A guide to startup business loan requirements in 2023

- What are startup business loans?

- 12 different startup business loans

- What do you need to get a business loan? [requirements + checklist]

- Strengthen your loan application with better financial management

- What if a startup business loan still doesn't feel right?

Running a startup can sometimes feel like one of those 10,000-piece jigsaws.

There are so many puzzle pieces to slot together—but you have to find the right ones first. You’ve got product development and marketing, hiring great employees, and even securing office space.

You can't do any of that without the right finance. There are thankfully a lot more options for small business financing in 2023. Among the most common is a startup business loan.

In this startup guide, we’ll cover many loan options, mention some of the main lenders, and help you understand the most common startup business loan requirements.

To start, we’ll dive into what startup business loans are and give a quick primer on some of the most popular choices available. But for deeper dives into each, check out our articles on:

- Loan requirements

- The underwriting process

- Business loan vs line of credit

- Working capital financing

- Inventory financing

- Equity financing

- Accounts receivable financing

What are startup business loans?

Startup business loans are designed specifically for new and small businesses that need funds for working capital, to fund expenses such as vendor invoices, payroll and taxes, SaaS subscriptions, marketing, and product sourcing and shipping.

Why are startup business loans useful?

New businesses have many operating costs, but they often have little to no credit history too.

Conventional lenders have shied away from such business borrowers because they decided the loans were too risky. But that doesn’t change the fact that entrepreneurs, founders, and small business owners have always needed working capital.

Startup business loans have emerged to close this gap and meet the demand.

Who uses startup business loans?

Startup business loans have been created to serve a growing number of entrepreneurs who have previously been underserved by the traditional banking system.

12 different startup business loans

More startup business loan options are emerging in recent years, and here are some of the different forms of financing available in 2023.

1. Invoice financing

With invoice financing, lenders will let you borrow an amount equal to your outstanding invoices.

- With this form of accounts receivable financing, your business still owns the invoice and still collects the payment from your customer.

- Invoicing financing providers typically charge a percentage fee on the principal for the duration of the outstanding invoice.

A loan like this can be helpful for startups with long or variable billing cycles.

2. Invoice factoring

Invoice factoring has the same central idea: your business uses your outstanding accounts receivables (AR) for working capital. That’s where the similarities end.

- Invoice factoring involves selling your outstanding invoices to the factoring provider.

- The amount you’re paid will be less than the amount you billed your customer.

And the factoring company will also take on the collection of the payments from customers.

3. Sales-based credit limits

Sales-based credit is another option for startups and small businesses, especially those with a clear revenue stream.

- For example, Ramp can assess your sales data from Shopify and Stripe to provide limits up to 30 times higher than other loans.

- These limits — and interest rates — are based on participating businesses’ actual performance instead of bank account balances.

Sales-based credit can be useful for online businesses, like ecommerce platforms, that do not have assets to use as collateral for conventional business bank loans.

4. Vendor financing

This is when a vendor loans money to a customer to enable them to use the loan as capital to purchase their goods or services. Vendor financing — or trade credit, as it's sometimes known—can be a one-time payment or a credit line. Usually, you can negotiate the interest rate with your vendor, given you are not only the borrower but the customer too.

5. Business line of credit (LOC)

What if you think you need to borrow and repay the same amount quarter after quarter, or year after year? This is where a business line of credit (LOC) might be useful.

- LOCs enable your business to borrow different amounts at different times that add up to a specific limit. You need to repay the money within a specific time frame.

- And once you do so on time and in full, you can borrow in the same way again, up to that same pre-agreed limit.

6. Startup business grants

Grants from nonprofits and government agencies are a further option. For example, the Small Business Innovation Research program and the Small Business Technology Transfer support startups involved in scientific research and technological innovation. While grants normally don’t have to be repaid, some do have tax implications. The eligibility criteria can be rigorous too.

7. SBA loans

There are other government-backed finance schemes to consider too, such as Small Business Administration (SBA) loans. Under this scheme:

- Participating lenders must follow SBA guidelines for small business borrowers.

- Some loans do not require collateral, but the process can be long and rigorous.

- Some SBA loans include business education and counseling services for owners.

8. Micro-loans

- Microlending is when state and federal agencies, fintech platforms, and nonprofits lend to specific communities or demographic groups. These loans are typically less than $50,000.

- Micro-loans may come with more affordable interest rates and favorable loan terms, to support financial inclusion among businesses in various communities.

9. Crowdfunding

With crowdfunding, a startup can secure funding from a potential base of future customers.

- Startups can use popular platforms like Kickstarter to pitch their ideas to ‘micro investors,’ who can then fund the development of a product or service.

- This option is often best reserved for stealth-mode startups or beginner entrepreneurs looking to establish the viability of their idea.

10. Personal credit cards

Many young and emerging startups are funded by the founders’ personal credit cards.

- It’s an easy fit in the early days because the business can pay for all kinds of business expenses, with a continuous and regular source of credit.

- Founders can also tap into loyalty and reward programs, and make savings on travel, dining, and accommodation.

But personal credit cards quickly hit the limits of their usefulness, once startup expenses, operations, and staff begin to grow.

The best startup business credit cards tend to be a much better fit for most new and small businesses, because they can offer more generous rewards, cashback, and customized card controls.

11. Merchant cash advances

A merchant cash advance (also known as a merchant loan) is a loan based on future sales that serve as working capital while you establish your small business.

- Small business borrowers must then share a portion of their regular revenue with the advance provider until the amount is returned in full.

- MCAs are an expensive form of credit that can put your business in an even worse financial position.

They should only be considered last-resort financing if your business cannot qualify for any other type of financing.

12. Startup loans from family or friends

Lastly, your friends and family could be a source of a business loan too.

- Initially, borrowing from a friend or relative is often simpler than going the bank route.

- You probably won’t face credit checks, and it’s less likely you’ll have forms to fill out. You might even pay zero interest.

- Repayment terms might be more flexible too, depending on the strength of the friendship or family bond.

But most business and financial advisors caution this process can be fraught with risk. For example, non-payment can create rifts in important personal relationships and put your business in strife.

What do you need to get a business loan? [requirements + checklist]

One of the biggest requirements for a business loan is to have a clear picture of the business’s financial performance before you start talking to potential lenders. Having good reporting around current (and projected) cash flow is a good place to start.

Top startup business loan requirements

Most lenders will want you to have specific (even measurable) plans for how funds will be used. Create a detailed budget, setting out how and where you plan to spend the loan. If you can pair this with a detailed business (and business continuity) plan, even better.

Here are three small business loan qualifications to bear in mind while you learn about how to qualify for a business loan and research any startup loan requirements.

- Revenue matters: Favorable interest rates on startup loans are usually reserved for businesses with strong revenue and a good credit score. lenders will want to see that your business has a steady revenue stream to confirm your business loan eligibility, supporting a positive cash flow. They may ask you for proof of sales and a detailed profile of your existing customer base.

- Collateral is key: Many lenders will require collateral in the form of personal assets or business equipment. Be sure you’re comfortable with any collateral you put forward for a loan, and bear in mind you could lose the asset if you're unable to repay the loan.

- Debt will be a factor: Make sure existing debt is at a reasonable level.Among the long list of new business loan requirements, most lenders will want to see a debt-to-income ratio of no more than 50%, which means your monthly repayments should be less than 50% of your monthly income.

Startup business loan checklist

Lastly, be sure to check the following features when browsing lenders’ loans. Customize this checklist to your own needs by adding in your targets for the criteria. The more ‘ticks’ you can give a lender, the likelier they are to be a good fit for your startup.

Strengthen your loan application with better financial management

Qualifying for startup business loans often feels like an uphill battle. Lenders scrutinize your financial health, cash flow patterns, and spending habits—but many startups struggle to present clean, organized financial data that tell a compelling story. Without proper expense tracking and financial controls, you might miss out on favorable loan terms or get rejected altogether.

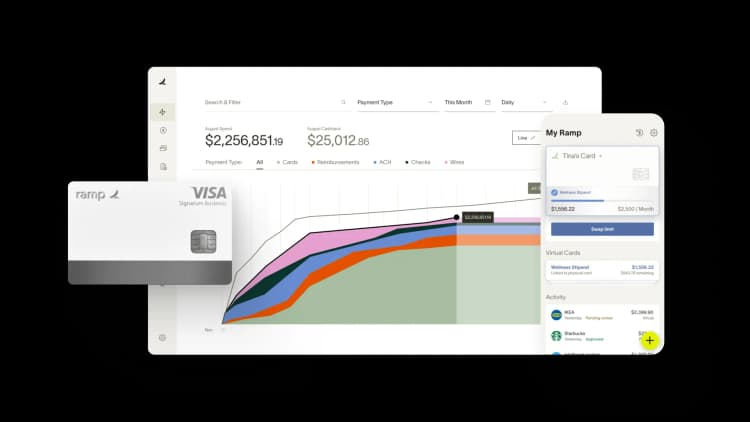

Ramp's expense management automation directly addresses these challenges by giving you the financial clarity lenders want to see. The platform automatically categorizes and tracks every business expense in real-time, creating a comprehensive financial picture that demonstrates fiscal responsibility. When loan officers review your application, they'll see organized expense reports, clear spending patterns, and controlled cash flow—exactly what builds lender confidence.

Beyond basic tracking, Ramp's automated receipt matching and expense categorization eliminate the scattered spreadsheets and missing documentation that make loan applications messy. Every transaction gets captured, categorized, and stored digitally, so you can quickly pull detailed financial reports showing exactly where your money goes. This level of detail helps you identify cost-saving opportunities before applying for loans, potentially improving your debt-to-income ratios and making you a more attractive borrower.

Ramp's spending controls add another layer of credibility to your loan application. By setting category-specific limits and requiring approvals for certain expenses, you demonstrate proactive financial management—a quality lenders value highly. These controls also help you maintain healthy cash flow patterns month after month, building the consistent financial track record that opens doors to better loan options.

Instead of scrambling to organize months of receipts and transactions when loan opportunities arise, you'll have everything ready at your fingertips, positioning your startup as a responsible, loan-worthy business from day one.

What if a startup business loan still doesn't feel right?

Sometimes traditional lending just isn't the answer. You need working capital, but the timing, terms, or process doesn't align with your business needs.

That's where Ramp's corporate cards come in. Unlike loans that saddle you with debt and interest payments, Ramp gives you immediate access to capital without the lengthy applications or rigid repayment schedules. You get the flexibility to cover expenses as they arise while building credit history that strengthens future financing options.

Think of it as a smarter way to manage cash flow—one that grows with your business instead of constraining it.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group