- What is third-party billing?

- Why do businesses use third-party billing?

- Where third-party billing falls short

- From third-party billing to automation: A smarter way forward

- Ramp: An alternative to third-party billing

Billing and invoicing are daunting tasks for many finance teams. To free up time for more critical tasks, some companies choose to outsource billing to a third party.

In this guide, we’ll cover all the most important questions about working with a third party to handle billing for your company.

What is third-party billing?

Third-party billing is a process where another company handles all invoicing and payment processes between a business and its customers and vendors.

The work of a third-party billing company typically includes invoicing, payment, and other billing-related activities. However, the services offered by these agencies vary based on company size and the complexity of the payment process.

Third-party billing is especially popular with health services, insurance companies, and other sectors with complex billing and payment collection processes.

Why do businesses use third-party billing?

Invoice management and payment processing are daunting, resource-intensive tasks. Their complexity often pushes organizations to delegate operations to a third party.

Here are four additional reasons why businesses outsource payments to a third-party provider:

1. Reduces costs

Outsourcing invoice processing is cost-effective. Companies don’t have to build expertise in a non-core business area or invest in internal technical infrastructure. The result is lower costs in the long run since companies do not have to worry about maintenance or hiring personnel.

2. Ensures compliance with industry regulations

Payments are highly regulated, and it can be challenging to stay on top of regulations. Failure to comply with industry regulations can lead to hefty fines and damage your company’s reputation. However, working with a third-party billing provider ensures compliance out of the box, leading to greater confidence in the payment process.

3. Simplifies invoice collection

Keeping track of billing and invoicing and ensuring that customers pay on time can be time-consuming and expensive. A third-party provider simplifies the entire process by handling collections on a company’s behalf. This saves time and money.

4. Safety

Security and safety are essential for every organization’s payment process. For example, most third-party payment service providers in the healthcare industry are HIPAA-compliant.

The Health Insurance Portability and Accountability Act, most commonly known as HIPAA, is a federal law that protects sensitive patient health information from being disclosed without their consent. Failure to comply with HIPAA can lead to serious repercussions.

Billing service providers across multiple industries offer a secure billing process that safeguards confidential data against malware attacks and other malicious actors.

Where third-party billing falls short

As with outsourcing any business function, third-party billing has its downsides. Here’s where it can fall short:

Limited control over your finances

While using a third-party billing provider frees up more time to work on business-critical tasks, you lose control over your finances. Delegating all your financial operations to another company isn’t something everyone wants to do.

While third-party providers are highly reliable, controlling your cash flow and payment acceptance is ideal. Thus, third-party billing services tend to fall short in this regard.

Additional fees

Third-party billing services charge transaction fees and a host of other onboarding charges that might stretch your net margins. For companies of a certain size, handling payments in-house makes more sense because the savings you realize from the lack of one-time or recurring fees justifies the expense of setting up your own infrastructure.

From third-party billing to automation: A smarter way forward

Switching from third-party billing to an automated billing system is more than just an upgrade—it’s a strategic move that streamlines operations, cuts costs, and boosts efficiency. While third-party billing offers convenience, it comes with limitations that automation solves, giving businesses direct control and scalability at a lower cost.

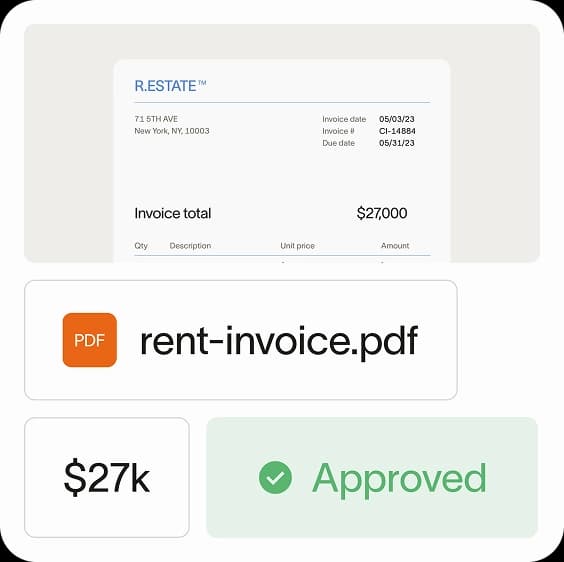

The best accounts payable automation software supports this transition by combining invoice processing, approvals, and payments into one seamless workflow.

Why make the switch?

- More control and transparency: Third-party billing keeps you reliant on external providers, often slowing decisions and limiting visibility. Automation hands you the reins with real-time tracking and full transparency.

- Cost efficiency: Outsourcing billing can rack up fees per transaction. Automated systems eliminate intermediaries, reducing costs and keeping processes in-house.

- Speed and accuracy: Manual tasks lead to errors and delays. Automation uses programmed workflows to process transactions faster and with fewer mistakes.

Steps to transition to automated billing

- Assess your current system: Identify inefficiencies, costs, and challenges in your third-party billing setup to pinpoint where automation adds value.

- Choose the right solution: Look for platforms that integrate with existing systems, support your industry needs, and offer customizable workflows, reporting, and compliance features.

- Migrate gradually: Start small—automate recurring payments or invoice generation first to minimize disruptions. Expand as your team gains confidence.

By transitioning to automation, businesses gain more than efficiency: They unlock cost savings, scalability, and complete control over billing management. It’s not just about keeping up; it’s about setting your business up for long-term success.

Ramp: An alternative to third-party billing

Third-party billing providers come in all shapes and sizes. Some focus solely on payment processing, while others offer specialized billing services, like consulting. But why settle for outsourcing when you could take full control?

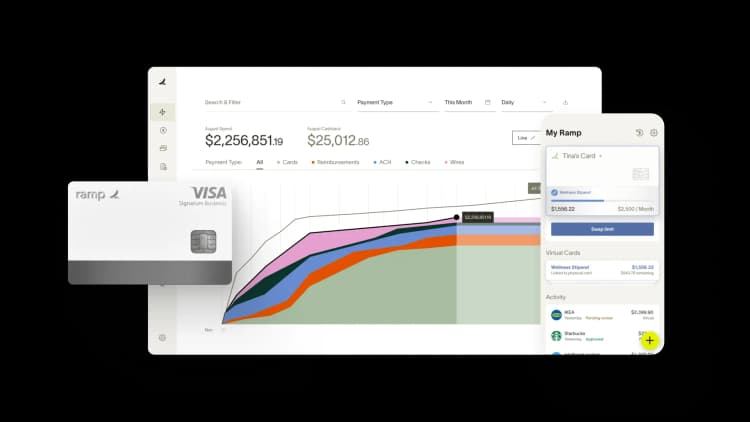

Ramp is a finance automation platform that eliminates the need for third-party outsourcing. It’s designed to handle bill payments, manage expenses, and give you complete visibility into your financial operations in a single, unified solution.

Feature | Third-party billing | Ramp |

|---|---|---|

Bill payment automation | Limited | Yes |

Real-time spend control | No | Yes |

Vendor management | No centralized view | Yes (dashboard with contracts + spend) |

Expense reporting | Limited or manual | Automated with AI-powered tools |

How Ramp helped Heyday Skincare unify their AP workflow

Heyday Skincare had a problem. With 23 geographically distributed locations, each with its own unique spending patterns, Heyday Skincare struggled with a fragmented accounts payable system. That meant a lot of duplicated effort and administrative burden for their finance team.

Heyday needed a platform that could manage expenses for both its national brand marketing campaigns and its individual shops. They turned to Ramp for a solution. "It’s a challenge to bring all those things together, and Ramp is a tool that allows us to do that," says Senior Accounting Manager Shawn Gordon.

Ramp Bill Pay has been a true game-changer for Heyday. Prior to using Ramp, Heyday struggled with a legacy bill pay system that duplicated the company’s inventory. Shawn says, "We immediately stopped bleeding by switching to Ramp."

As a result of the switch, Heyday has seen a monthly time savings of 5–15 hours and a total savings of 3%–5%. Shawn says, "Ramp has been a saving grace by organizing and consolidating systems and giving us real-time visibility across 23 entities."

Unify your finances with Ramp

Ramp streamlines financial management by consolidating expense tracking, corporate card spending, bill payments, and budget oversight into a single platform that gives you complete visibility and control over your cash flow.

Here’s how Ramp puts you in control:

- Automate bill payments: Pay bills via credit card, ACH, check, or international wire automatically, ensuring on-time payments and freeing up time for more strategic tasks

- Control spend: Set spending limits by merchant, category, team, or department, with real-time alerts to enforce compliance

- Centralize insights: Unlike third-party billing, Ramp provides a single, unified view of vendor details, contracts, and transactions, giving you unmatched financial oversight

- Simplify expense management: Use AI-powered receipt matching and an intuitive corporate card to streamline reimbursements and expense tracking

Ramp isn’t just an alternative to third-party billing; it’s a powerful way to manage your finances. Automate payments, control spend, and get total financial visibility with one platform.

Time is money. Save both with Ramp.

FAQs

Third-party billing companies help lower overhead costs, ensure compliance with industry regulations, and simplify invoice collection.

Using a third-party provider to process payments won’t give you control over your finances. Plus, you may incur additional costs that could affect your company’s bottom line via one-time fees and other hidden charges.

No, Ramp is a finance automation company that will not only ensure that your company pays bills on time, but also help save time and money. It’s also far more secure compared to third-party billing services.

Accounts payable outsourcing is possible and increasingly common. Third-party providers take over invoice management, payment processing, and reconciliation tasks to boost efficiency and cut costs.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits