- How does a business credit card work?

- Benefits of business credit cards

- Disadvantages of business credit cards

- What is the difference between a business credit card and a personal credit card?

- Should I get a business credit card?

- How to apply for a business credit card

- How to use a credit card in business

- Consider Ramp's corporate card for your business

Business Credit Card

A business credit card is a type of credit card that’s intended for business use. Compared to personal credit cards, business credit cards often offer higher credit limits, better rewards on business purchases, and expense management features to track and report business spending.

A business credit card can be a powerful tool for managing expenses, earning rewards, and building credit—but is it the right move for your business? With higher limits, unique perks, and the ability to separate personal and business finances, these cards offer distinct advantages.

However, not all business credit cards work the same way, and choosing the right one can make a big difference. In this guide, we’ll break down how they work, their benefits, and what to watch out for before you apply.

Key takeaways

- Business credit cards help separate business and personal expenses while offering higher credit limits, rewards, and expense management tools tailored for business use.

- These cards function similarly to personal credit cards but may come with added benefits like free employee cards, better reward structures, and expense tracking features.

- Paying in full each month avoids interest, but revolving credit cards allow businesses to carry a balance—though at potentially high APR rates.

- Ramp offers a modern alternative to traditional business credit cards, with a charge card that has no fees, no interest, and smart expense management tools to help businesses control spending and streamline accounting.

How does a business credit card work?

Business credit cards work just like a personal credit card. You can charge purchases on the card and receive a statement at the end of the month that includes your balance and minimum payment amount.

Business credit cards also have features like:

- A revolving line of credit

- Higher credit limits than personal cards

- Free employee cards

When you pay the balance off in full, you won’t pay any interest. If you opt to carry a balance, you’ll accrue interest. Typically, if your business has a good credit history, you have a higher chance of landing a favorable interest rate.

Do you have to pay business credit cards in full every month?

It depends on the type of business credit card. Charge cards, like the Ramp Business Credit Card, require full payment each month, while revolving credit cards allow you to carry a balance, but interest will accrue if not paid in full.

The best business credit cards come with rewards, like cashback or travel perks. They usually come with higher credit limits than personal cards and may include expense management features such as custom spending limits, automated expense tracking, and reporting to streamline accounting processes and improve cash flow management.

As a bonus, separating personal and business expenses cleanly can help you spot tax deduction opportunities more easily.

Benefits of business credit cards

The major benefit of business credit cards is that they allow you to separate business and personal expenses while earning rewards.

Here’s a look at all of the advantages of opening a business credit card:

Separate business expenses | Using one card just for business spending makes it easy to track expenses, simplifying your tax return. |

|---|---|

Higher credit limits | Since businesses have higher monthly expenditures, business credit card offer higher credit limits. |

Rewards and perks | Choose between rewards programs like cashback, points on eligible purchases, and business travel rewards. |

Build business credit | Business credit cards allow you to build business credit, which lenders require when accepting applications for business loans. |

Sign-up bonuses | Typically, these cards provide more generous sign-up bonuses compared to consumer cards, although they may have an annual fee. |

Employee cards | Some business credit cards let you assign employee cards with custom spending limits to enforce your expense policy. |

What are the benefits of having business credit?

Having business credit makes it easier to secure loans, credit lines, and better financing terms. It also improves credibility with suppliers, enables higher credit limits, and can provide access to business-specific rewards and perks.

Disadvantages of business credit cards

While opening a business credit card is usually a good idea, there are some drawbacks to keep in mind:

Annual fees | Business credit cards often carry high annual fees, although they also offer savings through rewards. Small business owners should consider whether the rewards outweigh the fees. |

|---|---|

Personal guarantee | Unless your business has an established credit history, you’ll likely have to put up a personal guarantee upon account opening, holding you personally liable for any card debts. Corporate cards, unlike other credit cards, usually don’t require a personal guarantee. |

No consumer protections | The Credit Card Accountability Responsibility and Disclosure Act of 2009, more commonly known as the CARD Act, protects personal credit card customers from unannounced interest rate changes. The CARD Act doesn’t extend to business credit cards, so be sure to read the fine print from your credit card issuer to learn if they offer any protections. |

What is the difference between a business credit card and a personal credit card?

Here are some key differences between business and personal credit cards:

- Credit limits: Business credit cards often have higher credit limits compared to personal cards, accommodating the larger expenses typically incurred by businesses.

- Rewards: Business cards offer rewards tailored to common business expenses, like office supplies or travel, whereas personal cards tend to have rewards more suited to individual consumer spending patterns.

- Expense management tools: Business credit cards often come with advanced tools for tracking and categorizing expenses, which can be extremely helpful for budgeting, tax preparation, and financial reporting.

- Building credit: While both types of cards can help build credit, business cards affect your business credit score, and personal cards impact your personal credit score.

- Interest rates and fees: The interest rates and fees can vary between the two, often reflecting the different risk profiles of businesses and individuals.

While personal credit cards can be used for business expenses, and vice-versa, it's generally not a good idea to do so. Mixing personal and business expenses can complicate accounting, make it harder to track business expenses accurately, and potentially violate your card's terms and conditions.

Is business credit the same as personal credit?

The government uses your Social Security Number (SSN) to identify your personal credit, while your Employer Identification Number (EIN) or Tax ID Number is used to connect your business credit history and identify your business for tax purposes. Most business credit cards will ask for your SSN to apply, but your card activity will only reflect on your business credit score–as long as you also have an EIN number.

Should I get a business credit card?

Anyone who owns a business should consider getting a business credit card. Aside from letting you separate your business and personal expenses, building a business credit history will prove useful down the line should you seek out business financing.

Business credit cards are easier to qualify for than loans, making them an especially good option for new or small businesses. That said, if you have little to no credit, you will likely have an easier time getting approved for a charge card like the Ramp Corporate Credit Card.

Here are a few signs that you should get a business credit card:

- Juggling personal and business expenses on one card is getting confusing

- Your business is registered as a separate legal entity

- Your personal credit card limit isn’t high enough to cover your business needs

- You have employee spending and expense reimbursements

- You might need a business loan in the future

If you don’t have a strong personal credit score but still need a business credit card, consider a card program that doesn’t require a credit check or personal guarantee.

Discover Ramp's corporate card for modern finance

How to apply for a business credit card

To apply for a business credit card, you'll have to make sure your business meets the issuer's requirements, which usually include a good personal credit score and a Social Security Number.

The application process typically involves providing your business details and financial information. For new businesses or those with limited credit history, a personal guarantee or a secured business credit card might be necessary. With a secured card, you put up a security deposit that becomes your line of credit.

Do you need income for a business credit card?

Business credit card eligibility depends more on your personal credit and financial background, rather than your business's income. While you won’t need to prove any business financials, you’ll likely have to put up a personal guarantee. That means that you as the cardholder, not your business, will be responsible for any credit card debt.

Can I use my business credit card for personal use?

It isn’t illegal to use a business credit card for personal use, but it probably goes against the terms and conditions outlined in your cardholder agreement. If you regularly put personal expenses on your business credit card, that could raise a red flag for your credit card issuer, potentially leading to the cancellation of your card.

Is it worth getting a business credit card?

Yes, getting a business credit card can be beneficial, especially if you want to separate business expenses and build credit. If you prefer to avoid carrying a balance and want to maximize cash flow management, a charge card might be a better option.

How to use a credit card in business

Using a credit card in business can help manage expenses, build credit, and improve cash flow. Here’s how to use it effectively:

- Separate business and personal expenses – Use a dedicated business credit card to keep finances organized for tax and accounting purposes.

- Make essential purchases – Use it for recurring expenses like office supplies, travel, or inventory, but avoid unnecessary spending.

- Pay in full each month – To avoid interest charges, pay off the balance every month, or consider a charge card if you want to be required to do so.

- Leverage rewards and benefits – Choose a card that offers cashback, travel points, or discounts on business-related expenses.

- Monitor spending and cash flow – Use built-in expense tracking tools to manage budgets and prevent overspending.

- Build business credit – Consistently paying on time helps establish a strong business credit profile, improving financing opportunities.

- Utilize introductory offers – Some cards offer 0% APR periods or signup bonuses that can provide short-term savings. Since a typical APR range is 20-30%, it pays to take advantage of these incentives.

How often do you pay on a business credit card?

Business credit card payments are typically due monthly, but you can make multiple payments throughout the billing cycle to reduce interest and improve cash flow.

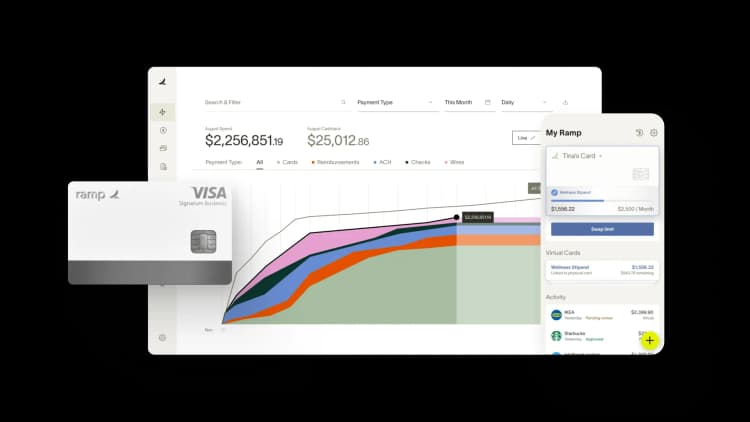

Consider Ramp's corporate card for your business

Ramp is unlike the traditional business credit cards. Our charge card comes with no fees and no interest.

When you sign up for Ramp, you also get access to intuitive software that provides a host of useful tools.

Here are just a few of the features you can expect with a Ramp corporate card:

- Set individual spending limits and restrictions on free employee cards

- Access a higher credit limit with sales-based underwriting

- Take advantage of automatic receipt tracking and purchase categorization

- Integrate your Ramp account with your favorite bookkeeping platforms to save time closing your books

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits