How automated invoice processing works: A starter guide

- What is automated invoice processing?

- How automated invoice processing works: Step-by-step workflow

- Manual vs. automated invoice processing: A side-by-side comparison

- How to implement automated invoice processing: A 6-step guide

- Implementation tips for different business sizes

- Recap: Key benefits of automated invoice processing

- Ramp Bill Pay automates invoice processing end-to-end

- Why finance teams automate with Ramp

Manual accounts payable processes can slow down finance teams, introduce errors, and waste valuable staff time. If you're responsible for managing invoices, you know how quickly manual data entry and paper-based workflows can become bottlenecks—especially as your business grows.

If this sounds familiar, you’re not alone. The average finance team spends about 6 hours a week or more on manual tasks due to limited automation. Automating your invoice process changes that—helping teams move faster, with fewer mistakes and less overhead.

Here’s a complete starter guide on how automatic invoice processing transforms the typical AP chase into a streamlined workflow—from invoice capture to payment.

What is automated invoice processing?

Automated invoice processing

Automated invoice processing (AIP) refers to the use of software systems to manage and execute invoice-related tasks with minimal human intervention. It streamlines the accounts payable process by automating invoice capture, data extraction, validation, approval routing, and payment execution.

Unlike manual processing—which relies on paper handling and manual data entry—AIP uses digital workflows to move invoices through approval paths automatically. Staff only step in for exceptions, while the system handles capture, validation, and approvals. This accelerates invoice cycles, reduces errors, improves cash flow visibility, and strengthens vendor relationships.

The three main technologies that help automate these tasks are:

- Optical character recognition (OCR): OCR invoice processing converts printed or handwritten text into machine-readable data, pulling out vendor details, line items, and payment terms

- Artificial intelligence and machine learning: Validates the extracted data, spots patterns, learns from corrections, and gets more accurate over time

- Workflow automation: Routes invoices to the right approvers, sends reminders, and escalates when needed based on your rules

When should you consider automating your invoice workflow? If you notice any of the following, it's time to evaluate your current process:

- Your invoice volume outpaces your team's capacity

- Duplicate payment prevention is mostly manual

- Manual errors that lead to missed discounts

- You need better visibility into what you owe and when

- Your business growth makes manual processes unsustainable

How automated invoice processing works: Step-by-step workflow

Automated invoice processing follows a clear sequence that turns incoming invoices into approved payments with minimal manual effort. Here’s how the process works to handle repetitive AP tasks, step-by-step:

- Invoice capture: Invoices arrive via email, supplier portals, or EDI. The system captures all formats. OCR scans paper invoices, while AI classifies document types and pulls invoice details from emails.

- Data extraction: The system pulls out essential fields—vendor info, invoice number, date, line items, tax amounts, and payment terms. OCR recognizes text from images, and machine learning improves accuracy over time.

- Matching and validation: Invoice data is matched against purchase orders and receiving documents. The system checks for mathematical accuracy and flags discrepancies. This reduces manual three-way matching , saving your team significant time.

- Approval routing: Your rules automatically route invoices to the right approvers. Automated reminders and escalation rules prevent invoices from getting stuck.

- Payment scheduling: Approved invoices are queued for payment based on terms and cash flow needs. Integration with payment systems eliminates manual entry and reconciliation.

- Compliance logging: The system maintains a complete audit trail of every action, approval, and change. This ensures compliance with AP internal controls and external regulations without manual documentation.

Once your workflow is automated, compliance becomes much easier to manage. This is because automated systems create detailed approval logs showing who approved what and when. These records support AP audits and regulatory standards by enforcing consistent processes, segregation of duties, and proper authorization.

Industry-specific compliance needs are also addressed:

- Healthcare: Maintains HIPAA compliance and validates complex billing codes

- Financial services: Enforces strict vendor management and payment authorization rules

- Manufacturing: Tracks country of origin and supply chain documentation, linking them to invoice records

Manual vs. automated invoice processing: A side-by-side comparison

We’ve already covered how invoice automation eliminates tedious tasks, but a direct comparison between manual and automated processing shows just how much more is being optimized.

The table below outlines the key differences between manual and automated invoice processing:

Factor | Manual processing | Automated processing |

|---|---|---|

Data entry | Staff manually keys invoice data into systems; prone to errors and typically takes 5-15 minutes per invoice | OCR and AI extract data automatically with up to 99% accuracy in seconds |

Invoice matching | Manual comparison of invoices against POs and receiving documents; often inconsistent | Automatic matching using predefined rules; exceptions flagged instantly |

Approval workflow | Paper routing or emails; approvals often delayed or lost; average cycle time 14-21 days | Automated routing with reminders; parallel approvals possible; cycle time reduced to 2-5 days |

Manual payment scheduling; limited visibility into cash flow impacts | Optimized payment timing based on terms; early payment discounts captured automatically | |

Error handling | Errors discovered late in process; costly and time-consuming to correct | Validation at point of entry; exceptions handled proactively |

Record keeping | Paper files or disconnected digital storage; difficult to retrieve for audits | Centralized digital repository with instant access to all documents and audit trails |

Scalability | Linear relationship between invoice volume and staff required | Can handle volume increases with minimal additional resources |

Cost | Typically $6-$15 per invoice (fully loaded cost including labor) | Typically $2-$5 per invoice |

What this means for your team

Manual invoice processing holds finance teams back. It's labor-intensive, error-prone, and difficult to scale. As your organization grows, these inefficiencies multiply, creating bottlenecks that damage vendor relationships and slow down operations.

Automated invoice processing changes this dynamic by eliminating manual data entry, streamlining approvals, and providing real-time visibility. Automated systems make accounts payable more efficient, accurate, and scalable—supporting business growth instead of hindering it.

How to implement automated invoice processing: A 6-step guide

Implementing automated invoice processing requires careful planning to achieve meaningful efficiency gains and ROI. A structured approach reduces the risk of common pitfalls and ensures the solution aligns with organizational needs.

Here's a roadmap for implementation:

- Assess your current workflow

- Select the right software

- Customize your solution

- Integrate with existing systems

- Train your team

- Optimize for continuous improvement

Each phase includes critical considerations—feature requirements, potential challenges, performance metrics, and practical tools to guide the process. Following this structure helps minimize disruption and maximize the impact of automation.

Step 1. Assess your current workflow

Start by mapping out your entire invoice process—from when an invoice is received to when it’s paid. Look at every step: who handles it, which systems are used, and where delays happen. Common slowdowns include manual data entry, delayed approvals, and handling exceptions (invoices that don’t match what’s expected).

Here are some key metrics that help evaluate your current process:

- Average invoice processing time: How many days it takes from receiving an invoice to paying it. In manual systems, this often takes up to 14–15 days

- Error rate: The percentage of invoices with mistakes, such as wrong data, missing POs, or mismatched amounts

- Approval cycle time: How long invoices sit waiting for someone to approve them. This can account for over half of total processing time

- Cost per invoice: Total AP costs (including labor and overhead) divided by the number of invoices. For manual processes, this can range from $10 to $15 per invoice

Review rejected or corrected invoices to look for patterns. Often, issues stem from manual entry errors, missing purchase order numbers, or incorrect account codes. Calculating your current cost per invoice gives you a baseline to measure improvements against.

Make sure to consider the bigger picture too—how delays affect purchasing decisions and cash flow. Involve everyone who touches the process: buyers, AP staff, approvers, and finance. Don’t overlook exception handling. Even if it only affects a few invoices, it can take up a disproportionate amount of time and effort.

Step 2. Select the right automation software

Choosing the right automation software is critical for success. Focus on these essential features when evaluating solutions:

Feature | Description | Importance |

|---|---|---|

OCR & data extraction | Accurately captures data from various invoice formats | High: Directly impacts manual effort reduction |

AI/ML capabilities | Self-improves recognition accuracy over time | High: Ensures long-term performance |

ERP integration | Connects seamlessly with your accounting system | Critical: Prevents creating new data silos |

E-invoicing support | Accepts electronic invoices directly from vendors | Medium: Increasingly important as e-invoicing grows |

Customizable workflows | Adapts to your specific approval processes | High: Ensures automation matches your requirements |

Fraud prevention | Detects duplicate invoices and unusual patterns | Medium-High: Provides important financial controls |

Mobile accessibility | Allows approvals and monitoring from any device | Medium: Speeds approval cycles |

Analytics & reporting | Provides insights into process performance | Medium: Supports continuous improvement |

Ask these questions when evaluating solutions:

- Does it integrate easily with your ERP or accounting system?

- What does the typical implementation look like? How long does it take, and who needs to be involved?

- How does the system handle exceptions or non-standard invoice formats?

- What kind of security certifications does it have?

- How is pricing structured—per invoice, per user, or a flat rate?

- What kind of support and training is included?

To make an informed decision, use a simple decision matrix. List your must-have features and give each one a weight based on importance. Then rate how each vendor performs on those features. Multiply the ratings by the weights to compare options objectively.

Avoid choosing based on price alone. Consider long-term costs like integration, support, and scalability. Also, avoid tools that are overloaded with features you won’t use—they can make the system harder to implement and maintain.

Step 3. Customize your workflows for efficiency

The real power of automatic invoice processing comes from customizing it to your business. Most tools let you create workflows using rules and conditions so invoices automatically follow the right path.

Set up AP approval workflows by defining rules based on invoice amount thresholds, department or cost center routing, vendor-specific approval paths, and differences between PO and non-PO invoice handling. These configurations ensure invoices follow the right path without manual intervention.

For example, invoices under $1,000 might require only department manager approval, while those over $10,000 might need CFO review.

Sample workflow template

- Invoice receipt: System captures invoice and extracts data

- Initial validation: System checks for required fields and formats

- PO matching: For PO-based invoices, system attempts 2-way or 3-way match

- If matched successfully: Sends to payment scheduling

- If match fails: Sends to AP team with an explanation

- Approval routing:

- Under $1,000: Department manager only

- $1,000-$10,000: Department manager then finance director

- Over $10,000: Department manager, finance director, then CFO

- Payment scheduling: Based on payment terms and cash flow requirements

Also plan for exceptions—things like missing info, price mismatches, or unusual vendors. Set clear rules for how these should be reviewed, and consider tolerance thresholds (for example, allow small price differences without requiring a manual review).

Keep approval chains simple to avoid creating new delays. And make sure there’s a process for what happens when someone is out of office.

Step 4. Integrate with your accounting or ERP system

To get the full benefit of automation, your system needs to connect with your ERP or accounting software. This step can be tricky—especially if your system is older or has limited API access.

Work closely with your vendor to map fields correctly. Some tools offer pre-built connectors or middleware that help with integration. You'll also need to sync core data like vendor records and account codes.

Here are some best practices for data migration and validation:

- Audit your data before migrating—clean up duplicate or incorrect records

- Run test migrations with a small sample first

- Use automated and manual checks to validate the migrated data

- Keep the old system running during the transition to catch anything that’s missed

- Document every integration point and decision for future reference

Test the system thoroughly using different scenarios. And make sure to build time into your schedule for unexpected issues—especially if you're working with legacy software. Always have a fallback plan in case something breaks during the process.

Step 5. Test, train, and get buy-in

Implementing automation isn’t just about systems—it’s about people. Change management plays a big role in making the rollout successful. Involve key team members early so they can offer input and feel invested in the outcome. Show how automation will make their work easier, not just how it helps the company.

A strong training plan includes:

1. Pre-launch awareness (1-2 weeks before launch):

- Explain the new system and what’s changing

- Share the timeline

- Highlight what’s expected from each team

2. Role-specific training (1 week before launch):

- Ramp is recognized as one of the easiest AP softwares to use based on G2 reviews, earning an average 4.8/5 stars from 2,000+ user reviews. Teams across industries trust Ramp to minimize repetitive tasks, prevent costly mistakes, and maintain accurate financial records. One user described Ramp as the best corporate card, expense, bill pay, and expense reimbursement platform they've used.

- Approvers: Focus on how to review and approve invoices

- Finance leaders: Explore reporting and visibility features

3. Post-launch support (first month after launch):

- Daily check-ins during the first week

- Dedicated support contact for questions

- Optional refresher sessions based on common issues

Offer different formats—live sessions, short videos, and quick-reference guides—to fit different learning styles. And don’t rush the rollout. A phased approach gives people time to adjust without disrupting business.

Step 6. Monitor, optimize, and scale

Once your automated invoice processing system is live, ongoing monitoring and optimization are essential for maximizing your AP ROI. Track these key performance indicators:

- Average processing time: Days from invoice receipt to payment completion

- First-time match rate: Percentage of invoices that match POs without exceptions

- Exception rate: Percentage of invoices requiring manual intervention

- Approval cycle time: Average days in approval workflow

- Cost per invoice: Total processing cost divided by invoice volume

- Early payment discount capture: Percentage of available discounts captured

- User adoption rate: Percentage of intended users actively using the system

Review these monthly to catch trends and uncover areas to fine-tune.

As the business grows, your automation system should grow with it. That might mean expanding to more departments, adding new invoice types, or updating workflows as volume increases. Train new team members, update access controls, and stay current with new features from your vendor.

And remember—optimization isn’t a one-time task. Build in time for periodic reviews so the system evolves alongside your business.

A month of work done in minutes.

Handle 10x the invoices in half the time. Our standard tier is free.

Implementation tips for different business sizes

No two businesses are alike, and your approach to automation should reflect your company's size and complexity. Here’s how to tailor your implementation for the best results.

Automatic invoicing for small businesses

Small businesses should look for affordable, easy-to-implement solutions that deliver quick value without heavy IT needs. Cloud-based platforms with simple subscription pricing work best—no upfront infrastructure required. Many vendors offer packages tailored for small teams and limited IT support.

- Focus on core features first: Automated data capture, basic approval routing, and accounting integration. Only add advanced capabilities as your needs grow

- Consider a phased rollout: Start with invoice capture and data extraction, then add approval workflow automation once the basics are running smoothly. This spreads costs and delivers benefits incrementally

- Use vendor-provided training and support: Most small business solutions include standard training that's sufficient for less complex processes

Automatic invoicing for mid-size businesses

Mid-size organizations should prioritize scalability and integration. Choose solutions that can handle growing invoice volumes and expanding approval hierarchies without needing a replacement down the road.

- Integrate with more than just accounting: Connect to purchasing, receiving, and contract management for true end-to-end automation

- Invest in customizable workflows that fit your unique processes: Make sure your solution allows configuration without custom coding

- Balance cloud and on-premises options based on your IT strategy: Many mid-size businesses benefit from cloud solutions' lower maintenance, while still integrating with on-premises systems via secure connectors

Automatic invoicing for enterprises

Enterprises face complex compliance needs across multiple entities and regions. Your solution should support varied approval hierarchies, segregation of duties, and regulatory documentation for each unit and geography.

- Prioritize robust security: Role-based access, data encryption, audit logging, and integration with enterprise identity management. These are essential for compliance with internal and external regulations

- Plan for complex integrations across multiple systems: ERP, procurement, and banking systems for enterprise projects often require dedicated integration resources and custom connectors

- Develop a comprehensive change management strategy: Include executive sponsorship, detailed communication, and metrics to track adoption and compliance across departments and locations

By aligning your approach with your business size, you’ll set the stage for a smoother rollout and long-term success for automatic invoicing.

Recap: Key benefits of automated invoice processing

Automated invoice processing directly addresses the most common challenges in accounts payable. Here’s a quick summary of what its benefits:

- Cut processing time by up to 80% and reduce costs from $6–$15 to as low as $2–$5 per invoice

- Eliminate manual errors and apply business rules consistently

- Shorten approval cycles, capture early payment discounts, and avoid late fees

- Ensure timely, accurate payments and provide clear visibility into invoice status

- Track invoices, approvals, and payment timing all in one place

- Forecast liabilities more accurately and time payments strategically

- Automatically flag duplicates and detect unusual patterns

- Enforce approval policies and maintain a full audit trail

- Handle higher invoice volume without adding manual work

Now that you’ve seen the benefits and steps involved in implementation, the next move is to find the best automated invoice processing software that fits your current workflow. With the right setup, AP becomes much easier to manage.

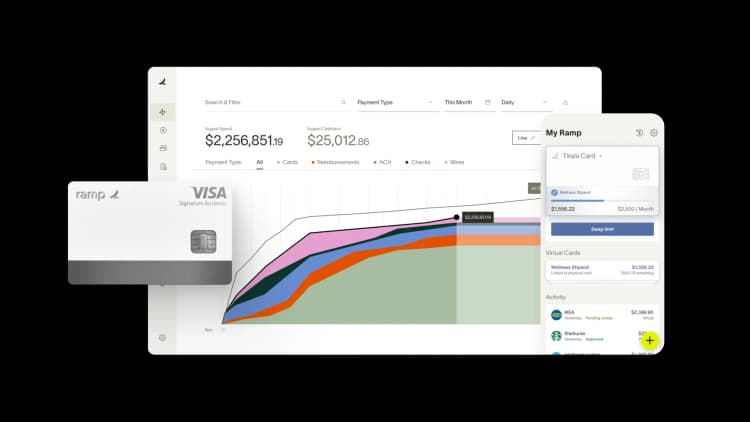

Ramp Bill Pay automates invoice processing end-to-end

Ramp Bill Pay is an autonomous AP platform designed to take manual work out of invoice processing entirely. Four AI agents handle transaction coding, fraud detection, approval summaries, and card-based vendor payments—moving invoices from capture to payment without human intervention. The platform's 99% accurate OCR extracts every line item instantly, processing invoices 2.4x faster than legacy AP software1.

Ramp works as a standalone invoice processing solution or as part of a unified platform connecting bill pay, corporate cards, expenses, and procurement. However your finance team operates, Ramp adapts. Companies using Ramp report up to 95% improvement in financial visibility2.

Manual invoice processing creates predictable problems: data entry errors, approval delays, PO mismatches, and disconnected systems. Ramp eliminates each with touchless, autonomous automation:

- Intelligent invoice capture: Extracts data from every line item at 99% OCR accuracy the moment an invoice arrives

- Auto-coding agent: Maps expenses to the correct GL codes instantly by analyzing historical patterns, product IDs, and invoice details

- Automated PO matching: Compares invoices against purchase orders using 2-way and 3-way matching to flag discrepancies before payment

- Approval agent: Creates summaries with vendor history, contract terms, and pricing comparisons—then recommends approval or rejection

- Automatic card payments agent: Identifies invoices eligible for card payment, enters details into vendor portals, and captures cashback automatically

- Custom approval workflows: Build multi-level approval chains with routing rules that match your organization's structure

- Approval orchestration: Accelerates processing with fewer clicks and clearer visibility across reviewers

- Real-time invoice tracking: Follow every invoice from the moment it's captured through final payment

- Roles and permissions: Set granular user controls to enforce separation of duties

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for always-accurate records

- AI-assisted GL coding: Map transactions to the right accounts using intelligent recommendations

- Reconciliation: Match invoices to payments automatically for faster closes

- Flexible payment methods: Pay vendors via ACH, card, check, or wire

- Batch payments: Process multiple invoices in a single payment run

- Recurring bills: Automate repeat vendor payments with templates

- International payments: Send wires to 185+ countries

Why finance teams automate with Ramp

Ramp represents what modern invoice processing automation looks like—touchless workflows, accurate data capture, and speed that legacy systems can't match. Deploy it as a dedicated AP tool or connect it across your spend infrastructure for full visibility.

Finance professionals on G2 rank Ramp the easiest AP software to use, backed by over 2,100 verified reviews and a 4.8 out of 5 rating. Teams consistently cite reduced processing time, fewer manual errors, and faster month-end closes.

Ramp's free tier includes core invoice automation. Ramp Plus adds advanced processing capabilities at $15 per user per month, with enterprise pricing available on request.

Manual invoice processing is outdated. Ramp automates it.

Try Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

Automated invoice processing usually cuts cost per invoice by 60-80% compared to manual methods. Manual processing averages $6-$15 per invoice, while automation can bring this down to $2-$5. Your actual savings depend on your current efficiency, invoice volume, and the solution you choose. Higher volumes generally mean lower per-invoice costs.

Most modern automation solutions offer pre-built integrations with popular accounting systems like QuickBooks, Xero, Sage, NetSuite, and Microsoft Dynamics. These integrations synchronize vendor data, GL codes, and payment information, and automatically post approved invoices to your accounting system.

Modern solutions can process various formats, including PDFs, scanned paper documents, images, and electronic invoices. Advanced OCR and AI extract data regardless of format or layout, though structured electronic invoices typically yield the highest accuracy rates.

These two terms are very similar, as invoice processing is a part of the accounts payable process. However, invoice processing refers to receiving, documenting, and paying incoming invoices specifically, while accounts payable processing refers to the broader process of managing payment obligations.

Yes, Ramp comes with AI-powered invoice management automation software that digitally matches and logs any incoming invoices, and automates approval workflows to eliminate time-consuming tasks and speed up processing.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°