- Why schools struggle with accounts payable

- What Ramp Bill Pay does for school finance teams

- How schools are using Ramp Bill Pay

- Why educational institutions automate AP with Ramp

School and district finance teams are often stretched thin. They're handling hundreds of invoices, tracking spending across departments, and ensuring compliance with grant requirements and reporting standards.

Chasing approvals and assembling audit-ready documentation can turn into a time-consuming scramble, especially during end-of-year close or when grant auditors come calling.

AP automation software helps educational institutions speed up invoice processing and reduce manual reconciliation work. Instead of chasing paper trails, you get centralized document storage and approval workflows that keep everything in one place.

This guide walks through how AP automation software works for schools and which solutions make the most sense for different types of institutions.

Why schools struggle with accounts payable

Accounts payable in educational institutions covers everything from textbook and classroom supply purchases to vendor payments for food services, facilities maintenance, and transportation. When AP breaks down, students don't get textbooks on time and cafeterias can't pay food vendors.

School finance teams face a unique set of challenges that make AP more complex and time-consuming:

- High invoice volume with limited staff. Schools often process hundreds or thousands of invoices each month, particularly during seasonal peaks. Lean teams struggle to keep up. This creates bottlenecks and delays payments.

- Manual processes. Many institutions still rely on paper invoices, physical approvals, and handwritten checks. Documents get lost, data entry errors pile up, and turnaround times stretch out.

- Complex approval hierarchies. A single invoice might require signoff from a department chair, program director, grant administrator, and central finance. These layers delay processing, especially when approvers work across campuses or are unavailable.

- Seasonal vendor pressure. Invoice volumes spike before academic terms and during capital projects, straining AP processes at the worst possible time.

Public fund oversight, academic calendars, and diverse funding streams make all of this harder. When AP workflows break down, vendor trust breaks, compliance risks increase, and finance teams lose time they could spend on budgeting, planning, and oversight. The good news? Most of these challenges have practical solutions.

What Ramp Bill Pay does for school finance teams

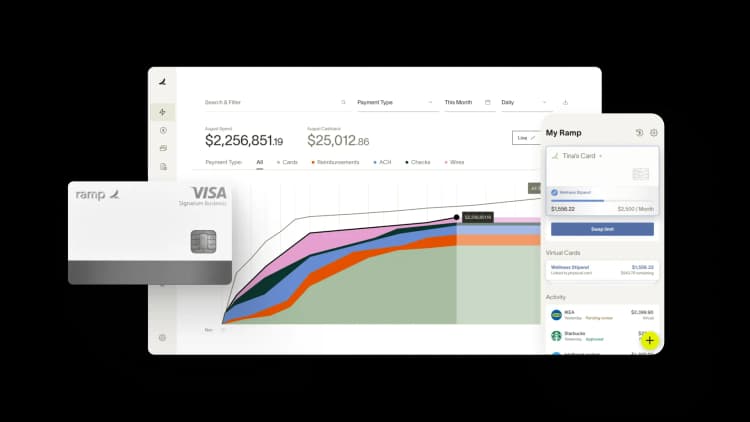

Ramp Bill Pay is accounts payable software that handles the full AP process. It receives invoices, routes them for approval, executes payments, and syncs with your accounting system.

While Ramp is known for spend management, Bill Pay adds AP features like OCR-powered invoice capture, two-way matching, customizable approval flows, and scheduled payments via ACH, card, or check.

- It integrates in real-time with accounting platforms like NetSuite and QuickBooks.

- You can set up approval workflows to route invoices based on department, location, amount, or category. This gives you accurate oversight across different funding sources like grants, restricted accounts, and general budgets.

- Payments go out via ACH, virtual cards, or check. You can schedule them based on your cash flow, payment due dates, and discount opportunities.

- Ramp Bill Pay also syncs payment and invoice data with your accounting software. This cuts down on manual data entry and makes month-end reconciliation simpler.

Here’s a breakdown of each feature:

Automated invoice processing and data capture

Ramp Bill Pay cuts down on manual data entry by automatically reading invoices, validating information, and routing them for approval.

The platform uses OCR and machine learning to extract vendor details, line items, payment terms, and totals. The accuracy improves over time as the system learns.

For schools, this helps with complex invoices. Think textbook orders with multiple editions, food service invoices with variable pricing and quantities, or facilities maintenance costs spread across multiple buildings.

The system processes even detailed, varied invoices accurately.

Invoice matching

Ramp Bill Pay performs automated two-way matching of invoices against purchase orders. It flags any discrepancies between invoice amounts, quantities, or terms.

If matches fail, the invoice gets flagged for review before payment. This helps detect duplicate payments, fraud, and non-compliant spending. Three-way matching (which includes receiving confirmations) is supported for NetSuite.

Multi-level approval workflows for schools

Schools often need layered approval processes because of budget oversight, departmental structures, and funding source restrictions.

Ramp lets you build and customize approval workflows that reflect these complexities. Processing gets faster and more transparent.

Every approval step is timestamped and logged. This creates audit trails that support proper oversight of spend during internal audits.

Budget controls and real-time spending visibility

Ramp Bill Pay gives finance teams and department heads real-time visibility into spending across different needs.

You can set up soft warnings that notify users when they're approaching budget limits. Or you can configure hard stops that prevent approvals or payments that exceed set limits. It depends on your organizational policies.

This visibility helps finance teams catch overspending early. You can make proactive adjustments instead of reactive fixes during reconciliation—leading to better resource planning and fewer surprises at fiscal year-end.

Vendor management

Ramp Bill Pay centralizes vendor information. It maintains complete, up-to-date records including vendor tax documents. This helps teams verify documentation before releasing payments. It also makes audit and compliance prep simpler.

Payment scheduling

You can plan when to pay vendors based on invoice due dates or early payment discount opportunities. Payment batching lets you group payments by vendor. This saves time and helps you manage cash flow better.

Integrations with accounting and financial management systems

Ramp integrates with whichever accounting system your business uses—so you can reconcile your books without friction. Ramp offers over 200 direct integrations with various applications, including ERP and nonprofit platforms like NetSuite, QuickBooks Online, Sage Intacct, and Blackbaud Financial Edge NXT, enabling real-time sync of vendor bills, reimbursements, payments, and accounting fields. Select systems also support bi-directional sync for vendor bills and imported item receipts.

For platforms without native integrations, Ramp also provides Universal CSV (uCSV) exports that match your chart of accounts, tracking categories, and project codes for seamless reconciliation. Ramp also offers a robust API and trusted implementation partners to support custom integrations when needed.

Low pricing and processing fees

Ramp offers a free plan that lets you manage spend, improve vendor payment timeliness, and speed up your month-end close. For organizations with more advanced needs, Ramp Plus is available at $15 per user per month, and custom Enterprise plans are also available upon request. Plus, you can handle all domestic and global vendor payments on a single platform—by check, card, ACH, or international wire with zero fees*.

AI agents for accounts payable

Ramp is also introducing AI agents for AP—autonomous systems built into Ramp that go beyond workflow automation. These agents understand invoice context and take action on behalf of your team. They code line items based on historical data, flag potential fraud, suggest the appropriate approver, and submit card payments when applicable.

Ramp customers can enable or join the waitlist for AP Agents in the Early Access tab. Auto-coding and approval recommendations are only available to Ramp Plus customers.

How schools are using Ramp Bill Pay

Education finance teams are using Ramp Bill Pay to handle vendor payments faster and see where money's going. From charter school networks to major university foundations, they're automating manual work and freeing up time to focus on students and staff.

Here's how two education organizations changed how they handle AP.

1. How The University of Tennessee Athletics Foundation streamlined approvals to better support student-athletes

The University of Tennessee Athletics Foundation needed to modernize its back office to match the pace and expectations of a top-tier athletics program. Manual processes for purchasing, bill pay, and reconciliation slowed down operations and diverted attention from where it mattered most: supporting student-athletes.

With Ramp, the foundation brought all spend management into a single platform. Bill pay is now centralized and automated, with granular approval workflows tailored to departments, teams, and individuals. Administrators can approve quickly, monitor activity in real time, and eliminate the back-and-forth that once bogged down the process.

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.” — Sarah Harris, Secretary at The University of Tennessee Athletics Foundation, Inc.

2. How KIPP Nashville cut its approval timeline with Ramp Bill Pay

Before Ramp, KIPP Nashville’s finance team was buried in manual processes. Bill payments required hand-coded invoices, slow approvals, and disconnected systems that didn’t sync with their accounting platform. Invoices would sit with approvers for weeks, and it wasn’t unusual for month-end close to take the entire month.

With Ramp Bill Pay, KIPP consolidated vendor payments, reimbursements, POs, and card management into a single system. Invoices are now processed automatically, approvals happen daily, and vendors are paid on time without manual intervention. Finance leaders can track invoice status, see real-time coding, and rely on integrated PO data to know when expenses are coming in.

These changes haven’t just saved time—they’ve improved compliance, boosted visibility, and freed the team to focus on strategic planning instead of chasing paperwork.

“There was no fire drill for the beginning of the school year this year, because the schools had a process. Ramp will ingest the line items automatically, so no more manual import. It’s made the process so much easier.” — Carey Peek, CFO at KIPP Nashville Public Schools

Why educational institutions automate AP with Ramp

Ramp Bill Pay helps schools, districts, and higher educational organizations manage accounts payable with more speed, accuracy, and control. With features built for grant compliance, complex approval hierarchies, and real-time budget oversight, Ramp allows finance teams to scale operations without adding administrative burden.

Most teams tell us they spend less time on invoice entry and month-end close, which means more time for the work that actually matters—like helping departments stay on budget or making sure grant money goes where it's supposed to.

Cut your invoice processing time. Get started with Ramp Bill Pay.

*Same-day ACH payments and International payments may incur a fee unless you are using a Ramp Business Account. Ramp Bill Pay is available on our free plan with no software or transaction fees. Note that certain ERP integrations require a Ramp Plus account, which includes a monthly fee.

FAQs

Ramp Bill Pay is Ramp’s name for its accounts payable software—a modern AP automation system that helps finance teams manage invoices, streamline approvals, and make vendor payments all in one place. It automates manual AP tasks, syncs directly with accounting systems like NetSuite, QuickBooks, and Sage Intacct, and gives businesses real-time visibility and control over spend.

Learn how your team can simplify and automate AP on our official Ramp Bill Pay page.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group