- What is an employee credit card?

- How employee credit cards work

- How are employee credit cards different from other cards?

- Benefits of employee credit cards for businesses

- What to look for in an employee credit card

- Best practices for issuing company credit cards to employees

- Why growing businesses choose Ramp for their employee cards

- Choose the best employee credit card

Employee credit cards let your team make purchases on your company’s behalf using their own physical or virtual copy of your business credit card. They’re a useful tool to help you control spending, earn rewards, and limit or even eliminate employee expense reimbursements.

With employee cards, you can centralize business purchases and monitor spending in real time. In this guide, you'll learn how employee credit cards work, their benefits for businesses of all sizes, what to look for when choosing a card, and answers to common questions about rolling out employee cards.

What is an employee credit card?

An employee credit card is an authorized payment card your employees can use to make purchases on your business’s behalf. The card draws from your company’s line of credit, so employees don’t need to use their personal funds for business expenses.

Employee credit cards can help eliminate the need for expense reimbursements and make it easier to track business spending. Some business credit cards, like corporate cards, include other features like custom spending limits and vendor restrictions. These cards also come with expense management features that allow you to automate expense reporting.

How employee credit cards work

Employee credit cards connect to your business's main credit account, and each card links directly to your company's line of credit. Your team can use these cards for authorized business expenses like travel, office supplies, client meals, or software subscriptions without using their personal funds or requesting expense reimbursements.

The best employee cards come with a card management system that lets you:

- Issue individual cards to your employees based on their spending needs

- Set spending limits for each cardholder or department

- Restrict purchases to specific merchant categories

- Create automated alerts for transactions that exceed certain thresholds

Your business is fully responsible for all charges made on employee cards, and you must pay the balance according to your credit agreement. Many cards offer rewards and perks such as points, miles, or cashback on purchases. These rewards all go to your business, not to individual employees.

Additionally, employees aren't personally liable for legitimate business expenses charged to these cards, and these transactions don't impact their personal credit scores.

How are employee credit cards different from other cards?

Employee credit cards differ from personal credit cards and other business payment methods in several important ways. They give your employees purchasing freedom while maintaining full control and visibility. This balance lets your team make necessary purchases while giving you the oversight to manage business spending effectively.

Feature | Employee credit cards | Personal credit cards | Debit cards |

|---|---|---|---|

Liability | Business is solely responsible | Individual is solely responsible | Tied to available cash deposits |

Credit impact | Affects business credit only | Affects personal credit score | No credit impact |

Rewards program | Business earns and redeems all rewards | Individual earns and controls rewards | Limited or no rewards |

Spend control | Customizable limits and category restrictions | Limited controls | Basic controls |

Reporting | Detailed business expense categorization | Basic personal spending reports | Basic transaction history |

Individual spending limits | Customizable per employee or department | Fixed credit limit per individual | Limited to account balance |

Merchant category restrictions | Block/allow specific merchant types | No merchant controls | Basic merchant controls |

Approval workflows | Built-in approval processes for purchases | No approval controls | Limited approval features |

Real-time expense tracking | Automatic categorization and reporting | Basic personal spending history | Transaction history only |

Vendor locking | Restrict purchases to approved vendors | No vendor restrictions | Basic vendor controls |

Spend analytics | Department and employee-level insights | Personal spending summaries | Basic account reporting |

Card provisioning | Instant virtual cards, quick physical cards | Individual application required | Standard card issuance |

Key differences that make employee credit cards valuable for small and mid-sized businesses include:

- Your business, not your employees, is responsible for all charges, reducing or even eliminating the need for employee expense reimbursements

- The best employee credit card options come with business expense software that enables customizable spend limits, vendor and category restrictions, and more

- There's no impact on your employees' personal credit, protecting their financial profiles

This setup enables necessary business purchases while maintaining strong oversight.

Corporate credit cards vs. small business credit cards

Corporate credit cards are typically for larger companies with established credit histories and significant annual revenues. These cards offer:

- Higher average credit limits

- Advanced expense management systems

- Sometimes no personal guarantee from business owners

Small business credit cards are accessible to smaller operations and newer businesses with lower revenue and thinner credit history. They usually have:

- More modest credit limits

- A personal credit check and personal guarantee required from the business owner

- Rewards programs tailored to typical small business spending, like office supplies, telecom, and shipping

Small business cards typically provide basic expense management features, while corporate cards deliver enterprise-level reporting and integration with accounting software or enterprise resource planning (ERP) systems.

Benefits of employee credit cards for businesses

Employee credit cards offer several advantages that make your financial operations more efficient. The main benefits include better expense management, stronger spending control, consolidated rewards, enhanced fraud protection, and greater operational flexibility.

Streamlined expense tracking and reporting

Employee credit cards automatically capture and categorize transaction data, creating digital records of all purchases. Modern solutions like AI agents can review these transactions in real-time, automatically approving compliant expenses while flagging potential issues for review. This automation eliminates manual entry and frees your employees from filling out expense reports or waiting for reimbursement.

The digital transaction trail reduces errors and provides a complete, accurate record for your finance and accounting teams. At month-end, they can quickly reconcile expenses without chasing down missing receipts, saving hours of administrative work.

More control and visibility over employee expenses

Modern employee card programs give you customizable spending parameters, letting you:

- Set individual spending limits based on employee roles or departments. For example, a manager can issue cards to sales representatives with $2,000 monthly limits for client entertainment and travel, where transactions that would exceed their remaining budget get declined automatically

- Restrict purchases to specific vendors or merchant categories. Your marketing team can use their cards for advertising platforms like Google Ads and Facebook, but purchases at electronics stores or gas stations get blocked to prevent accidental personal purchases

- Implement approval workflows for transactions above a certain limit. Any employee transaction over $1,000 triggers an automatic approval request to their manager, who can approve or deny it through the card management platform within minutes

- Enforce your business's expense policy automatically. For instance, if your policy prohibits personal purchases, the system can decline transactions at grocery stores or gas stations while allowing office supply purchases

Real-time transaction alerts notify you of out-of-policy purchases, allowing immediate intervention. When an employee makes a purchase, you receive an instant notification showing the amount, merchant, and employee name. If a team member buys office supplies at 2 PM, you can see the transaction in your dashboard before they return to the office. In some cases, these controls can even help prevent unauthorized spending before it happens rather than catching it during monthly reconciliation.

Reduce fraud and misuse

Employee credit cards include multiple layers of protection against fraud and misuse. Card issuers provide zero-liability policies for unauthorized transactions, and advanced fraud detection systems flag suspicious activity in real time.

You can immediately freeze or cancel physical cards if they're lost, stolen, or when employees leave. Additionally, many modern employee card options offer the ability to spin up virtual cards for one-off or highly specific purchasing needs, reducing the risk of fraud even further.

Earn rewards on employee spending

By consolidating employee purchases onto company cards, you can maximize rewards. These rewards accumulate in your business account and can add up quickly.

Some cards offer points or miles-based rewards on eligible purchases, while others offer cashback. Certain employee cards may give you higher rewards rates in specific categories as well. You can then redeem rewards for statement credits, business travel, or exclusive business services and discounts.

What to look for in an employee credit card

When choosing employee credit cards, consider factors that affect both financial value and operational efficiency. The right card should balance cost, rewards, expense management features, and integration capabilities to fit your business needs.

- Unlimited cards: Look for options that offer free unlimited physical and virtual cards for authorized users. Some providers charge fees for each additional card, and others may not offer virtual cards.

- Spending controls: Some cards allow you to create employee spending limits, and more advanced cards let you set vendor and expense category restrictions. These limits can reduce business expenses by ensuring cardholders follow your spending policy.

- Real-time tracking: Some providers let you track spending on corporate credit cards in real time. This means you always have an accurate view of how your actual spend is tracking against projected budgets.

- Annual fees and interest rates: Cards with annual fees often provide enhanced rewards and premium perks like airport lounge access. If you plan to carry a balance from month to month, be sure to research the APR for your chosen card. To avoid interest charges, set policies requiring balances to be paid in full each billing cycle.

- Rewards structure: Look for cards that match your spending patterns. Some offer a flat cashback rate on all purchases, while others provide higher rewards in specific categories. Some cards also feature rotating bonus points categories or anniversary bonuses, which can boost your return.

Ideally, the company card you choose should be able to integrate with your business accounting software. Cards that sync automatically with platforms like QuickBooks, Xero, or Sage Intacct reduce manual data entry and reconciliation.

Modern solutions can automatically categorize transactions, attach digital receipts, and generate expense reports. This seamless data flow saves you time, improves reporting accuracy, and simplifies tax prep and audits.

Best practices for issuing company credit cards to employees

Before you begin issuing employee cards, make sure you consider factors like training employees, auditing transactions, and tracking and reporting on spending

- Create a clear policy: Write a comprehensive corporate credit card policy that outlines approved purchases, documentation requirements, and consequences for misuse

- Training: Provide annual training to cardholders regarding acceptable use and company expectations, and make your policy readily available for easy reference

- Regular audits: Implement a schedule for reviewing card activity to identify patterns and look for opportunities to reduce spending

- Receipt management: Require employees to submit receipts for all transactions, either physically or through a receipt scanner app, so you don’t run afoul of IRS rules

- Expense reporting: Implement simple processes for employees to categorize and report expenses—or, better yet, choose a card like Ramp that does it automatically

Why growing businesses choose Ramp for their employee cards

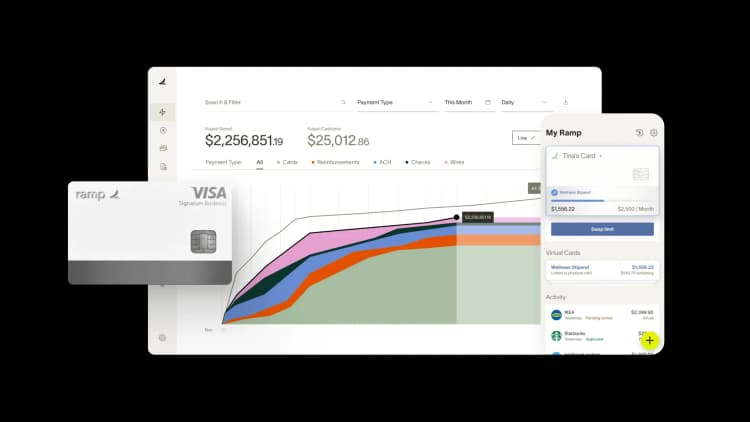

Ambitious companies choose Ramp because it combines high-limit corporate cards with an all-in-one finance operations platform that includes expense management automation, bill pay, corporate travel booking, accounting automation features, and more. Ramp lets you issue as many physical or virtual corporate cards as your team needs for free.

Eventbrite, the global ticketing and event technology platform, struggled with a fragmented, labor-intensive process for getting corporate cards for employees. “We had a very poor experience for the cardholders and approvers,” says Laura Morenno, Director of Global AP & FSO at Eventbrite. “It was a very painful process, with labor-intensive administration.”

Any time an employee requested a new credit card via email or Slack, it took about three weeks to enroll, receive, and activate the new card. And once employees actually had their cards, the approval process for reporting expenses was also painful. “Everything was manual, and you’d have to save the email for internal audit requests,” says Laura.

All that changed with Ramp. “People can just go into Ramp and request a new card, and the approval workflow is built in there,” Laura says. One feature the team found especially helpful was Ramp’s ability to safely, securely, and quickly issue virtual cards. “If employees have an urgency, they have a fully approved virtual card right away.”

Now, Eventbrite employees can access the cards they need in Ramp in a single day rather than the three weeks it took with their previous card provider. Ramp has improved the user experience for employees, increased visibility into spending for the finance team, and helped the whole organization operate more efficiently.

Choose the best employee credit card

Employee credit cards should do more than just let your staff spend up to a certain limit. That’s where Ramp stands out as the best option for growing businesses.

Ramp’s corporate cards come paired with built-in employee expense management software and a whole lot more:

- Automated receipt matching: Employees can submit receipts via SMS the instant they make a purchase. Ramp automatically matches receipts with purchases and codes them to the correct expense category, saving time on both the front and back end.

- Real-time expense tracking: Monitor every business expense you in real time. Analyze spending by department, location, merchant, and more to help you spot trends and find opportunities to improve cash flow.

- More than $350,000 in partner rewards: Ramp offers exclusive discounts and credits on purchases with common business vendors like UPS, Amazon Business, and others.

Ramp is more than an employee credit card. Try an interactive demo and learn why Ramp customers save an average of 5% a year across all spending.

FAQs

Yes, companies may issue business credit cards to employees who need to make purchases on behalf of the company, such as travel, client meals, or office supplies.

Not all employees receive corporate cards. Eligibility depends on company policies, job roles, and expense needs. Typically, only employees who need to incur business-related expenses or travel frequently are issued an employee credit card.

To get an employee credit card, your company must issue it to you directly. Your eligibility for a corporate card usually depends on your role, responsibilities, or other criteria based on your company’s expense policy. With employee credit cards, companies usually set a spend limit at the employee, card, or department level to control spending and effectively manage expenses.

Generally, using a company-issued credit card will not impact your personal credit score. These cards are typically used for business expenses and are often reported under the company's business credit account, not your personal credit report.

Virtual cards can be issued instantly through most modern platforms, allowing immediate online purchases. Physical cards typically arrive within 2-5 business days via standard shipping, or next-day with expedited delivery. The approval process for adding new cardholders usually takes 1-2 business days, depending on the company's internal approval workflow.

Employee credit cards provide detailed transaction-level reporting that shows which employee made each purchase, when, where, and for how much. Most platforms categorize expenses automatically and generate individual spending reports. Managers can set up real-time alerts for specific employees and track spending against individual budgets or department allocations.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°