Economic profit: Definition, formula, and examples

- What is economic profit?

- Why economic profit matters for businesses

- Economic profit vs. accounting profit

- The economic profit formula

- Opportunity cost and its role in economic profit

- How to calculate economic profit

- How businesses use economic profit to make decisions

- Track true profitability with Ramp's real-time spend visibility and automated reporting

Economic profit goes beyond standard accounting metrics to show the true financial impact of business decisions. It factors in explicit costs (like wages and materials) and implicit costs (such as opportunity costs), providing a clearer picture of profitability. Unlike accounting profit, which only looks at revenue minus expenses, economic profit considers the cost of missed opportunities.

What is economic profit?

Economic profit

Economic profit is the difference between a company’s total revenue and the sum of its explicit and implicit costs. It is a measure of true profitability that accounts for both explicit and implicit costs.

Accounting profit only factors in explicit costs, while economic profit goes further by assessing how effectively a company utilizes its resources to maximize profitability. If a business has a positive economic profit, it means it is generating returns that exceed the next best alternative use of its resources. If economic profit is negative, it signals that the company’s capital could have been better allocated elsewhere.

Why economic profit matters for businesses

Economic profit is primarily calculated by businesses that need to assess whether their resources are being used efficiently to generate real economic value. Large corporations and publicly traded companies use it to determine if they are creating returns above their cost of capital, ensuring long-term shareholder value.

Startups and high-growth businesses rely on it to gauge whether their rapid expansion is truly profitable beyond surface-level earnings. Capital-intensive industries, on the other hand, such as manufacturing, energy, and infrastructure, calculate economic profit to ensure that their heavy investments yield returns that justify their costs. In all cases, economic profit provides a clearer financial picture than accounting profit, helping businesses make strategic decisions that drive sustainable growth.

- It measures real profitability, not just earnings on paper. A business can report high accounting profits yet still fail to generate economic profit. For example, if a company earns $500,000 in accounting profit but could have made $600,000 by investing its resources elsewhere, its economic profit is actually negative. This insight helps businesses avoid false assumptions about their financial health.

- It improves long-term decision-making. Businesses rely on economic profit to assess whether an investment, expansion, or operational change is truly beneficial. If a company consistently earns negative economic profit, it indicates that its capital could be better used in a different industry, market, or strategy. This is especially important for large corporations managing multiple business units.

- It determines competitive advantage. A company that generates consistent economic profit is outperforming competitors in efficiency and profitability. Businesses with positive economic profit are using resources more effectively, leading to sustained growth, market leadership, and stronger financial stability. On the other hand, businesses with negative economic profit may struggle to compete, as they are not maximizing their potential returns.

- It influences investor confidence and valuation. Investors and analysts use economic profit to gauge a company’s ability to create real value. Companies with high economic profit typically attract more investment, higher stock valuations, and better financing opportunities. Investors prefer businesses that generate returns exceeding the cost of capital, as it indicates strong management and long-term profitability.

- It helps in pricing and cost efficiency. Understanding economic profit allows businesses to refine pricing strategies and optimize costs. If a company’s economic profit is negative, it may need to adjust pricing, reduce depreciation expenses, or improve operational efficiency to stay competitive. Companies that regularly analyze economic profit are more likely to make proactive adjustments before financial problems arise.

Economic profit vs. accounting profit

Both economic profit and accounting profit measure a company's financial performance, but these types of profit serve different purposes. Accounting profit is the net income a business reports after subtracting explicit costs. It follows standard accounting principles and is used for tax filings, financial reporting, and compliance.

Economic profit, on the other hand, goes a step further by including implicit costs. A company can report high accounting profit while having negative economic profit, indicating that its resources could have been more profitably invested elsewhere.

Accounting Profit | Economic Profit | |

|---|---|---|

What it measures | The money a company actually earns after subtracting direct expenses | Whether a company is making the best financial decisions based on opportunity costs |

Costs considered | Only explicit costs (e.g., wages, rent, materials) | Both explicit costs and implicit costs (e.g., forgone investment returns, alternative business opportunities) |

Why it matters | Helps with tax filings, financial reporting, and compliance | Helps businesses and investors determine if resources are being used efficiently |

Business impact | A company with positive accounting profit can still be underperforming | A positive economic profit means the company is outperforming alternative investment options |

Example scenario | A business generates $1M in revenue, with $700K in explicit costs, leaving $300K in accounting profit | If the company could have earned $350K by investing the same resources differently, its economic profit is -$50K, signaling inefficiency |

The economic profit formula

Economic profit measures a business’s true profitability by factoring in both explicit and implicit costs. It is calculated using the formula:

Economic Profit = Total Revenue − (Explicit Costs + Implicit Costs)

Total revenue includes all income a business generates from sales, services, or other operations. Explicit costs are direct expenses such as wages, rent, raw materials, and utilities. These are the expenses that appear on financial statements.

Implicit costs represent opportunity costs or the potential earnings a business sacrifices by choosing one investment over another. These are not recorded in traditional accounting but play a crucial role in financial decision-making.

For example, if a company generates $1 million in revenue, spends $600,000 on explicit costs, and has an opportunity cost of $200,000, its economic profit is $200,000. This means the company is creating value beyond its total costs. However, if implicit costs increase to $500,000, the economic profit becomes negative, signaling that its resources might be better allocated elsewhere.

Tracking economic profit requires businesses to accurately categorize expenses and assess opportunity costs. Manually doing this can be time-consuming and prone to errors. Ramp’s AI-powered transaction categorization automates this process, ensuring expenses are classified correctly, and financial data remains accurate for better decision-making.

Opportunity cost and its role in economic profit

Opportunity cost is the value of the best alternative a business gives up when making a decision. It plays a key role in economic profit because it helps businesses determine whether their resources are being used most effectively.

Industries that rely heavily on capital investments, like real estate, manufacturing, and tech startups, are most affected by opportunity costs. A tech company, for instance, must decide whether to fund new product development or expand marketing efforts. If it chooses marketing and later finds out the new product could have led to higher long-term revenue, the opportunity cost of that decision becomes clear.

Even businesses that seem profitable can struggle if they consistently ignore opportunity costs. A company making $100,000 in accounting profit may appear successful, but if it could have earned $120,000 by using its resources differently, it would have lost $20,000 in economic profit. This is why businesses factor in opportunity costs when setting prices, making investments, and managing operations.

Opportunity cost doesn’t just affect immediate income statements. It also shapes long-term strategy. Companies that consistently track economic profit can spot inefficiencies early, redirect resources wisely, and stay ahead of competitors. Those who overlook opportunity costs risk wasting capital, missing better investments, and limiting their growth potential.

How to calculate economic profit

Businesses calculate economic profit based on their specific needs and financial goals. Large corporations and investors typically assess economic profit on a quarterly or annual basis to evaluate long-term financial health.

Private equity firms and investment analysts may calculate it before making acquisitions or restructuring decisions. Small businesses and startups may track economic profit less frequently, often during key decision-making moments, such as expansion planning or fundraising rounds.

Step 1: Determine total revenue

Start by calculating the total revenue generated from sales, services, or any other business activity. This includes all income inputs before deducting any costs.

Example: If a company sells 10,000 units at $50 each, the total revenue is:

10,000 × 50 = 500,000

So, the total revenue here would be $500,000.

Step 2: Identify explicit costs

Explicit costs are direct expenses that businesses pay to operate. These include wages, rent, utilities, raw materials, and other out-of-pocket costs.

For example, a company incurs $200,000 in wages, $50,000 in rent, and $100,000 in raw materials. The total explicit costs are:

200,000 + 50,000 + 100,000 = 350,000

Step 3: Identify implicit costs

Implicit costs represent the opportunity cost of using resources in one way instead of another. These costs are not recorded in financial statements but are essential in economic profit calculations.

For example, if a business owner invests $100,000 into the company instead of investing it in the stock market with a 5% annual return, the implicit cost is:

100,000 × 0.05 = 5,000

Here, we can assume that the implicit costs are $75,000.

Step 4: Apply the economic profit formula

Now, use the formula:

Economic Profit = Total Revenue − (Explicit Costs + Implicit Costs)

Using the values from the previous steps:

500,000 − (350,000 + 75,000) = 75,000

This means the company has an economic profit of $75,000, showing that it is generating returns beyond its total costs.

Step 5: Interpret the results

A positive economic profit means the business is earning more than it would from alternative investments. This indicates that resources are being used effectively.

A negative economic profit signals that the business could have earned more by investing its resources elsewhere. However, a small negative economic profit doesn’t always mean failure. It could also mean the company is still growing or has invested in long-term strategies that haven’t paid off yet.

How businesses use economic profit to make decisions

Economic profit helps businesses decide whether they are using their resources wisely. It considers opportunity costs, making it a better measure of whether a company is truly creating value.

- Deciding whether to expand or invest. Businesses calculate economic profit before expanding or launching a new product to see if the return outweighs other options. A company considering opening a second location might compare its expected profit to the potential earnings from reinvesting in existing operations. If economic profit is negative, the expansion may not be the best move.

- Evaluating business units and product lines. Companies with multiple divisions use economic profit to identify which areas are adding value. A business unit may show strong accounting profit, but the company is better off reallocating resources if its economic profit is negative. This often leads to restructuring, selling off underperforming units, or shifting focus to more profitable areas.

- Adjusting pricing and reducing costs. If economic profit is consistently low, businesses may need to adjust prices or cut costs. For example, a company might find that lowering prices to increase sales volume improves economic profit more than keeping prices high with fewer customers. Cost inefficiencies, like excessive spending on operations or raw materials, can also eat into economic profit and signal the need for changes.

- Comparing investment opportunities. Businesses often choose between expanding operations, acquiring assets, or returning money to shareholders. Economic profit helps them compare these options by showing which will generate the highest return after accounting for opportunity costs. A company that consistently directs capital toward projects with high economic profit is more likely to grow sustainably.

- Gaining investor confidence. Investors want to know if a company is earning more than its cost of capital. A business with strong economic profit signals efficient resource management and long-term growth potential. On the other hand, if economic profit turns negative, investors may push for changes in leadership, business strategy, or cost-cutting measures.

Track true profitability with Ramp's real-time spend visibility and automated reporting

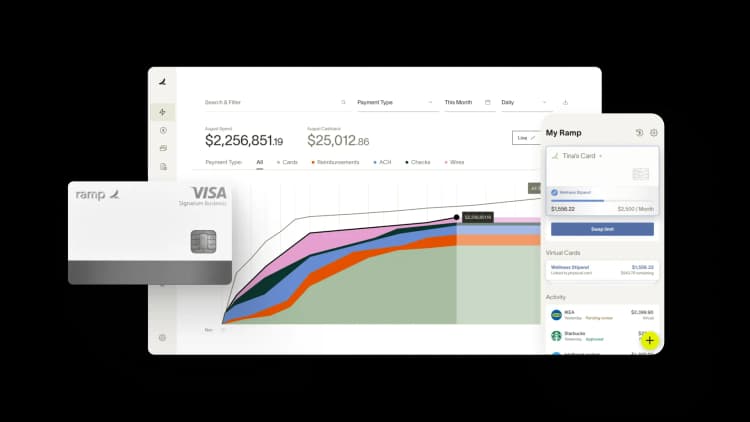

Accounting profit tells you what happened last quarter, but true profitability requires understanding which customers, projects, and initiatives actually drive margin today. Without real-time visibility into spend by department, vendor, or cost center, you're making strategic decisions based on outdated snapshots instead of current reality.

Ramp's accounting automation software gives you the granular spend data you need to measure profitability as it happens, not weeks after close. Every transaction is automatically coded to the right department, project, vendor, and GL account in real time, so you can track margins by customer, analyze spend patterns by initiative, and identify cost overruns before they impact your bottom line.

Here's how Ramp helps you measure what matters:

- Real-time spend tracking: Monitor expenses by department, project, vendor, or custom dimension as transactions post, so you always know where money is going

- Automated multi-dimensional coding: Ramp's AI applies department codes, class tracking, location tags, and custom fields to every transaction, giving you the granularity to analyze profitability across any dimension

- Custom reporting and dashboards: Build reports that show spend by customer, project margin, or any other metric that matters to your business, with data that updates in real time

- Vendor and category insights: Identify which vendors and spend categories drive the most value, so you can optimize contracts and reallocate resources to high-margin activities

Try a demo to see how finance teams use Ramp to track profitability in real time.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits