How to prepare your business for merchant underwriting

- What is merchant underwriting?

- Key steps in the merchant underwriting process

- Key factors merchant underwriters evaluate

- Common challenges in merchant underwriting

- How automation is transforming merchant underwriting

- Best practices to prepare for merchant underwriting

- Glossary: Merchant underwriting terms and definitions

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Merchant underwriting is a process conducted by financial institutions like banks, payment processors, and fintech companies before granting businesses the ability to accept electronic and credit card payments. This assessment helps protect against fraud, chargebacks, and other financial risks, making it an essential step for any business seeking to process card transactions.

In this guide, we explain how merchant underwriting works, what financial and operational factors underwriters evaluate, common challenges businesses face, and how automation is streamlining the process. We also walk through steps you can take to prepare your business and improve your chances of approval.

What is merchant underwriting?

Merchant underwriting is a risk management process that evaluates whether your business demonstrates the financial stability, regulatory compliance, and trustworthiness necessary to handle electronic and credit card payments securely. This process helps:

- Protect the payments ecosystem from fraud

- Reduce the likelihood of excessive chargebacks

- Safeguard consumers from unauthorized transactions

- Ensure compliance with industry regulations and standards

- Minimize potential financial losses for all parties involved

Businesses in high-risk industries, e-commerce, and those with high transaction volumes tend to face stricter underwriting due to greater exposure to chargebacks, credit card fraud, and regulatory scrutiny.

The time it takes to complete merchant underwriting varies depending on your business's complexity and how quickly you submit the required information. While it can take up to a week, some financial facilitators can complete the process in just a few days.

Once underwriting is complete and your business is approved, the payment provider or acquiring bank will open a merchant account, enabling you to accept card payments.

Key steps in the merchant underwriting process

Before a payment provider approves your business to accept card payments, it follows a structured underwriting process to evaluate risk and ensure compliance. Here’s a step-by-step breakdown of what to expect:

1. Application submission

The process begins when your business applies for a merchant account with a bank, payment processor, or payment facilitator. This step triggers the formal underwriting review.

2. Document collection and review

Underwriters request and analyze financial statements, bank records, chargeback history, and other documents to evaluate your business's financial health and risk profile.

3. Risk assessment

The underwriter evaluates a combination of financial and operational factors, including credit history, chargeback trends, and how your business operates, to assess the overall risk of working with your company.

4. Compliance checks

Businesses must meet regulatory standards such as Know Your Customer (KYC), Anti-Money Laundering (AML), and, depending on your industry, Payment Card Industry Data Security Standard (PCI DSS) or Europay, Mastercard, and Visa (EMV) requirements. These checks help ensure your business is legitimate and operates within legal and security frameworks.

5. Approval, follow-up, or rejection

If your business passes the review, you're approved and will soon have a merchant account. If there are issues, the underwriter may request more information or impose conditions. In some cases, the underwriter may deny applications due to high risk or insufficient documentation.

Required documents checklist

Underwriters request specific documentation to evaluate your business. Here’s what you’ll typically need:

- Bank statements from the past 3–6 months

- Financial statements, including your profit and loss (P&L) statement, balance sheet, and cash flow statement

- Chargeback reports showing volume, resolution rates, and dispute reasons

- Risk management protocols such as fraud detection tools, address verification systems (AVS) usage, or chargeback prevention strategies

- Compliance documents related to KYC, AML, and PCI DSS requirements (if applicable)

Key factors merchant underwriters evaluate

Merchant underwriters examine a range of business and financial data points to determine whether your company poses a low enough risk to approve for card payment processing. Here’s a closer look at the main factors they assess:

Business model and industry risk

Your business model describes how your company makes money and what kinds of products or services it offers. Underwriters consider whether your business is involved in higher-risk industries, such as adult entertainment, gambling, or telemarketing. These sectors face stricter scrutiny due to increased fraud, chargebacks, and compliance risks.

- What they look for: Type of products sold, sales and refund practices, industry standards, and regulatory compliance

- Example: An online gambling business may face stricter underwriting due to elevated fraud and chargeback risks, requiring additional documentation or guarantees

Transaction volume and history

Transaction volume indicates the scale at which your business operates. Underwriters assess the number and size of transactions, as well as consistency over time. Sudden spikes, drops, or unusually large transactions can trigger closer scrutiny, as they may indicate instability or suspicious behavior.

- What they look for: Monthly, quarterly, and annual transaction volume, average transaction size, and volume trends

- Example: A new e-commerce business may start with modest transaction volumes but will need to prove its ability to scale safely before being approved for a larger merchant account

Chargeback history

Chargeback history reflects how often customers dispute transactions or request refunds. A high chargeback ratio is a red flag for underwriters, as it suggests your business may have a poor reputation or could be susceptible to fraud. Many underwriters consider a chargeback rate above 1% to be a red flag.

- What they look for: Chargeback volume, chargeback ratio, and the reasons for disputes, such as fraud or customer dissatisfaction

- Example: An online retailer with a history of high chargebacks may face higher processing fees or have to implement preventive measures, such as adopting fraud detection systems

Credit history and financial health

Credit history is one of the most significant underwriting factors. Your business’s credit score reflects its financial reliability and ability to manage business debt. Underwriters also review financial statements such as your balance sheet, profit and loss statement, and cash flow report to assess profitability and long-term stability.

- What they look for: Credit score, payment history, outstanding debt, previous bankruptcies, P&L statements, and cash flow

- Example: A business with a high credit score and strong financials is more likely to receive favorable terms, while one with a low score may face higher fees or rejection

Bank statements

Underwriters often request bank statements to verify your business’s financial status and ensure that funds are available for processing payments. These documents help underwriters confirm your business’s transaction volume, account balances, and any irregular activity.

- What they look for: Consistent deposits, adequate reserves, and account stability

- Example: A business with volatile bank account balances may prompt questions about whether it can manage transactions smoothly, resulting in higher scrutiny during the underwriting process

Compliance with regulatory requirements

If your business is subject to regulations such as AML or KYC requirements, underwriters will review your compliance to confirm you're operating legally and not at risk for suspicious activity.

- What they look for: KYC and AML documentation, PCI DSS compliance, and adherence to industry-specific regulations

- Example: A business in the financial services industry that doesn't comply with AML regulations might face outright rejection, while one that is fully compliant is more likely to meet with approval

Risk management systems

Well-established risk management protocols can improve your chances of approval. These systems, such as fraud detection tools, help prevent issues such as chargebacks and fraud.

- What they look for: Secure payment gateways, AVS usage, fraud detection tools, and dispute resolution processes

- Example: A business using automated fraud detection and chargeback prevention tools may have an easier time in the approval process

Merchant automation and monitoring

Many payment providers now use automated systems to streamline the underwriting process and continuously monitor merchants for risk. These tools can validate your financials faster, spot potential fraud earlier, and reduce manual errors.

- What they look for: Use of automation tools, digital compliance systems, and proactive monitoring solutions

- Example: A business that leverages automation to maintain clean transaction records and reduce chargebacks is more likely to receive quicker approvals and better terms

Common challenges in merchant underwriting

Traditional merchant underwriting can be slow and complex, which can be frustrating. Some common challenges you might face include:

- Complex documentation: Underwriters require a lot of documentation, including financial statements, bank statements, and evidence of fraud prevention measures, which can be overwhelming for new merchants

- Slow approval times: Manual underwriting processes can take days and even weeks, delaying the business’s ability to start processing payments

- Lack of transparency: Sometimes, businesses are unsure why they were denied or why they have to pay higher fees

- Rejections due to chargebacks or poor credit: A history of excessive chargebacks or a low credit score can result in stricter requirements or outright rejection

- Higher fees or limits for high-risk merchants: If your business operates in a high-risk industry, you may be approved with higher processing fees or lower transaction limits

- Compliance confusion: Requirements such as AML, KYC, or PCI DSS can be confusing for small businesses or first-time applicants

How automation is transforming merchant underwriting

Automation and AI are revolutionizing merchant underwriting, transforming a paperwork-heavy ordeal into a streamlined digital process. Digital verification systems now authenticate your business information and financial statements within minutes instead of days. This moves you from application to approval significantly faster.

AI-powered risk assessment tools analyze thousands of data points from your transaction history and industry benchmarks to create accurate risk profiles in real-time. Unlike traditional methods, these systems evaluate your specific business circumstances, often resulting in more favorable terms for merchants who might have been unfairly penalized based solely on their industry.

Machine learning algorithms continuously monitor transaction patterns, identifying suspicious activities before they impact your business. These systems distinguish between legitimate customer behavior and potential fraud with remarkable accuracy, reducing false positives while still protecting you from actual fraud threats and maintaining your merchant account standing.

Best practices to prepare for merchant underwriting

Here are a few best practices to help you get ready for merchant underwriting:

Organize your financial documentation

Gather your bank statements from the last 6 months, prepare current balance sheets and income statements, and verify your business credit score. Underwriters scrutinize your debt-to-income ratio and look for consistent revenue growth quarter-over-quarter. For seasonal businesses, prepare year-over-year comparisons to demonstrate stability despite cyclical fluctuations.

Minimize your chargeback profile

Implement detailed refund policies with clear timeframes, improve product descriptions with accurate shipping estimates, and establish address verification systems for all transactions.

Document your recent chargeback resolution efforts and maintain records showing dispute win rates. As mentioned above, underwriters typically flag applications with chargeback rates exceeding 1%, so prioritize bringing your numbers below this threshold.

Calculate your true processing costs

Request comprehensive fee schedules including interchange rates, assessment fees, authorization fees, and monthly minimums. Additionally, analyze how your average transaction size impacts your effective rate; smaller transactions often cost proportionally more to process.

Many merchants overlook batch closing fees and gateway costs that can add hundreds to their monthly overhead.

Leverage industry expertise

Partner with payment facilitators or independent sales organizations (ISOs) experienced in your specific industry. For example, restaurants benefit from processors familiar with high-volume, low-ticket transactions, while subscription businesses need experts in recurring billing models.

These specialists can guide you through compliance requirements such as PCI DSS for e-commerce or EMV standards for in-person transactions.

Glossary: Merchant underwriting terms and definitions

- Financial facilitator: A financial facilitator is an organization that helps your business process payments. They typically provide merchant services such as credit card processing, payment gateway setup, and fraud prevention tools.

- Merchant: A merchant is a business that processes customer payments. This can include online stores, brick-and-mortar businesses, and service providers.

- Merchant account: A merchant account is an account set up by the financial facilitator that enables businesses to accept customer credit card payments

- Merchant agreement: A merchant agreement is a document that outlines the terms and conditions of your relationship with the financial facilitator. In addition, it includes information such as fees, chargeback limits, and dispute resolution.

- EDI payments: Electronic data interchange (EDI) payments are digital transactions that use a secure protocol to transfer payment details and other documents between businesses

- Financial profile: A financial profile is an assessment of your business's financial health. It includes information such as credit history, cash flow, and current liabilities.

- Chargeback fees: Chargeback fees are fees merchants must pay when a customer disputes a transaction. This is usually caused by credit card fraud or unauthorized card use, but can also result from customer dissatisfaction.

- Operational history: An operational history includes information about how long you've been in business, the type of products or services you offer, and your past performance records

- Risk assessment: A risk assessment evaluates your business's potential risks, such as fraud or insolvency. It helps the financial facilitator determine if your business meets its standards for accepting payments.

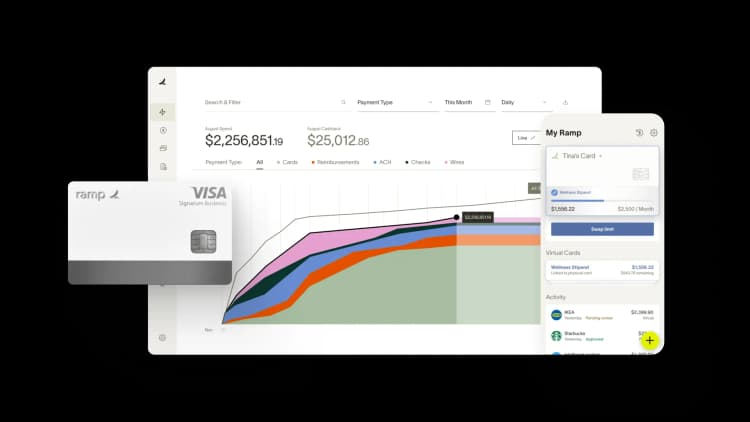

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

Payment processing underwriting is the review process that evaluates your business’s financial health and risk level before approving it to accept credit or debit card payments. It focuses on financial documents, credit history, and operational factors to ensure your business can handle transactions securely.

The merchant underwriting process can take anywhere from a few days to up to a week. The exact time frame will depend on the payment processor and the amount and complexity of the financial documents needed for approval. Preparing your documents ahead of time can speed up the application process.

The merchant is typically responsible for paying the underwriting fee. The fee amount varies depending on your business type and the payment processor used. Some companies may qualify for a discounted or waived cost if they meet specific criteria.

In merchant processing, an independent sales organization is a third-party company authorized by a payment processor or bank to sell merchant accounts and related services. ISOs often work directly with your business to help it set up credit card processing and manage payment solutions.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits