What is financial accounting? Definition, principles, and best practices

- What is financial accounting?

- Core accounting principles

- Understanding financial statements

- Accrual accounting vs. cash accounting

- The general ledger and chart of accounts

- The financial accounting process

- Financial accounting best practices

- Automate compliance and accuracy with Ramp's AI-powered accounting controls

Financial accounting is the process of recording, summarizing, and reporting a business’s financial activity in a standardized format. It gives you a clear view of your company’s performance so you can make informed decisions and stay compliant.

Businesses rely on financial accounting to stay organized, track profitability, and maintain transparency with investors and other external stakeholders. Unlike managerial accounting, which focuses on internal planning and analysis, financial accounting centers on presenting accurate information to people outside the company.

What is financial accounting?

Financial accounting is the ongoing process of recording, summarizing, and reporting a company’s financial transactions. It results in standardized financial statements, including the income statement, balance sheet, and cash flow statement, that show performance over a specific period.

The purpose of financial accounting is to give external stakeholders accurate, transparent, and reliable information. This helps investors, creditors, and regulators evaluate your business and make informed decisions. Key objectives include:

- Monitoring financial performance

- Meeting legal and regulatory requirements

- Providing data to support investment and lending decisions

- Maintaining clear records to build trust with stakeholders

Primary users

Financial accounting is designed for external stakeholders. Here’s how each group uses the information:

- Investors: Evaluate potential returns and overall financial health

- Creditors: Assess creditworthiness and repayment ability

- Regulators: Ensure compliance with reporting standards

- Suppliers: Determine whether it’s safe to extend credit or enter a contract

How financial accounting differs from other types

While accounting has many branches, these are the core types and how they compare:

- Financial accounting: Creates standardized financial statements for external stakeholders

- Managerial accounting: Supports internal planning and decision-making

- Cost accounting: Calculates the cost of producing goods or services

- Tax accounting: Focuses on tax rules, compliance, and reporting

- Forensic accounting: Investigates financial irregularities and potential fraud

Core accounting principles

Financial accounting relies on a set of principles that promote accuracy, consistency, and transparency in financial reporting. These guidelines ensure financial statements are reliable and comparable across companies and industries.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP) are the standards for preparing financial statements. GAAP creates consistency in how businesses report financial information so stakeholders can compare performance across companies.

The 10 key GAAP principles are:

- Regularity: Adherence to all GAAP principles

- Consistency: Use of the same accounting methods across periods

- Sincerity: Accurate, objective representation of a company’s finances

- Permanence of Methods: Consistent methods within a reporting period

- Non-compensation: Reporting both positive and negative results transparently

- Prudence: Using only verifiable facts, not speculation

- Continuity: Assuming ongoing business operations when recording long-term assets

- Periodicity: Reporting financial results over consistent time periods

- Materiality: Valuing assets based on historical cost

- Utmost good faith: Honest and ethical accounting

Many countries outside the U.S. follow the International Financial Reporting Standards (IFRS). GAAP is more rule-based, while IFRS is more principles-based and allows more interpretation.

GAAP vs. IFRS

| Standard | Approach | Common use |

|---|---|---|

| GAAP | Rule-based with specific guidance | United States |

| IFRS | Principles-based with broader interpretation | More than 140 countries |

Key accounting principles

Beyond GAAP, these principles shape how financial information is recorded and presented:

- Revenue recognition principle: Record revenue when it’s earned, not when payment is received

- Matching principle: Record expenses in the same period as the revenue they support

- Cost principle: Record assets at their original purchase price rather than current market value

- Full disclosure principle: Share all relevant information that could affect stakeholder decisions

- Consistency principle: Use the same methods across periods to make results comparable

- Objectivity principle: Base financial records on verifiable evidence to prevent manipulation

Understanding financial statements

Financial statements give you a structured view of your company’s revenue, expenses, assets, and liabilities. Investors, regulators, and lenders use them to evaluate financial health and long-term stability.

Here’s a quick overview of the three primary statements:

| Statement | What it shows | Why it matters |

|---|---|---|

| Income statement | Revenue, expenses, and profit over a period | Helps you understand profitability and cost trends |

| Balance sheet | Assets, liabilities, and equity at a point in time | Shows financial position and ability to cover obligations |

| Cash flow statement | Cash in and out from operations, investing, and financing | Reveals liquidity and cash management strength |

Income statement

The income statement, sometimes called the profit and loss statement, shows revenue, expenses, and profit over a specific period. It tells you whether your business is generating or losing money and highlights trends in efficiency and spending.

Key metrics include:

- Revenue: Total earnings from products or services

- Gross profit: Revenue minus the cost of goods sold (COGS)

- Operating income: Profit after operating expenses

- Net income: Final profit after accounting for expenses, taxes, and interest

Common line items include:

- Sales or revenue

- COGS

- Operating expenses

- Taxes

- Net profit

Balance sheet

The balance sheet shows your company’s financial position at a specific moment. It lists assets (what you own), liabilities (what you owe), and equity (your stake in the business) based on the accounting equation:

Assets = Liabilities + Equity

A strong balance sheet shows a healthy relationship between assets and liabilities. Investors and lenders use it to assess financial risk and determine whether a business can meet its obligations.

Common line items include:

- Current assets: Cash, inventory, accounts receivable

- Long-term assets: Property, equipment, long-term investments

- Current liabilities: Accounts payable, short-term loans, accrued expenses

- Long-term liabilities: Bonds, long-term loans, deferred tax liabilities

- Shareholders’ equity: Common stock, retained earnings, additional paid-in capital

Cash flow statement

The cash flow statement tracks how money moves in and out of your business. It’s divided into three sections:

- Operating activities: Cash from daily operations

- Investing activities: Cash used to buy or sell assets

- Financing activities: Cash from loans, stock sales, or debt payments

A company can show strong profits yet still struggle with cash if collections are slow or expenses are poorly timed. The cash flow statement helps you understand liquidity and whether your business can meet short-term obligations.

The income statement and balance sheet feed directly into the cash flow statement. Net income affects operating cash flow, while changes in assets, liabilities, and equity influence investment and financing cash flows. Together, the three statements give a complete picture of financial performance.

Accrual accounting vs. cash accounting

Your accounting method shapes how you track revenue, manage expenses, and present financial performance. The two most common approaches are the accrual basis and the cash basis.

Here’s a quick comparison:

| Method | When revenue is recorded | When expenses are recorded | Best for |

|---|---|---|---|

| Accrual accounting | When earned | When incurred | Growing businesses, companies that extend credit, GAAP filers |

| Cash accounting | When cash is received | When cash is paid | Small businesses, sole proprietors, simple operations |

Accrual accounting method

Accrual accounting records revenue when it’s earned and expenses when they’re incurred. This method follows the matching principle so income and related costs appear in the same reporting period.

For example, if you finish a project in December but don’t get paid until January, accrual accounting records the revenue in December. This creates a more accurate picture of performance by including unpaid invoices and outstanding bills.

Accrual accounting gives stakeholders a clearer view of long-term financial health, but it requires more detailed bookkeeping. You also have to monitor cash flow closely because revenue may be recorded before the cash arrives. Medium and large businesses, companies that sell on credit, and organizations that follow GAAP typically use this method.

Cash accounting method

Cash accounting records revenue when you receive cash and expenses when you pay them. It doesn’t track accounts receivable or accounts payable, which makes it straightforward and easy to maintain.

For example, if you sell goods in December but get paid in January, cash accounting records the income in January. This keeps bookkeeping simple, but it can distort profitability from month to month.

Cash accounting works best for smaller businesses, freelancers, and companies that don’t extend credit. While it’s easier to manage, it doesn’t provide the detail needed for complex financial reporting and isn’t compliant with GAAP.

Scenario comparison

Here’s how each method treats the same transaction:

| Month | Event | Accrual accounting | Cash accounting |

|---|---|---|---|

| December | Work completed; invoice sent | Revenue recorded | No revenue recorded |

| January | Payment received | No revenue recorded | Revenue recorded |

The general ledger and chart of accounts

The general ledger is a detailed record of your company’s financial activity. It organizes every transaction across accounts and serves as the foundation for your financial statements.

The chart of accounts is the structure behind the general ledger. It lists all accounts your business uses to categorize transactions, and each account type typically follows a standard numbering system:

| Account type | Typical numbering |

|---|---|

| Assets | 1000–1999 |

| Liabilities | 2000–2999 |

| Equity | 3000–3999 |

| Revenue | 4000–4999 |

| Expenses | 5000–5999 |

How transactions flow from journal entries to the general ledger

Every transaction begins as a journal entry with a debit and a credit. Under double-entry accounting, each entry must balance.

Here’s an example:

| Account | Debit | Credit |

|---|---|---|

| Office supplies | $300 | |

| Accounts payable | $300 |

After an AP journal entry is recorded, it’s posted to the general ledger. The ledger aggregates activity for each account over time, creating the information used to build your income statement, balance sheet, and cash flow statement.

The financial accounting process

The financial accounting process ensures every transaction is recorded, organized, and reported accurately. It starts with day-to-day entries and ends with preparing financial statements for internal and external stakeholders.

Recording transactions

Every financial activity, such as sales, expenses, or loan payments, is recorded as a journal entry. Under double-entry bookkeeping, each transaction affects at least two accounts through a debit and a credit. For example, when you make a sale, your cash or accounts receivable increases, and revenue increases as well.

Each entry must be supported by documentation, including invoices, receipts, purchase orders, or contracts. These documents create an audit trail and verify the accuracy of your records. Once entered, transactions are posted to the general ledger, where they are organized under accounts such as assets, liabilities, revenue, and expenses.

Period-end procedures

At the end of an accounting period, you make adjustments to account for accrued expenses, depreciation, and other timing differences. These entries ensure your financial statements reflect your actual financial position.

After adjustments, you prepare a trial balance to confirm total debits and credits match across accounts. This step helps identify any discrepancies before creating financial statements. When the period closes, temporary accounts like revenue and expenses reset to zero so the next cycle starts fresh.

Financial reporting

Once entries are recorded and the books are closed, you prepare your financial statements. These include the income statement, balance sheet, and cash flow statement.

Reporting requirements differ depending on the audience.

- Internal reporting: Gives management the information needed for planning, budgeting, and decision-making

- External reporting: Provides investors, lenders, and regulators with standardized financial information that follows GAAP or IFRS

Financial accounting best practices

Effective financial accounting depends on accuracy, consistency, and strong internal controls. These practices help you maintain clean records, stay compliant, and support better decision-making.

- Build internal controls: Create clear policies that reduce fraud risk and protect data. Common controls include separating duties, establishing approval workflows, and restricting access when appropriate.

- Reconcile your books regularly: Monthly reconciliations help you catch errors early and ensure transactions match supporting documentation

- Maintain documentation and audit trails: Keep receipts, invoices, contracts, and other supporting documents organized so you’re prepared for internal or external audits

- Stay current with accounting standards: GAAP and IFRS evolve, and monitoring updates helps ensure your financial reporting stays accurate and compliant

- Use accounting software effectively: Modern software automates data entry, reconciliations, reporting, and approvals, improving both accuracy and efficiency

Automate compliance and accuracy with Ramp's AI-powered accounting controls

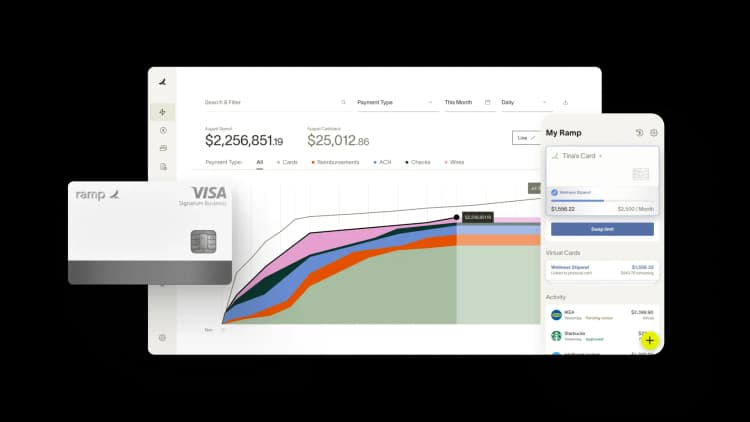

Manual accounting processes create compliance risks and drain your team's time. Spreadsheets introduce errors, policy violations slip through, and audit trails disappear when transactions aren't tracked properly. Ramp's accounting automation software eliminates these risks by enforcing controls, maintaining audit trails, and ensuring every transaction is compliant from the start.

Ramp automates compliance at every step. Custom approval workflows route spend requests to the right stakeholders before money moves, so you catch policy violations before they happen. Real-time spend limits and merchant controls prevent out-of-policy purchases automatically, while Ramp's AI codes transactions to your chart of accounts with 67% more accuracy than rules-based automation systems.

Here's how Ramp maintains compliant, accurate accounting:

- Enforce policy before spend: Set custom approval workflows, spending limits, and merchant restrictions that prevent non-compliant transactions automatically

- Capture receipts instantly: Ramp collects receipts via text, email, or mobile upload and matches them to transactions in real time, eliminating manual chasing

- Code with accuracy: Ramp's AI learns your accounting rules and applies them consistently across all transactions, reducing miscoding and rework

- Maintain audit trails: Every transaction includes complete documentation—receipts, approvals, memos, and coding history—stored in one searchable system

- Sync with confidence: Ramp validates data before syncing to your ERP, flagging errors and ensuring clean, compliant books

Try a demo to see how Ramp helps teams close their books 3x faster while staying audit-ready.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits