- Are expenses liabilities?

- What is a liability?

- Types of liabilities

- What is an expense?

- Types of expenses

- How to classify liabilities and expenses

- How to record liabilities and expenses

- Impact on financial statements

- Classify liabilities and expenses accurately with Ramp's AI-powered coding and review

If you're just getting started with financial management, you may struggle with the difference between expenses and liabilities. It may seem trivial, but confusion over liabilities vs. expenses can lead to costly mistakes.

Being able to distinguish between the two can improve your financial planning and performance for the future. Here, we provide clear definitions of expenses and liabilities in accounting, along with practical examples and guidance on how to classify and record each.

Are expenses liabilities?

Liabilities aren’t expenses. People often mix them up, but there are key distinctions between liabilities and expenses in accounting, and they're classified differently in your financial statements.

Expenses are the costs associated with running your business. They're neither liabilities nor assets. Liabilities are the obligations your company owes, while assets are the resources your business owns. In practice, you would include expenses on your company’s income statement and list liabilities on your balance sheet.

But here's where things get a bit fuzzy. Expenses can become liabilities on a balance sheet when you accrue them, which means you’ve incurred the expense and received the benefit from it, but you haven’t paid for it yet. You record these as liabilities until you pay them.

What is a liability?

In accounting, liabilities refer to the financial obligations or debts that your company owes to external parties, such as lenders, suppliers, or even employees. These obligations typically arise from past transactions or events, and they represent claims against the company’s assets.

Accurately calculating liabilities on your balance sheet is essential for financial planning and complying with regulatory reporting requirements. Common examples of liabilities include:

- Repayment of borrowed funds, such as loans or lines of credit

- Unpaid bills to vendors, also known as accounts payable (AP)

- Salaries and wages you owe to employees

- Taxes you owe to the government

- Obligations under contracts or leases

Types of liabilities

The three main types of liabilities are current liabilities, long-term liabilities, and contingent liabilities. Here are the details on each:

Current liabilities

A current liability isn’t an expense. You list these on your balance sheet, and you often pay them with current assets, which include cash and cash equivalents, marketable securities, and receivables. Current liabilities include payables, other short-term obligations, and short-term debt (i.e., debt maturing within a year).

Here are some examples of current or short-term liabilities:

- Accounts payable

- Short-term loans

- Accrued expenses

- Income taxes payable

- Unearned revenue

Long-term liabilities

These consist mainly of long-term debt maturing in more than one year. You usually pay these out of fixed assets.

Here are some examples of long-term or non-current liabilities:

- Mortgage debt

- Bonds and subordinated debt

- Long-term loans and other notes payable of over one year in maturity

Contingent liabilities

Contingent liabilities are often a source of confusion. These are business liabilities that are probable, but not certain; in other words, the need to pay them is contingent on some event.

Typical examples of contingent liabilities include:

- Pending lawsuits

- Warranties

- Loan guarantees

Under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), your company must record contingent liabilities on your balance sheet if you can reasonably estimate their size and probability.

What is an expense?

In accounting, an expense is any cost your business incurs to generate revenue. You report expenses on your company’s income statement, or profit and loss (P&L) statement, and record them as revenue deductions.

Every business incurs expenses of some kind. Common examples include:

- Rent

- Utilities

- Wages

- Equipment and office supplies

- Marketing and advertising costs

Types of expenses

There are countless types of business expenses, but they'll typically fall into one of these four major buckets:

Cost of goods sold (COGS)

The cost of goods sold, or COGS, represents the actual cost incurred to produce the products or services that your company sells, including overhead costs associated with production.

Examples include:

- Raw materials

- Direct labor

- Shipping, freight, and storage costs for products

Selling, general, and administrative (SG&A) expenses

SG&A expenses encompass all the other costs associated with running the business. You have to manage them carefully to ensure that revenues don’t leak out through poor cost controls.

These expenses can include:

- Advertising and marketing costs

- Consulting fees

- Depreciation of equipment

- Employee salaries and benefit programs

- Insurance premiums

- Office supplies and equipment

- Sales commissions

Operating and non-operating expenses

Operating expenses are the day-to-day costs you incur to keep your business running. Importantly, they aren’t directly related to the production of goods or services, which makes them different from COGS. Examples include:

- Rent and utilities for office space

- Payroll expenses

- Training and development

In contrast, non-operating expenses are typically one-time charges or irregular costs unrelated to the day-to-day operations of your company. Examples include:

- Inventory write-offs

- Interest on loans

- Losses from asset sales

Capital expenditures

Capital expenditures (CapEx) differ from operating expenses because they aren’t related to your current day-to-day business needs. Instead, these are long-term investments meant to generate future growth.

Examples of capital expenditures include:

- Real estate

- Copyrights or patents

- New equipment or significant upgrades to existing equipment

How to classify liabilities and expenses

When you need to determine whether something is a liability or an expense, you can use this step-by-step guide:

1. Identify the transaction

What does this transaction represent? What benefit did the business receive, give up, or plan to receive or give up?

2. Determine if it’s an obligation or cost

Next, review the transaction. Did it create an obligation, meaning a future cost that the company will owe? If so, the transaction is a liability. Is the transaction a cost you incurred to generate future revenue? If so, the transaction is an expense.

3. Review the timing

Lastly, take a look at the timing. Are you making payments in advance for services you haven’t received yet? If so, those should be classified as assets for now and expenses once you’ve received the benefit. Or, did you already receive the services but haven’t paid for them yet? If so, those should be classified as liabilities for now and expenses once you pay.

Let’s say a company receives a business loan to purchase new equipment. First, you identify that transaction and determine that it’s an obligation, since the loan is a debt. That means you initially record it as a liability on your balance sheet. The actual purchase of the equipment is an expense, and over time, the equipment depreciates, which is also an expense on the income statement.

Once the loan is repaid, you can remove the liability.

Key things to remember

When classifying liabilities and expenses, remember these facts:

- Liabilities represent an obligation to give something up in the future

- Expenses represent a cost right now in the service of generating revenue

- Classifying transactions as a liability or expense often depends on the timing of the transaction

Common accounting mistakes

Liabilities and expenses can be confusing. These are a few of the most common accounting mistakes:

- Misclassifying transactions

- Data entry errors

- Failure to reconcile accounts

- Disorganized recordkeeping

- Missing or duplicate entries

One of the best ways to avoid these kinds of mistakes is by automating the process. Accounting software will help streamline the process, creating much more efficient and accurate financial reporting.

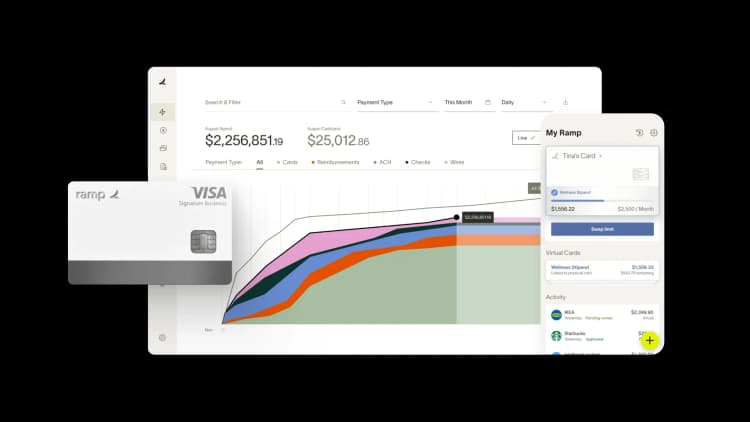

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

How to record liabilities and expenses

To record liabilities, look at all the items on your company’s general ledger, which tracks the obligations you’re due to pay in the future. Then take the following steps:

- Classify transactions: Determine if the liability is current, long-term, or contingent

- Estimate liabilities: Estimate the size and probability of any contingent liabilities, such as the outcome of a lawsuit or regulatory investigation. If you can reasonably estimate the probability and size of the liability account, put it on your balance sheet.

- Calculate liabilities: To calculate your liabilities, add up your current, long-term, and contingent liabilities separately, and put the separate totals on the balance sheet

- Record liabilities: Sum the liabilities and put the total liabilities figure on your balance sheet

Classifying expenses is generally easier than calculating liabilities because these are costs you've already incurred during the reporting period. However, depending on the maturity of your expense management process, assembling and managing your P&L could be time-consuming:

- Track your expenses: Use a real-time bookkeeping and expense management system that eliminates cumbersome expense reports and integrates with your accounts payable, accounts receivable, and treasury management systems

- Calculate the cost of goods sold: Add up the materials, wages, and other costs that went toward creating the products or services your company sold

- Calculate your SG&A expenses: Add up the additional expenses that fueled the day-to-day operations of your business

- Total your expenses: Enter the COGS and SG&A expenses into your income statement

If you’re still manually tracking your balance sheets, it might be time to explore accounting automation software. An accounting platform can help simplify and streamline the workflow via automation, saving you both time and money throughout the process.

Impact on financial statements

Liabilities and expenses are both important components of financial statements, but they impact them in different ways. These are the key ways liabilities and expenses differ in financial reporting:

Criteria | Liabilities | Expenses |

|---|---|---|

Definition | Debts and obligations to others | Costs of doing business |

Impact | Can predict future profits if managed properly | Reduce a company's net worth |

Recordkeeping | On the balance sheet | On the income statement |

Timing | Settled in the future | Recorded when incurred, not when cash is paid |

Examples | Accounts payable, short-term loans | Rent, salaries, utilites |

Classify liabilities and expenses accurately with Ramp's AI-powered coding and review

Misclassifying liabilities and expenses creates downstream headaches—inaccurate financial statements, compliance risks, and hours spent hunting down errors during audits. You need a system that codes transactions correctly from the start and flags potential issues before they become problems.

Ramp's AI-powered accounting software eliminates misclassification by learning your chart of accounts and applying the right codes across all required fields as transactions post. The AI analyzes transaction details, merchant information, and historical patterns to suggest accurate classifications in real time. When you provide feedback or make corrections, Ramp learns from those adjustments and applies that knowledge to future transactions, getting smarter with every coding decision.

Here's how Ramp prevents misclassification:

- Multi-dimensional coding: Ramp codes transactions across all required fields—account, department, class, location, and custom dimensions—so every expense lands in the right bucket

- Context-aware suggestions: The AI reviews transaction details, receipts, and approval workflows to recommend classifications based on complete context, not just merchant names

- Intelligent review queues: Ramp flags transactions that need human attention and auto-syncs routine, in-policy spend so you focus review time where it matters most

- Audit-ready documentation: Every transaction includes attached receipts, approval history, and coding rationale so you can trace decisions and demonstrate compliance

Try a demo to see how Ramp's AI coding achieves a 67% increase in zero-touch accuracy compared to rules-only automation.

FAQs

Expenses are neither liabilities nor assets. They are the costs associated with running a business in the pursuit of generating revenue. Liabilities are debts and financial obligations, and assets are resources owned by a company.

An expense becomes a liability when you accrue it. That means that your business has received the benefit from a good or service, but has yet to pay for it. Here's a simple example: You get heat and hot water from the utility company for the month of December, but your bill isn't due until January.

Although they are distinct concepts, a liability can also be an expense. An example is interest on a loan. It accrues over time and is a liability until you pay it off, at which point it becomes an expense.

Taxes can be both a liability and an expense. They are recorded as an expense when incurred and as a liability until you pay them.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits