What are EDI payments, and how do they differ from ACH and EFT?

- What is EDI?

- What are EDI payments?

- What are the main types of EDI payments?

- How do EDI payments work?

- Manual vs. EDI payment process

- How do EDI payments differ from ACH and EFT?

- Why use EDI payments?

- Potential challenges with EDI payments

- Why virtual cards are a great alternative to EDI payments

- Use Ramp to take control of your payments

In an increasingly paperless world, electronic communication has become the norm. Electronic data interchange (EDI) has standardized the exchange of business documents between organizations, simplifying the transmission of traditionally paper documents.

EDI has dramatically improved the B2B payment process. We'll explain EDI payments in greater detail, including the different types, how they work, and when to use them. We also discuss how they differ from ACH and EFT payments, their benefits and drawbacks, and EDI alternatives.

What is EDI?

Electronic data interchange (EDI) is a standardized method of exchanging business documents like invoices, purchase orders, and bank account information. It's an automated, digital replacement for traditional manual methods like fax, physical mail, or sending documents via email attachment.

EDI eliminates manual data entry, improving the speed and accuracy of information exchange between companies. Businesses across industries, including healthcare, manufacturing, retail, and logistics, use EDI to automate the transfer of documents and improve efficiency.

What are EDI payments?

An EDI payment facilitates the transmission of transaction data in the EDI format. It isn't a payment method in itself; rather, it's a protocol for exchanging information electronically in a standard format.

It’s easy to confuse EDI transactions with Automated Clearing House (ACH) or electronic funds transfers (EFTs). ACH and EFT describe electronic payment methods, whereas EDI payments denote the secure transfer of documents related to payments rather than payments themselves.

You can use EDI payments to exchange transaction data such as:

- Bills of lading

- Purchase orders (POs)

- Bank account information

- Invoices

- Inventory and customs documents

EDI payments are typically used by accounts payable (AP) and accounts receivable (AR) managers, controllers, and procurement teams to exchange this information electronically, eliminating the need for paper-based documents.

EDI payment automation is also efficient for international or otherwise complex B2B payments. For example, import-export payments usually involve three parties. EDI payments make sure each stakeholder receives the relevant information while maintaining data security.

What are examples of EDI payments?

EDIs are closed networks. Only the parties you add to your EDI network can exchange data. A single EDI network can be limited to two parties or contain several. Some common examples of EDI transactions include:

- Student loan guarantees

- Credit/debit adjustments

- Debit authorizations

- Payment orders or remittance advice

What are the main types of EDI payments?

Because payment-related information can vary widely, there are many types of EDI payments. However, two of the most common terms you might hear are web EDI and direct EDI, or point-to-point:

- Web EDI: This payment type uses a standard web browser to process a funds transfer. You can conveniently exchange the payment information using a third-party tool or a hosted web tool. Because of its ease of use, this method is often used by small businesses.

- Direct EDI/point-to-point: This type connects individual business partners directly for payments. Larger businesses that process transactions daily most commonly use this method.

There are also specific types of EDI transactions, each noted by an EDI code. Here are some of the most commonly used EDI codes and documents:

EDI code | Purpose | Function |

|---|---|---|

EDI 810 | Invoice | Requests payment for goods/services delivered |

EDI 812 | Credit/debit adjustment | Corrects billing errors or adjusts account balances |

EDI 820 | Payment order/remittance advice | Initiates electronic payment with remittance details |

EDI 828 | Debit authorization | Authorizes automatic debit from payer's account |

EDI 835 | Electronic remittance advice | Provides payment and claim adjustment details from payers to healthcare providers |

EDI payment methods provide businesses with multiple options to process transactions electronically, each designed to meet different needs and technical capabilities.

How do EDI payments work?

EDI payments convert transaction data into a standard electronic format that computers can automatically exchange between businesses. When a company needs to pay a supplier or receive payment from a customer, the payment information is converted into EDI format and transmitted securely through established networks.

Automation plays a central role in this process, eliminating manual data entry and reducing processing time from days to hours, or even minutes. Security measures like encryption and authentication protocols protect sensitive financial data during transmission, while built-in validation checks ensure accuracy before payments go through.

The EDI payment workflow

EDI payments follow a step-by-step process that automates financial transactions from start to finish across multiple business systems. Here's an example workflow:

- Invoice creation: The supplier generates an electronic invoice (EDI 810) containing itemized charges, payment terms, and remittance details

- Data formatting: The system converts payment information into a standardized EDI format that both trading partners' systems can interpret

- Secure transmission: Encrypted payment data travels through EDI networks or direct connections between business partners

- Automated processing: The buyer's system receives, validates, and routes payment information through internal approval workflows

- Payment authorization: Approved transactions generate payment instructions (EDI 820) or debit authorizations (EDI 828) to banking systems

- Electronic settlement: Banks process the actual funds transfer while sending confirmation back to both trading partners

- Remittance matching: Payment details automatically match with outstanding invoices, updating accounts payable and receivable records

This automated workflow eliminates manual intervention while maintaining complete audit trails for financial compliance and reporting requirements.

Manual vs. EDI payment process

Business payment methods have evolved, yet many companies still rely on outdated manual processes that waste time and create unnecessary complexity. Here's how manual and EDI payment processes differ:

Manual payment process | EDI payment process |

|---|---|

Paper checks require printing, signing, and mailing | Electronic payments process instantly with digital authorization |

Manual data entry increases risk of human error | Automated data transfer eliminates mistakes |

Physical document handling slows processing times | Digital transmission enables same-day processing |

Limited visibility until payment clears | Real-time status updates throughout payment lifecycle |

Higher labor costs for processing and reconciliation | Reduced staffing needs with automated workflows |

Security vulnerabilities with physical mail | Encrypted transmission protects sensitive financial data |

Storage requirements for physical payment records | Digital archives eliminate paper storage needs |

Delayed notifications to vendors about payment status | Instant delivery of payment confirmation and remittance details |

The hidden costs of manual methods

Manual payment processing creates several pain points that affect your bottom line. Time becomes a significant factor when staff spend hours each week printing checks, stuffing envelopes, and manually entering payment data. These repetitive tasks pull employees away from higher-value activities that could help grow your business.

Human error presents another challenge with manual processes. A mistyped invoice number or incorrect payment amount can trigger disputes and time-consuming reconciliation efforts. Security risks multiply when payments travel through postal services, while processing costs add up quickly with check stock, postage, and labor hours dedicated to payment preparation.

EDI payment advantages

EDI payments address these challenges through automation. Processing speeds improve when payments are sent electronically, often settling within the same business day. And accuracy increases substantially with EDI systems that eliminate manual data entry.

You also get stronger security via encrypted transmission protocols that protect sensitive payment information during transfer. Reduced manual labor and the elimination of physical payment materials mean cost savings, while better visibility enables real-time tracking.

How do EDI payments differ from ACH and EFT?

The terms EDI, ACH, and EFT are often used interchangeably. While all of these methods are electronic, there are some key differences between them.

EDI vs. ACH

EDI is a standard system for electronically exchanging business documents and payment information. In contrast, ACH payments are electronic bank transfers made through the Automated Clearing House network, which is managed by Nacha.

EDI and ACH are sometimes confused because they both include remittance information in EDI format. That said, ACH transactions are a type of electronic funds transfer, while EDI is not a payment type. It’s the digital language that businesses use to send payment information.

Here are some of the key differences between EDI and ACH:

Aspect | EDI | ACH |

|---|---|---|

Network | Private networks maintained by company or third-party service provider | ACH network maintained by Nacha |

Speed | Instantaneous | Not always instantaneous |

Process | Automates common payment processes | Requires manual approval from banks |

Geographic scope | No geographical limits | Confined to the United States |

Primary uses | Supply chain, healthcare, retail, manufacturing | Payroll, bill pay, direct deposits, e-commerce |

Security & standards | Company-controlled encryption and protocols | Standardized Nacha rules and bank oversight |

Cost | Higher setup and maintenance costs | Lower per-transaction fees |

Target market | Better for large enterprises with complex workflows | Accessible to small and mid-sized businesses |

EDI offers instant, global automation for large enterprises with complex workflows, while ACH provides cost-effective, standardized payment processing for smaller businesses within the United States.

EDI vs. EFT

EDI payments are part of a wider set of electronic data interchange processes, which includes both financial and non-financial data. EFT is a broad term that essentially covers all electronic payment methods.

Here’s how EDI and EFT payment processes differ:

Aspect | EDI | EFT |

|---|---|---|

Scope | Part of a broader set of Electronic Data Interchange processes | Strictly involves the electronic transfer of funds |

Information detail | Carry detailed information about the related business transaction along with the payment instructions, facilitating automatic reconciliation | Focused on the fund transfer itself, with limited transaction details |

Primary uses | Commonly used in B2B environments where detailed transaction information alongside payments is crucial | Used for both personal and business transactions, where the goal is to transfer funds efficiently |

Common applications | Supply chain management, healthcare claims, retail invoicing | Banking, payroll, consumer payments, bill pay |

Security standards | Industry-specific standards (e.g., HIPAA, AS2 encryption) | Banking regulations and encryption standards |

Cost | Higher implementation and maintenance expenses | Lower transaction fees and setup costs |

Target users | Best suited for large enterprises with complex data needs | Accessible across all business sizes and individual users |

Choose EDI for complex B2B transactions requiring detailed data exchange, ACH for standard U.S. banking transfers, or EFT for simple transactions. The right choice depends on your transaction complexity, global reach, business size, and budget considerations.

Why use EDI payments?

Businesses across industries are embracing EDI payments to replace manual, paper-based payment processes. The driving force behind this adoption centers on improving operational efficiency while reducing the administrative burden that comes with traditional payment methods.

Key benefits of EDI payments

EDI payments deliver clear advantages that directly impact your bottom line and operational efficiency:

- Faster transaction times: Electronic payments process in minutes rather than days, giving you quicker access to funds

- Improved accuracy and fewer errors: Automated data exchange eliminates manual mistakes and ensures payment information matches invoices

- Enhanced security of payment data: Encrypted transmissions and secure protocols protect sensitive financial information far better than paper checks or faxes

- Lower processing costs: Reduced paper, printing, postage, and manual labor expenses add up to substantial savings for businesses that process a high volume of payments

- Easier reconciliation and reporting: Electronic records integrate seamlessly with accounting systems, making month-end close faster and audit trails clearer

- Stronger business relationships: Reliable, timely payments build trust with suppliers and demonstrate your commitment to efficient business practices

These benefits combine to create a payment system that works harder for your business while requiring less effort from your team. Many companies that use EDI also adopt AP automation solutions to streamline invoice approvals, payment scheduling, and reconciliation alongside secure document exchange.

Potential challenges with EDI payments

EDI payments are a great option for many businesses, but there are a few things to keep in mind when getting set up:

- Staff training: Given the sensitivity of the data, you need to train your staff on how to use EDI software. Third-party service providers usually offer training programs and ongoing support.

- Costs: Setting up and maintaining an EDI network is costly, especially if you don’t establish the right maintenance processes. It may not make financial sense for some businesses and can become a bloated operating cost.

- Need for compatible software/systems: EDI requires specific software and system compatibility between trading partners, which can be complex when working with multiple vendors using different standards. Choose an EDI provider that supports multiple transaction sets, and consider cloud-based solutions for greater flexibility.

- Integration with existing workflows: EDI systems need to integrate with your current accounting, inventory, and order management processes to avoid disruptions. Work with your IT team early in the planning phase and choose EDI solutions that offer strong APIs and pre-built connectors for your existing fintech stack.

If you experience these concerns, choose a third-party provider that reduces costs through economies of scale. However, while third-party service providers are an option, consider whether your business needs EDI payments in the first place.

Why virtual cards are a great alternative to EDI payments

EDI payments are an excellent option for securing payment data. However, they make more sense for large businesses that handle several documents during payment and invoice reconciliation. Virtual credit cards are a better option if your business sends less complex data.

Here's how they help:

- Accounting integrations: Virtual cards integrate with popular accounting software and automate routine tasks, resulting in quick and accurate monthly closes and clear insight into spending patterns

- Digitized expense policies: EDI payments automate tasks in invoice approval processes, but they don’t integrate with your expense policies. For instance, you might incur redundant expenses if two employees each have subscriptions for the same SaaS tool. Virtual cards help you simplify expense analysis and approvals by digitizing your expense policies and automating multi-level approval workflows.

- Increased data security: With virtual cards, data is encrypted in transit and at rest using the highest security standards. They also simplify fraud monitoring by creating spend management categories and restrictions, which provide full visibility into your expense payments and precise spending controls.

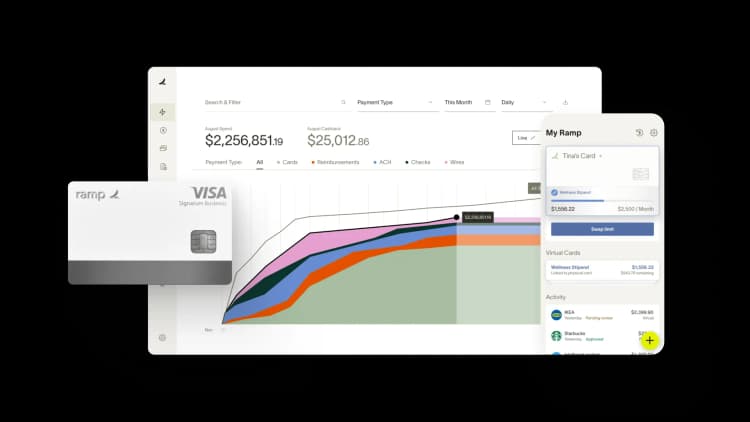

Virtual card providers like Ramp offer streamlined accounting integration, automated expense management, and enhanced security controls, making them an ideal payment solution for businesses seeking efficiency without EDI's complexity.

Use Ramp to take control of your payments

EDI payments are a great way to secure payment data and eliminate manual processes in your payment approval workflow. But virtual cards may be a better option if your business deals with simple transaction data.

Thankfully, with modern fintech software, you don't have to lock yourself into a single payment method. Ramp's all-in-one finance operations platform combines physical and virtual corporate cards with integrated accounts payable software that lets you pay bills via card, ACH, wire, and even traditional paper checks.

With enterprise-grade security features, including real-time fraud monitoring and customizable card controls, Ramp delivers the payment security benefits of EDI while giving you the flexibility to use whatever payment method works best for your business situation.

Learn more about how Ramp Bill Pay can simplify your payment workflow.

FAQs

You can learn more about Ramp Bill Pay and how it helps automate accounts payable at our official page: https://ramp.com/accounts-payable

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits