American Express Blue Business Cash Card requirements in 2025

- Eligibility criteria for the American Express blue business plus credit card

- American Express Blue Business Plus Credit Card overview

- American Express Blue Business Plus VS Chase Ink Business Preferred VS Ramp Corporate Card

- Consider Ramp as an alternative

If you're considering a credit card for your business, understanding the requirements and features is crucial. This article explores the American Express Blue Business Plus Credit Card, offering you a clear overview of what to expect in terms of eligibility, benefits, and limitations.

If you're looking to expand your purchasing power, manage cash flow, or earn rewards, knowing these details will help you make informed decisions tailored to your business needs.

Eligibility criteria for the American Express blue business plus credit card

To apply for the American Express Blue Business Plus Credit Card, you should have a credit score of 670 or above. This ensures a higher likelihood of approval and the ability to fully take advantage of the card's features.

When preparing your application, you'll need to gather several documents to verify both your personal and business details:

- A government-issued ID such as a driver's license or passport.

- Documents such as business registration certificates or articles of incorporation.

- Recent financial statements or tax returns to demonstrate your business's financial health.

- Personal and business bank statements from the last few months are also required.

Having these documents ready and meeting the credit score requirement will streamline the application process and improve your chances of qualifying for this credit card.

American Express Blue Business Plus Credit Card overview

The American Express Blue Business Plus Credit Card is a no-annual-fee business credit card that offers a simple rewards points structure for small business owners. This card lets you earn Membership Rewards points on your everyday business purchases.

Key features

- Earning rate: Earn 2X Membership Rewards points on the first $50,000 in purchases per year, then 1 point per dollar after that.

- Welcome offer: Earn 15,000 Membership Rewards points after spending $3,000 in eligible purchases within the first 3 months of card membership.

- Intro APR: 0% intro APR on purchases for 12 months from the account opening date, then a variable APR of 18.49% - 26.49% (APR won't exceed 29.99%).

- Expanded buying power: Spend above your credit limit with adjustable buying power based on factors such as your payment history and credit record.

- Employee cards: Add up to 99 employee cards at no additional cost.

Pros

- No annual fee, making it an affordable option for small businesses.

- Straightforward rewards structure.

- Access to valuable American Express Membership Rewards points, which can be transferred to various airline and hotel partners.

- Introductory 0% APR on purchases for 12 months.

Cons

- The 2X points earning rate is capped at $50,000 in annual purchases, which may not be sufficient for businesses with higher spending.

- Charges a 2.7% foreign transaction fee, making it less suitable for businesses with frequent international expenses.

- Limited welcome offer compared to other business credit cards.

American Express Blue Business Plus VS Chase Ink Business Preferred VS Ramp Corporate Card

Feature | Amex Blue Business Plus | Chase Ink Business Preferred | Ramp Corporate Card |

|---|---|---|---|

Annual Fee | No annual fee | $95 | No annual fee |

Foreign Transaction Fee | 2.7% | No foreign transaction fees | No foreign transaction fees |

Credit Limit | Varies based on creditworthiness | $5,000 - $25,000+ | Up to 30 times higher than traditional cards |

Rewards Earning Rate | 2X points on first $50,000/year, 1X thereafter | 3X points on first $150,000/year on select categories, 1X thereafter | Cashback rewards on purchases |

Employee Cards | Up to 99 at no additional cost | Unlimited free employee cards | Unlimited free physical and virtual employee cards |

Special Features | Expanded buying power, Amex Offers | Cell phone protection, purchase protection, travel insurance | Customizable spending controls, advanced expense management, no personal credit checks |

Credit Score Requirement | 670+ | 670+ | No personal credit checks; sales-based underwriting |

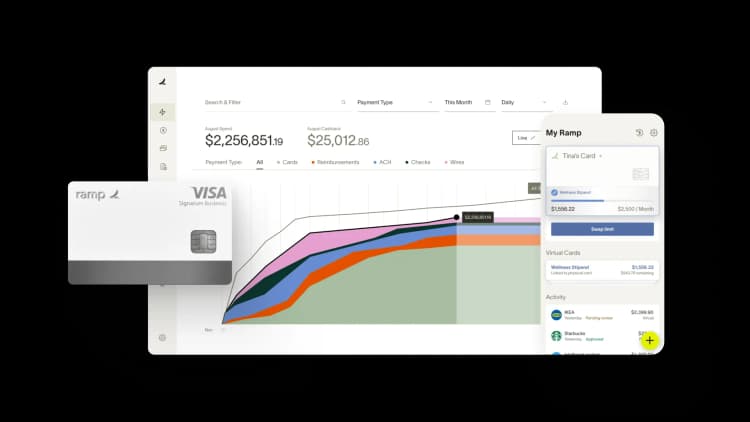

Consider Ramp as an alternative

Ramp stands out for several reasons, especially if you're looking for flexibility and control over your business expenses:

- Higher credit limits: Ramp offers up to 30 times higher credit limits than traditional cards, providing significant spending power for your business.

- No personal credit checks: With Ramp, your credit score remains unaffected as no personal credit checks are involved.

- Advanced expense management: Ramp's platform includes automated expense management, customizable spending controls, and integrations with accounting software, simplifying your expense tracking and reporting processes.

- No fees: Ramp has no annual fees or foreign transaction fees, helping you save more on operational costs.

- Cashback rewards: Earn cashback on purchases, offering straightforward and valuable rewards for your business spending.

- Customizable virtual cards: Create custom virtual cards with specific permissions for different teams or purposes, enhancing control over your business expenses.

Ramp offers tailored solutions to meet the demands of modern business operations. Discover more about how Ramp Credit Card can help your business manage its cash flow.

Cashback rates, limits, fees, and other card details mentioned in this article are for illustrative purposes only. They do not represent guaranteed or expected rates. Actual terms and rewards vary by issuer and may change without notice. Always confirm current details directly with the card provider before applying.

FAQs

You need a credit score of 670 or above to qualify for the American Express Blue Business Plus Credit Card. You'll also need to provide business registration documents, recent financial statements, and personal and business bank statements to verify your eligibility during the application process.

You earn 2X Membership Rewards points on the first $50,000 in purchases per year, then 1 point per dollar thereafter. The card also offers a welcome bonus of 15,000 points after spending $3,000 in the first 3 months, with no annual fee.

Yes, the card charges a 2.7% foreign transaction fee on international purchases. This makes it less suitable for businesses that frequently make international transactions compared to cards that waive these fees entirely.

Traditional cards like the Amex Blue Business Plus require personal credit checks and have spending caps on rewards, while modern alternatives like Ramp offer no personal credit checks, unlimited cashback rates, and advanced expense management features.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits