- How to calculate accounts payable

- Additional key accounts payable metrics

- How automation makes accounts payable processing faster

- How Ramp Bill Pay simplifies AP tracking

- What sets Ramp Bill Pay apart

Calculating accounts payable means tracking what your business owes to suppliers and vendors for products or services bought on credit. This requires monitoring outstanding invoices, payment terms, and due dates to keep your financial records accurate. When you manage AP effectively, you avoid missed payments, late fees, and supply chain disruptions while gaining clear insight into your short-term financial obligations.

In this guide, we’ll go over the basic formula for calculating accounts payable, understand important AP metrics like turnover ratio and days payable outstanding, and how automation can make your AP process more efficient.

How to calculate accounts payable

Accounts payable covers the short-term debts your business owes for goods or services received on credit. Managing these obligations helps you maintain vendor trust, protect your credit, and ensure you always have the supplies you need.

To calculate accounts payable, you’ll need to use this formula:

Ending Accounts Payable = Beginning Accounts Payable + Purchases on Credit - Payments to Suppliers

Let's break down each part:

Beginning accounts payable

This is the total owed to suppliers at the start of the accounting period.

- It's your baseline for tracking changes

- You'll find it as a current liability on your previous balance sheet

- It shows your commitments before new transactions occur

Purchases on credit

These are new invoices from vendors during the period.

- They increase your accounts payable balance

- This includes goods or services acquired without immediate payment

- All credit-based transactions count, regardless of payment terms (like net-30 or net-60)

Payments to suppliers

This is the money paid out to vendors to reduce your accounts payable.

- All payment methods count (checks, ACH, wire, credit card)

- Each payment fulfills a previous credit obligation

Example of using the accounts payable formula

Let's go over a quick example:

- Company A starts January with $45,000 in accounts payable

- They purchase $30,000 in inventory on credit during January

- Company A pays $35,000 to vendors that month

- This means your Ending Accounts Payable = $45,000 + $30,000 - $35,000 = $40,000

At the end of January, Company A still owes $40,000 to suppliers. What does this mean for your business? If your ending AP is higher than your beginning AP, it might signal:

- Increased purchasing (business growth)

- Delayed payments to keep more cash

- Potential cash flow problems

If your ending AP is lower, as in the example, it could indicate:

- Reduced purchasing activity

- Faster payments (e.g., to take advantage of early payment discounts)

- A deliberate effort to reduce liabilities, but not necessarily a stronger cash position unless evaluated alongside cash flow

Additional key accounts payable metrics

Beyond the basic calculation, several other metrics can help you analyze your payment practices and supplier relationships. These insights support better financial decisions, help you manage cash flow, and reveal opportunities for improvement.

1. Average accounts payable

Average accounts payable tells you the typical amount owed to suppliers during a period. This metric helps you spot trends and seasonal changes in payment behavior. To calculate your average AP, use this formula:

Average AP = (Beginning Accounts Payable + Ending Accounts Payable) / 2

When calculating your average AP, check your balance sheet at the start and end of the period. The AP line item shows what you owe suppliers.

For example, If your balance sheet shows $45,000 in AP on January 1 and $55,000 on December 31: Your Average AP = ($45,000 + $55,000) / 2 = $50,000

A rising average may signal business growth or slower payments. A falling average could mean reduced purchasing or faster payment cycles. Comparing average AP across quarters helps you spot seasonal patterns and make better cash flow decisions.

2. Accounts payable turnover ratio

The accounts payable turnover ratio shows how quickly you pay your suppliers. This ratio helps you gauge payment efficiency:

- High turnover: You pay vendors quickly. This can strengthen relationships, but might stretch your cash flow.

- Low turnover: You pay more slowly. This preserves cash, but could harm supplier relationships or cost you early payment discounts.

Here is the formula you’ll need to use:

AP Turnover Ratio = Total Supplier Purchases / Average Accounts Payable

To calculate your AP turnover ratio, get the total supplier purchases on credit from your general ledger or P&L (only include purchases on credit, not cash).

For example, let’s say you spent $240,000 on credit purchases this year and your average accounts payable is $30,000. This means your AP Turnover = $240,000 / $30,000 = 8.

This means you pay off your average accounts payable balance 8 times per year—or about every 45 days. Compare this figure to your payment terms (net-30, net-60) to see if you're paying bills at the right pace.

3. Days payable outstanding (DPO)

Days payable outstanding measures how long, on average, it takes you to pay suppliers after receiving invoices. DPO is a key cash flow metric where:

- Higher DPO: You hold onto cash longer

- Lower DPO: You pay suppliers faster

The formula for DPO is:

DPO = (Average Accounts Payable / Cost of Goods Sold) × 365 days

To calculate your DPO, let’s say your average accounts payable is $50,000. Then, determine your annual cost of goods sold. Let’s say it’s $600,000. This means your DPO = ($50,000 / $600,000) × 365 = 30.4 days

So, your business takes about 30 days, on average, to pay suppliers. If your standard terms are net-30, you're right on schedule. If your DPO is lower, consider whether you’re missing opportunities to hold cash longer. If it’s higher, check for supplier risks or late payment penalties.

How automation makes accounts payable processing faster

Automating accounts payable changes the way you manage, track, and analyze payment obligations. Modern AP automation platforms reduce manual data entry by extracting invoice details and tracking payments automatically. This gives you real-time insight into payment status and overall financial health.

Here's how automation benefits your accounts payable process:

- Reduced processing time: Automated systems capture invoice data and route approvals instantly, cutting processing times compared to manual methods

- Fewer manual errors: Automation eliminates mistakes like typos, miscalculations, and duplicate payments, keeping your financial data reliable

- Real-time insights: Access live dashboards and up-to-date metrics, so you always know your current obligations and upcoming payments—no more waiting for month-end

- Streamlined operations: Integrate with your existing accounting systems for seamless data flow between purchasing, receiving, and payments

- Improved cash flow management: Automated scheduling helps you pay at the optimal time—taking advantage of early payment discounts or strategically managing cash outflows

- Enhanced visibility into liabilities: Get instant access to reports showing your financial obligations, aging summaries, and vendor payment history for smarter planning

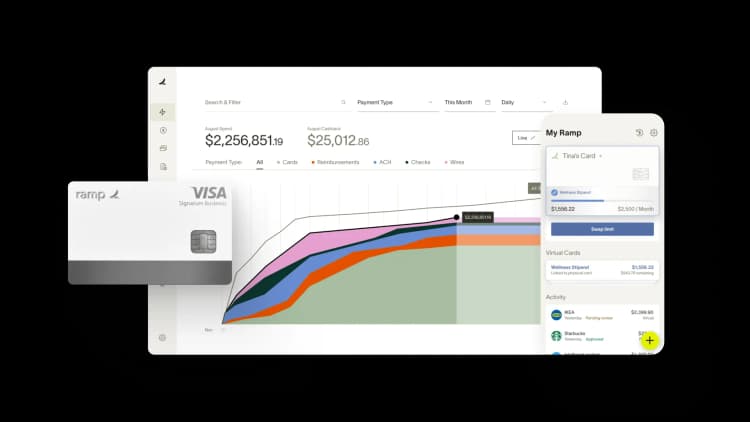

How Ramp Bill Pay simplifies AP tracking

Ramp Bill Pay is autonomous AP software that turns manual tasks into touchless operations. Four AI agents manage invoice categorization, flag fraud pre-payment, create approval records, and execute vendor payments via cards—taking your team out of repetitive work. The platform's OCR achieves up to 99% accuracy on data capture and processes invoices 2.4x faster than legacy systems1, while also giving you real-time visibility.

Ramp Bill Pay works as standalone AP software, or connects with Ramp's corporate cards, expense tools, and procurement platform for complete spend control. Up to 95% of businesses even see stronger oversight after adopting Ramp2.

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Reconciliation: Close books faster with automatic transaction matching

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Fraud prevention agent: Flags suspicious activity before payments go out

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons

- Recurring bills: Automate regular payments with recurring bill templates

- Roles and permissions: Enforce separation of duties with granular user controls

- Vendor onboarding: Collect W-9s, match TINs, and track 1099 data directly in the platform

What sets Ramp Bill Pay apart

Ramp Bill Pay shows what modern AP automation delivers—precision, autonomous processing, touchless workflows, and speed. With 2,100+ verified reviews on G2 averaging 4.8 stars, finance teams describe it as one of the most intuitive AP platforms available.

Ramp Bill Pay functions as complete AP software on its own, but teams looking to track bills with card transactions, expenses, and procurement can use Ramp's integrated platform that unifies everything. Get started with Ramp's free tier handling essential AP automation, or access Ramp Plus for $15 per user monthly to unlock advanced capabilities.

Experience what Ramp Bill Pay can do for your AP reporting.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits