Deferred revenue journal entry: How to record unearned revenue

- What is deferred revenue?

- How deferred revenue works in accrual accounting

- Deferred revenue journal entry: Step-by-step guide

- Deferred revenue journal entry examples

- Managing deferred revenue: Best practices

- How to avoid common journal entry mistakes

- Deferred revenue and financial reporting

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

A deferred revenue journal entry records cash you receive before delivering a product or service and recognizes that revenue only as you fulfill the obligation. In practice, this happens in two steps: you first record the payment as deferred revenue, then reclassify it to earned revenue over time. Recording these entries correctly keeps revenue timing accurate and ensures your financial statements reflect what your business has actually earned.

What is deferred revenue?

Deferred revenue, also called unearned revenue, is cash you receive from a customer for a product or service you’ll deliver in the future. Because you still owe the customer that product or service, deferred revenue is recorded as a liability on your balance sheet rather than as income.

In accrual accounting, prepaid funds increase your cash balance but don’t count as revenue on the income statement until you deliver the goods or services. That’s why deferred revenue often improves short-term cash flow without immediately increasing reported revenue.

If the product or service is never delivered, the payment must be returned to the customer. Until your obligation is fulfilled, deferred revenue represents money you’ve collected but haven’t yet earned.

How deferred revenue works in accrual accounting

Accrual accounting recognizes revenue when your company earns it, not when you receive cash. This approach follows the revenue recognition principle, which requires revenue to be recorded in the period when goods or services are delivered.

Deferred revenue fits naturally into this framework. When cash comes in before delivery, you record it as a liability. As you fulfill the contract over time, you reduce that liability and recognize revenue gradually.

This treatment also supports the matching principle. Revenue is recognized in the same periods as the costs incurred to deliver the product or service, which leads to more accurate profitability reporting.

| Accrual accounting | Cash accounting |

|---|---|

| Recognizes revenue when earned | Recognizes revenue when you receive cash |

| Uses deferred revenue for prepayments | No deferred revenue account |

| Required under generally accepted accounting principles (GAAP) for most businesses | Common for very small businesses |

Cash accounting differs from accrual accounting because it does not account for deferred revenue. As a result, income can appear inflated in periods with large upfront payments, even though the underlying obligations have not yet been fulfilled.

Deferred revenue journal entry: Step-by-step guide

A deferred revenue journal entry always follows the same logic: record cash as a liability when payment is received, then recognize revenue as the obligation is fulfilled.

Recording deferred revenue isn’t complicated, but consistency matters. Each entry serves a specific purpose, and skipping steps can lead to misstatements that compound over time.

Step 1: Record deferred revenue

When you first receive payment, you haven’t earned the revenue yet. You record the cash and set up a deferred revenue liability.

Journal entry format:

Debit: Cash

Credit: Deferred revenue

Example of deferred revenue:

A customer prepays $12,000 for a 12-month subscription. You would record it as:

Debit: Cash $12,000

Credit: Deferred revenue $12,000

At this point, no revenue is recognized on the income statement.

Step 2: Recognize revenue over time

As you deliver the service, you recognize revenue by reducing deferred revenue and increasing earned revenue.

Journal entry format:

Debit: Deferred revenue

Credit: Revenue

Example:

For the annual subscription, you divide the total amount received by 12 to calculate monthly revenue.

$12,000 / 12 months = $1,000 per month

Each month, you record:

Debit: Deferred revenue $1,000

Credit: Revenue $1,000

You continue until the deferred revenue balance reaches zero.

Step 3: Adjust journal entries

At the end of each period, you make adjusting entries to reflect progress that hasn’t yet been recorded. Common adjustments include:

- Partial fulfillment, which requires prorating revenue based on time or usage

- Refunds and cancellations, which reverse deferred revenue and, if needed, previously recognized revenue

- Contract modifications, which require updating the remaining deferred revenue schedule to reflect new terms

Deferred revenue journal entry examples

Deferred revenue journal entries are easier to understand when you see how upfront payments move from liabilities to earned revenue over time. These examples show how timing affects journal entries across common business scenarios.

SaaS subscription

A software-as-a-service (SaaS) company sells a 6-month software subscription for $12,000, paid upfront.

Initial entry:

Debit: Cash $12,000

Credit: Deferred revenue $12,000

Monthly entry (6 months):

Debit: Deferred revenue $2,000

Credit: Subscription revenue $2,000

Deferred revenue activity:

Credit: $12,000 (initial payment)

Debit: $2,000 monthly * 6

A simple T-account view helps visualize this:

| Debit | Credit |

|---|---|

| $2,000 (Month 1 recognition) | $12,000 (Initial payment) |

| $2,000 (Month 2 recognition) | |

| $2,000 (Month 3 recognition) | |

| $2,000 (Month 4 recognition) | |

| $2,000 (Month 5 recognition) | |

| $2,000 (Month 6 recognition) | |

| Total debits: $12,000 | Total credits: $12,000 |

Service contract

A consulting firm signs a 6-month service contract for $6,000, billed upfront.

Initial entry:

Debit: Cash $6,000

Credit: Deferred revenue $6,000

Monthly recognition:

$6,000 / 6 = $1,000 per month

Each month:

Debit: Deferred revenue $1,000

Credit: Service revenue $1,000

After 6 months, deferred revenue is fully recognized.

Product deposit

A customer places a $3,000 deposit on a custom product.

Initial entry:

Debit: Cash $3,000

Credit: Deferred revenue $3,000

Upon delivery:

Debit: Deferred revenue $3,000

Credit: Product revenue $3,000

Revenue recognition occurs at delivery, not when payment is received.

Managing deferred revenue: Best practices

Managing deferred revenue becomes more complex as transaction volume grows. Clear policies, reliable tracking, and automation help reduce errors, support compliance, and keep financial reporting consistent.

Establish clear revenue recognition policies

Written policies for unearned revenue define when your company earns revenue and how it should be measured. These policies create consistency across contracts and teams and reduce judgment calls during month-end close. Clear documentation also supports audits and helps new team members apply revenue recognition rules correctly as the business scales.

Set up proper tracking systems and schedules

Deferred revenue requires schedules that map revenue recognition to time or performance milestones. Without structured tracking, it’s easy to miss monthly entries or recognize too much revenue at once. Reliable systems make revenue recognition repeatable. They support accurate forecasting, consistent journal entries, and fewer last-minute adjustments during close.

Maintain detailed documentation for audit trails

Contracts, invoices, and recognition schedules should link directly to journal entries. Strong documentation supports compliance, speeds up audits, and reduces back-and-forth with auditors. Clear audit trails also make internal reviews more efficient and lower the risk of errors going unnoticed.

Review and reconcile deferred revenue accounts regularly

Monthly payment reconciliations help catch issues early. Regular reviews confirm that deferred revenue balances reflect outstanding obligations rather than outdated contracts or missed adjustments. Consistent reconciliation also improves forecasting by keeping deferred revenue balances accurate and current.

Use accounting software features for automation

Manual deferred revenue tracking does not scale. Automation helps generate journal entries, apply recognition schedules, and sync data across billing and accounting systems. Modern accounting tools reduce manual effort, minimize errors, and provide real-time visibility into deferred revenue balances.

How to avoid common journal entry mistakes

Deferred revenue errors usually stem from timing or classification issues. To avoid misstating revenue or liabilities, entries should always reflect when obligations are fulfilled rather than when cash moves.

Watch for these common issues and how to prevent them:

- Recording deferred revenue as immediate income: Always confirm whether goods or services have been delivered before recognizing revenue, even if payment is received upfront

- Forgetting to recognize revenue over the service period: Use revenue recognition schedules tied to contract terms so deferred balances are reduced consistently each period

- Misclassifying deferred revenue on financial statements: Review balance sheet classifications regularly to ensure deferred revenue is recorded as a liability until earned

- Failing to adjust for contract modifications or cancellations: Revisit deferred revenue schedules whenever contracts change to reflect updated timing, scope, or refund obligations

Deferred revenue and financial reporting

Deferred revenue affects all three financial statements by separating cash collection from revenue recognition. This distinction helps ensure financial reports reflect actual performance rather than payment timing.

On the balance sheet, deferred revenue appears as a current or long-term liability depending on when the obligation will be fulfilled. On the income statement, it determines when revenue is recognized, smoothing income over the period services are delivered. On the cash flow statement, deferred revenue explains why cash received may not match reported revenue.

Deferred revenue also matters for financial analysis:

- It impacts current ratios and working capital

- It affects revenue growth trends and comparability across periods

- It influences the predictability of future earnings

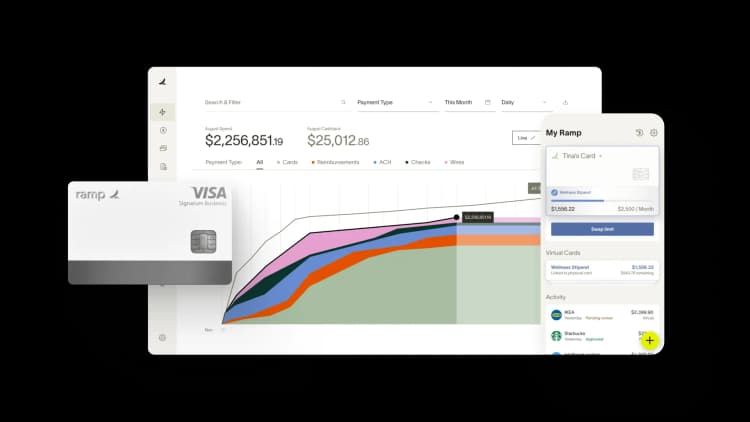

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits