What are payroll expenses? A complete guide for businesses

- What are payroll expenses?

- Examples of payroll expenses

- Payroll expenses vs. wage expenses

- Payroll expenses for independent contractors

- How to calculate payroll expenses in 5 steps

- Making payroll tax journal entries

- Strategies for managing payroll expenses

- Simplify your payroll expense management with Ramp

Managing your payroll expenses is much more than just compensating your employees. It includes staying on top of all the associated costs, including payments to independent contractors and other monthly costs associated with payroll, including taxes, software, and more.

Whether you manage a startup, a small business, or a large enterprise, understanding your payroll costs is essential to both your bottom line and compliance with tax laws. In this article, we offer a clear definition of payroll expenses, share tips on how to calculate them, and provide strategies for managing them.

What are payroll expenses?

Payroll expenses refer to the total cost you take on to pay your employees. This includes regular wages and salaries, overtime, bonuses, commissions, benefits, and payroll taxes. If you work with contractors or freelancers, their compensation also falls under payroll-related costs.

Tracking your payroll expenses helps you manage costs, plan headcount, and meet reporting requirements. Since these expenses take up a large share of your budget, even small changes can affect your margins and cash flow.

Payroll goes beyond wages because you’re responsible for more than just what employees take home. You cover payroll taxes like Social Security and Medicare, and you may offer health insurance, retirement contributions, or paid time off. These extras add up and vary by role, location, and benefit structure.

According to a 2023 survey from Mercer, the average employer spends over $15,700 per employee each year on health benefits alone. When you factor in taxes and other contributions, your true payroll cost can be much higher than expected.

Examples of payroll expenses

As we’ve noted, payroll expenses encompass many different facets of the payroll system. Not all payroll expenses look the same across teams or industries. What you include depends on how you structure compensation, the benefits you offer, and the types of workers you employ. Below, we go into more detail on each component.

Gross wages

Employers must pay employees and contractors for the services they perform. Salaries and wages are usually the largest component of payroll expenses for employers. This includes base salaries, hourly wages, overtime pay, and bonuses.

Gross pay is the amount you pay your employees before any withholdings for taxes and benefits are taken out. Net pay is the amount on their check each pay period.

Payroll taxes

A percentage of every employee’s pay gets withheld to cover state and federal income taxes. These are the key payroll taxes to be aware of:

- FICA tax withholdings: This is the federal payroll tax that funds Social Security and Medicare benefits. Employees pay 6.2% of their gross wages to Social Security and 1.45% to Medicare, totaling 7.65% in payroll tax withholdings. Your business matches this 7.65% rate, which counts as a business payroll expense.

- FUTA: The Federal Unemployment Tax Act (or FUTA) requires businesses to pay taxes that fund state unemployment insurance programs. FUTA tax is the amount employers pay annually to the IRS. At the federal level, the first $7,000 of a worker’s gross wages gets taxed at 6%.

- SUTA: The State Unemployment Tax Act (or SUTA) is similar to FUTA, except it is collected at the state level, and rates vary by state. If your wages are subject to SUTA taxes, your business may be eligible for a tax credit of up to 5.4% for the federal program. This reduces the FUTA tax to 0.6%.

- State and local taxes: Most states collect an income tax in addition to the federal income tax. Certain municipalities, like New York City, San Francisco, St. Louis, and Detroit, also levy an additional local tax.

Employees must fill out IRS Form W-4 and the state equivalent, where necessary, to determine their federal, state, and local tax rates. The amount withheld automatically for W-4 employees depends on filing status and total income.

Employers are responsible for actually withholding the proper amounts, paying unemployment taxes (FUTA and SUTA), reporting and depositing taxes to the IRS, and providing employees with documentation (a W-2) at the end of each tax year.

Employee benefits

These funds get earmarked for employee benefits. Businesses generally only have benefits withholdings for full-time workers, but some companies also offer benefits to part-time staff. Some of the most common employee benefits include:

- Healthcare coverage, including health insurance, dental, vision, and other related benefits

- Paid time off, such as vacation time and sick leave

- Retirement plans, including 401(k) plans or other employer-sponsored savings programs

- Life insurance premiums paid on behalf of employees

- Workers’ compensation coverage, required by law in many states

- Childcare assistance or subsidies offered as part of the benefits program

For employees, benefits are considered a part of their total compensation. For employers, these are factored into payroll expenses depending on the cost to the employer and the total scope of the benefits programs.

Other payroll-related costs

Depending on how you categorize your business expenses, you might consider payroll processing a payroll expense. This would include any costs related to payroll processing services, including payroll software, online payroll services, processing fees, or support from a third-party payroll specialist.

Other payroll-related costs include workers’ compensation insurance and wage garnishments. You may also need to account for time-tracking systems, employer-paid unemployment insurance, bank transfer fees tied to payroll runs, or compliance costs related to payroll tax filings.

Payroll expenses vs. wage expenses

Wage expenses refer to the hourly or salaried amount paid to employees. Payroll expenses, on the other hand, include the total cost of paying an employee, including salary taxes, benefits, and processing.

The difference matters when it comes to accounting and reporting:

Category | Wage expenses | Payroll expenses |

|---|---|---|

Scope | Covers only direct employee earnings | Includes wages plus all additional compensation-related costs |

What it includes | Base pay, hourly wages, overtime, bonuses, commissions | Wage expenses, employer payroll taxes, benefits, insurance, contractor payments |

Applies to | Employees only | Employees, contractors, benefit providers, payroll service vendors |

Accounting treatment | Recorded as part of compensation or cost of labor | Recorded as a broader payroll or administrative expense |

Reporting | Appears in employee earnings statements | Required for IRS forms, tax filings, and year-end reporting |

Tax impact | Subject to income tax withholding | Includes employer share of Social Security, Medicare, and unemployment taxes |

Budget planning | Helps estimate take-home pay and direct compensation | Provides full picture of labor costs for financial forecasting |

Examples | $60,000 salary, $1,000 bonus | Salary, bonus, 401(k) match, payroll tax, health insurance, software fees |

Payroll expenses for independent contractors

While calculating their payroll expenses, employers must also include payments to freelancers and independent contractors. However, it’s important to note that, unlike for your W-4 employees, you don’t need to withhold any of an independent contractor’s gross income.

A worker’s classification determines how your business handles tax withholdings for them. If the worker is an employee, you’re responsible for the payroll expenses, including wages, payroll taxes, and benefits.

In contrast, independent contractors are responsible for their own tax withholdings and don’t receive benefits from the business. Here, your only payroll expense is the contractor’s gross wages.

If you pay an independent contractor more than $600 in a year, you're required to file a 1099-NEC form to the contractor and the IRS. The independent contractor is responsible for their own tax obligation, including paying quarterly self-employment taxes for their individual tax return.

How to calculate payroll expenses in 5 steps

Finance teams, payroll specialists, or business owners themselves usually handle payroll expense calculations. Projecting your business’s total payroll costs can help you set a budget and allocate cash for upcoming expenses. You can follow these practical steps to calculate payroll:

Step 1: Collect form W-4 and state tax forms

When a new employee starts at your company, they must complete IRS Form W-4. It informs your business of how much money to withhold from the employee’s paycheck for income taxes.

The employee indicates their allowances, tax filing status, and other factors to determine their tax withholdings. New employees will also need to submit the equivalent state form, where applicable.

Accuracy is essential on a W-4 because it's the basis of all tax withholdings and can impact how much tax an employee owes at the end of the year.

Step 2: Calculate gross pay

Begin your calculation with your employees’ gross wages, excluding all withholdings. Your payroll period will determine how much of an employee’s wages you pay on each payroll date.

For example, let’s say you have a biweekly payroll. If an employee earns $50 per hour and works 40 hours per week, they receive a gross pay of $4,000 per biweekly pay period. You can then calculate annual payroll costs and break them down into monthly, quarterly, or weekly costs as needed.

If your employees are salaried, it will be a set amount per pay period.

Step 3: Calculate withholdings and net pay

Net pay is the amount an employee receives after all payroll tax deductions. To calculate withholdings, use the employee’s gross wages, the information they provided on Form W-4 (and the equivalent state income tax form), and their benefits elections.

Using the same example from above, let’s say the employee withholds 15% for federal income taxes and 5% for state income taxes:

- Gross wages: $4,000

- Federal income tax withholding (15%): $4,000 * 0.15 = $600

- State income tax withholding (5%): $4,000 * 0.05 = $200

- FICA taxes (7.65%): $4,000 * 0.0765 = $306

- Healthcare deduction: Flat $100 per period

- Total withholdings: $600 + $200 + $306 + $100 = $1,206

- Net pay: $4,000 − $1,206 = $2,794 per payroll period

Tracking each withholding helps you ensure accurate payroll, avoid compliance issues, and give employees a clear breakdown of their earnings.

Step 4: Add employer payroll taxes and contributions

Next, add in the additional employer taxes and contributions. This includes the FICA match, FUTA and SUTA tax obligations, and any employer benefits you offer, such as 401(k) matching or health and wellness reimbursements.

Step 5: Total payroll expenses

Lastly, add all the numbers you pulled together, and you’ll understand the full sum of your payroll expenses per employee.

Using the example above, this would include the $4,000 gross wage, your contributions for the FICA match, FUTA and SUTA taxes, the amount you agree to pay for healthcare benefits, your 401(k) match, and any other benefits you offer your employees. The total amount is the cost of keeping this employee employed on your team.

Making payroll tax journal entries

Posting payroll tax journal entries is crucial for accurate financial bookkeeping and tax compliance. You can use three types of entries to organize your payroll costs:

- Accrual accounting for payroll: Accountants should debit accrued earnings and credit wages payable. These entries should take place during their corresponding pay periods.

- Accrued payroll in cash: Cash payments debit your wages payable account and credit your cash position

- Income taxes withheld: Your company records liabilities for the amount you withhold in income taxes. Once your business pays withheld taxes, cash decreases with a credit, while tax liabilities decrease with a debit.

Here’s a simple example of how a journal entry might look for a $5,000 payroll:

Account | Debit | Credit |

|---|---|---|

Salaries and Wages Expense | $5,000 | |

Federal Income Tax Payable | $500 | |

FICA Payable | $382.50 | |

State Income Tax Payable | $250 | |

Cash | $3,867.50 |

Strategies for managing payroll expenses

Keeping your payroll expenses organized makes it easier to create accurate budgets and ensure timely payments. Here are some strategies you can use to ensure paydays go smoothly:

Monitor your payroll budget to identify trends

As your understanding of payroll expenses becomes more nuanced, you can periodically review your budget to identify trends in wages, benefits, and payroll tax expenses.

It costs more money and time to replace an employee than it does to retain top talent. You may find in reviewing your data that you can retain top talent by giving an existing employee a raise to keep them on board. You can maintain a strong payroll and productivity position by retaining your top talent.

Avoid overstaffing and monitoring overtime pay

If you bring on more workers but productivity stays the same or there’s not enough work to keep your existing team busy, it may be time to reexamine your strategy. Consider how hiring a new worker would increase productivity in the long run. You should also determine whether the additional cost is worth the marginal increase in the company’s output.

Non-salaried employees may get extra pay if they work for more than 40 hours a week. While you can’t avoid overtime entirely, you can look for ways to keep it manageable. Consider implementing a pre-approval process or hiring additional staff to distribute the workload.

Use payroll software for accuracy and efficiency

Investing in payroll processing software helps make payroll less time-consuming and minimizes the risk of human error. Payroll systems reduce your investment in outsourcing these kinds of tasks to payroll specialists. Automated payroll software also helps you keep up with changes in tax laws.

Stay up to date with tax laws

Tax laws are frequently changing at the federal, state, and local levels. So, before making any decisions about your payroll expenses, always make sure you’re working from the most up-to-date rules and regulations. And if you’re ever unsure, consult with a tax professional.

Simplify your payroll expense management with Ramp

As a small business owner, managing payroll expenses can be challenging on your own. You have to calculate the gross pay for each employee, determine how much to withhold from every paycheck, and comply with state and federal regulations.

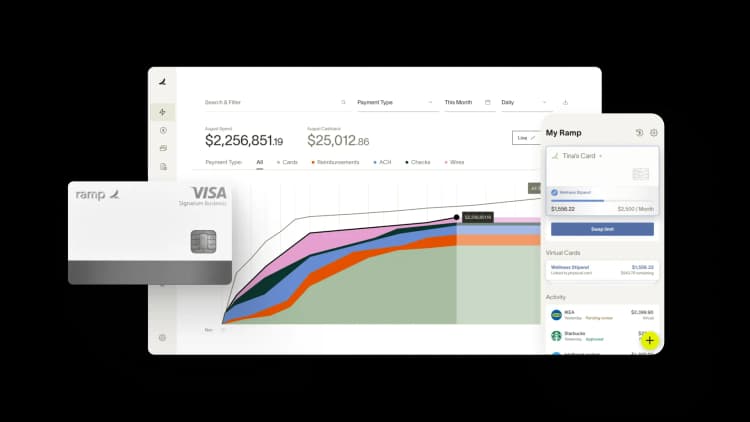

Ramp has you covered if you need help with managing payroll costs. Stay on top of all your business expenses with Ramp's all-in-one expense management software. We integrate with QuickBooks, NetSuite, Xero, Square Payroll, and other accounting software to help you close your books faster and maintain accurate financial statements.

Give Ramp a try and see why our customers save an average of 5% a year across all spending.

FAQs

Yes, the amount you pay to independent contractors is part of your total payroll expenses. However, you generally don't withhold taxes or offer employee benefits to contractors.

Yes. Depending on the size of your company, payroll may be one of your most significant business expenses.

Yes, payroll tax expenses appear as operating expenses on your income statement.

Gross pay is the base wage you offer your employee before taxes. Net pay, on the other hand, is the amount on their paycheck that they actually take home once taxes and benefits are withheld.

There are four common IRS payroll tax forms to keep in mind:

- Form 940: To report federal and FICA taxes quarterly

- Form 941: Your annual federal unemployment (FUTA) tax form

- Form 1096: File this annually to report the dollars you pay independent contractors via 1099 forms

- Form W-3: File this with the Social Security Administration each year to report the total wages and tax withholdings for all of your employees

As a general rule, employees are required to pay income taxes in the state where they perform their work duties. Therefore, if you employ fully remote team members, you must withhold income taxes based on the state where their home office is located. If they live in one state but do work in another, you should withhold income tax based on the state where they actually do the work.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits