Complete monthly expenses list for personal and business budgeting

- What is a monthly expenses list?

- Essential monthly living expenses

- Insurance and healthcare costs

- Personal and family expenses

- Debt payments and financial obligations

- Savings and investments

- Lifestyle and entertainment expenses

- Commonly forgotten monthly expenses

- Fixed vs. variable monthly expenses

- How to calculate your total monthly expenses

- Average monthly expenses by category

- Budgeting methods for managing monthly expenses

- Tools for tracking monthly expenses

- How Ramp automates monthly expense tracking and categorization

Creating a monthly expenses list is the foundation of financial control, but most people miss recurring costs when they rely on memory alone. A complete list captures everything from obvious bills like housing and utilities to easy-to-forget expenses like subscriptions, irregular fees, and variable spending that adds up over time.

This guide lays out a comprehensive monthly expenses list you can use for personal budgeting, business expense tracking, or both, with clear categories and practical benchmarks to help you stay accurate.

What is a monthly expenses list?

A monthly expenses list is a complete record of the costs you pay on a recurring basis, organized into categories like housing, transportation, food, insurance, and discretionary spending. It shows where your money actually goes each month, not just where you expect it to go.

For context, the average U.S. household spends about $6,440 per month on living expenses such as housing, food, transportation, insurance, and healthcare, though actual costs vary widely by household size, location, and lifestyle.

Most people underestimate their true total because smaller or irregular costs, like subscriptions, maintenance, and variable spending, aren’t always top of mind. Laying out every recurring expense in one place helps prevent surprises, reveals spending patterns, and makes it easier to plan realistically.

Essential monthly living expenses

Essential living expenses are the costs you need to cover every month to keep your household running. These expenses typically come first in a budget because they’re harder to cut quickly and form the baseline for how much flexibility you have with the rest of your spending.

While the exact mix varies by household, most budgets start with housing, utilities, food, and transportation.

Housing costs

Housing is usually the largest single monthly expense, often accounting for roughly 25–35% of take-home pay. Your rent or mortgage payment is only part of the picture, so it’s important to include the full set of housing-related costs.

- Rent or mortgage payment

- Property taxes, if not included in your mortgage

- Homeowners or renters insurance

- HOA fees or condo association dues

- Home maintenance and repairs

- Household supplies such as cleaning products and paper goods

Utilities and services

Utility costs tend to fluctuate throughout the year, which makes them easy to underestimate. Looking at a few months of past bills can help you arrive at a realistic monthly average:

- Electricity

- Natural gas or heating oil

- Water and sewer

- Trash and recycling collection

- Internet service

- Phone service

- Cable or streaming services

Food and groceries

Food spending often spans many small transactions, which can hide how much you’re really spending. Separating grocery costs from dining out makes this category easier to track and adjust:

- Groceries for home cooking

- Dining out and takeout

- Coffee shops and beverages

- Work lunches

- Meal delivery services or subscriptions

Transportation expenses

Transportation is one of the most variable expense categories, depending on whether you own a car, use public transit, or rely on rideshare services. In addition to monthly payments, it’s important to plan for ongoing operating costs:

| Expense type | Typical monthly range |

|---|---|

| Car payment | $300–$700 |

| Auto insurance | $100–$200 |

| Gas | $150–$300 |

| Maintenance and repairs | $50–$100 |

| Public transit passes | $50–$150 |

| Parking fees | $50–$200 |

| Rideshare services | Variable |

Less frequent costs like vehicle registration, inspections, or tire replacements can still disrupt your budget if you don’t plan for them. A common approach is to estimate the annual total and set aside one-twelfth of that amount each month.

Insurance and healthcare costs

Insurance and healthcare expenses often combine fixed monthly payments with variable, harder-to-predict costs. Budgeting for both fixed and variable expenses helps you avoid underestimating how much healthcare actually costs over the course of a year.

Separating premiums from out-of-pocket expenses makes this category easier to track and adjust.

Insurance premiums

Insurance premiums are the fixed amounts you pay, usually monthly, to keep coverage in place. You pay these costs whether or not you use the underlying services.

- Health insurance, often partially covered by an employer

- Dental insurance

- Vision insurance

- Life insurance

- Disability insurance

- Long-term care insurance

Out-of-pocket medical costs

In addition to premiums, healthcare comes with expenses that vary based on usage and health needs. These costs can fluctuate significantly from month to month:

- Copays for doctor and specialist visits

- Prescription medications

- Deductibles and coinsurance

- Over-the-counter medications and supplies

- Medical equipment or devices

- Therapy or counseling sessions

If you use a Health Savings Account (HSA) or Flexible Spending Account (FSA), setting aside funds for these expenses can make irregular medical costs easier to manage.

Personal and family expenses

Personal and family expenses tend to grow gradually as your household changes, which makes them easy to underestimate if you’re not reviewing them regularly. These costs vary widely depending on family size, lifestyle, and stage of life, but they play a meaningful role in most monthly budgets.

Childcare and education

Expenses related to children often extend well beyond tuition or daycare and can shift quickly as schedules and needs change.

- Daycare or preschool tuition

- After-school care programs

- School tuition and fees

- Extracurricular activities such as sports or music lessons

- Tutoring or academic support

- College savings contributions

Personal care and clothing

Personal care spending is typically spread across many small purchases, which can make it harder to spot trends without tracking.

- Haircuts and salon services

- Personal hygiene products

- Cosmetics and skincare

- Clothing and shoe purchases

- Dry cleaning and alterations

- Gym memberships or fitness classes

Pet expenses

Pet-related costs often include a mix of predictable monthly spending and irregular veterinary expenses that can disrupt a budget if you’re not planning for them.

- Pet food and treats

- Veterinary care and routine checkups

- Pet insurance

- Grooming services

- Medications and preventive care

- Boarding or pet-sitting services

Debt payments and financial obligations

If you carry debt, monthly payments need to be treated as fixed obligations in your budget. Even when balances change over time, the required payment amounts shape how much flexibility you have in other categories.

Include the minimum monthly payment for each outstanding obligation so your budget reflects your true baseline spending:

- Credit card payments

- Student loan payments

- Personal loans

- Car loans, if not already included under transportation

- Medical debt payments

- Other installment loans

Savings and investments

Savings and investment contributions are often planned monthly, even when the underlying goal is long term. Including them in your expenses list helps you account for money that is already spoken for, rather than treating savings as whatever is left over at the end of the month.

Depending on your situation, these contributions may support short-term stability, long-term goals, or both:

- Emergency fund contributions

- Retirement savings such as a 401(k) or IRA

- Short-term savings goals like travel or a car down payment

- Long-term savings goals such as a home purchase

- Investment account contributions

- Health Savings Account (HSA) contributions

Lifestyle and entertainment expenses

Lifestyle and entertainment expenses cover non-essential spending that supports your quality of life. Because these costs are more flexible than fixed expenses, they’re often where people look first when adjusting a budget.

Even small, recurring charges in this category can add up over time, especially when they’re spread across multiple services or activities.

Subscriptions and memberships

Subscriptions are easy to forget because they renew automatically and don’t always feel like active spending. Reviewing this category regularly can surface costs you no longer use or value.

- Streaming services such as Netflix, Hulu, or Disney+

- Music streaming services

- Software subscriptions

- News and magazine subscriptions

- Meal kit or food delivery subscriptions

- Professional memberships and associations

- Amazon Prime or similar services

Entertainment and recreation

This category includes hobbies, events, and social activities that vary from month to month. Budgeting for them helps avoid overspending without eliminating them entirely.

- Movies, concerts, and live events

- Hobbies and recreational activities

- Books and digital content

- Gaming subscriptions or purchases

- Sporting events

- Social outings and activities

Commonly forgotten monthly expenses

The expenses that disrupt budgets most often are the ones that don’t show up every month or feel too small to matter. These costs tend to arrive sporadically or run quietly in the background, which makes them easy to overlook until they add up.

Accounting for them upfront helps smooth out cash flow and reduces unpleasant surprises.

Irregular but predictable expenses

Some expenses don’t occur monthly, but they’re still inevitable. Annual fees, seasonal costs, and planned purchases can all strain a budget if they aren’t accounted for in advance.

Common examples include annual memberships, vehicle registration, holiday gifts, and seasonal home maintenance. Spreading these costs across the year by setting aside a monthly amount can make them easier to absorb when they come due.

Technology and communication

Small technology-related charges often fly under the radar because they’re fragmented across devices and platforms. App subscriptions, costs associated with unused software, cloud storage fees, and periodic hardware upgrades can quietly grow into a meaningful monthly total. Reviewing bank and app store statements can help surface recurring digital charges you may have forgotten about.

Professional and business expenses

If you’re self-employed, freelance, or run a side business, professional expenses can easily blur with personal spending. Software tools, office supplies, professional services, and education costs are common examples.

Separating business and personal expenses, even at a basic level, makes tracking easier and reduces friction during tax season.

Fixed vs. variable monthly expenses

Not all expenses behave the same way month to month. Separating fixed and variable costs helps you understand which parts of your budget are predictable and which ones give you room to adjust.

Fixed expenses are typically harder to change in the short term, while variable expenses fluctuate based on usage and choices.

| Expense type | What it is | Examples |

|---|---|---|

| Fixed | Expenses that stay consistent each month and are easy to plan for | Rent or mortgage, car payment, insurance premiums, loan payments, most subscriptions |

| Variable | Expenses that change from month to month based on behavior or usage | Groceries, dining out, utilities, gas, entertainment, clothing, personal care |

Understanding this split makes it easier to decide where to focus when you need to reduce spending or reallocate cash toward other priorities.

How to calculate your total monthly expenses

Once you’ve identified your expense categories, the next step is turning them into a realistic monthly total. Using recent data rather than rough estimates helps you avoid undercounting variable or irregular spending.

- Gather documentation: Pull the last three months of bank statements, credit card statements, and receipts

- List all expenses: Write down every expense you can identify, using the categories outlined in this guide

- Calculate monthly averages: For variable expenses, add up three months of spending and divide by three

- Convert irregular costs: Divide annual or non-monthly expenses by 12 to estimate a monthly amount

- Add everything up: Sum all categories to calculate your total monthly expenses

- Compare to income: Measure your total expenses against your monthly take-home pay to identify a surplus or deficit

- Review for gaps: Look for expenses that don’t occur every month or categories you may have overlooked

This approach gives you a clearer baseline and makes it easier to adjust individual categories with confidence.

Average monthly expenses by category

Comparing your expenses to national averages can help you spot areas that may be unusually high or low. These figures are benchmarks, not goals, and your actual costs will vary based on location, household size, and lifestyle.

| Category | Average monthly cost | Percentage of budget |

|---|---|---|

| Housing | $2,025 | 33% |

| Transportation | $1,024 | 17% |

| Food | $778 | 13% |

| Insurance and pensions | $728 | 12% |

| Healthcare | $487 | 8% |

| Entertainment | $288 | 5% |

| Apparel | $162 | 3% |

| Other | $588 | 9% |

| Total | $6,080 | 100% |

Use this breakdown as a reference point when reviewing your own numbers, especially if you’re trying to understand which categories have the biggest impact on your monthly cash flow.

Budgeting methods for managing monthly expenses

A budgeting method gives structure to how your income supports your expenses. The right approach is less about following rules and more about choosing a framework you can maintain over time.

The 50/30/20 rule

This framework divides your after-tax income into three broad buckets, making it easy to see how much room you have for flexibility.

- 50% to needs: Essential expenses such as housing, food, and transportation

- 30% to wants: Discretionary spending like entertainment and hobbies

- 20% to savings and debt: Emergency savings, retirement contributions, and additional debt payments

Zero-based budgeting

With zero-based budgeting, every dollar is assigned a purpose. Income minus expenses equals zero, which encourages intentional decisions about where money goes each month. This approach works well for people who want detailed control and are comfortable reviewing their budget frequently.

Envelope system

The envelope system allocates spending limits to specific categories, traditionally using cash but increasingly through digital tools. Once a category’s envelope is empty, spending pauses until the next budgeting period, which can help curb overspending in flexible categories.

Tools for tracking monthly expenses

Tracking expenses consistently matters more than the specific tool you use. The right option depends on how much automation you want and how complex your spending is.

Spreadsheets and templates

Spreadsheets work well if you want full visibility and control over your data and don’t mind manual entry.

- Best for: People who prefer a DIY approach

- How it works: Expenses are manually entered and categorized in a spreadsheet

- Pros: Free, flexible, and easy to customize

Budgeting apps

Budgeting apps reduce manual work by pulling transactions directly from your accounts.

- Best for: People who want automation and real-time tracking

- How it works: Transactions sync automatically and are categorized by the app

- Pros: Real-time insights, alerts, and mobile access

Expense management platforms

Expense management platforms are designed for more complex needs, especially when business and personal expenses overlap.

- Best for: Businesses or individuals with high transaction volume

- How it works: Transactions, receipts, and categories are tracked automatically

- Pros: Deeper reporting, stronger controls, and less manual reconciliation

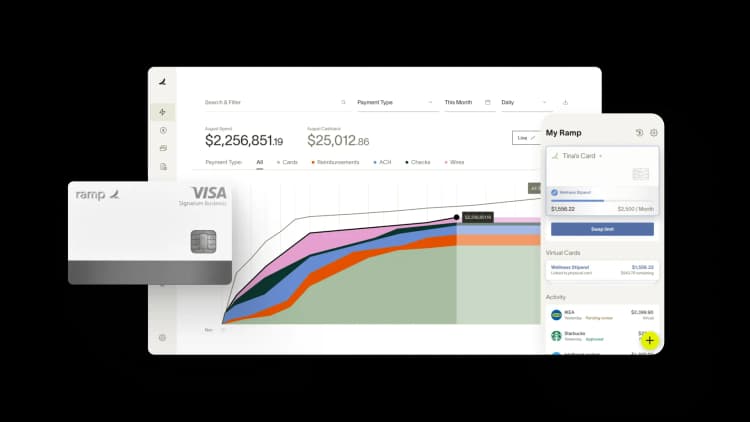

How Ramp automates monthly expense tracking and categorization

Managing monthly business expenses can feel like a never-ending battle. You're constantly chasing down receipts, manually categorizing transactions, and trying to enforce spending policies across your entire team. Without proper systems in place, expenses slip through the cracks, budgets get blown, and month-end close becomes an even bigger headache.

Ramp transforms this process through intelligent automation. Our expense management automation software automatically captures and categorizes every transaction in real time, eliminating the manual data entry that eats up hours of your team's time. When employees make purchases with Ramp cards, the system instantly matches transactions to the correct expense categories based on merchant data and your customized rules.

But tracking is only half the equation; control matters just as much. Ramp's dynamic spending controls let you set precise limits at every level of your organization. You can establish monthly budgets by department, team, or individual, with real-time notifications when spending approaches those limits.

Need to restrict certain merchant categories or set different rules for different employees? Ramp handles it all through customizable policies that enforce themselves automatically. When someone tries to make a purchase that violates a policy, the transaction gets blocked before it happens, not flagged after the fact.

The result is complete visibility into your spending patterns combined with proactive controls that prevent overspending before it occurs. Instead of scrambling at month-end to understand where your money went, you have a real-time dashboard showing exactly how much each team has spent, what they've spent it on, and how much budget remains. This level of automation and control transforms expense management from a reactive scramble into a strategic advantage.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits