Accounts payable vs. accrued expenses: A quick guide

- At a glance: Accounts payable vs. accrued expenses

- How accrued expenses and accounts payable work together

- When do accrued expenses vs. accounts payable impact cash flow?

- Why it’s important to understand cash flow impact

- Streamline expense and AP management with Ramp

- Why Ramp Bill Pay delivers value

Accrued expenses and accounts payable play an essential role in financial reporting. They both track what you owe to third parties, and you’d list them both as current liabilities on your company’s balance sheet. Still, the terms aren’t interchangeable. Let’s learn the key differences between the two and how and when to use them.

At a glance: Accounts payable vs. accrued expenses

Accrued expenses and accounts payable are both short-term liability accounts that track your company’s financial obligations, but there’s one major difference: You record an accrued expense before you receive an invoice, and you post to accounts payable after you receive an invoice.

Here are a few other points of comparison:

Criteria | Accrued expenses | Accounts payable |

|---|---|---|

Timing | When you incur an expense, but before you receive an invoice | Once you receive an invoice |

Amount owed | Estimate of what will be billed | Exact amount you’ve been billed (i.e., the amount on the invoice) |

Cash flow impact | Shows an eventual obligation to pay | Shows an imminent obligation to pay |

Examples | Accrued wages, utilities, accumulated interest, estimated taxes | Asset purchases, supplies, freelancer and contractor payments |

Timing

When do you post an entry to your accrued expense account, and when do you post an accounts payable journal entry?

- Accrued expenses: If your business uses accrual accounting, you record an accrued expense when you’ve accepted goods or services but haven’t received a formal invoice

- Accounts payable: You post to accounts payable upon receiving an invoice or when you otherwise have an obligation to pay, representing a current liability

Amount owed

How much will your journal entry be for?

- Accrued expenses: Record the amount you will be billed for the goods or services you purchased. If you don’t know the exact number, you can estimate.

- Accounts payable: Post the amount shown on the invoice to accounts payable, i.e., the total cost of the goods or services that remains unpaid

Cash flow impact

Posting entries to accrued expense and AP don’t immediately impact cash flow. Rather, they signify an eventual impact.

- Accrued expenses: When you accrue an expense, you don’t imminently owe any cash, but you know that you’ll eventually receive an invoice that requires a cash payment

- Accounts payable: When you post to accounts payable, you signal that a cash payment will soon be required

Examples

Nearly any business expense can be posted to accrued expenses or accounts payable; it all depends on when the invoice is sent. However, some expenses are commonly accrued, and others are typically pushed straight to accounts payable.

Accrued expenses

Common examples of accrued expenses are:

- Employee wages: Your employees have performed their job duties, but you haven’t paid them yet

- Utilities: You’ve used heat and water but haven’t received any utility bills yet

- Accrued interest: You’ve incurred interest on a loan but haven’t been billed for the interest payments yet

Accounts payable

Common examples of accounts payable include:

- Purchases on credit: You’ve purchased raw materials, inventory, supplies, assets, etc. on credit, but the bill hasn’t come due

- Professional fees: Your lawyer reviews a contract for you and sends you an invoice, which you’re required to pay within 15 days

- Contractor fees: Your contractor performed services for you and sent you an invoice, which you’re required to pay within 30 days

How accrued expenses and accounts payable work together

The main difference between accrued expenses and AP is when your payments are due. That means the same expense will sometimes hit both accounts. Let’s look at an in-depth example.

You have a contract with your HVAC provider that requires them to provide maintenance services throughout the year. The $1,200 contract is due once per year. Under the accrual method of accounting, you record 1/12 of the contract to accrued expense each month, showing that you’ve used 1/12 of that service contract.

These are the monthly adjusting entries you’ll record:

Date | Description | Account | Debit | Credit |

|---|---|---|---|---|

1/31/2025 | Use of HVAC service contract for January | HVAC Expense | $100 | |

Accrued Expense | $100 | |||

2/28/2025 | Use of HVAC service contract for February | HVAC Expense | $100 | |

Accrued Expense | $100 | |||

3/31/2025 | Use of HVAC service contract for March | HVAC Expense | $100 | |

Accrued Expense | $100 |

On January 5 of the following year, after completing the maintenance contract, you receive a bill from your provider. Now that you’ve received an invoice, you’ll want to move all the expenses you’ve accrued from your accrued expense account into your accounts payable account:

Then, you pay the total amount when the invoice is due on February 5:

Date | Description | Account | Debit | Credit |

|---|---|---|---|---|

2/5/2026 | Payment of HVAC invoice | Accounts Payable | $1,200 | |

Cash | $1,200 |

When do accrued expenses vs. accounts payable impact cash flow?

When an expense gets booked to accrued expenses, there’s no immediate cash outlay. The same goes for when an expense gets booked to AP. But, as mentioned above, both entries indicate there will be a future impact on cash flow.

Generally, when comparing the two, an entry to AP shows that a cash outlay is just around the corner, while an entry to accrued expense indicates that a cash outlay is on the horizon. When it comes to accrued expenses, that payment could be due soon, or it could come due in months.

Because entries to accrued expense and AP don’t directly affect cash, you won’t see these entries on the cash flow statement. However, a reversing entry to these expense accounts does tend to hit your company’s cash flow statement. Let’s look at an example of each:

Accrued expense example

Each month, you accrue wastewater expenses. These periodic expenses come due only once per quarter. At the end of the quarter, you pay your bill. Only the payment (i.e., the reversing entry) would impact cash flow. This is what those entries might look like:

Date | Description | Account | Debit | Credit |

|---|---|---|---|---|

4/30/2025 | Wastewater accrual | Utilities Expense | $500 | |

Accrued Expense | $500 | |||

5/31/2025 | Wastewater accrual | Utilities Expense | $500 | |

Accrued Expense | $500 | |||

6/30/2025 | Wastewater accrual | Utilities Expense | $500 | |

Accrued Expense | $500 | |||

7/1/2025 | Wastewater payment for Q2 | Accrued Expense | $1,500 | |

Cash | $1,500 |

Accounts payable example

You receive an invoice from your supplier on June 1, and your payment terms are net 30. Only the payment (i.e., the reversing entry) would impact cash flow. This is what those entries might look like:

Date | Description | Account | Debit | Credit |

|---|---|---|---|---|

6/1/2025 | Receive invoice from supplier | Supplies Expense | $750 | |

Accounts Payable | $750 | |||

7/1/2025 | Pay off supplier invoice | Accounts Payable | $750 | |

Cash | $750 |

Why it’s important to understand cash flow impact

Cash is the lifeblood of a business. Without cash, even the most profitable businesses can’t survive. Fortunately, the amounts shown in your accrued expense and AP accounts can help you manage cash flow effectively.

AP shows a more immediate need for cash. If you don’t have enough cash to cover what’s in your AP account, you’re in trouble. Accrued expenses are a bit different because they don’t have a set due date. However, that doesn’t mean you can’t worry about that account balance; accrued expenses could turn into cash requirements at the drop of a hat.

It’s best practice to have enough cash to cover all current liabilities (which includes both accrued expenses and AP). To see if your cash reserves are adequate, look at some of the following financial ratios:

Streamline expense and AP management with Ramp

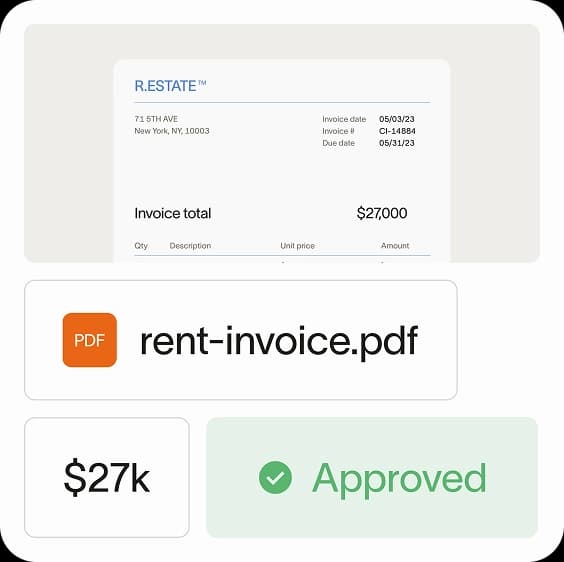

Ramp Bill Pay is autonomous AP software that converts manual work into touchless workflows. Four AI agents handle invoice coding, catch fraud before payments go out, build approval documentation, and push vendor payments through cards—removing your team from repetitive tasks.

OCR hits up to 99% accuracy on data extraction while processing invoices 2.4x faster than traditional platforms1.

Run Ramp Bill Pay as your standalone AP system, or link it with Ramp's corporate cards, expense management, and procurement tools for unified spend oversight. Up to 95% of companies report better payables visibility after switching to Ramp2.

Top Ramp Bill Pay features

- Auto-coding agent: Uses historical patterns and invoice data like product IDs and descriptions to automatically assign the right GL codes

- Intelligent invoice capture: Pulls data from every line item with 99% OCR accuracy

- Automated PO matching: Compares invoices against purchase orders with 2-way and 3-way matching to prevent overbilling

- Fraud prevention agent: Detects suspicious activity like unexpected bank detail changes and unverified vendor accounts before payments process

- Approval agent: Creates detailed summaries with vendor history, contract terms, PO matching, and pricing analysis, then suggests approval or rejection

- Automatic card payments agent: Finds card-eligible invoices, enters card details into vendor portals, and captures cashback automatically

- Reconciliation: Automatically matches transactions to close books faster

- Approval orchestration: Cuts down clicks, increases visibility, and speeds up processing for reviewers

- Real-time invoice tracking: Provides visibility into every invoice from receipt to payment

- GL coding: Assigns transactions to the right accounts with AI assistance

- Real-time ERP sync: Connects vendor master data bidirectionally with 10 ERPs like NetSuite, QuickBooks, Xero, and Sage Intacct for audit-ready books

- Batch payments: Handles multiple vendor payments at once

- Custom approval workflows: Creates multi-level approval chains with role-based routing that matches your org structure

- Roles and permissions: Controls who can do what with granular user settings

- Recurring bills: Automates regular payment schedules with templates

- Vendor Portal: Allows vendors to update their own payment details, check payment status, and message your AP team

- Ramp Vendor Network: Gives access to pre-verified vendors who skip extra fraud checks for quicker payments

Why Ramp Bill Pay delivers value

Ramp Bill Pay demonstrates what AP automation should be—accurate, autonomous, touchless, and fast. Over 2,100 verified G2 reviews give Ramp a 4.8-star average, with finance teams calling it one of the easiest AP platforms to implement.

Ramp Bill Pay works as full-featured AP software without requiring other products, but teams wanting to manage bills alongside card spend, expenses, and procurement can leverage Ramp's unified platform that brings it all together. Start with Ramp's free tier covering core AP automation, or upgrade to Ramp Plus at $15 per user monthly for enhanced features.

See how Ramp Bill Pay reduces costs for your team.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group