Can you use a personal credit card for business expenses?

- Is it OK to use a personal credit card for business?

- Why you might use a personal credit card for business expenses

- Advantages of using a business credit card

- Risks of using a personal card for business

- Use Ramp’s corporate card for your business expenses

Technically speaking, you can use a personal credit card for business expenses, and many small business owners do. But that doesn’t necessarily mean you should.

While there’s no law preventing you from using a personal credit card for business expenses, you lose the legal protections that come with a business credit card if your company runs into debt. You also have a tough time separating your business and personal expenses when tax season hits.

For those reasons, many small business owners opt to use a dedicated business credit card. We outline when and why you might use a personal card for business expenses, as well as the advantages and risks involved.

Is it OK to use a personal credit card for business?

There’s no law against using a personal credit card for business expenses. Many small business owners and sole proprietors do, especially in the early stages of their business.

However, just because it’s legal doesn’t mean it’s the best option. Using a personal credit card for business can make it harder to keep business and personal spending separate, cause bookkeeping difficulties, and open you up to personal liability if your business runs into financial trouble.

A common misconception is that you can’t deduct business expenses unless they’re charged to a business credit card, but that’s not true. As long as the expense is ordinary and necessary, the IRS allows you to deduct it, even if it was paid from a personal account.

Despite this, relying on personal cards makes it harder to track spending and raises the risk of audit errors. It can also undermine the legal separation between your personal and business finances, especially if your business operates as an LLC or corporation.

Can employees use their personal cards for business expenses?

Your employees can use their personal cards for business as well, but this often creates more problems than it solves.

In many companies, employees can use their personal credit cards for business expenses and request reimbursement afterward. As long as the purchase qualifies as a valid business expense and the company has a formal expense reimbursement process, this shouldn’t be too much of a hassle.

Giving your employees corporate credit cards can make expense tracking easier and reduce the need for reimbursements, especially as your team grows.

Why you might use a personal credit card for business expenses

There are certain specific scenarios where it might make sense for you to use your personal credit card for business costs. For example:

- You can’t qualify for a business card: You may have no choice if your personal credit score is lacking. The lower your credit score, the fewer options you may have for a business credit card or business line of credit. You can always apply for one in the future as your score improves.

- You don’t plan on charging much: If your business expenses are relatively low and you only need a card for occasional purchases, it might make more sense to stick to your personal card

- You forgot your business card: Say you’re out at a client dinner, forgot your corporate card, and pay with your personal credit card instead. It’s not ideal, but it’s a common one-off scenario. Just be sure to track the expense for reimbursement or tax purposes.

- You need quick access to funds: If you just launched your business and need to make a time-sensitive purchase, a personal credit card can be the quickest option. Waiting for a business card to be approved could slow things down when time is tight.

Advantages of using a business credit card

As a sole proprietor, small business owner, or startup entrepreneur, it’s convenient to use your personal card for business purchases such as office supplies or travel expenses. There might even be times when it’s unavoidable.

While using a personal credit card may feel easier in the moment, business credit cards offer stronger legal protections and better financial separation, not to mention a range of business-specific benefits.

1. Business credit building

From small, everyday business purchases to large-scale loans, your business needs credit to function. One of the best ways to build your business credit score and demonstrate creditworthiness is to keep your business credit history and your credit score strong. You can accomplish that by using a dedicated business credit card.

Building business credit over time allows your business to access better interest rates and terms on any future loans. You won't build business credit using your personal credit card for business expenses, which you might regret if you need to take out a business loan for equipment, real estate, or other larger business expenses.

2. Access to higher credit limits

Running a business can be expensive, so a line of credit to help cover costs is essential. The best business credit cards are purpose-built for the demands of running a business, including higher credit limits than personal credit cards.

3. Rewards programs tailored to business spending

Business credit cards tend to optimize rewards for common business purchases, earning credit card points on categories such as fuel, office supplies, and travel costs. You stand to rack up more points, miles, or cashback on eligible purchases than you would with a personal credit card.

4. Free employee cards

Many premium consumer credit cards make you pay a fee for additional cards or authorized users. In contrast, business credit cards typically offer free, unlimited employee credit cards and virtual credit cards.

5. Spend tracking and expense management features

Some corporate card companies feature additional ways to help you save without incentivizing unnecessary spending. This could be through an expense management platform that analyzes your company’s spending in real time, automatically enforces your company’s expense policy, and finds areas to cut costs.

Risks of using a personal card for business

While there is a strong case for using business credit cards for business expenses, you may still decide to use your personal card or let your team use their personal credit cards. In that case, you need to understand the drawbacks.

1. Fewer legal protections

The main risk of using your personal credit card for business is that you have fewer legal protections should your business become insolvent. Using a personal consumer credit card for business opens you up to personal liability for business expenses, which can damage your personal credit score and even lead to legal action.

2. Personal asset vulnerability

One of the main reasons corporate structures exist is to protect your personal assets from possible business disputes, but you throw consumer protections out the window when you mix your personal and business finances together.

It can lead to some serious legal implications and unfortunate scenarios. For example, your personal assets could be seized in a lawsuit against your business, or family accounts and co-owned property, such as your home, could be liable for seizure.

3. Administrative complications

Using a personal credit card for business purposes complicates your finances and confuses business and consumer credit bureaus, creating room for bookkeeping errors and credit reporting disadvantages.

This is especially true if you operate a nonprofit, which has its own unique tax and bookkeeping requirements. For that reason, it's essential to use a separate business credit card for your nonprofit.

4. Intermingled banking accounts

All the reasons for using a business credit card over a personal card also apply to banking. Opening a dedicated business bank account and checking account that’s separate from your personal accounts is one of the first things you should do when you start your business.

All the major banks and lenders, including Chase, Capital One, American Express, and Wells Fargo, offer business checking accounts with varying perks and fees.

5. Expense tracking, reimbursement, and misuse

When employees use their personal cards for business expenses, it complicates your ability to track expenses and manage reimbursements. Filing and approving expense reports can be time-consuming, error-prone, and may increase the risk of expense fraud.

Relying on employees to front your business expenses could increase frustration and impact morale if you can’t keep up with reimbursement requests and employees can’t pay off their balances.

Use Ramp’s corporate card for your business expenses

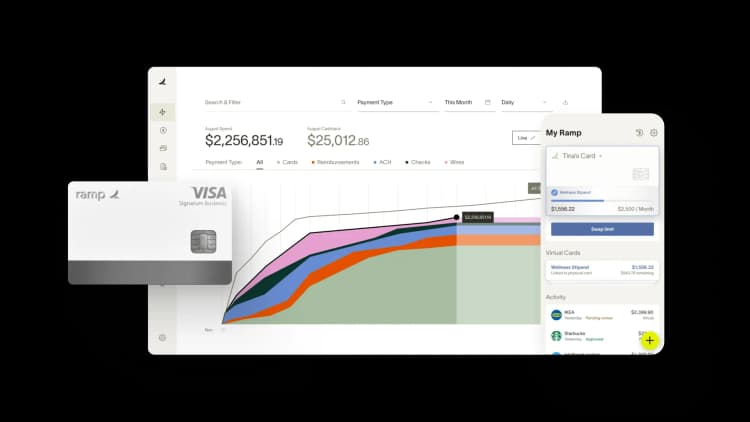

Now that you understand the risks of using a personal credit card for business expenses, it’s worth considering a solution built for growing businesses.

The Ramp Business Credit Card offers real-time expense tracking, smart automation, and robust controls. Even better, it doesn't require a personal credit check or personal guarantee for approval.

Issue unlimited physical and virtual cards for your employees and create custom spend limits by team or vendor to keep spending in check. Plus, employees can submit receipts right from their phones while we handle the follow-ups and expense matching.

Ready to learn more? Try an interactive demo and see why businesses that use the Ramp Business Credit Card save an average of 5% a year across all spending.

FAQs

Using a personal credit card for business is legal, but it's generally not recommended due to the potential complications it creates. The practice makes it more difficult to properly track business expenses and claim all the tax deductions your business may be entitled to.

If you already used a personal credit card or bank account to pay for a business-related expense, you can still write off the expense at tax time. Any ordinary and necessary business expense is tax-deductible regardless of the payment method you used.

Depending on the credit card issuer, you may be able to switch an existing personal credit card to a business credit card. Be aware that closing a personal credit card could affect your credit score, so verify whether the personal credit card account will be fully closed out or transformed into a business card.

You technically can’t add your LLC to a personal credit card, but you can use the card for business purchases if needed. Just keep in mind that the account will remain under your name, not the business, and you’ll be personally liable for any charges. It’s usually smarter to open a business credit card in your LLC’s name for better separation and protection.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits