How can I check my American Express business credit card application status?

- How can I check my American Express business credit card application status?

- How long does it take to get an American Express business card approval?

- Why is my credit card application pending?

- Get approved for a Ramp card in 1-3 days on average

If you've recently applied for an American Express business credit card and are eager to know the status of your application, American Express provides multiple convenient ways to check this information. You can easily track your application's progress online, by phone, or by visiting a branch.

In this article, we’ll walk you through the steps to check your American Express business credit card application status, starting with the quick and easily accessible online method, and then exploring other options for obtaining this information.

How can I check my American Express business credit card application status?

Online method

- Visit the American Express website:

- Navigate towww.americanexpress.com.

- Log in:

- Click on the “Log In” button located at the top right corner of the homepage.

- Enter your user ID and password to access your account.

- Navigate to Application Status:

- Once logged in, find a section typically labeled “Account Services” or a similar heading.

- Look for and select an option that says “Check Application Status”.

- View Status:

- Clicking on “Check Application Status” will display the details of your credit card application, including its current status.

Phone method

- Prepare your information:

- Have your Social Security number and other relevant personal details handy, as you will likely need to verify your identity.

- Call customer service:

- Dial the American Express customer service number specific for credit card inquiries: 1-800-567-1083.

- Follow the prompts:

- Follow the voice prompts to navigate to the credit card application status option. You might need to say “Application status” or enter a specific number corresponding to that choice.

- Speak to a representative:

- If the automated system does not provide the status, you can opt to speak with a customer service representative for further assistance.

Visit a branch

For those who prefer a face-to-face interaction or might be near a branch, visiting an American Express office is another option to check your credit card application status.

- Locate your nearest American Express office:

- Use the office locator on the American Express website or a map application to find the closest location.

- Visit the office:

- Head to the office during its operating hours. It’s advisable to bring identification and any documents related to your application.

- Request assistance:

- Speak with an officer once you arrive. Provide them with your identification and any necessary information so they can help you check the status of your credit card application.

How long does it take to get an American Express business card approval?

The approval time for an American Express business credit card can vary, but typically, applicants receive a decision within 7 to 10 business days.

In some cases, if further review is needed, it might take up to 30 days to get a final decision. You can check the status of your application using any of the methods described earlier if you don't receive a decision within the expected time frame.

Why is my credit card application pending?

When your credit card application is marked as "pending," it typically means the issuer needs additional time to review your information before making a decision. This status often arises when further verification of your personal or financial details is required, or when the issuer is dealing with high volumes of applications.

Here are some common reasons why your credit card application might be pending:

- Incomplete application: If any essential fields are left blank or filled incorrectly, the issuer will need more time to request the correct information.

- Credit review: The issuer may require additional time to thoroughly review your credit history, especially if there are discrepancies or your credit score is borderline for their criteria.

- Verification processes: Additional verification steps might be needed to confirm your identity, income, EIN number, or employment details, particularly if the provided documents do not clearly support your application.

- Fraud checks: To prevent fraud, issuers conduct detailed checks. If something looks unusual, they might hold your application for further scrutiny.

- Operational delays: Sometimes, the delay is due to high application volumes, technical issues, or internal processes at the issuer's end.

Discover Ramp's corporate card for modern finance

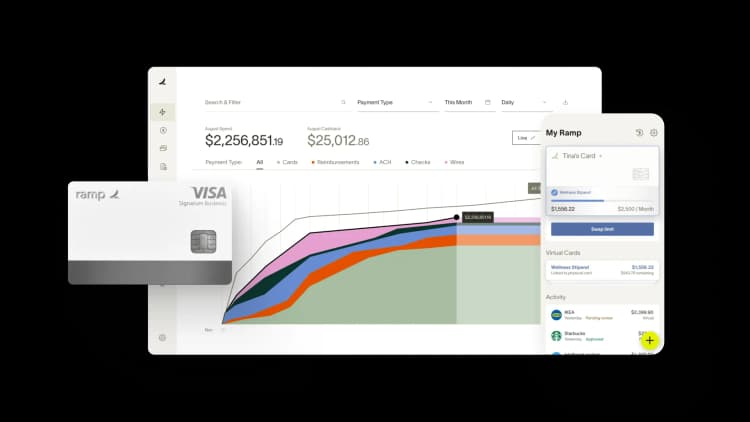

Get approved for a Ramp card in 1-3 days on average

If your business needs a credit card, Ramp’s corporate card may be the answer. Unlike traditional business credit cards, Ramp doesn’t require a credit check or personal guarantee. As a result, our approval process takes just one day on average.

Plus, our cards come with advanced spend management features and unlimited free physical and virtual employee cards. Here are just a few features you can expect from Ramp:

- No annual fee: Get started with Ramp’s corporate card and expense management software for free. No annual fees or setup fees.

- Expense management tools: Set spending limits, automate receipt collection, and streamline expense reporting.

- Accounting integrations: Ramp connects with leading accounting platforms like QuickBooks, Xero, Sage Intacct, and NetSuite to help you close your books 8x faster.

Disclaimer: The information provided in this article has not been officially confirmed by American Express and is subject to change.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits