- What is the accounts payable approval process?

- How to improve your accounts payable approval process

- Manual vs. automated accounts payable approval

- Why Ramp Bill Pay is the best way to automate accounts payable

- Why choose Ramp Bill Pay?

How do companies ensure bills get paid on time? The accounts payable approval process makes it happen—but inefficiencies often bog down the process, causing delays and headaches. This guide breaks down why AP matters, the challenges it faces, and how to streamline it with modern solutions.

What is the accounts payable approval process?

Within the full accounts payable cycle is the AP approval process, which refers to the series of steps the AP team takes to validate and authorize supplier invoices for payment. This process starts with the receipt of the invoice from the vendor and concludes once the vendor invoices are paid. Stages of the AP process:

- Invoice receipt: Upon delivery of goods and services as specified in the purchase order (PO), the buyer generates a goods receipt note (GRN). Subsequently, the supplier prepares the invoice, detailing the quantity, unit cost, total cost, and delivery specifics. The invoices are then sent to the accounts team.

- Invoice matching and validation: Invoices are cross-checked against the purchase order (PO) and goods receipt note (GRN) through 3-way matching to confirm payment is only for received goods or services. This matching process is crucial for avoiding discrepancies but is time-consuming for accounts teams.

- Review and approve: Once the 3-way match is complete, the accounts team verifies the data. Any issues are flagged for the procurement manager or sent back to the supplier for corrections. Approved invoices proceed to payment processing.

- Create an invoice in the accounting system: Approved invoices are entered into the accounting system, creating a clear audit trail for tracking and compliance.

- Vendor payment: The finalized, approved invoices progress to payment processing, marking the culmination of the AP approval process.

Each stage of the accounts payable process serves a distinct purpose: finance teams need assurance that payments are accurate and compliant; approvers need clarity on what they’re signing off on; and executives need confidence that company funds are being managed responsibly.

To build stronger financial controls across the process, explore related topics like AP audits and internal control frameworks.

How to improve your accounts payable approval process

Efficiency in accounts payable starts with adopting smart, actionable strategies. Here’s how to take your AP process to the next level:

How can strategic invoice management improve cash flow?

What you can do: Prioritizing invoice payments based on terms and early payment discounts helps optimize cash flow and strengthen vendor relationships.

Why it works: Paying invoices strategically keeps cash flow healthy, avoids late fees, and allows businesses to leverage vendor incentives. Timely payments also ensure a steady supply chain by strengthening trust with suppliers.

According to research by Ardent Partners, processing a single invoice cost an average of $10.18 in 2023, up 10% from 2022 due to inflation and labor costs. By streamlining workflows with invoice automation software, businesses can reduce these costs and free up cash flow for more strategic uses.

Also, make sure to pay attention to:

- Early payment discounts: Capitalize on vendor discounts for early payments to save costs.

- Invoice terms: Organize payments by due date to avoid late fees or damaged supplier relationships.

How can you catch discrepancies before they cost you?

What you can do: Regularly reconciling bank accounts ensures every transaction aligns with your records. This step helps identify discrepancies—like duplicate payments or missing funds—before they spiral into costly errors.

Why it works: Reconciliation is a foundational accounting practice that ties financial activity to recorded transactions. It provides an up-to-date snapshot of your cash flow, uncovering inconsistencies caused by manual errors, system glitches, or fraud.

By staying on top of your cash flow by reconciling accounts frequently, even with automated payment systems, this step helps catch discrepancies, detect unauthorized charges, and maintain financial accuracy.

How can you reduce the risk of fraud in your accounts payable process?

What you can do: Fraud prevention starts with robust internal AP controls, like restricting system access and separating duties. By ensuring no single person has end-to-end control over the invoice approval process, you safeguard your finances.

Why it works: Segregation of duties in accounts payable prevents potential misuse of authority, while controlled access limits exposure to sensitive financial systems. This approach creates multiple checkpoints, minimizing the likelihood of errors or fraud slipping through.

According to the ACFE, on average, fraud cases go undetected for about 12 months. Of the 43% uncovered through tips, more than half came from employees. This highlights the importance of proactive measures—fraud detection is valuable, but prevention through strong controls is even better.

Here’s how you can protect your AP workflow by setting clear internal controls:

- Control access: Limit access to your accounting system based on employee roles. Only grant permissions necessary for tasks like invoice approval or payment processing to reduce fraud risks.

- Segregate duties: Ensure no single person handles the entire AP process. For example, the accounts team member approving payments shouldn’t also perform the 3-way match. Even for small teams, separating responsibilities adds a critical layer of security.

How do you stop duplicate payments from hurting your bottom line?

What you can do: Automating invoice matching helps flag duplicate or suspicious entries, ensuring payments only go out once.

Why it works: Manual invoice tracking often leads to duplicate payments due to human error or mismatched invoice details. AP automation solves this by cross-referencing invoice data with purchase orders and receipts in real time.

Duplicate invoices with similar amounts can easily slip through manual processes. Use AP automation tools to flag potential duplicates before issuing payments. Fixing overpayments later is time-consuming and often requires extensive vendor follow-up.

What’s the easiest way to eliminate inefficiencies in invoice approvals?

What you can do: Invoice approval automation can route documents to the right approvers and send reminders to reduce delays. This eliminates bottlenecks from manual follow-ups and missing paperwork.

Why it works: Accounts payable automation ensures every invoice follows a predefined approval path. By replacing manual back-and-forth with automated system-triggered actions, approvals happen faster, and accountability improves.

Here’s how you can automate your AP process:

- Simplify 3-way matching for invoices, purchase orders, and receipts.

- Automatically route invoices to approvers with reminders to avoid delays.

- Reduce repetitive tasks, freeing up your accounts team to focus on strategic projects.

How can you measure and improve your AP process over time?

What you can do: Tracking KPIs for AP, like invoice cycle time and processing costs, reveals inefficiencies and creates opportunities for continuous improvement.

Why it works: When you know how long it takes to process an invoice or how much each one costs, you can identify bottlenecks. This data allows for targeted improvements in areas like approval speed or cost management.

Monitor key performance indicators like the following to refine your AP workflow:

- Invoice cycle time: Understand how long it takes from invoice receipt to payment.

- Processing costs: Track the cost of handling each invoice to identify inefficiencies.

How can clear authorization and approval policies strengthen your AP workflow?

Understanding the difference between authorization (granting spending limits or budget approvals) and approval (verifying transactions against policies and documentation) is crucial for ensuring compliant financial operations.

What you can do: Define who can authorize budgets and approve transactions, ensuring clear roles and segregation of duties. This creates multiple layers of accountability in your AP process.

Why it works: Separating authorization (budget-level approvals) from transaction approvals ensures multiple checkpoints for accuracy and legitimacy. This reduces the risk of errors, fraud, and unauthorized spending. Clear policies also improve internal compliance, supporting smoother audits and minimizing disruptions.

Bringing it all together: Tactics, challenges, and results

Improving your accounts payable approval process means building a system that works under pressure, scales with your business, and holds up to audit scrutiny. Below is a summary of the strategies we covered, mapped to the operational challenges they solve and the benefits they help deliver.

What to implement | Challenge it solves | What it enables |

|---|---|---|

Standardize invoice submission channels | Scattered, inconsistent invoice intake | Centralized document flow and faster invoice routing |

Implement automated invoice capture | Manual data entry errors and slow processing | Improved accuracy and quicker processing time |

Create clear approval hierarchies | Approval delays and unclear sign-off authority | Faster approvals and better financial oversight |

Establish KPIs and monitor performance | Lack of visibility and process accountability | Ongoing optimization and data-backed decision-making |

Integrate AP with procurement and receiving | Disconnected systems and process silos | Accurate three-way matching and fewer payment issues |

Document approval workflows and audit trails | Compliance concerns and limited traceability | Lower audit risk and stronger internal controls |

Manual vs. automated accounts payable approval

Managing the AP approval process manually presents significant challenges for the AP department. As per findings from Payables Friction Index survey, nearly 44% of companies report that they continue to receive invoices via fax, making tracking and organizing them time-consuming and inefficient.

Manual invoice approval workflows also drive up costs and increase the risk of errors, from missed details to duplicate payments.

Some of the most common issues with manual AP workflows include:

- Manual data entry errors

- Delays in invoice approval

- Inaccurate reporting

- Missed discounts

The best advice? Find the right AP solution for your business. Automation delivers the biggest benefits when your invoice volumes are high or growing quickly. If you process fewer than 100 invoices monthly, manual processes might be adequate. But if you handle hundreds or thousands of invoices, you'll see compelling returns from automation.

The transition point often happens when your AP staff spend more time on transaction processing than on value-added activities like vendor management and cash flow optimization.

Manual vs. automated AP approval comparison

Factor | Manual AP approval | Automated AP approval |

|---|---|---|

Efficiency | Time-consuming process requiring physical handling of documents and manual routing. Invoice processing typically takes 1-3 weeks. | Streamlined workflow with automatic routing and notifications. Processing time can be reduced to 1-3 days on average. |

Error rates | Higher error potential from manual data entry, misplaced documents, and calculation mistakes. | Reduced errors through validation rules, duplicate detection, and elimination of manual entry. |

Compliance | Compliance depends on staff diligence and knowledge. Documentation may be inconsistent or incomplete. | Enforced compliance through system rules that require proper approvals and maintain complete audit trails. |

Transparency | Limited visibility into invoice status. Tracking requires phone calls or emails to determine current location. | Real-time visibility into invoice status, approval history, and processing metrics through dashboards. |

Scalability | Difficult to scale as volume increases. Growth typically requires additional staff. | Easily handles volume increases without proportional staff additions. Rules-based processing adapts to organizational changes. |

Cost | Lower initial investment but higher ongoing labor costs. Hidden costs include late payment penalties and missed discounts. | Higher initial investment offset by reduced processing costs, captured discounts, and eliminated late fees. |

The difference between an automated workflow and automated processing

Optimizing your accounts payable process also means understanding how to set it up effectively. But first, it’s important to understand the difference between automated workflows and automated invoice processing:

- AP workflow: The sequence of steps in accounts payable, from routing invoices to the right approvers to final approval.

- AP processing: The execution of tasks within that workflow, such as reviewing, validating, and approving invoices.

For a deeper dive into each and how they work, check out our detailed guide on setting up automated workflows and understanding automated invoice processing.

Why Ramp Bill Pay is the best way to automate accounts payable

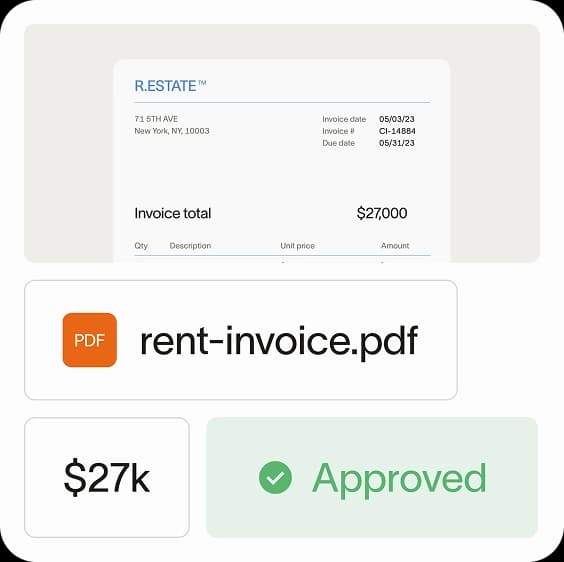

Ramp Bill Pay is an autonomous AP automation platform, powered by four AI agents that handle invoice coding, fraud detection, approval summaries, and card-based payments without manual intervention. With 99% accurate OCR and intelligent line-item capture, Ramp delivers touchless invoice processing that's 2.4x faster than legacy AP software1.

Whether you need a standalone AP solution or a unified platform that connects bill pay with corporate cards, expenses, and procurement, Ramp Bill Pay adapts to how your business operates. Up to 95% of businesses report improved visibility into their payables after using Ramp2.

Top Ramp Bill Pay features

- Four AI agents: Automatically code transactions using historical patterns, detect fraud before payments go out, generate approval summaries with vendor history and pricing analysis, and complete card-eligible payments directly in vendor portals

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Roles and permissions: Enforce separation of duties with granular user controls

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- Recurring bills: Automate regular payments with recurring bill templates

- Vendor onboarding: Collect W-9s, match TINs, and track 1099 data directly in the platform

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Bulk W-9 collection: Request all W-9s and e-consent at once instead of chasing vendors with one-off emails

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- One-click IRS filing: File directly with the IRS and eligible states in minutes—no extra portals or logins

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

Why choose Ramp Bill Pay?

You can use Ramp Bill Pay as a standalone AP platform—you don't need to bundle it with anything else to get full functionality. But if you do want unified visibility across bill pay, corporate cards, expenses, and procurement, Ramp can connect everything all in one place. Choose the setup that fits how your team actually works.

Ramp Bill Pay sets a new standard for touchless, accurate, and fast AP processing. And don’t just take our word for it. Ramp ranks among the most user-friendly AP platforms on G2, backed by over 2,100 verified reviews and a 4.8 out of 5 star rating. Finance teams choose Ramp to eliminate manual work, catch errors before they become problems, and close books faster.

Getting started is easy: Ramp's free tier includes core AP automation, with advanced features available on Ramp Plus for $15 per user per month.

AP should be easy. Now it is. Try Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

Invoice exceptions usually stem from discrepancies between documents or missing information. To reduce exceptions:

- Standardize purchase order practices

- Implement vendor guidelines for invoice submission

- Use automation to validate invoices upon receipt

Creating a dedicated exception handling workflow with clear ownership also prevents these issues from causing extended delays.

Approval thresholds should align with your organizational structure and risk tolerance. A common approach:

- Department managers: approve invoices up to 1% of their budget

- Directors: up to 5%

- VP-level executives: up to 10%

- Amounts above that: require CFO or CEO approval

Document these thresholds in your approval policy and configure them in your AP system.

Automation offers the best balance between control and efficiency:

- Implement automated three-way matching for routine transactions

- Maintain human review for exceptions and high-value items

- Create approval workflows that operate in parallel (not sequentially) when multiple approvers are required

- Establish clear service level agreements (SLAs) for each approval step to set expectations for response times

Key metrics include:

- Average approval cycle time (from invoice receipt to approval)

- Exception rate (percentage of invoices requiring special handling)

- First-pass match rate (invoices that match PO and receiving docs without intervention)

- Approval productivity (approvals per approver per day)

These metrics help you identify bottlenecks and measure improvement initiatives.

Establish formal delegation protocols that allow approvers to temporarily transfer authority during absences. Your AP system should support backup approver designation and automatic escalation after defined waiting periods. Document these procedures in your approval policy and test them periodically to ensure continuity.

You can learn more about Ramp Bill Pay and how it helps automate accounts payable at our official page: https://ramp.com/accounts-payable

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits