- What does net 45 mean?

- Components of net 45 payment terms

- How to calculate net 45 payment terms

- Common examples of net 45 payment terms

- Advantages and drawbacks of net 45 terms

- Net 45 vs. other payment terms

- Should your business use net 45 payment terms?

- How to manage net 45 payments

- Use Ramp to manage net 45 payments effectively

Net 45 payment terms can play a big role in shaping your company’s cash flow strategy. When used strategically, it provides a predictable payment schedule that benefits both buyers and suppliers.

But when your invoice is due 45 days from receipt, depending on how well you plan, it can either extend breathing room or cause bottlenecks.

In this guide, we'll explain how it works, its pros and cons, and how to manage it to help you make smarter business decisions and prevent financial gaps.

What does net 45 mean?

Net 45 is a credit term that means an invoice must be paid in full within 45 days of the invoice date. It offers slightly more flexibility than net 30 terms, allowing for extended cash flow management while ensuring timely vendor payment.

The impact of net 45 terms is different for each party involved in the transaction:

- For buyers: Provides flexibility, allowing them to manage cash flow before paying invoices

- For sellers: Means waiting longer for payment, which can affect liquidity and financial planning

Net 45 payment terms include weekends and holidays. For example, say a supplier delivers office furniture to a company and issues an invoice on March 1 with net 45 terms. The buyer must pay by April 15. There’s no earlier requirement and no late penalties as long as they pay on time. If payment is late, the supplier may charge late invoice fees or restrict future credit terms.

Why do businesses use net 45?

Payment terms aren’t one-size-fits-all. Some industries, such as wholesale, consulting, and enterprise sales, favor net 45 because they operate on longer financial cycles. Larger companies may also push for extended terms to optimize their working capital.

Net 45 often hits the sweet spot between net 30 and net 60. While net 30 can feel too restrictive for complex B2B transactions or clients with lengthy approval processes, net 60 might strain the seller's cash flow unnecessarily. Net 45 provides enough flexibility for buyers to manage their payment schedules without creating excessive financial pressure on suppliers.

Additional reasons a business might use net 45 include:

- Cash flow management: Net 45 gives businesses more breathing room between when they receive goods or services and when they need to pay, which can be especially valuable for companies with seasonal revenue patterns or those waiting on their own customer payments

- Relationship dynamics: Established vendors often extend net 45 terms to long-term, trusted clients to maintain strong relationships and secure repeat business. This form of trade credit can make one supplier more attractive than another.

- Administrative efficiency: Companies with complex payment approval processes benefit from the extra cushion net 45 provides. Large organizations often need multiple departments to review and approve invoices before payment can be processed.

- Industry standards: In some sectors, net 45 has simply become the expected norm. When competitors offer these terms, businesses may need to match them to stay competitive in their market.

- Risk assessment: Companies may offer net 45 to financially stable clients while requiring shorter terms from newer or higher-risk customers, using payment terms as a tool to manage credit risk

Net 45 terms ultimately serve as a flexible option that helps you balance cash flow needs, maintain client relationships, stay competitive within your industry, and manage credit risk effectively.

Common invoice language

When you see "net 45" on an invoice, it typically occupies a prominent place in the payment terms section, often appearing as "Payment Terms: Net 45" or simply "Terms: Net 45." You might also encounter variations such as "Net 45 days" or "Payment due within 45 days."

The term usually appears alongside other key invoice details, such as the invoice number, date, and total amount due. Some businesses include additional context by writing "Net 45 days from invoice date" to make the payment deadline crystal clear. You'll often find this information in a dedicated box or section labeled "Payment Terms" or "Terms and Conditions."

Many invoices also include the actual due date calculated from the net 45 terms, so instead of making clients do the math, you might see both "Terms: Net 45" and "Due Date: \[specific date\]" listed together. This dual approach helps prevent any confusion about when payment is due.

Using net 45 is about balancing financial flexibility with vendor relationships. You need to weigh the benefits of delayed payment against the potential effect on supplier trust and future terms.

Components of net 45 payment terms

Not all payment structures operate the same way, and net 45 terms come with specific expectations that businesses need to navigate. Here’s what defines them:

- Invoice date vs. due date: The 45-day window starts from the invoice date, not from the delivery of goods or completion of services. This distinction matters, especially for businesses managing multiple invoices at once.

- No early payment discounts (unless specified): Unlike terms such as 2/10 net 45, which offer a discount for early payment, standard net 45 terms require the full amount to be paid on or before day 45, with no incentives for settling the balance sooner

- Late fees and penalties: If the buyer doesn’t remit payment within 45 days, they may face late fees, interest charges, or even restrictions on future credit terms. In some cases, consistent late payments can affect a company’s financial reputation and vendor relationships.

Understanding net 45 payment terms helps you manage expectations, whether you're extending credit or operating within a longer payment cycle.

How to calculate net 45 payment terms

Calculating net 45 payment terms is straightforward. It’s just a matter of adding 45 calendar days to the invoice date to determine when payment is due. Since net 45 starts from the invoice date, not the delivery date, you need to track the timeline carefully to avoid late fees.

Here’s how it works:

- Identify the invoice date: This is the date the seller issues the invoice, which starts the 45-day count

- Add 45 calendar days: Count forward, including weekends and holidays, unless the contract specifies business days only

- Determine the due date: The full payment is due exactly 45 days after the invoice date. If that date lands on a weekend or holiday, some businesses may shift it to the next business day, but this depends on the agreement.

Example calculation

A supplier issues an invoice on March 10 with net 45 terms:

- Invoice date: March 10

- Due date: April 24 (45 days later)

Since weekends and holidays are typically included in the calculation, April 24 remains the due date unless the contract specifies otherwise. If payment processing policies adjust for non-business days, the due date may shift, so it's always best to review the terms in advance.

Net 45 calculator tools

Several online calculators and accounting software platforms can automate this calculation process for you. These tools allow you to enter your invoice date and automatically generate the exact due date, accounting for variables like month lengths and leap years.

Many invoicing platforms include built-in payment term calculators that handle net 45 calculations automatically when you create invoices. These digital tools help eliminate manual errors and ensure consistency across all your invoicing.

Common examples of net 45 payment terms

Net 45 payment terms can vary slightly depending on the payment conditions set by the supplier. These variations often include discounts for early payment, which can encourage buyers to settle their invoices sooner. Here are a few common examples of how net 45 terms might appear in invoices:

- Net 45: The full invoice amount is due in 45 days with no discount for early payment

- 2/10 net 45: The buyer receives a 2% discount if they pay within 10 days. Otherwise, the full amount is due within 45 days.

- 1/10 net 45: A 1% discount applies if the buyer pays the invoice within 10 days. Otherwise, the full amount is due in 45 days.

- 1/15 net 45: A 1% discount is available if the buyer pays within 15 days. Otherwise, the full amount is due in 45 days.

We’ve already covered how standard net 45 terms work in our previous calculation. Here’s how the other variations work.

2/10 net 45 example

With 2/10 net 45, the buyer receives a 2% discount if they pay within 10 days. Otherwise, the full amount is due in 45 days.

- Invoice amount: $1,000

- Invoice date: March 10

- Discount deadline (10 days later): March 20

- Discounted payment amount: $1,000 – (.02 * $1,000) = $980

- Full payment deadline (45 days later): April 24

- Full payment amount: $1,000, if buyer doesn’t use discount

1/10 net 45 example

With 1/10 net 45, the buyer gets a 1% discount if they pay within 10 days, but they must pay the full amount if they wait the full 45 days.

- Invoice amount: $1,000

- Invoice date: March 10

- Discount deadline (10 days later): March 20

- Discounted payment amount: $1,000 – (.01 * $1,000) = $990

- Full payment deadline (45 days later): April 24

- Full payment amount: $1,000, if buyer doesn’t use discount

1/15 net 45 example

With 1/15 net 45, a 1% discount applies if the buyer pays within 15 days. Otherwise, they owe the full amount in 45 days.

- Invoice amount: $1,000

- Invoice date: March 10

- Discount deadline (15 days later): March 25

- Discounted payment amount: $1,000 – (.01 * $1,000) = $990

- Full payment deadline (45 days later): April 24

- Full payment amount: $1,000, if buyer doesn’t use discount

These variations help businesses balance cash flow management. Buyers get an incentive to pay early, while suppliers can improve liquidity by reducing waiting periods for payments.

How does net 45 compare to other payment terms?

Payment terms vary based on cash flow needs. Net 30 is common for quicker payments. Net 60 and net 90 give buyers more flexibility, but they can strain suppliers. Net 45 strikes a balance, offering buyers extra time while keeping supplier cash flow manageable.

Advantages and drawbacks of net 45 terms

Net 45 offers flexibility but comes with risks. Here’s what to consider.

Advantages of net 45

- Flexibility for buyers: Extends the payment window, easing short-term cash flow constraints

- Stronger business relationships: Appeals to clients who prefer longer payment terms, fostering trust

- Predictable revenue cycle: Helps suppliers anticipate cash inflows, assuming buyers make payments on time

- Less strain than longer terms: Offers more time than net 30 payment terms, but avoids the cash flow risks of net 60 or net 90

Drawbacks of net 45

- Risk of late payments: Clients may delay payments, creating cash flow uncertainty

- Potential collection issues: Longer payment cycles mean more follow-ups for outstanding invoices

- Not ideal for every industry: Businesses with high operational costs or tight margins may struggle with delayed payments

- Delayed cash flow for sellers: Extended payment terms can strain suppliers' working capital and limit their ability to invest in growth or cover immediate expenses

Net 45 works best when payments are reliable, but businesses should assess whether it aligns with their financial needs.

Net 45 vs. other payment terms

Different payment terms serve different business needs, and choosing the right one depends on your industry, cash flow requirements, and client relationships.

Payment term | Days to pay | Common industries | Cash flow impact |

|---|---|---|---|

COD (cash on delivery) | 0 days | Retail, new clients | Immediate cash flow |

Due on receipt | 0–5 days | Professional services, utilities | Very fast cash flow |

Net 15 | 15 days | Retail, small services | Fast cash flow |

Net 30 | 30 days | Standard B2B, manufacturing | Balanced cash flow |

Net 45 | 45 days | Wholesale, consulting, enterprise | Moderate delay |

Net 60 | 60 days | Large corporations, government | Significant delay |

Net 90 | 90 days | Government contracts | Longest delay |

45 EOM (end of month) | 45+ days | Wholesale, distribution | Variable delay |

Let's look at each payment term in a little more detail:

- COD (cash on delivery): Payment is due immediately upon delivery of goods or services, providing instant cash flow but limiting client flexibility. Common in retail and when dealing with new or high-risk customers.

- Due on receipt: Buyer agrees to pay within 0–5 days of receiving the invoice, offering very fast cash flow for sellers. Typically used by professional services, utilities, and subscription-based businesses.

- Net 15: Payment is due within 15 days of the invoice date, providing fast cash flow while giving clients a brief processing window. Popular in retail and small service industries.

- Net 30: Payment is due within 30 days of the invoice date, representing the standard B2B payment term that balances cash flow needs with reasonable client payment schedules. Widely used in manufacturing and professional services.

- Net 45: Payment is due within 45 days of the invoice date, offering extended terms for complex B2B transactions. Common in wholesale, consulting, and enterprise sales where approval processes take longer.

- Net 60: Payment is due within 60 days of the invoice date, typically reserved for large corporate clients or government contracts with lengthy procurement processes. Can create cash flow delays for suppliers.

- Net 90: Payment is due within 90 days of the invoice date; this is primarily used for government contracts and very large corporate deals. It’s the longest standard payment cycle.

- 45 EOM (end of month): Payment is due 45 days after the end of the month in which the invoice was issued. For example, an invoice issued on October 5 is due 45 days after October 31. Popular in the wholesale and distribution industries.

Businesses typically choose net 30 for standard transactions with established clients, net 45 for complex B2B deals or when competing for larger accounts, and net 60 for high-value contracts where buyers need extended approval processes. The decision often balances client satisfaction against cash flow needs.

Shorter payment cycles improve cash flow and reduce collection risks, while longer terms can attract bigger clients and accommodate complex purchasing processes. However, extended terms also increase the risk of late payments and can strain working capital for suppliers.

Net 45 vs. net 30

Net 30 remains the gold standard for most B2B transactions, offering a balanced approach that gives buyers sufficient time to process payments while maintaining reasonable cash flow for sellers. Net 45 extends this window by two additional weeks, which can make a significant difference for companies with lengthy approval chains or those managing multiple vendor payments.

From a cash flow perspective, net 30 gets money in your hands 15 days sooner than net 45, which can be substantial for businesses with tight margins. Industry norms vary considerably. While net 30 dominates in manufacturing and professional services, net 45 is increasingly common in wholesale distribution and enterprise software sales.

Net 45 vs. net 60

Net 60 terms are typically reserved for large corporate clients or government contracts where procurement processes are inherently slow and bureaucratic. While net 45 strikes a middle ground between flexibility and cash flow management, net 60 can create working capital challenges for suppliers.

The main benefit of net 60 is its appeal to major buyers who prefer extended payment schedules to optimize their own cash management. However, the additional 15 days beyond net 45 can substantially impact sellers’ ability to cover operational expenses and invest in growth.

Companies offering net 60 often require strong financial backing or factoring arrangements to bridge the extended payment gap.

Should your business use net 45 payment terms?

Net 45 payment terms can be a useful tool for building stronger business relationships, but they're not right for every situation. The key is knowing when to offer them and when to walk away.

When net 45 makes sense

Consider offering net 45 terms when you're working with large, established companies that have proven payment histories. These organizations often prefer longer payment windows because they align with their internal approval processes and accounting cycles. If you're trying to win a big contract or maintain a long-term partnership, longer terms might be worth the trade-off.

Net 45 also works well when you have healthy cash reserves and can comfortably handle delayed payments. Companies with strong financial positions can use these terms as a relationship-building tool without putting stress on their operations.

When to think twice

Smaller businesses or startups with tight cash flow should be cautious about net 45 arrangements. If you need quick payment to cover payroll, rent, or supplier invoices, those extra 15–30 days can create problems. New clients without established payment histories also present higher risk for extended terms.

Key factors to evaluate

Before committing to net 45 terms, evaluate these factors to help determine whether extended payment windows benefit or harm your business:

- Industry standards: Research what's normal in your field before making decisions. Construction and manufacturing often expect longer payment terms built into pricing structures, while technology services and consulting typically operate on shorter cycles.

- Client relationships: A loyal customer who always pays on time deserves different consideration than a new prospect you're still evaluating. Look at their payment history, financial stability, and the size of the contract relative to your business.

- Cash flow needs: Calculate how delayed payments will affect your ability to meet obligations. If you'll need to borrow money or delay paying your own vendors, factor those costs into your pricing and decision-making process.

These three factors work together to guide your payment term decisions and protect your business interests while maintaining client relationships.

Negotiating payment terms effectively

Start by asking about standard payment practices early in your discussions. Many businesses have set policies, but there's often room for negotiation, especially on larger contracts. Present your preferred terms confidently while showing flexibility for the right deal.

Consider offering incentives for faster payment. A 2% discount for payment within 10 days can motivate quicker settlements while still protecting your margins. This approach gives clients options while encouraging the behavior you want.

When clients push for extended terms, don't just accept or reject them outright. Explore alternatives such as partial upfront payments, milestone-based billing, or progress payments. These arrangements can give clients flexibility while protecting your cash flow.

Making it work for your business

Success with net 45 terms requires proper planning and execution. These steps help protect your cash flow while maintaining positive client relationships.

- Build costs into pricing: Delayed payment creates a financing cost that your prices should reflect. Many businesses underestimate this impact and end up subsidizing their clients' cash flow needs without realizing it.

- Set clear expectations: Your contracts should specify exactly when the 45-day period begins, what happens if payments are late, and any applicable fees or interest charges. Clear communication prevents misunderstandings later on.

- Monitor accounts receivable closely: The longer payment window means problems can develop before you notice them. Regular follow-ups and proactive communication help keep payments on track.

Net 45 terms can strengthen business relationships and help you compete for valuable contracts. The key is using them strategically, with full awareness of the impact on your cash flow and operations. When applied thoughtfully, they become a valuable tool for growth rather than a source of financial stress.

How to manage net 45 payments

Once you've decided to offer net 45 terms, proper management becomes essential for maintaining healthy cash flow and client relationships. The extended payment window requires more attention than standard terms, but the right approach makes it manageable.

Track every invoice carefully

Create a detailed tracking system that shows invoice dates, due dates, and payment status for all outstanding invoices. A simple spreadsheet works for smaller businesses, while growing companies benefit from highly-rated invoice automation solutions. Include client contact information, invoice amounts, and any special terms or conditions.

Set up weekly reviews of your accounts receivable aging report. This practice helps you spot potential problems early and take action before payments become seriously overdue. Mark invoices that are approaching their due dates so you can send timely reminders.

Prevent late payments proactively

Taking proactive steps to prevent late payments saves time, maintains positive client relationships, and effectively protects cash flow:

- Send reminders: A friendly reminder at 30 days, followed by a more formal notice at 40 days, keeps your invoice visible without being pushy. Many clients appreciate the heads-up, especially when managing multiple relationships.

- Use automated invoicing: Automated systems can send reminders without requiring manual intervention. Set up email templates that maintain a professional tone while clearly stating payment expectations and include all necessary payment information.

- Establish clear contract terms: Specify exactly when the 45-day period begins, acceptable payment methods, and any late fees or interest charges. Include complete payment instructions and contact information for questions.

These prevention strategies reduce collection efforts and create smoother payment processes that benefit both your business and your clients.

Use software

Invoicing software offers built-in payment tracking, automated reminders, and aging reports that simplify accounts receivable management. Most platforms can generate detailed reports showing which invoices are approaching their due date and which clients consistently pay late.

Cloud-based solutions provide mobile access and collaboration features, allowing you to check payment status from anywhere. For larger operations, specialized accounts receivable platforms offer advanced workflows, payment portals, and analytics that help identify trends in your collection patterns.

Collect late payments

Late payments require escalating responses that balance the vendor-client relationship with effective collection. Follow these steps to recover overdue amounts professionally:

- Start with phone calls: Contact clients when payments reach 50 days past invoice date. Many late payments result from simple oversights or processing delays rather than inability to pay, and friendly conversations often resolve issues quickly.

- Document all communication: Keep records of phone calls, emails, and any agreements reached with clients. This documentation becomes valuable if you need to escalate collection efforts later or evaluate ongoing client relationships.

- Send formal demand letters: If phone calls don't work, send written notices outlining overdue amounts, late fees, and consequences of non-payment. Many businesses respond quickly to formal letters when they realize the seriousness of the situation.

- Consider professional help: For significantly overdue accounts, hire collection agencies or consult attorneys. These professionals can often recover payments that internal efforts cannot, though they typically charge a percentage of collected amounts.

Consistent follow-up and documentation turn late payment management from a stressful situation into a controlled process that protects your business interests.

Maintain cash flow balance

Factor collection timeframes into your cash flow projections. Net 45 terms often become net 60 or longer in practice, so plan accordingly. Build cushions into your operating budget to handle extended payment cycles.

Consider offering early payment discounts to encourage faster settlements. A 2% discount for payment within 15 days can motivate quicker payments while still protecting your margins on most transactions.

Regular analysis of your payment patterns helps identify trends and problem accounts. Track average collection times, late payment rates, and successful collection methods. This data guides future decisions about payment terms and client relationships.

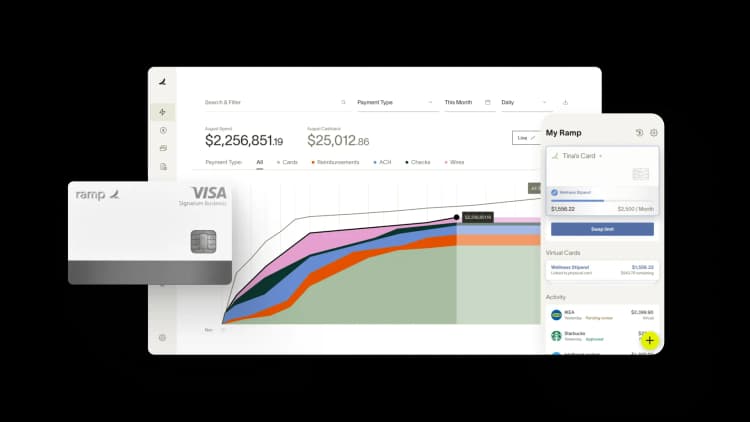

Use Ramp to manage net 45 payments effectively

Net 45 terms offer a balance between flexibility and timely payments, but managing them requires careful tracking to avoid cash flow issues. Without the right systems in place, vendors may experience delays, and buyers risk missing due dates, leading to penalties or strained relationships.

That’s where Ramp Bill Pay makes managing net 45 payments easy:

- Automated invoice processing: Capture, categorize, and approve invoices faster, reducing manual data entry

- Smart approval workflows: Route invoices to the right stakeholders, ensuring approvals happen before payments are due

- Visibility into cash flow: Get a real-time view of upcoming payments and optimize working capital

Try an interactive demo and see how Ramp Bill Pay simplifies financial management while saving your business time and money.

You can learn more about Ramp Bill Pay and how it helps automate accounts payable at our official page: https://ramp.com/accounts-payable

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits