio to industry averages and consider your unique operational requirements when assessing what’s ideal for your business.

How to calculate your accounts payable turnover ratio

Here’s the typical accounts payable turnover ratio formula:

AP turnover ratio = Total net credit purchases / Average AP balance

Here’s how to calculate each component of the formula individually:

- Total net credit purchases: The total credit purchases added to your accounts payable during the period, excluding cash purchases and adjusted for returns.

- Average AP balance: Add the beginning and ending AP balances for the period, then divide by two.

You can calculate your AP turnover ratio for any accounting period that you want—monthly, quarterly, or annually. Many businesses calculate AP turnover ratios monthly and plot the results on a trendline to see how their ratio changes over time.

AP turnover ratio calculation example

Imagine that at the beginning and end of the year, you had $5,000 and $3,800 in your AP balance, respectively. During the year, you made total supplier purchases of $31,800 on credit and returned $500 of those goods. Using the AP turnover ratio formula from above, you calculate your annual AP turnover ratio to be 7.11:

$31,800 - $500 = $31,300 net credit purchases

($5,000 + $3,800) / 2 = $4,400 average AP balance

$31,300 / $4,400 = 7.11 AP turnover ratio

This means that you effectively paid off your AP balance just over seven times during the year.

How can you manage your AP turnover ratio?

Managing and improving your accounts payable turnover ratio requires understanding the factors that influence it and taking actionable steps to optimize your processes.

What influences your AP turnover ratio?

Your AP turnover ratio is dependent on many factors, including:

- Seasonality: Busy periods may result in a higher ratio, while slower periods can lead to a lower ratio.

- Product type: Businesses dealing with perishable goods often have higher ratios due to quicker payment cycles compared to those purchasing long-shelf-life items.

- Inventory turnover: Faster inventory turnover typically increases the ratio, as frequent purchases and payments are needed to maintain stock.

- Inventory management strategy: Overstocking can lead to a lower ratio, while consistently low inventory levels may result in a higher ratio due to frequent restocking.

How to improve your AP turnover ratio

If you notice that your AP turnover is off from industry averages or simply isn’t where you want it to be, there are plenty of things you can do to fix it:

- Negotiate better terms: Build strong supplier relationships and negotiate for more favorable payment terms

- Streamline your AP process: Use AP automation software to simplify workflows, pay bills on time, and reduce invoice processing times

- Leverage early payment discounts: Review payment terms and take advantage of discounts when paying early

- Upgrade inventory management: Avoid over- or under-purchasing by using inventory management systems

- Eliminate cash flow issues: Use projection software to ensure cash availability for timely payments

And lastly, tracking your AP turnover ratio over time is also crucial. Monitoring how your ratio trends can reveal the impact of operational changes, like negotiating better payment terms. A decreasing ratio might signal success—or point to cash flow issues. Always evaluate it within the context of your broader financial picture.

Using KPIs to analyze your AP turnover ratio

While the AP turnover ratio provides insight into how efficiently you pay suppliers, it gains more meaning when analyzed alongside other financial KPIs. These comparisons help uncover patterns, diagnose inefficiencies, and optimize financial performance. Here’s how to use these metrics together.

1. AP turnover ratio and days payable outstanding (DPO)

How they work together: Days payable outstanding converts your AP turnover ratio into the average number of days it takes to pay suppliers. A higher AP turnover ratio corresponds to a lower DPO, indicating faster payments.

What to look for: Compare DPO to your supplier terms (e.g., net 30, net 60) to ensure payments are neither too early nor too late. Use this insight to align payment timing with cash flow needs while maintaining supplier trust.

2. AP turnover ratio and AR turnover ratio

How they work together: The AR turnover ratio measures how quickly you collect payments from customers. Comparing it with AP turnover helps evaluate your cash flow balance.

What to look for: If you collect receivables faster than you pay suppliers, you’re maintaining positive cash flow. If the opposite is true, consider strategies to speed up receivables or extend supplier payment terms to improve liquidity.

3. AP turnover ratio and percentage of discounts captured

How they work together: The percentage of discounts captured shows how often you take advantage of early payment discounts.

What to look for: If your AP turnover ratio is high but your discount percentage is low, you may be missing cost-saving opportunities. Aim to align fast payments with opportunities to reduce costs through discounts.

4. AP turnover ratio and inventory turnover ratio

How they work together: The inventory turnover ratio reflects how quickly you sell or use inventory. It impacts how often you purchase stock and, consequently, your AP turnover.

What to look for: If your inventory turnover is low, a high AP turnover ratio could indicate over-purchasing or inefficient stock management. Align inventory and AP strategies to avoid tying up cash in unsold goods.

Key takeaways

Comparing the AP turnover ratio with these metrics provides a fuller picture of your company’s financial health and your ability to reach your AP goals and benchmarks. For example:

- Rising late fees paired with a falling AP turnover ratio signals payment delays and inefficiencies.

- High DPO combined with low AR turnover might indicate cash flow strain.

- Frequent discounts captured alongside a high AP turnover ratio highlights strategic payment timing.

By evaluating the relationships between these KPIs, you can fine-tune payment strategies, improve cash flow, and reduce costs without jeopardizing supplier relationships.

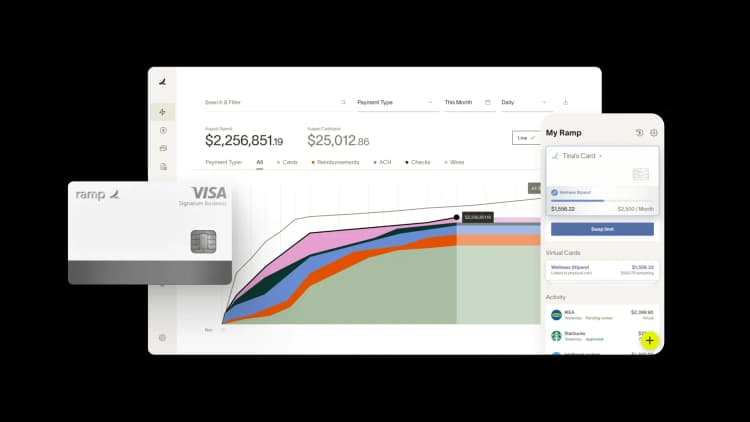

How Ramp Bill Pay automates your entire AP process

Ramp Bill Pay is autonomous AP software that converts manual work into touchless workflows. Four AI agents handle invoice coding, catch fraud before payments process, build approval documentation, and push vendor payments through cards—removing your team from repetitive work. OCR hits up to 99% accuracy on data extraction while processing invoices 2.4x faster than traditional platforms1, helping you optimize accounts payable turnover.

Use Ramp Bill Pay on its own, or link it with Ramp's corporate cards, expense management, and procurement tools for total spend oversight. Up to 95% of companies report better visibility when using Ramp2.

The platform supports better AP features like:

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- Automatic card payments agent: Identifies card-eligible invoices, fills card details directly into vendor payment portals, and captures cashback opportunities automatically

- Reconciliation: Close books faster with automatic transaction matching

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Recurring bills: Automate regular payments with recurring bill templates

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Fraud prevention agent: Flags suspicious activity before payments go out

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

What makes Ramp Bill Pay different

Ramp Bill Pay delivers AP automation that's accurate, autonomous, touchless, and quick. Over 2,100 verified G2 reviews give Ramp a 4.8-star average, with finance teams calling it one of the most straightforward AP platforms to implement.

Ramp Bill Pay works as standalone AP software, but for teams wanting to manage bills alongside card spend, expenses, and procurement, they can use Ramp's unified platform that connects it all. Start with Ramp's free tier covering core AP automation, or upgrade to Ramp Plus at $15 per user monthly for advanced features.

See what Ramp Bill Pay can do for your team.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits