What is the vendor management lifecycle? 6 key stages

- What is the vendor management lifecycle?

- The 6 stages of the vendor management process

- Vendor scorecard example

- Vendor management best practices

- Common vendor management challenges and solutions

- How to implement your vendor management lifecycle

- Use Ramp to improve your vendor lifecycle management

The vendor management lifecycle is a structured, end-to-end process for managing vendor relationships, from initial selection and onboarding through performance management, renewal, or offboarding.

Organizations that follow a defined lifecycle gain better control over costs, reduce operational and compliance risk, and build more productive vendor relationships over time. This framework breaks vendor management into clear stages so teams can manage vendors consistently instead of relying on ad hoc processes.

What is the vendor management lifecycle?

The vendor management lifecycle is an end-to-end approach to managing vendor relationships. It covers every stage of working with a vendor, from identifying and evaluating potential partners to managing active contracts and deciding whether to renew or offboard them.

Traditional vendor management often focuses on individual transactions or short-term needs. A lifecycle approach takes a broader view, treating vendor relationships as ongoing engagements that require consistent oversight as they evolve.

Without a defined lifecycle, organizations rely on ad hoc processes that vary by team or department. This leads to inconsistent standards, missed renewal opportunities, and limited visibility into vendor performance across the business.

What are the key components of vendor lifecycle management?

Vendor lifecycle management breaks the relationship into distinct stages, each with its own responsibilities and decision points:

- Vendor identification and selection: Define requirements, research options, and choose vendors that align with business needs and budget

- Vendor evaluation and due diligence: Assess financial stability, security posture, compliance readiness, and operational capabilities

- Contract negotiation and onboarding: Finalize terms, establish service levels, and integrate vendors into systems and workflows

- Performance management and monitoring: Track KPIs, review deliverables, and address issues before they escalate

- Relationship management: Maintain communication, resolve problems, and identify opportunities for improvement

- Vendor offboarding or renewal: Decide whether to renew, renegotiate, or transition to a new vendor

These stages form a continuous loop rather than a linear checklist. Insights from performance reviews inform renewal decisions, and lessons learned during offboarding shape future vendor selection.

What are the benefits of implementing a vendor management lifecycle?

Poor vendor management creates measurable financial and operational risk. According to World Commerce & Contracting, the average business loses 9% of its value annually due to ineffective contract management.

A structured vendor management lifecycle helps organizations:

- Control costs by negotiating better terms, consolidating vendors, and eliminating underperforming relationships

- Reduce risk through ongoing monitoring of vendor financial health, security practices, and compliance

- Improve audit readiness with centralized records and documented processes

- Strengthen vendor performance through regular reviews and clear accountability

- Increase operational efficiency by standardizing workflows and identifying automation opportunities

Without a formal lifecycle, these benefits are difficult to achieve consistently, especially as vendor portfolios grow.

The 6 stages of the vendor management process

The vendor management lifecycle breaks vendor relationships into six stages, each with its own goals, activities, and decision points. Organizing the process this way helps teams apply consistent standards across vendors while maintaining flexibility for different use cases.

Some frameworks describe the vendor lifecycle in seven or eight steps. This six-stage model consolidates closely related activities, such as risk and compliance work, into the stages where teams typically manage them day to day.

| Stage | What happens | Primary focus |

|---|---|---|

| Vendor identification and selection | Define requirements and shortlist vendors that meet business needs and budget | Fit and feasibility |

| Vendor evaluation and due diligence | Assess financial stability, security posture, compliance readiness, and capabilities | Risk and validation |

| Contract negotiation and onboarding | Finalize terms, set service levels, and integrate vendors into systems and workflows | Alignment and setup |

| Performance management and monitoring | Track KPIs, review deliverables, and address issues early | Accountability |

| Relationship management | Maintain communication, resolve issues, and identify improvement opportunities | Collaboration |

| Vendor offboarding or renewal | Decide whether to renew, renegotiate, or transition to a new vendor | Continuity or exit |

Stage 1: Vendor identification and selection

Vendor identification and selection establishes the foundation for the relationship by clarifying business needs and identifying vendors that can meet them.

Start by documenting technical requirements, budget constraints, timelines, and any regulatory or security considerations. Clear criteria reduce misalignment later and make it easier to compare vendors objectively.

Potential vendors may come from industry directories, peer recommendations, trade events, or online research. Initial screening narrows the field to vendors with relevant experience, sufficient capacity, and a track record in your industry.

Stage 2: Vendor evaluation and due diligence

Vendor evaluation and due diligence confirms whether shortlisted vendors can reliably deliver on their promises. Assessment criteria typically include financial health, operational maturity, security practices, and cultural fit. Scoring vendors against weighted criteria allows teams to compare options consistently while prioritizing what matters most for the engagement.

Due diligence also involves risk assessment. Reference checks, certification reviews, insurance verification, and validation of compliance claims help surface potential issues before contracts are signed.

Stage 3: Contract negotiation and onboarding

Contract negotiation and onboarding turns expectations into enforceable agreements and prepares both teams to work together.

Contract negotiations should address pricing structures, payment terms, termination rights, and liability provisions. Clear service level agreements (SLAs) define performance expectations and remedies for underperformance.

Onboarding covers system access, security requirements, communication protocols, and initial deliverables. A documented checklist and realistic timeline keep the process moving and reduce confusion during handoff.

Stage 4: Performance management and monitoring

Performance management and monitoring ensures vendors continue meeting expectations throughout the relationship.

Key performance indicators should align with SLAs and business objectives. Common metrics include delivery timelines, quality standards, response times, and cost variance. Review frequency often depends on vendor criticality, with more frequent reviews for strategic or high-risk vendors.

Performance scorecards help track trends over time and provide a shared reference point during reviews. Documented results support renewal decisions and create accountability on both sides.

Stage 5: Relationship management

Relationship management focuses on maintaining alignment, communication, and trust beyond contracts and metrics.

Regular communication helps address issues early and adapt to changing needs. For strategic vendors, scheduled business reviews create space to discuss upcoming priorities, improvement opportunities, and potential collaboration.

Clear escalation paths and defined points of contact prevent minor issues from becoming operational problems. Over time, consistent communication builds trust and supports more productive partnerships.

Stage 6: Vendor offboarding or renewal

Vendor offboarding or renewal determines whether to continue the relationship and manages transitions when vendors change.

Renewal evaluations typically begin months before contract expiration. Performance history, cost effectiveness, business needs, and market alternatives all inform the decision to renew, renegotiate, or exit.

Offboarding procedures should address knowledge transfer, data return or destruction, and removal of system access. Planning ahead reduces disruption and ensures continuity, especially for vendors supporting critical services.

Vendor scorecard example

A vendor scorecard is a practical way to track performance against the metrics that matter most for a specific relationship. Teams use scorecards to compare actual results to agreed-upon targets and document performance trends over time.

A typical vendor scorecard includes the vendor name, review period, and a small set of weighted KPIs. Each metric is scored against a defined target, with space for notes and an overall assessment to support renewal and escalation decisions.

| Vendor: ABC Tech Solutions | |||||

|---|---|---|---|---|---|

| Review period: Q4 2025 | |||||

| Overall score: 4.3/5 | |||||

| Category | Metric | Weight | Target | Actual | Score |

| Security | Audit compliance | 35% | 100% | 100% | 5/5 |

| Reliability | System uptime | 30% | 99.9% | 99.7% | 4/5 |

| Support | Ticket resolution | 20% | <4 hrs | 3.5 hrs | 5/5 |

| Satisfaction | User rating | 15% | >4.0/5 | 3.8/5 | 3/5 |

| Comments: Perfect security compliance; user satisfaction trending down—investigate. |

Vendor management best practices

Effective vendor management depends on consistent processes, clear accountability, and the right level of oversight for each relationship. These best practices help organizations maximize vendor value while reducing risk across the entire lifecycle.

Technology and automation

Technology plays a central role in scaling vendor management without adding unnecessary manual work. Vendor management systems centralize vendor records, contracts, performance data, and compliance documentation so teams have a single source of truth.

Automation can support nearly every lifecycle stage. Automated workflows streamline vendor onboarding, approval routing, and renewal reminders, while performance tracking tools collect and analyze KPI data automatically. Integrating vendor management tools with accounting, procurement, and project management systems reduces data silos and improves visibility.

Risk management strategies

Vendor relationships introduce financial, operational, security, and compliance risks that require ongoing attention. Effective risk management starts with identifying which vendors pose the greatest potential impact to the business.

Common risk mitigation strategies include monitoring vendor financial health, conducting regular security assessments, and verifying compliance with relevant regulations and certifications. Clear SLAs and documented escalation paths help address performance issues before they disrupt operations.

Risk management is not a one-time exercise. Regular reviews of vendor compliance documentation, audit results, and business continuity plans help organizations stay ahead of emerging risks as vendor relationships evolve.

Building strategic vendor relationships

Not all vendors require the same level of oversight. Vendor segmentation allows organizations to apply deeper management to strategic vendors while using lighter-touch processes for tactical or low-risk relationships.

Strong strategic relationships rely on consistent communication and shared expectations. Regular business reviews create opportunities to discuss performance, upcoming needs, and areas for improvement. Defined points of contact and escalation paths help resolve issues quickly and maintain alignment.

Over time, strategic vendors can contribute more than basic service delivery. When vendors understand broader business goals, they are better positioned to suggest process improvements, share market insights, and support long-term growth.

Common vendor management challenges and solutions

Even well-designed vendor management programs encounter predictable challenges. Addressing these issues early helps prevent operational disruption and keeps vendor relationships productive as they scale.

- Lack of centralized vendor data: Vendor information spread across spreadsheets, inboxes, and departments makes it difficult to track contracts, performance, and compliance. Centralizing vendor records in a single system gives teams consistent access to current information and reduces missed deadlines.

- Inconsistent vendor evaluation processes: When departments use different criteria to select vendors, organizations end up with uneven performance and duplicated effort. Standardized evaluation templates with weighted scoring bring consistency while still allowing for department-specific requirements.

- Poor contract visibility and tracking: Missed renewal dates can lead to service interruptions or automatic renewals on unfavorable terms. Automated renewal alerts and shared contract dashboards help teams stay ahead of key deadlines.

- Inadequate performance monitoring: Vendors may underperform when expectations and metrics are unclear or inconsistently reviewed. Defining KPIs at contract signing and scheduling regular performance reviews creates accountability and supports continuous improvement.

- Limited vendor communication: Infrequent or reactive communication leads to misaligned expectations and unresolved issues. Regular check-ins and structured business reviews provide a forum for addressing concerns and identifying opportunities for improvement.

- Compliance gaps and audit challenges: Without organized documentation, proving vendor compliance during audits becomes time-consuming and error-prone. Centralized repositories for certifications, insurance policies, and audit reports make compliance easier to manage.

- Vendor concentration risk: Heavy reliance on a single vendor increases exposure to disruptions, pricing changes, and service failures. Identifying critical services and maintaining qualified backup vendors reduces dependency and improves resilience.

- Difficulty scaling vendor programs: Manual processes break down as vendor portfolios grow. Technology platforms and tiered vendor management approaches allow teams to scale oversight without proportional increases in headcount.

How to implement your vendor management lifecycle

Moving from ad hoc vendor management to a lifecycle-based approach requires planning, coordination, and sustained follow-through. Breaking implementation into clear phases makes the transition more manageable and helps teams realize value along the way.

Step 1: Assess your current state

Start by documenting existing vendor relationships, contracts, and processes across the organization. Identify gaps in performance tracking, compliance monitoring, and risk management, and gather input from stakeholders to understand where vendor management breaks down today.

This baseline assessment helps prioritize improvements and provides a reference point for measuring progress as the program matures.

Step 2: Define your framework

Establish clear policies and standards for each stage of the vendor lifecycle, from selection criteria to offboarding procedures. Define performance expectations, documentation requirements, and approval workflows so teams understand how vendor decisions should be made.

At this stage, organizations often determine how to segment vendors based on risk, spend, or strategic importance. This ensures high-impact vendors receive appropriate oversight without overburdening teams with unnecessary process.

Step 3: Select and implement technology

Choose vendor management tools that align with your requirements, scale, and budget. Configure workflows, reporting, and integrations to reflect how your teams actually work rather than forcing new processes unnecessarily.

Migrating vendor records and contracts into a centralized system improves visibility early and sets the foundation for automation in later stages.

Step 4: Pilot with critical vendors

Test new processes with a small group of high-impact or high-risk vendors before rolling them out broadly. Piloting allows teams to identify gaps, refine workflows, and validate assumptions in a controlled environment.

Feedback from both internal users and vendors during this phase helps improve adoption and reduces friction during full rollout.

Step 5: Roll out across your vendor portfolio

Expand the lifecycle framework to additional vendor categories in phases rather than all at once. Training and clear communication help teams understand expectations and apply the process consistently.

Setting clear timelines and ownership for each phase reduces confusion and keeps implementation on track as scope expands.

Step 6: Monitor and optimize

Ongoing monitoring ensures the lifecycle remains effective as vendor relationships and business needs change. Track adoption, performance outcomes, and feedback to identify areas for improvement.

Adjust policies, tools, and review cadences based on what works in practice. Continuous refinement helps the vendor management lifecycle stay relevant rather than becoming a static set of rules.

Plan for change, timelines, and ownership

Successful implementation depends as much on change management as it does on process design. Executive sponsorship signals that vendor management improvements matter, while clear communication helps teams understand how new workflows reduce friction rather than add bureaucracy. Involving skeptics early and incorporating their feedback improves adoption and long-term buy-in.

Implementation timelines vary by organization size and complexity, but most vendor management programs take 6–12 months to fully roll out. Early wins often include automated contract renewal alerts, centralized vendor contact information, and standardized evaluation templates, all achievable within the first 90 days.

Resource needs typically include a program owner, cross-functional steering committee, and dedicated support during initial rollout. Ongoing ownership depends on vendor portfolio size and risk profile, but commonly involves vendor managers, contract specialists, and compliance stakeholders.

Use Ramp to improve your vendor lifecycle management

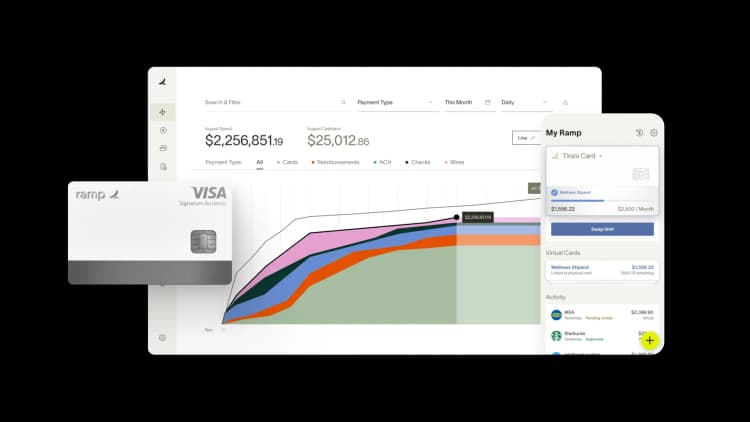

Ramp’s vendor management system is your single source of truth for all vendor details. It provides finance teams with a robust, AI-powered contract management solution paired with unique Price Intelligence, which uses data from millions of real transactions to help you understand if you're paying too much for things like software.

Our platform provides a single view into every vendor detail, document, and transaction so you can get answers about your vendors quickly and easily. Ramp automatically extracts key details from contracts, from SKU name to start and end dates, eliminating manual data entry. You can also set automated reminders to be alerted when a contract is coming up for renewal.

Try an interactive demo and see why businesses that choose Ramp save an average of 5% a year across all spending.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits