- Your sales team’s time should be spent selling

- The perils of unchecked sales expenses

- Reward revenue generation, not spending

- How to reduce the cost of sales T&E

Business T&E is back on the rise, which signals that execs and sales teams are starting to take business trips again to meet customers in person.

Unfortunately, sales T&E is one of the biggest wastes of company dollars because of time-consuming systems and inefficient processes that generate unnecessary costs and spending. What are these costs and how can you avoid them?

Your sales team’s time should be spent selling

If you were to guess how much of your sales team’s time is spent actually selling, what would your estimate be? 75%?

The answer, according to the latest State of Sales Report by XANT, is a shockingly low 35%. That’s right—almost two-thirds of your sales team’s time is spent doing things other than selling your product and services. At a salary of $105,000 per year, that means you’re paying almost $70,000 every year to have your salespeople do low-value tasks.

It’s clear that salespeople should be freed up to focus on doing what they were hired for. And sales leaders and CFOs can make this change a reality by clearing a major barrier: T&E management and admin.

A good corporate card and spend control software eliminates tasks like filling out manual business expense reports, gathering paper receipts from months ago, or figuring out who needs to be given an expense reimbursement during important rapport-building activities like prospect meals or events. It frees up your top-performing salespeople to simply photograph receipts at the time of the transaction or forward a digital receipt when it arrives. That process takes seconds rather than hours. That’s more time they can spend nurturing prospects and closing good deals.

The perils of unchecked sales expenses

On top of the wasted hours on tedious paperwork, the other big source of high sales costs is the percentage of spend that’s wasted.

This problem affects companies large and small. Take a recent audit of New York’s Metropolitan Transport Authority (MTA), for example. The audit looked into dozens of purchases made on procurement cards over 10 weeks in 2020 and found that 24% of the audited purchases were “problematic,” i.e., not within T&E policy. Because of the audit, the MTA has revoked more than 90 cards.

This MTA expenses scandal would not have happened if the authority had a way to control and limit spending in real-time. The problem with traditional corporate credit cards and T&E expense reports is that the data is always delayed, sometimes by as much as a month. That’s a long delay for any finance leader who wants to improve policy compliance and nip out-of-policy spending in the bud! A salesperson who doesn’t follow your expense policy can build up a mountain of employee expenses over a month.

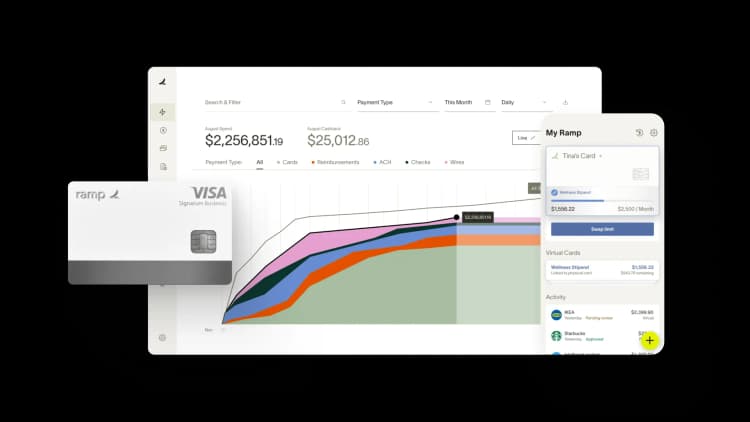

Modern corporate card software like Ramp lets you set limits and locks on certain merchants, providers, and business expense categories (rental cars, travel booking, etc.), so that salespeople only spend on the right things.

You can know what’s happening moment by moment, set up custom alerting rules, and flag out-of-policy charges as soon as they occur.

This combination of card controls and real-time transaction data is a powerful antidote to the cost disease that plagues so many organizations. Many businesses have generated over 10% in savings by switching to a corporate card program.

Reward revenue generation, not spending

The solutions to the issues above require sales teams to switch to modern corporate cards for their T&E spending. But many people have become used to using their personal credit card for business travel expenses to take advantage of personal reward points. Despite the fact that these points are non-transferrable, hard to keep track of, and have no direct monetary value, your salespeople probably still view them as a perk they’re eager to hold on to. How can you convince them to let go?

When you think about it, these points are not so much a perk as they are a bonus for spending as much as possible. People know they keep a percentage of what they spend on personal cards—often up to 4% on corporate travel and meals that they are spending on. Be honest, what would you do in that situation? That’s right, you’d do everything you can to spend as much as is allowed. If the maximum allowed total price for meals or other entertainment expenses is $30, then your employees are going to throttle that right up to a cent under the limit. This isn’t your team's fault. It’s the fault of personal cards that incentivize bad spending.

Wouldn’t you rather be giving bonuses for revenue generation instead?

At Ramp, we estimate switching to corporate cards can save you as much as 10% of your company’s current travel spend. With that saving, you can give your salespeople a replacement bonus—actual cash—that they will value much more than personal card points that have no monetary value. That’s a bonus you can link to ambitious business development targets. It's a reward based on revenue generation, not expenditure. And your best salespeople will love you for it.

"You can give your salespeople a replacement bonus—actual cash—that they will value much more than personal card points."

How to reduce the cost of sales T&E

To sum up, here are 3 ways that founders, finance teams, and sales leaders can cut T&E expenses by at least 10%:

- Set proactive spend controls, and monitor transactions as they happen. Expecting busy managers to enforce your policies isn’t practical. Instead, use automated controls to prevent the most common types of inappropriate spending, and use automated alerts to catch whatever’s left.

- Reward revenue, not spending. Letting your sales reps keep the points they earn on their personal card may seem like generosity, but it’s really a reward for poor behavior. Give your reps corporate cards and a pay increase instead—the better spending behavior will more than pay for the bonus, and everyone will walk away with more money in their pockets.

- Automate T&E processes. Sales T&E expenses themselves aren’t the only thing that can eat away at your profit margins. Time your sales team spends tracking down receipts and submitting expense reports is time they aren’t spending selling. Replace your hour-long T&E expense reporting processes with one-minute receipt matching and accounting automation.

The shift away from personal cards for salespeople is a winner for everyone across the business. Founders and finance leaders can stop worrying about out-of-policy spending and rest assured they are not leaving T&E expense management to chance or blind trust. Ambitious salespeople can be motivated and incentivized with bonuses funded by the savings made possible through the more efficient systems. And you can free up your top performing sales leaders with the time they need to develop your business by closing bigger and better deals. Make sure to check out our page on travel and expense policy examples for more information.

FAQs

T&E is an operational expense for many sales teams. Common sales T&E expenses include air travel, car rental, hotels or lodging, and client dinners.

This depends on a lot of factors. Some company travel budgets are linked to percentage of sales, while others have a fixed expense. What works best for a business depends on the size of team, amount of sales, type of travel, size of company, and many other factors to consider.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°