Best fleet cards for small businesses: Should you get one?

- What is a fleet card?

- How do fleet cards work?

- What are the benefits of a fleet card?

- So, is a fleet card right for your small business?

- Best fleet fuel cards for small businesses to choose from

- How to build small business credit with fuel cards

- How to get a fuel card

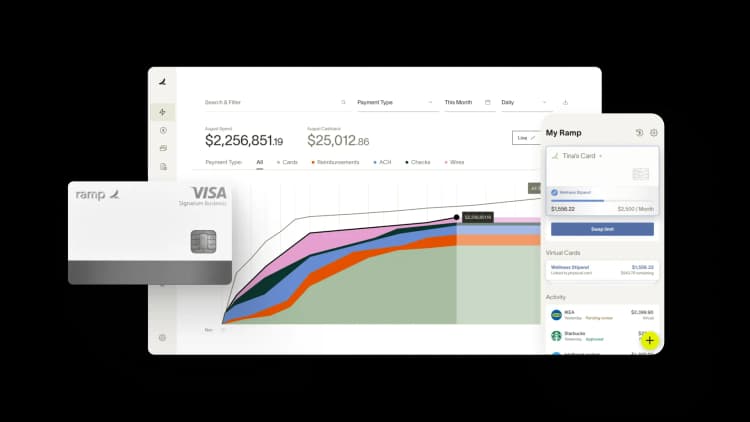

- A corporate card built for total spend control

Any small business that deploys a fleet of vehicles faces a unique set of challenges. According to AAA, the average cost of operating just one sedan is $8,558 per year. When you multiply that over a fleet, those costs add up quickly, especially when you don’t have the right business cards or spend management tools to track your spending.

This is why small businesses that provide employees with company cars turn to fleet cards (or fleet fuel cards), which enable them to pay for fuel and other vehicle-related expenses. In this guide, we’ll walk you through everything you need to know about fleet cards—and more importantly, we’ll help you know if a fleet fuel card is right for your small business.

What is a fleet card?

A fleet card, also known as a fleet fuel card, is a charge card designed specifically to pay for gasoline, EV charging, vehicle maintenance, parking, and tolls. Each card is tied to an individual vehicle or employee, and the cardholder is sometimes required to enter a driver ID number before completing a purchase.

Fleet cards vs. gas cards

Fleet cards and gas credit cards are both designed to pay for fuel, but fleet cards are used by businesses to manage expenses across multiple vehicles and often include features for tracking maintenance and usage.

Gas credit cards, meanwhile, are typically aimed at individual consumers, offering gas rewards or discounts at specific fuel stations.

How do fleet cards work?

Fleet cards are used by companies with extensive fuel costs, whose employees operate corporate vehicles. Examples include trucking companies, delivery services, and sales fleets.

Employees can use fuel cards just like they would use any charge card. They can swipe them at fueling locations to pay for gas and any additional purchases that the company has approved. This eliminates the need to reimburse employees for fuel expenses on their personal cards. Unlike traditional business credit cards, fuel cards require full balance payments at the end of each billing cycle.

Some fleet cards also offer fuel discounts, which can fluctuate depending on agreements in place with the fueling location and card provider.

Examples of fleet cards

Oil and gas companies like Chevron, Shell, ExxonMobil, and Texaco offer most fleet cards. These cards are typically restricted to the card issuer's specified locations. There are also some companies that specialize in fuel cards, like Wex and Fuelman.

Is a fleet card like a credit card?

Yes, a fleet card is similar to a credit card, but it's specifically designed for managing fuel and vehicle-related expenses. It offers features like spending controls, detailed reporting, and restrictions based on location or purchase type—tools not typically available with regular credit cards.

What are the benefits of a fleet card?

Automate fuel spend tracking

Fleet cards typically offer reporting and tracking tools that give business owners visibility into the spending habits of each employee, which eliminates the need to require employees to manually track their spend at the pump and submit expense reports each month.

These real-time reports also enable administrators to remediate quickly whenever an employee attempts to use their fuel card on an unapproved purchase or is re-fueling more often than the other cars in the fleet. This data also makes it easier for administrators to analyze spending trends and identify cost-saving opportunities.

More streamlined back-end operations

Since small business fuel cards can only be used on approved purchases, administrators can track vehicle-related spending in a single platform. Fuel cards also enable business operators to set parameters that prevent cardholders from inadvertently making unapproved purchases.

Some of the most common automated controls on a fuel card include:

- Only approving gasoline purchases at the pump

- Approving at-pump and in-store purchases

- Limiting purchases to specific fuel stations

- Varying spending limits depending on the fueling needs of each vehicle

Fraud protection

Fuel cards come with various security features designed to protect small businesses from unauthorized usage and fraudulent activities. These may include:

- Purchase restrictions: Small businesses can set limits on what types of products or services can be purchased with fleet cards, such as restricting it solely for fuel purchases.

- Daily/weekly spending limits: Establishing spending caps per day or week helps prevent excessive expenditures and potential misuse by employees.

- Fraud monitoring and alerts: Many providers offer real-time fraud detection systems that monitor unusual activity patterns and send notifications if suspicious transactions are detected.

So, is a fleet card right for your small business?

A fleet card can be a valuable asset for small businesses, especially those with even a small fleet of vehicles. They offer potential cost savings through fuel discounts and negotiated rates, improve cash flow, and provide valuable data for tracking expenses and controlling costs.

That said, fleet cards, by design, have a narrow application. That’s why many small businesses are pursuing modern corporate charge cards in lieu of traditional fleet cards. These cards offer more versatility to spenders as they can be used for all business expenses, offering greater flexibility and simplifying spending management.

Plus, they might include enhanced features to streamline financial operations like AI-powered expense categorization, real-time spending controls, and robust integrations with accounting software.

Does a fleet card help me save on fuel expenses?

Yes, a fleet card can help you save on fuel expenses through rebates, discounts at partner stations, and controls that reduce unauthorized spending or fuel theft.

Best fleet fuel cards for small businesses to choose from

When sorting through your fleet card comparison, take note of each offering’s unique benefits. Here’s a quick list of the best feel fuel cards for small businesses to choose from:

- Coast: Takes a software-forward approach on the Visa network with broad retail acceptance, merchant and category rules, real-time alerts, and clean dashboards with automated exports. It's designed for small teams wanting fast rollout and modern controls without heavy complexity.

- WEX Fleet Card: WEX provides acceptance at 180,000+ locations covering approximately 95% of U.S. gas stations, with potential savings of up to 15¢ per gallon in-network and up to 3¢ per gallon elsewhere. It offers spend controls with real-time monitoring and automated accounting.

- Fuelman: Fuelman offers fuel rebates on the Fuelman Network, including 8¢ per gallon savings at 40,000+ Discount Network locations. It provides driver and vehicle-level reporting with detailed fuel and tax reporting, plus customizable fuel controls and real-time fraud alerts.

- Voyager (U.S. Bank Voyager Mastercard): Operates on dual networks (Voyager + Mastercard) giving broad acceptance across the U.S. and in Canada and Mexico. It supports fuel, maintenance, and unplanned expenses through a single platform for card administration and detailed data capture.

- Shell Card Business/Business Flex: Shell provides up to 6¢ per gallon savings at Shell with the Business Card, or up to 5¢ per gallon at Shell with approximately 95% U.S. station coverage through Business Flex. Both cards offer broad acceptance and spending controls.

- Chevron and Texaco Business Cards: Chevron and Texaco offers volume-based rebates up to 6¢ per gallon with dual verification security through driver ID numbers and odometer readings. The standard Business Card has no fees, while options include expanded network access and credit flexibility.

- Honorary mention - Ramp corporate card: Ramp isn’t a traditional fleet card, but it can help businesses manage fuel spend as part of a broader corporate card program. It offers robust expense management tools and a flat cashback rate. With no personal guarantee required and seamless accounting integrations, Ramp is a strong option for companies that want to track and control all expenses.

When choosing a fuel card, it's important to consider network coverage in addition to savings. A card with high discounts is less useful if you can't find locations to use it. With numerous options available, research cards with fueling locations that align with your regular driving routes.

How to build small business credit with fuel cards

Using your fuel card can be a highly effective way to build your small business credit since it operates just like a charge card. Here are two ways you can use your fuel card to build your business credit score.

- Choose the right fuel card: Not all fuel cards report your payment history to business credit bureaus like Dun & Bradstreet or Experian. Ensure the card you choose does.

- Maintain on-time payments: Simply paying your bills on time is a great way to build business credit with a fuel card. As the major credit bureaus see that you consistently make on-time payments, they’ll be more inclined to increase your credit score.

- Keep your credit utilization low: Resist the temptation to use every dollar available on your credit card each month. Creditors typically like to see a credit utilization ratio of under 30%.

How to get a fuel card

To get and use a fuel card, start by researching providers to find one that matches your business size, fueling habits, and reporting needs. Apply online or through a sales rep, providing basic business and financial information.

Once approved, you’ll receive your cards in the mail—activate them and assign each to a driver or vehicle. Set controls such as spending limits, allowed fuel types, and usage times to help manage costs. Drivers can then use the card at approved fuel stations, often entering a PIN or odometer reading during each transaction.

You can track spending, monitor activity, and generate reports through an online dashboard, making it easier to manage your fuel expenses.

A corporate card built for total spend control

Choosing a business credit card isn’t just about earning rewards, it’s about gaining control over one of your largest recurring costs. Businesses often overspend on fuel and other operational expenses not because they’re using more, but because they can’t see who’s spending what, where, or when.

Ramp is not a traditional fleet card—it’s a corporate card and expense management platform built to help businesses track, control, and optimize employee spend, including fuel.

Accepted wherever Visa is, it comes with no annual fee and is available to businesses with at least $25,000 in a U.S. business bank account. With centralized controls and automation, Ramp gives finance teams visibility across all employee spend:

- Save more by preventing out-of-policy spend: Preset controls on corporate cards for specific vendors and categories.

- Be free from expense reports: Easily submit expenses through SMS, mobile app, and integrations.

- Unlock savings in real time: Get insight into spend as it happens, with a platform that pays off immediately.

- Grow your business with the right terms: Get rewards and perks, like 5% savings*. There’s no personal credit checks or personal guarantee.

Ramp gives finance teams precise oversight, cleaner books, and fewer wasted dollars. Instead of rewarding overspending, Ramp helps you spend less and know exactly where every dollar goes.

See how Ramp helps you manage expenses. Try the Ramp corporate card.

Information about third-party card providers is based on publicly available sources and may change over time. Details have not been independently verified or endorsed by the providers themselves.

*We calculate average savings as a percentage of an illustrative customer's total card spending when using Ramp features designed to reduce business expenses. Keep in mind that this percentage is an estimate, not a guarantee. Ramp delivers savings from more than just card spending; savings can also come from non-card expenses so we may factor decreases to non-card spending into our calculation. For example, savings may result from reduced time spent on manual expense tracking, the financial benefit of cash back or other rewards, smarter expense monitoring, and eliminating costs associated with alternative solutions. Our calculations are based on platform data, industry research, customer surveys, and info on alternative options. Your actual savings may vary.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits