Mastering inventory accounting: Key to cash flow management in e-commerce and wholesale businesses

- What is inventory accounting?

- Strategically budgeting for inventory: Balancing costs with profitability

- Holistic inventory accounting: Bridging budget, cash flow, and inventory management

- Free up cash with Ramp's automated spend controls and real-time visibility

Cash flow management at an inventory-based company can be the difference between thriving and merely surviving in a competitive market.

What is inventory accounting?

Inventory accounting is more than just keeping track of stock levels; it's a strategic tool that directly impacts your cash flow and overall financial health. In this post, we'll explore how effective inventory accounting practices can help business owners navigate the challenges of managing cash flow, especially when capital is tied up in inventory.

First, let’s start with a simple example of an inventory-based business:

Joe looked at his wholesale business credit card account. The balance was substantially larger than the cash available in his account. Add to that, the upcoming payroll was on its way. And his trusted CPA had reminded him about the upcoming estimated quarterly taxes that were due next week.

Joe started selling sports memorabilia on his Amazon account while he worked full-time as a software engineer and his business had taken off. Now, Joe had gotten more aggressive with his inventory. He tripled down on his ability to sell. In fact, he was holding on to purchase orders that he was looking to fill. But a strange anxiety had come across him. His cash balance in the business was too low, while his inventory balance had nearly tripled in dollar amount in comparison to the previous year. He was in big trouble.

It’s a challenge that many business owners face: How can I pay my bills if all my cash is tied into inventory? Their question is a good one, but it’s something that the average widget-selling business owner goes through. The problem is that many are ill-prepared for an unexpected expense that comes their way. Here’s a small list of action items every business owner should take to make sure they don’t hit the same obstacles Joe did.

Strategically budgeting for inventory: Balancing costs with profitability

A successful business that wants to invest its profits back into the business needs an airtight budget to avoid running out of cash. Unfortunately, this isn’t something you can hand over to your CFO and hope for the best. In fact, it requires collaboration from multiple teams. Try more proactively involving these teams to get better ahead of cash flow problems:

- Sales and marketing teams: Understand how much spend in marketing you'll have and for which vendors monthly. From that spend, your sales team should have a good idea of what revenue can be projected per month.

- Inventory planners: The skill and insight of inventory planners are often highly impressive, especially in their detailed management of stock levels and efficiencies. They get into the nitty-gritty of how much goods you’ll need to spend to achieve those sales goals. They need to be able to collaborate with the sales team to make sure that goods don’t become obsolete. A great planner will also be able to help with warehouse, freight, and third-party seller costs to make sure you are the most efficient version of yourself.

- CFO: Once the sales and inventory aspect has solidified, it’s time to hand it over to your CFO who is going to bring you back down to reality. They’ll look based on historical results, if the numbers being discussed are achievable and what operating costs they’ve incurred in the past that should be planned for in the future. And, if necessary, maybe payroll or other business cuts need to be looked at.

The budget needs to account for seasonal periods for the respective business. Because cash can fluctuate, it is so important to break down the budget into granular monthly goals, rather than an annual expectation. This allows for accountability and the ability to be flexible when things get tight on cash.

Holistic inventory accounting: Bridging budget, cash flow, and inventory management

Successful inventory accounting goes beyond specific budgets, encapsulating a broad, company-wide perspective that links financial planning with operational efficiency and strategic foresight. Here are some areas beyond specific finance outputs to consider:

- Budget to actual: I used to work with a colleague that I respected who would say, “What good is a lottery ticket if you never go back to check if you won.” A budget is nice, but if your CFO doesn’t hold the accountable parties to the fire, what good is the budget? At the very least, as part of the monthly closing process, a budget to actual needs to be performed. So that if we don’t hit the sales, cost of goods sold, or operating number we budgeted to, we understand the reason and adjust the budget accordingly. The budget adjustment needs to consider where we stand with cash.

- Cash flow analysis: The CFO should also be looking at the cash flow analysis and determining if the Company has enough cash for the next three weeks based on the expectations. It’s a good time for the CFO to get together with various teams to see what cash is coming in, what cash we can expect to go out, and will we have enough cash when it’s time to pay payroll. If the answer is no, the CFO can strategically look at the accounts payable balance, payroll payables, estimated taxes, and any other liability on the books and determine the next steps to make sure the company can get by during a temporary crunch.

- Run lean: Many companies stocked up on goods because of Covid and the shortage of supply. But now that the pandemic is long over, the thinking of stockpiling more goods should go with it. Having inventory in the warehouse for more than a year shouldn’t be taking place. Running lean means you need to have a great inventory system and an even better planner. You need to be in a position to predict what purchase orders may come your way on short notice, but also make sure that your cash isn't locked in inventory. Using a Just-In-Time inventory management strategy can help reduce the cash burden tremendously!

- Be prepared: Mostof my clients, when they start working with me, are reactive, rather than proactive. A great CFO on your team will help guide you to prevent the ship from getting into the heart of the storm, much before you’ve gotten there. One of the greatest tools of trade is to help with securing a line of credit. When it comes to inventory-based businesses, many prefer a line of credit because it is revolving. The company only pays the interest when the line is being used. The CFO should negotiate the best terms available and use their contracts to secure a debt facility that best fits the company’s needs. Of course, the right method is at your discretion. Sometimes it's a line of credit, but other times it could be a payroll loan. Bottom line, the CFO can prepare you before it is too late.

As a business owner, you shouldn’t be afraid of this type of collaboration. Cash is the blood flow of your business. Implement these strategies so that you can make sure you keep the flow moving for a long time.

Free up cash with Ramp's automated spend controls and real-time visibility

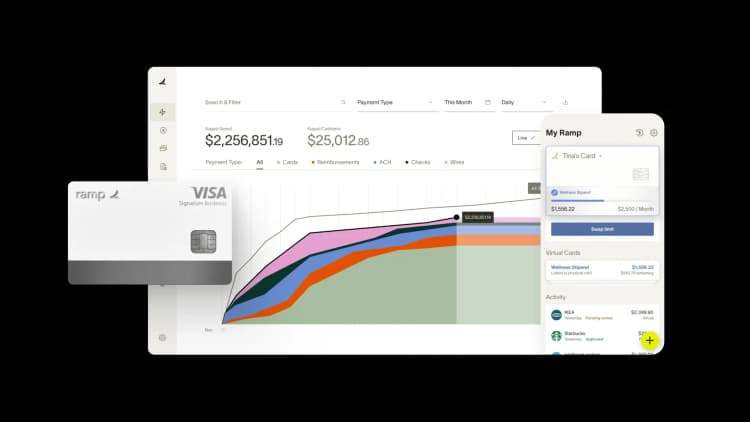

Excess inventory ties up cash that could fuel growth, but cutting stock levels without the right controls creates risk. You need visibility into what you're buying, when, and why so you can optimize inventory spend without disrupting operations.

Ramp's accounting automation software gives you the controls and insights to manage inventory purchases smarter. You can set spending limits, require approvals for large orders, and track every purchase in real time so cash doesn't sit idle on shelves.

Here's how Ramp helps you optimize inventory spend:

- Set granular spending limits: Create vendor- and category-level limits so teams can't over-order without approval, keeping inventory levels lean and cash available

- Require multi-level approvals: Route high-value inventory purchases through the right stakeholders automatically, so you catch unnecessary orders before they hit your balance sheet

- Track spend in real time: Monitor inventory purchases as they happen across all payment methods, so you spot trends, identify over-ordering, and adjust before cash gets locked up

- Get AI-powered insights: Ramp surfaces spending patterns and flags anomalies, so you can identify which inventory categories are draining cash and where to optimize

Try a demo to see how Ramp helps businesses control inventory spend and free up working capital.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits