5 best financial reporting software solutions for 2025

- Why do businesses need financial reporting software?

- The 5 best financial reporting software

- Pricing and budget considerations

- Key trends shaping financial reporting

- How to implement financial reporting software

- Automate financial reporting with AI that codes, syncs, and reconciles for you

Financial reporting software automates financial data collection, analysis, and presentation. It consolidates information from multiple sources, such as accounting systems, bank accounts, and expense management platforms, into clear, structured reports.

These reports then help your business track revenue, monitor expenses, stay compliant, and make data-driven financial decisions. Here, we review the best financial reporting software solutions for 2025 and share implementation tips to help you choose the right fit for your business.

Why do businesses need financial reporting software?

Managing finances through spreadsheets is risky. Just one misplaced entry can distort reports across your business, putting compliance at risk and steering leaders toward the wrong decisions.

Financial reporting software eliminates those risks. Automating data collection reduces the chance of human error and produces accurate reports on demand. Instead of waiting for month-end numbers, your business can get real-time visibility into performance, supporting stronger compliance, healthier cash flow management, and more confident decision-making.

Here are the six biggest benefits of using dedicated financial reporting software:

1. Reduces manual errors and saves time

Manual financial reporting is slow and prone to mistakes. Even a small data entry error can lead to misreported earnings or incorrect tax filings. Financial reporting software automates calculations, data entry, and report generation, reducing both risks and workloads.

2. Provides real-time insights for smarter decisions

Delayed financial data can lead to poor budgeting, unexpected cash shortages, and missed opportunities. Financial reporting software pulls real-time financial data from multiple sources, allowing your business to instantly monitor income, expenses, and profitability. This helps you make informed decisions based on current financial health, rather than outdated reports.

3. Ensures compliance and reduces audit risks

Your businesses may need to comply with various financial regulations, including Generally Accepted Accounting Principles (GAAP), International Financial Reporting Standards (IFRS), and IRS requirements.

Non-compliance can result in penalties, audits, or legal action. Financial reporting software automatically generates compliant reports, tracks tax obligations, and stores financial records securely, making audits smoother and reducing regulatory risks.

4. Enhances cash flow management

Without proper cash flow monitoring, your business can run out of cash even if it’s profitable on paper. Financial reporting software tracks receivables, payables, and cash flow trends in real time, helping you plan for expenses, avoid shortfalls, and optimize working capital.

5. Integrates with accounting and business tools

Many businesses rely on separate accounting, payroll, and invoicing systems, leading to disconnected financial data and inefficiencies. Financial reporting software integrates with existing accounting platforms, payroll systems, and enterprise resource planning (ERP) tools, consolidating all financial data into a single source of truth.

6. Improves decision-making with custom reports

Generic reports often lack the details your business needs. Financial reporting software lets you create custom dashboards, track key performance indicators (KPIs), and generate reports tailored to specific business needs. This helps you monitor financial performance and adjust strategies based on real-time data.

Integrate with your fintech stack for improved accuracy.

Financial reporting software helps track overall performance and compliance, but it often doesn’t capture day-to-day spending in real time. Integrating it with expense management and accounting automation tools improves accuracy by automatically tracking transactions and categorizing expenses.

The 5 best financial reporting software

The right software for you depends on the size and complexity of your business. If you’re running a small company, you might only need a straightforward tool to track expenses and generate invoices. But as your organization grows, you’ll likely need more advanced features such as analytics, audit trails, and multi-entity reporting.

Your industry also matters. If you’re in retail, inventory reconciliation may be essential. If you run a service business, project-based reporting could be what keeps you on track. And if you’re in manufacturing, analyzing cost of goods sold (COGS) will probably be one of your top priorities.

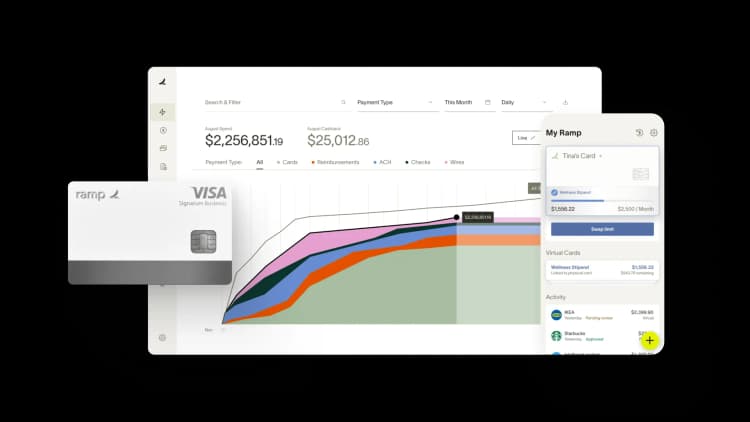

1. Ramp: Best for real-time expense tracking

Ramp is a modern financial operations platform built to save your business time and money. More than 50,000 companies, from fast-growing startups to established enterprises, have saved $10 billion and 27.5 million hours with Ramp.

With real-time expense tracking, comprehensive reporting, and AI-powered automation, we make financial reporting more efficient while helping businesses uncover cost-saving opportunities. By integrating corporate cards, expense management, and reporting into a single system, our software eliminates manual work and provides full visibility into your company's spending.

Key benefits

- Real-time expense tracking and reporting give you instant visibility into company spend

- Unified dashboard consolidates all card, payment, and reimbursement data in one place for easy oversight

- AI-driven insights automatically identify duplicate subscriptions and other cost-saving opportunities

- Automated expense management, including auto-matched receipts and policy enforcement, reduces manual work and errors

Drawback

- Not a standalone accounting system; works best integrated with existing accounting software

Ramp is best if your company needs real-time spend visibility and automated expense reporting to control costs.

2. Phocas: Best for financial forecasting

Phocas is a business intelligence and financial reporting software that can help your company analyze financial performance and forecast future trends. Founded in 2001, Phocas has grown into a trusted solution for over 2,800 businesses worldwide, providing them with real-time insights into their financial data.

The platform specializes in customizable reporting, interactive dashboards, and AI-driven analytics, making it a go-to choice if your business needs deeper financial visibility beyond traditional spreadsheets.

Key benefits

- Advanced financial forecasting helps businesses predict revenue, expenses, and cash flow trends

- Real-time financial reporting ensures businesses always have up-to-date insights

- Customizable dashboards allow users to tailor reports to their specific needs

- AI-powered insights enable users to ask questions and receive instant data-driven responses

- Seamless ERP and accounting software integrations centralize financial data for better visibility

Drawbacks

- New users looking to maximize advanced features face a steep learning curve

- Setup and configuration can be time-consuming, especially for complex financial structures

Phocas is ideal if you have a mid-sized to large business that needs customizable financial reports, in-depth forecasting, and AI-powered insights to enhance financial decision-making.

3. Xero: Best for small teams needing multi-user access

Xero is a cloud-based accounting and financial reporting software solution to help your small business or startup easily manage finances. Founded in 2006, Xero has grown to serve over 4.4 million users worldwide, offering an intuitive platform that integrates with 1,000+ business apps.

With features such as automated reconciliations, AI-powered cash flow forecasting, and real-time financial reports, Xero simplifies financial management for businesses that need a scalable and user-friendly solution.

Key benefits

- Affordable pricing makes it accessible for startups and small businesses

- AI-powered cash flow predictions help businesses plan ahead

- Automated bank reconciliations reduce manual data entry

- Customizable financial reports allow users to tailor reports to their needs

- Seamless integrations allow Xero to work with over 1,000 apps, including Shopify, HubSpot, and Mailchimp

Drawbacks

- Multi-currency support is only available on the highest-tier plan

- Entry-level plans have limited reporting and automation features

Xero is ideal if your startup or small business needs a cost-effective, easy-to-use financial reporting solution with strong automation and integration capabilities.

Integrate Xero with Ramp.

Xero integrates with Ramp, allowing your business to enhance financial reporting with real-time expense tracking, automated receipt scanning, and seamless reconciliation. Ramp’s powerful features help businesses gain better control over spending, reduce manual work, and streamline expense management, making financial reporting even more efficient.

4. Vena: Best for Excel-powered financial reporting

Vena is a financial planning and analysis (FP&A) platform that’s worthwhile if your business wants to streamline financial reporting while retaining the flexibility of Excel. Founded in 2011, Vena serves companies across various industries by automating financial consolidation, planning, and reporting processes.

With its native Excel interface, Vena eliminates the need for you to switch to a completely new system, making adoption seamless for finance teams already comfortable with spreadsheets. The platform also integrates with Microsoft Power BI and PowerPoint, allowing you to create, analyze, and present financial reports efficiently.

Key benefits

- Excel-native interface allows finance teams to work in a familiar environment

- Prebuilt financial templates speed up report creation and customization

- AI-powered analytics and forecasting help businesses model different financial scenarios

- Seamless data consolidation from ERP, customer relationship management (CRM), and HR systems provides real-time financial insights

- Direct integration with PowerPoint enables quick updates for board presentations

Drawbacks

- Setup can be time-intensive, especially for complex financial models

- Large and complex files may load slowly, impacting workflow efficiency

- Mac compatibility issues can limit functionality for non-Windows users

Vena is ideal if you run a mid-sized to large business that relies heavily on Excel for financial reporting. Its interactive dashboards and seamless data integration make it a great fit if you need to share real-time reports across multiple departments.

5. Workiva: Best for audit-ready financial statements

Workiva is a cloud-based financial reporting and compliance platform that can help your business manage complex reporting requirements across multiple teams and departments.

Founded in 2008, Workiva has become a trusted solution for enterprises handling Securities and Exchange Commission (SEC) filings, Environmental, Social, and Governance (ESG) disclosures, financial statement consolidation, and internal audits.

Key benefits

- Automated financial reporting workflows reduce manual data entry and errors

- Collaborative document management allows multiple users to work on reports in real time

- Compliance-focused features help businesses meet SEC, ESG, and internal control requirements

- Advanced data visualization provides dynamic charts, graphs, and dashboards for better insights

- Seamless integrations with Workday, Sage Intacct, NetSuite, QuickBooks, Tableau, and SAP centralize financial data

Drawbacks

- Steeper learning curve makes adoption slower for new users

- Premium pricing may be too costly for smaller businesses

Workiva is ideal if you run a large enterprise or finance team with complex financial reporting, regulatory compliance, and ESG disclosures. Its collaborative features and automation tools make it a great fit if you require highly detailed, audit-ready reports with minimal manual effort.

How we selected these tools

With so many financial reporting platforms on the market, we focused on the features that matter most to businesses. Ease of use and an intuitive interface were top priorities since reporting software only saves time if teams can adopt it quickly.

We also looked at how well each tool integrates with popular accounting and ERP systems, whether it offers real-time data and automated reporting, and if it includes compliance features that help companies stay audit-ready.

Cost, implementation time, and the quality of customer support also played a big role in our evaluation. To narrow down the list, we compared product features and user reviews and assessed how each platform performs in real-world business settings.

Pricing and budget considerations

Pricing structures can vary widely for financial reporting systems, so it’s worth understanding how vendors charge and what factors can affect the total cost:

- Pricing models: Most platforms use a subscription model, often tiered by features, users, or transaction volume. Some vendors charge per user, while others offer volume-based discounts or custom quotes for larger organizations.

- Compare tiers and costs: Look beyond the base subscription price. Factor in setup fees, training expenses, and premium support costs.

- Free trials and demos: Many vendors provide trial periods or demos so you can test usability before committing

- Total cost of ownership: Consider the long-term value, not just the upfront price. Financial reporting tools with higher fees may pay for themselves by reducing manual work, improving compliance, and consolidating systems.

Key trends shaping financial reporting

Financial reporting software continues to evolve as businesses demand more accuracy and flexibility. These trends are shaping how companies evaluate tools and prepare for the future:

- AI and machine learning: More platforms are embedding AI to automate analysis, spot anomalies, and forecast financial performance in real time. This reduces manual number-crunching and offers faster, data-driven insights.

- Multi-entity and multi-currency support: As businesses expand globally or manage multiple subsidiaries, the need for consolidated, cross-border reporting has grown. Software that can handle these complexities helps ensure consistency and compliance across the organization.

- Enhanced security and compliance: With rising data privacy regulations and audit requirements, vendors are investing heavily in security features and automated compliance checks. This reduces risk and makes it easier to meet standards such as GAAP, IFRS, and IRS requirements.

- Deeper integrations with business tools: Many companies expect their financial reporting systems to connect seamlessly with accounting platforms, ERP software, payroll, and even collaboration tools. Integrated workflows reduce errors and give finance teams a single source of truth.

These trends highlight the importance of future-proofing your investment. When selecting financial reporting software, consider not only what you need today but also whether the platform is keeping pace with advancements in AI, security, and global reporting needs.

How to implement financial reporting software

The time needed for implementation varies based on business size, system complexity, and data migration needs. Implementation may take 2–4 weeks for small businesses, while larger enterprises with complex integrations may require 3–6 months.

1. Define your business needs and objectives

Before implementing any software, identify exactly what your business needs. Consider factors such as reporting complexity, industry regulations, and scalability to ensure the software aligns with your business goals. A clear set of objectives prevents you from selecting an overly complex system or one that lacks essential features.

2. Choose software that integrates with existing systems

Most finance teams struggle with disconnected data, leading to inefficiency and errors. Ensure your financial reporting software integrates seamlessly with bookkeeping tools, ERP systems, payroll software, and expense management platforms.

A system that pulls real-time financial data from multiple sources eliminates manual data entry, reduces errors, and ensures you always work with accurate, up-to-date financial information.

3. Establish a clear implementation plan

Rushing implementation can lead to misconfigured settings, data loss, and system downtime. Instead, create a structured rollout plan with clear timelines, responsibilities, and goals. Assign a project lead, break the implementation into phases, and prioritize core functions first. Also, set milestones for data migration, system testing, and user onboarding for a smooth transition.

4. Migrate and validate financial data

Before switching systems, clean and validate your financial data to ensure there are no inconsistencies or errors. Conduct a trial migration, running reports in both the old and new systems to compare results. This ensures accuracy, prevents data corruption, and avoids financial misstatements once the system goes live.

5. Train your team for maximum adoption

Even the best financial reporting software will fail if your team doesn't know how to use it. Provide hands-on training, detailed guides, and role-based access to ensure employees can navigate dashboards, generate reports, and troubleshoot issues. Offering continuous training prevents misreporting and maximizes efficiency.

6. Automate workflows and reporting processes

Reduce manual work by setting up automated financial reports, approval workflows, and compliance checks. Your finance team can spend less time on reporting when automation handles routine tasks such as data entry, reconciliations, and financial analysis. Automation also ensures you generate reports on schedule, reducing human error and improving compliance.

7. Monitor, optimize, and scale

Once the system is live, track KPIs, such as reporting accuracy, processing speed, and compliance adherence. Regularly gather feedback from users to identify areas for improvement. As your business expands, ensure the software can scale to handle more complex reporting, additional entities, and increased transaction volumes.

Automate financial reporting with AI that codes, syncs, and reconciles for you

Manual financial reporting is time-consuming and error-prone. You're chasing receipts, coding transactions by hand, and reconciling across multiple systems—all while trying to close books on time. Ramp's accounting automation software eliminates these bottlenecks by handling the entire reporting workflow from transaction to close.

Ramp's AI codes every transaction in real time across all required fields, learning your accounting patterns and applying your feedback to improve accuracy with every coding decision. The platform delivers a 67% increase in zero-touch codings compared to rules-only automation, so you spend less time reviewing and more time analyzing. When transactions are coded correctly from the start, your financial reports reflect accurate data without manual cleanup.

Here's how Ramp consolidates and automates reporting:

- Real-time AI coding: Ramp codes transactions as they post, applying your chart of accounts, departments, classes, and custom fields automatically

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP without human review, keeping your books current throughout the month

- Automated accruals: Post and reverse accruals automatically so expenses land in the right period, even when invoices arrive late

The result? Businesses close their books 3x faster with Ramp, saving 40+ hours every month on manual processes.

Try a demo to see how Ramp automates financial reporting from transaction to close.

FAQs

The three most commonly used financial reports are the income statement, balance sheet, and cash flow statement. Together, they show your company’s profitability, financial position, and liquidity.

Financial statement analysis is the process of reviewing your company’s financial reports to evaluate performance, identify trends, and support decision-making. It helps stakeholders assess profitability, efficiency, and financial stability.

Financial consolidation software combines data from multiple entities into a single set of financial statements. Key features include multi-entity and multi-currency support, automated eliminations, compliance reporting, and integration with ERP and accounting systems.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits