How managerial accounting helps optimize costs and improve profitability

- Types of managerial accounting

- Essential techniques in managerial accounting

- How managerial accounting drives business growth

- Turn managerial accounting insights into action with Ramp

Managerial accounting is the process of collecting, analyzing, and interpreting financial data to help businesses make informed decisions. It focuses on internal reporting, giving you the insights needed to control costs, improve efficiency, and boost profitability. You can use managerial accounting to track performance, set budgets, and plan for growth.

Around 20% of CFOs rely on data-driven insights for business strategy. Managerial accounting provides these insights by breaking down the cost of goods sold, revenue trends, and operational data. Some key areas include cost analysis, budgeting, forecasting, and performance tracking.

How is managerial accounting different from financial accounting?

Managerial accounting focuses on internal decision-making, helping businesses analyze costs, budgets, and performance. On the other hand, financial accounting is used for external reporting, following strict regulations to create financial statements for investors and regulators. While financial accounting looks at past performance, managerial accounting helps with real-time analysis and future planning.

Types of managerial accounting

Businesses face different challenges, from controlling production costs or overhead costs to managing cash flow or forecasting future trends. That's why managerial accounting includes various types designed to solve specific financial problems.

Product costing and valuation

Product costing helps determine the total cost of making a product or offering a service. It includes direct costs like materials and labor and indirect costs such as overhead and equipment depreciation. Businesses use product costing to set prices, control expenses, and measure profitability.

If you manufacture custom products, you might use job costing. For mass production, process costing is more suitable. Some companies prefer activity-based costing (ABC), which assigns costs based on specific activities that drive expenses. Understanding these costs helps reduce waste, improve pricing strategies, and maximize profits.

Cash flow analysis

Cash flow analysis tracks how money moves in and out of your business. It ensures you have enough cash to cover expenses and invest in growth. Poor cash flow management is a major reason 82% of small businesses fail.

This analysis helps you anticipate cash shortfalls, plan for upcoming business expenses, and avoid financial trouble. If you run a startup, retail business, or service-based company, keeping an eye on cash flow can help you stay financially stable.

Inventory turnover analysis

Inventory turnover analysis measures how quickly you sell and replace inventory. A high turnover means strong sales, while a low turnover suggests you may be overstocking or holding slow-moving products. The ideal inventory turnover ratio for retailers is between 5 and 10. This means they sell and replace inventory five to ten times per year.

By analyzing inventory turnover, you can reduce storage costs, prevent losses from outdated stock, and maintain the right inventory levels. This is especially useful for retailers, wholesalers, and manufacturers who must balance supply and demand.

Constraint analysis

Constraint analysis helps you identify bottlenecks that slow down your business. These bottlenecks could be inefficient processes, limited workforce, outdated technology, or supply chain delays. By addressing these issues, you can improve productivity and increase revenue.

For example, if a slow machine is delaying production, investing in a better one or changing the workflow can fix the problem. Manufacturers, logistics companies, and retailers use constraint analysis to remove inefficiencies and optimize operations.

Financial leverage metrics

Financial leverage metrics show how much debt your business uses to finance operations. They help you understand whether your debt level is manageable or risky. Important metrics include the debt-to-equity ratio, which compares your debt to assets, and the interest coverage ratio, which measures your ability to pay interest on loans.

These metrics help you balance financial risk and borrowing capacity if you rely on loans. Lenders, investors, and financial analysts use them to assess a company's financial health before making funding decisions.

Accounts receivable (AR) management

Accounts receivable (AR) management helps you keep track of outstanding customer payments. Unpaid invoices can disrupt cash flow and create financial strain. In fact, small businesses in the U.S. are owed an average of $84,000 in unpaid invoices.

AR management involves setting clear payment terms, sending timely reminders, and offering early discounts. B2B service providers, wholesalers, and subscription-based businesses rely on strong AR management to avoid cash shortages and maintain steady revenue.

Budgeting, trend analysis, and forecasting

Budgeting and forecasting help you plan for the future by predicting revenue, expenses, and financial trends. You can make informed decisions and set realistic financial goals by analyzing past data. Businesses that use structured forecasting are more likely to outperform competitors.

Finance teams, CFOs, and business owners use these tools to adjust spending, allocate resources wisely, and improve financial stability. Rolling forecasts and variance analysis allow companies to effectively refine their budgets and respond to market changes.

Essential techniques in managerial accounting

Managerial accounting helps companies manage day-to-day business operations. It provides insights that allow businesses to identify inefficiencies, set competitive pricing, and allocate resources effectively.

Managerial accounting is an ongoing process. Some techniques, like budgeting and forecasting, are used monthly or quarterly to guide financial planning. Others, like cost-volume-profit analysis and marginal costing, help with short-term decisions and are used as needed.

- Activity-based costing (ABC)

Activity-Based Costing (ABC) assigns costs based on specific activities rather than spreading them evenly across all products. It helps you understand where money is being spent and identify costly processes. Instead of broad expense categories, ABC links costs directly to activities that drive them. This method improves cost control and eliminates inefficiencies. - Cost-volume-profit (CVP) analysis

CVP analysis helps you understand how costs, sales volume, and pricing affect profits. It shows you the break-even point, where total revenue equals total costs. Businesses use this technique to decide whether to change prices, increase production, or cut expenses. - Marginal costing

Marginal costing helps you determine the additional cost of producing one extra unit of a product. It focuses only on variable costs, such as raw materials and labor, while fixed costs remain the same. This technique is useful for short-term pricing decisions. Businesses use it to decide whether to accept special orders, offer discounts, or discontinue products. - Capital budgeting

Capital budgeting helps you evaluate long-term investments. It uses financial tools like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period to determine if an investment is worth it. Businesses use this technique when deciding whether to buy equipment, expand facilities, or invest in new projects. - Constraint analysis

Constraint analysis helps you identify bottlenecks that slow down production and reduce efficiency. It shows you which areas limit your business and how to fix them. If a factory has one slow machine holding up production, constraint analysis helps you decide whether to upgrade the machine or change the workflow. - Trend and ratio analysis

Trend and ratio analysis helps you track financial performance over time. It compares key financial metrics to spot patterns and assess profitability. Common ratios include the profit margin ratio, return on investment (ROI), and current ratio. Businesses use this technique to measure their growth and financial health. - Inventory management techniques

Inventory management techniques help you optimize stock levels, reduce storage costs, and avoid shortages. Methods like First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Just-in-Time (JIT) help businesses decide how to manage inventory efficiently. Retailers, wholesalers, and manufacturers depend on inventory management to balance supply and demand.

How managerial accounting drives business growth

Managerial accounting helps you grow your business by providing clear financial insights. It helps you track costs, manage cash flow, and make data-driven decisions.

Reducing costs and optimizing pricing

Without a clear understanding of expenses, you may end up overspending in areas that don't add value. Managerial accounting helps you track business expenses and find ways to cut waste. Activity-based costing (ABC) assigns costs based on actual resource usage, helping you see which processes or products are the most expensive. Regularly analyzing financial information can eliminate inefficiencies, increase profit margins, and reinvest in areas that drive growth.

Similarly, if your prices are too high, you may lose customers. If they're too low, your profit margins shrink. Managerial accounting helps you determine the right pricing strategy with cost-volume-profit (CVP) analysis. Many retail, manufacturing, and service businesses use CVP analysis to ensure they remain competitive while maintaining strong profit margins.

Making smarter investments and managing risks

Business growth often requires investment in new products, equipment, or market expansion. However, making the wrong investment can drain resources and slow progress. Capital budgeting techniques, like Net Present Value (NPV) and Internal Rate of Return (IRR), help you evaluate whether an investment will generate a strong return.

Along with making smart investments, you also need to manage financial risks. Poor planning can lead to overspending, debt issues, or market-related losses. Budgeting, forecasting, and trend analysis help you predict future expenses and income, making it easier to prepare for unexpected challenges.

Reviewing your accounting information, including balance sheets and past financial trends, allows you to identify risks early, adjust your strategy, and avoid financial trouble before it starts.

Improving cash flow and scaling operations

A business can be profitable on paper but still struggle with cash flow issues. Delayed customer payments, rising expenses, or slow-moving inventory can all create liquidity problems. Cash flow analysis and accounts receivable management ensure your business has enough working capital to cover daily operations.

Many businesses also struggle with manual expense tracking, which can lead to delays in financial reports and cash flow miscalculations. Instead, you can automatically sync your transactions and categorize expenses, helping you reduce the need for manual reconciliation.

Similarly, as your business expands, managing resources can become more complex. Without proper tracking, you might overspend on production, labor, or inventory. Constraint analysis and inventory management techniques help businesses scale efficiently by identifying bottlenecks and optimizing resource allocation.

Turn managerial accounting insights into action with Ramp

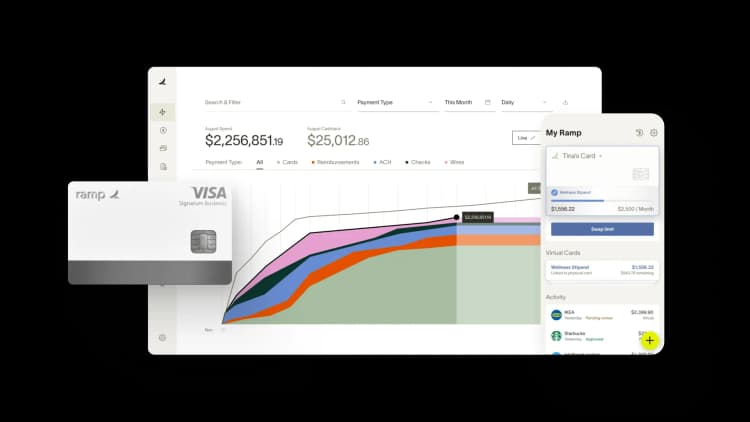

Managerial accounting relies on accurate, timely data to drive decisions that reduce costs and boost profitability. But when transaction data is scattered across systems, coded inconsistently, or delayed by manual processes, you're making decisions based on outdated or incomplete information.

Ramp's AI-powered accounting software gives you the real-time visibility and automated controls you need to act on managerial accounting insights immediately. Every transaction is coded accurately across all required fields as it posts, so your cost centers, departments, and projects reflect current spend without waiting for month-end.

Here's how Ramp supports better managerial accounting:

- Real-time expense tracking: Monitor departmental spend, project costs, and vendor payments as transactions post, so you can spot trends and take action before small issues become big problems

- Automated spend controls: Set spending limits by department, project, or cost center and enforce them automatically, so teams stay within budget without constant oversight

- Granular reporting: Filter and analyze spend across any dimension—department, vendor, category, or custom field—to understand exactly where money goes and identify opportunities to cut costs

Try a demo to see how finance teams use Ramp to turn managerial accounting data into faster, more profitable decisions.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits