- What is accounts payable?

- Common accounts payable examples

- Industry-specific accounts payable examples

- How to record and manage accounts payable

- Best practices for managing accounts payable

- How can automation improve the accounts payable process?

- Why Ramp Bill Pay is the best autonomous AP software

- Why choose Ramp Bill Pay?

Accounts payable (AP) is more than tracking bills—it’s the financial backbone that keeps operations running smoothly. Each invoice, from supplier payments to freight costs, represents a short-term obligation your business must manage strategically.

When accounts payable isn’t managed well, cash flow tightens, vendor relationships suffer, and growth slows. Strong AP systems, on the other hand, maintain liquidity, prevent late fees, and build lasting supplier trust.

Effective accounts payable management ensures every payment supports business stability, operational efficiency, and long-term financial health.

What is accounts payable?

Accounts payable are short-term obligations you owe to suppliers, vendors, or service providers for goods and services you’ve received but haven’t paid for yet. AP appears on the balance sheet as a current liability and directly influences cash flow decisions.

AP is the mirror image of accounts receivable: instead of tracking what others owe you, it tracks what your business owes others. For example, inventory purchased on vendor terms or monthly utility charges are recorded in AP and cleared when you remit payment on or before the due date.

Common accounts payable examples

Accounts payable captures routine obligations that keep operations moving. Here are the most frequent categories you’ll see and why they matter:

| Category | Typical AP items | Why it matters |

|---|---|---|

| Inventory & raw materials | Components, merchandise for resale | Keeps production and sales moving |

| Equipment & office supplies | Machinery, computers, furniture; SaaS subscriptions; utilities | Larger outlays on terms; recurring services tracked in AP |

| Outsourced labor & assembly | Subcontractors, specialized fabrication | Prevents project delays; coordinates specialist work |

| Professional services | Legal, consulting, accounting, marketing retainers | High-value invoices; relationship-sensitive |

| Licensing & permits | Software licenses, health permits, certifications | Compliance and continuity of operations |

| Rent, leases & insurance | Office/warehouse leases, equipment leases, insurance premiums | Recurring liabilities that benefit from automation |

| Travel & employee reimbursements | Airfare, lodging, meals, per diem via expense reports | Policy compliance and timely reimbursement |

| Shipping, freight & logistics | Carrier fees, third-party freight, warehousing | Product availability and delivery SLAs |

| Utilities & telecommunications | Electricity, water, internet, phone | Always-on services; avoid fees and service interruptions |

| Repairs & maintenance | Facility repairs, equipment servicing | Ties work orders to costs and approvals |

1. Procurement of raw materials

Raw materials are essential for manufacturing businesses, forming the foundation of production. When your company orders steel, wood, or chemicals from a supplier, the cost is recorded as accounts payable until the invoice is settled.

For instance, an automotive manufacturer sourcing metal sheets for car production must ensure timely supplier payments to avoid production delays. Timely supplier payments avoid production delays, supply shortages, or strained vendor relationships.

2. Equipment and office supplies

Your businesses may frequently acquire machinery and production equipment through accounts payable. These purchases often involve large sums, so your business may negotiate extended payment terms to manage cash flow efficiently.

For example, a manufacturing company investing in new assembly-line machinery may receive equipment upfront but defer payment based on vendor terms, categorizing it under accounts payable. Timely payments prevent interest charges or disruptions in future equipment supply.

Day-to-day office needs, such as computers, printers, desks, and furniture, are also purchased on credit terms and logged under AP. Your company may also include subscription services, like cloud software licenses or monthly utilities, in this category. For example, an SaaS company paying monthly accounting software fees will record these costs in AP until paid.

3. Outsourced manufacturing and assembly services

Your business may rely on external contractors and suppliers to assemble parts or complete specialized tasks. These subcontracted services are recorded under accounts payable until the invoice is cleared.

For example, in the construction industry, general contractors often subcontract electrical, plumbing, and HVAC work to specialized firms. The main contractor receives invoices from these subcontractors and logs them as accounts payable.

Timely payments ensure projects stay on schedule, subcontractors remain engaged, and good relationships are maintained. Delays in payments can disrupt workflow and lead to higher costs if subcontractors pause work or impose late fees.

4. Vendor and professional service payments

Vendor invoices and payments make up a significant portion of accounts payable, covering everything from raw materials to professional services. Beyond suppliers, AP also tracks professional services such as legal fees, consulting, accounting, marketing retainers, and freelancer invoices. For example, a retail business relies on suppliers to deliver inventory on time, while a startup may log monthly invoices from its law firm or marketing agency. Late payments can delay shipments, cause service interruptions, or even weaken critical partnerships.

5. Business licensing fees

Your business may pay licensing fees to operate legally, use proprietary technology, or comply with industry regulations. These costs fall under accounts payable until the invoice is settled.

For example, software companies pay annual licensing fees to use third-party development tools, while restaurants require health permits and liquor licenses. Keeping up with these payments ensures compliance and uninterrupted business operations.

Missing a licensing payment can result in penalties, service disruptions, or even legal consequences, making timely AP management essential.

6. Rental agreements, lease obligations, and insurance

Leasing provides your business with access to high-cost assets, such as office space, vehicles, or specialized machinery, without requiring large upfront investments. These recurring lease payments are recorded under accounts payable as ongoing liabilities.

Insurance premiums for property, liability, or employee benefits also fall under accounts payable, since they are paid regularly to maintain coverage. Missing payments on leases or insurance can result in penalties, lapses in coverage, or contract violations that disrupt operations.

For example, a logistics company leasing a fleet of trucks records its monthly lease payments as AP. Automating these obligations helps businesses preserve working capital, avoid late fees, and improve financial forecasting.

7. Business travel and employee reimbursements

Business travel expenses, including airfare, lodging, meals, and transportation, are common accounts payable entries, especially if your business has sales teams, consultants, or executives traveling for work. These expenses are typically billed to corporate accounts or reimbursed through employee expense reports.

For example, a consulting firm sending employees to client sites will log hotel bookings, airfare, and per diem costs as accounts payable. Automating invoice approval workflows for these expenses helps you prevent overspending, reduce errors, and ensure compliance with company policies.

8. Shipping, freight, and supply chain costs

Shipping, freight, and logistics expenses fall under accounts payable as your business coordinates the movement of goods. These costs include third-party freight services, carrier fees, and warehousing expenses.

Retailers, for example, rely on freight companies to transport inventory from warehouses to stores. Similarly, manufacturers must account for the cost of moving raw materials and finished products between suppliers and customers. A missed payment to a logistics provider can delay shipments, resulting in stock shortages and lost revenue.

9. Utilities and telecommunications

Monthly electricity, water, internet, and phone bills are recorded in accounts payable and cleared when due. Consistent tracking and automated scheduling help prevent missed payments and interruptions to essential services.

10. Repairs and maintenance

Vendors often invoice for facility repairs or equipment maintenance. Logging these invoices in AP ensures work orders are approved and coded before payment, preventing discrepancies and ensuring accurate cost tracking.

Industry-specific accounts payable examples

Accounts payable functions differently across industries, shaped by unique expenses, regulatory requirements, and supplier relationships. Understanding these nuances helps your business optimize cash flow and avoid common pitfalls.

Healthcare

Hospitals, clinics, and medical facilities rely on accounts payable to manage essential operating expenses such as:

- Medical supplies: Consumables like syringes, gloves, and pharmaceuticals are ordered in bulk and paid for through AP

- Equipment leasing: High-cost items like MRI machines and ventilators are often leased rather than purchased outright

- Insurance and compliance fees: Healthcare providers must pay malpractice insurance, regulatory compliance fees, and software subscriptions for electronic health records (EHR)

Managing AP in healthcare requires strict attention to payment deadlines to prevent supply shortages, delayed patient care, or regulatory fines. Automating invoicing processes and integrating AP with inventory systems help ensure seamless operations.

Technology

In the tech sector, accounts payable is dominated by licensing fees, hardware purchases, and cloud-based services. Common AP categories include:

- Software licensing: Enterprise software, developer tools, and cloud platforms like AWS or Salesforce are typically paid through AP

- Hardware procurement: IT firms purchase laptops, servers, and networking equipment, often on net terms

- Outsourced development: Many tech companies rely on third-party engineers or offshore teams, making AP vital for managing international vendor payments

Automation helps tech companies track renewals, prevent service disruptions, and maintain visibility across multiple vendors and expense categories.

Retail

Accounts payable in retail centers on inventory purchases, logistics, and supplier payments. Effective AP management is crucial for maintaining stock levels and smooth supply chain operations.

- Inventory purchases: Retailers must pay suppliers for goods before or shortly after they reach store shelves. Delayed payments can cause stock shortages or strained vendor relationships.

- Logistics and distribution: Warehousing, shipping, and fulfillment costs are major AP items, especially for e-commerce businesses. Timely payments ensure efficient delivery and prevent delays.

- Store operations and maintenance: Rent, utilities, and equipment purchases also flow through AP

Retailers often optimize their AP processes by negotiating favorable terms, using just-in-time inventory strategies, and leveraging automation for invoice approvals and payments.

How to record and manage accounts payable

To see how accounts payable works in practice, here’s a complete workflow from purchase order to final payment, and how it fits into your bookkeeping.

1. Issue a purchase order

Your retail company’s operations team issues a purchase order (PO) for 500 units of inventory at $20 each. The PO total is $10,000 and specifies net 30 payment terms.

2. Receive the goods

The supplier delivers the 500 units. Your receiving team checks the shipment and logs a receiving report confirming the quantity and quality.

3. Receive the invoice

The supplier sends an invoice for $10,000. Your accounts payable team enters it into the AP system for review.

4. Perform a 3-way match

Your team verifies consistency across documents before approval:

- Purchase order: Confirms the company ordered 500 units at $20 each, totaling $10,000

- Receiving report: Confirms the warehouse received all 500 units in good condition

- Supplier invoice: Confirms the supplier billed $10,000 for the 500 units delivered

If the documents match, the invoice moves forward. If there’s a discrepancy, AP flags it and investigates before approval.

5. Begin the approval workflow

The invoice routes through your approval chain. For example:

- Purchasing verifies order details

- The AP lead or budget owner confirms coding and budget

- Finance or the financial controller gives final approval

6. Process the payment

On the due date, AP schedules payment via ACH transfer. The accounting entry is:

- Debit accounts payable (reducing the liability)

- Credit cash (reflecting the payment)

The supplier is paid and the transaction is closed.

Here's an example timeline:

| Day | Event | Notes |

|---|---|---|

| 1 | PO issued (500 × $20 = $10,000) | Net 30 terms; vendor confirms lead time |

| 5 | Goods received | Receiving report logged; quantity and quality verified |

| 6 | Invoice received | Entered to AP; routed for approvals |

| 7–9 | 3-way match & approvals | Match PO, receiving report, and invoice; resolve discrepancies if any |

| 10 | Early-pay window (if offered) | With 2/10 Net 30, pay by Day 10 to take the 2% discount |

| 30 | Payment due | If no discount taken, schedule ACH; debit AP, credit Cash; close the transaction |

Common payment terms and discounts include:

- Net 30 / Net 60 / Net 90: Full invoice due 30, 60, or 90 days after the invoice date

- 2/10 Net 30: Take a 2% discount if paid within 10 days. Otherwise, the full amount is due in 30 days.

- Quick math example: A $5,000 invoice on 2/10 Net 30 costs $4,900 if paid by Day 10 ($5,000 * 98% = $4,900). If paid on Day 30, you owe the full $5,000.

Best practices for managing accounts payable

These best practices will help your small business stay organized, cut down on unnecessary costs, and keep payments running smoothly:

- Maintain clear payment terms: Ensure all vendor agreements specify due dates, payment methods, and potential penalties for late payments

- Centralize invoice intake: Use a single entry point (like a dedicated inbox or AP system) so invoices don’t get lost or duplicated

- Regularly reconcile accounts payable balances: Verify invoices, payments, and supplier statements to catch discrepancies early

- Use an aging report: Categorize outstanding invoices by due date to help prioritize payments and avoid late fees with accounts payable aging reports

- Take advantage of discounts: Track early-payment discount terms and schedule payments strategically to reduce costs

- Automate AP workflows: Digital tools can speed up invoice approvals, prevent errors, and provide real-time visibility into outstanding payables

How can automation improve the accounts payable process?

Manual AP management is time-consuming and prone to errors. Automating AP processes enhances efficiency, accuracy, and financial oversight. The key benefits of AP automation software include:

- Faster invoice processing: Optical character recognition (OCR) and AI-powered tools extract financial data automatically, eliminating manual data entry when processing invoices

- Error and fraud reduction: Automated matching of invoices with purchase orders helps detect duplicate or fraudulent payments

- Better cash flow visibility: Accounts payable automation provides real-time insights into outstanding liabilities, helping you plan payments more effectively

For example, a logistics company using AP automation might cut invoice processing times in half by eliminating paper-based approvals, while an SaaS business may streamline vendor payments using scheduled, automated disbursements.

- Before: Manual data entry, email chases, inconsistent coding, duplicate payment risk

- After: OCR-assisted capture, auto-routing, standardized GL coding, scheduled runs with audit trails

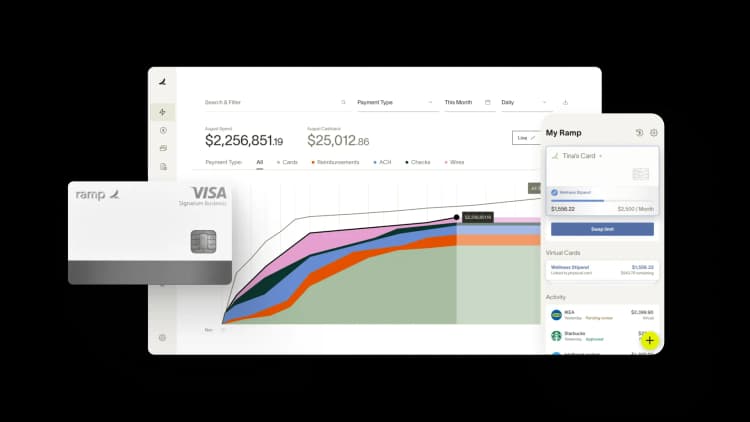

Why Ramp Bill Pay is the best autonomous AP software

Ramp Bill Pay runs your accounts payable on autopilot using AI that manages invoice coding, fraud checks, approval documentation, and card payment processing to bring you touchless AP workflows. The platform moves invoices 2.4x faster than older AP systems1 while hitting 99% accuracy on data capture.

Deploy it as your only AP tool, or link it with Ramp's cards, expense management, and procurement features for complete spend tracking. Up to 95% of businesses gain better payables insight when moving their team onto Ramp2.

Here are some top AP features that Ramp Bill Pay provides for your team:

- Automated PO matching: The system compares bills to purchase orders using two-way and three-way verification, identifying billing errors before you release funds

- Intelligent invoice capture: Advanced OCR technology digitizes invoice data with 99% precision across all line items

- Four AI agents: Automatically analyzes your spending history to classify invoices, monitors incoming bills for irregularities, creates approval summaries, and processes eligible payments using virtual cards

- Payment methods: Choose from ACH transfers, corporate cards, checks, and wire payments

- International payments: Send funds to vendors across more than 185 countries with global spend management support

- Batch payments: Execute multiple vendor disbursements simultaneously rather than processing them individually

- Real-time ERP sync: Maintain bidirectional synchronization of vendor information with leading accounting platforms including NetSuite, QuickBooks, Xero, Sage Intacct, and others—ensuring your books stay audit-ready

- Flexible approval workflows: Configure authorization paths that route invoices according to department hierarchy, spending thresholds, and vendor relationships

- Roles and permissions: Establish access controls that maintain proper segregation of financial responsibilities across your organization

- Ramp Vendor Network: Pay pre-approved vendors faster by skipping redundant verification steps

- Vendor Portal: Give your vendors a self-service hub where they can update bank details, track payments, and reach your AP team directly

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- One-click IRS filing: File directly with the IRS and eligible states in minutes

- Corporate cards: Create physical cards and virtual cards with spending limits you control

- Expense management: Scan receipts, reimburse employees, and enforce spending policies without juggling multiple tools

- Procurement: Review and approve purchase requests before your team commits to spending

Why choose Ramp Bill Pay?

Ramp Bill Pay functions as a full AP system without needing any other tools. But if you want to track bill payments alongside card transactions, employee expenses, and procurement in one place, Ramp can also connect it all in one place. Configure it however your business works best.

Whether standalone or unified, Ramp Bill Pay sets a higher standard for modern, touchless AP performance. With 2,100+ verified reviews on G2 and a 4.8-star average, teams call it one of the easiest AP platforms to use.

You can start with Ramp’s free tier with its core AP automation features, or upgrade to Ramp Plus for advanced tools at $15 per user each month.

AP shouldn't demand constant attention. Ramp Bill Pay handles it. Try Ramp Bill Pay to experience the difference.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

Accounts payable generally falls into trade payables (supplier invoices for goods and services), non-trade payables (professional services, licensing, or utilities), and recurring expenses such as leases or insurance premiums. For recurring bills, centralizing intake and scheduling payments helps avoid late fees and interruptions. See how to control recurring expenses.

AP affects when cash leaves your business. Negotiating payment terms and capturing early-pay discounts can preserve liquidity, while delayed or mismanaged payments can harm supplier relationships and trigger penalties. Clear approval paths and scheduled runs keep outflows predictable and aligned to cash planning.

Accounts payable are billed amounts you’ve recorded from supplier invoices but haven’t paid yet. Accrued liabilities are incurred expenses you’ve recognized without an invoice. Both are current liabilities, but AP is invoice-driven, whereas accruals rely on estimates until documentation arrives.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group