- Double vs. single-entry accounting

- How does double-entry accounting work?

- Types of accounts used in a double-entry system

- Benefits of double-entry accounting

- Double-entry accounting examples

- Automate bookkeeping with AI that codes, syncs, and reconciles transactions for you

Double-entry accounting

Double-entry accounting is a bookkeeping method where each financial transaction is recorded with equal and opposite entries in two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) stays balanced. This system enhances accuracy and provides a clear, comprehensive view of financial activities.

Double-entry accounting records financial transactions in at least two different accounts: one as a debit and the other as a credit. While this bookkeeping method might sound tedious, it is essential for maintaining accurate financial records and sticking to generally accepted accounting principles (GAAP).

Double vs. single-entry accounting

Single-entry accounting is a process by which financial transactions are recorded once, either as revenue or an expense. Conversely, double-entry accounting tracks both sides of the transaction in two different accounts. Each business transaction is recorded as two separate entries: one as a debit entry and the other as a credit entry.

Double-entry bookkeeping also tracks liability accounts, asset accounts, and equity accounts alongside revenue and expense accounts, which makes it suitable for small businesses and larger enterprises. This ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced, making financial reporting and analysis more reliable.

How does double-entry accounting work?

Double-entry accounting ensures that every financial transaction affects at least two accounts in the general ledger. For example:

- A debit entry decreases liabilities or equity accounts while increasing asset accounts or expense accounts.

- A credit entry increases revenue accounts, liabilities, or equity accounts while decreasing asset accounts or expenses.

This method allows businesses to maintain accurate financial statements, including the balance sheet, income statement, and cash flow statement. It also facilitates the generation of a trial balance to ensure total debits equal total credits, keeping the sides of the equation balanced.

Types of accounts used in a double-entry system

The double-entry bookkeeping system uses five types of accounts. These include assets, liabilities, equity, revenue, and expenses. Understanding these accounts helps you understand the effect of a particular transaction.

- Assets: Resources your business owns, such as cash accounts, accounts receivable, inventory, equipment, and prepaid expenses.

- Liabilities: Financial obligations owed to another party, such as accounts payable, unearned revenue, and bank loans.

- Equity: The difference between the company’s assets and liabilities, including retained earnings and owner investments.

- Revenue: Earnings from sales or other income accounts.

- Expenses: Costs of running the business, such as payroll, rent, and utility expenses.

Benefits of double-entry accounting

A double-entry accounting system provides several benefits that make it the preferred bookkeeping method for businesses of all sizes:

- Reduces accounting errors: Double-entry bookkeeping reduces errors compared to the single-entry method because transactions are recorded in two accounts, helping minimize accounting mistakes.

- Prevents fraud: This system also prevents fraud because each transaction has a visible record on both sides, which must balance.

- Improves reliability: The double entry is more reliable than a single entry because it provides a clear view of your business finances. It enables you to know the exact state of your accounts at any time.

- Boosts cash flow management: Double-entry bookkeeping provides an accurate view of your account receivable and payable. It lets you easily manage cash flow, identify slow-paying clients, and chase overdue payments.

- Simplifies financial reporting: The entry system simplifies financial reporting as it provides accurate records and helps identify and correct errors fast before they affect subsequent transactions.

- Helps in financial decision-making: The dual accounting method provides valuable insights into your business's financial operations. It helps make informed decisions in setting financial goals or taking advantage of business opportunities. It leverages technology to assess the financial health of your business through data-driven solutions.

- Enhances comparisons: This bookkeeping system lets you easily compare financial activities between two periods. It helps to identify areas that need improvement in the future and makes projections for budgeting.

Double-entry accounting examples

One of the most common concerns with double-entry accounting is understanding how to correctly identify which accounts to debit or credit for each transaction. Below are examples of double entries with transactions recorded in two or more accounts for the balance.

Example 1

If your business records a depreciation expense of $50,000, you will debit the depreciation expense account and credit the accumulated depreciation account to reflect the reduced value of assets.

- Depreciation expense: $50,000 (Debit)

- Accumulated depreciation: $50,000 (Credit)

Example 2

If your business pays a utility bill of $3,500, the asset account decreases (cash) while the expense account increases. You will therefore debit utility expenses and credit cash.

- Utility bill: $3,500 (Debit)

- Cash: $3,500 (Credit)

Example 3

Assume that your company purchased an inventory worth $100,000. You paid $60,000 cash, and the balance was on the account. To journalize these entries, you calculate the amount on account ($100,000 - $60,000) = $40,000. You credit the inventory at $100,000, credit cash at $60,000, and credit accounts payable at $40,000.

- Inventory: $100,000

- Cash: $60,000

- Accounts Payable: $40,000

Example 4

Towards the end of the last financial year, a particular company declared dividends of $43,000. This company should debit retained earnings and credit the dividend payable. If the company paid the dividends two months later, then the company debits dividends payable and credits cash.

- Retained earnings: $43,000 (Debit)

- Dividends payable: $43,000 (Credit)

Once paid:

- Dividends payable: $43,000 (Debit)

- Cash: $43,000 (Credit)

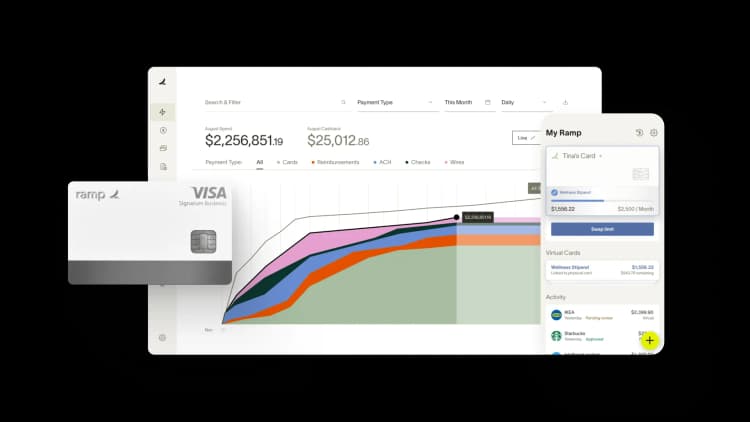

Automate bookkeeping with AI that codes, syncs, and reconciles transactions for you

Manual bookkeeping eats up hours every week and introduces errors that throw off your books. Ramp's AI-powered accounting software eliminates manual data entry and ensures accurate double-entry accounting by automating transaction coding, syncing, and reconciliation across your entire financial system.

Ramp codes every transaction automatically across all required fields using AI that learns your accounting patterns and applies your feedback over time. You'll see a 67% increase in zero-touch codings compared to rules-only automation, so fewer transactions need manual review, and your books stay current without constant intervention.

Once coded, Ramp syncs transactions directly to your ERP in real time, posting debits and credits that maintain double-entry integrity. The platform identifies in-policy spend and syncs it automatically, so routine transactions flow through without bottlenecks, while flagged items stay in your review queue for closer attention.

The result: You'll save 40+ hours every month and close your books 3x faster, with fewer errors and full audit readiness.

Try a demo to see how Ramp can automates your bookkeeping workflow.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits